Together with

Good Morning,

Hollywood studios have offered writers a new deal, Burry is shorting the market again, UBS will pay billions to settle a DOJ mortgage-bond case, China cut key rates, hedge funds are preparing for a legal battle with the SEC over fee disclosures, and physical markets are helping push oil to $90.

Work shouldn’t be the only hard thing in your life. If something else hasn’t been, today’s sponsor, Hims, might be able to help.

Let’s dive in.

Before The Bell

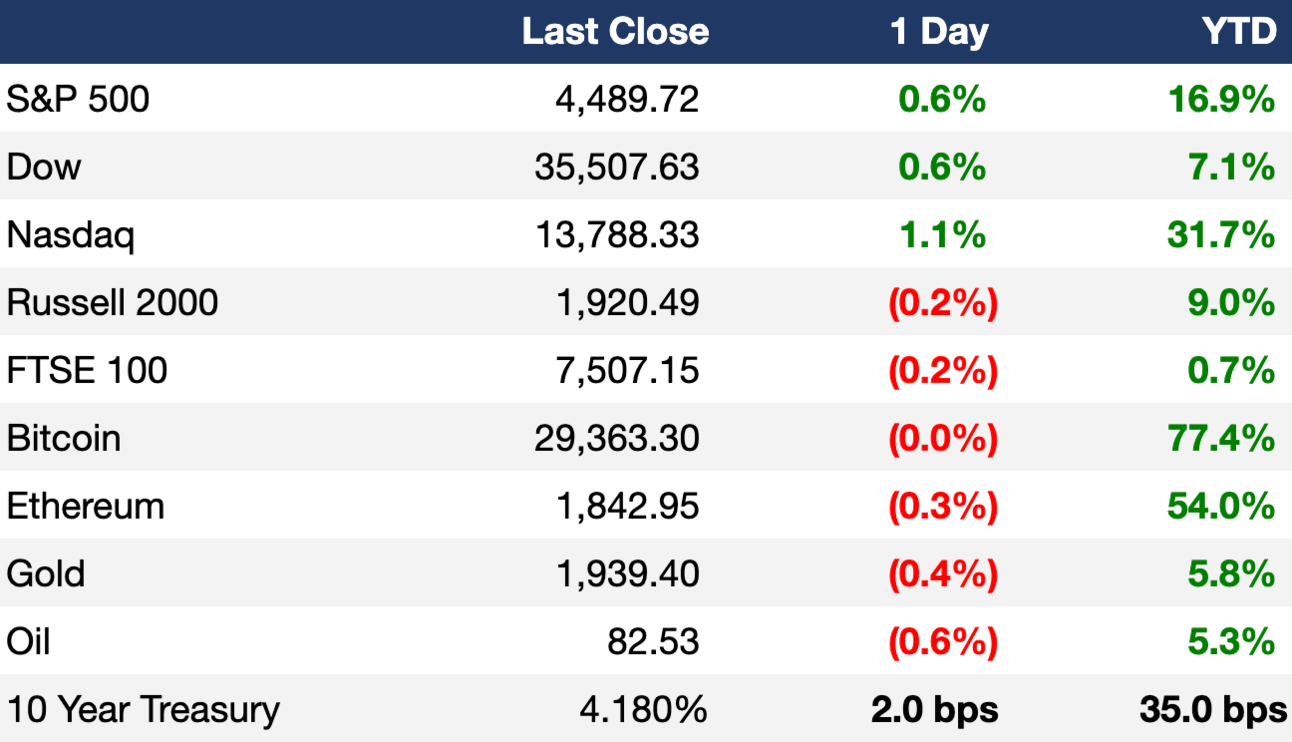

As of 8/14/2023 market close.

Markets

US stocks rallied yesterday led by tech stocks as investors awaited big retail earnings this week

The Nasdaq led the US indexes with a 1.1% gain thanks to strong-performing chip stocks

Asian stocks dropped due to continued concerns about China’s economy, as Hong Kong’s HSI fell 1.6%, Singapore’s STI fell 1.4%, and Japan’s Nikkei fell 1.3%

Earnings

Foxconn beat analyst earnings estimates thanks to a hot AI sector, but it downgraded its full-year revenue outlook to a slight decline due to global economic uncertainty, especially China (CNBC)

What we're watching this week:

Tuesday: Home Depot, Suncor Energy, Sea Limited, CAVA Group, H&R Block

Wednesday: Cisco Systems, TJX, JD.com, Progressive, Target

Thursday: Walmart, Applied Materials, Ross Stores, Dole, Keysight Technologies

Friday: Deere & Company, Palo Alto Networks, Estee Lauder, XPeng

Full calendar here

Headline Roundup

Hollywood studios offer writers a new deal with push from Netflix, Iger to end strike (BBG)

Michael Burry of ‘The Big Short’ fame reveals potential big bets against the market, tech stocks (CNBC)

Oil’s push to $90 gets lift from physical markets everywhere (BBG)

UBS to pay $1.44B to settle DOJ mortgage-bond case (BBG)

China cuts key rates as weak batch of July data darkens economic outlook (RT)

Out of options and money, Argentina presses the panic button (BBG)

China’s deepening housing problems spook investors (WSJ)

Steel CEO who fights with Goldman takes on US industry icon (BBG)

More Americans are ending up homeless - at a record rate (WSJ)

Hedge funds prepare for legal battle with SEC over fee disclosures (BBG)

Cruise vehicles cause weekend traffic jam one day after California approves 24-7 robotaxi service (CNBC)

As World Cup breaks records, Adidas, Nike navigate bumps in retail demand (RT)

Ford taps Apple exec to build high-margin digital services (RT)

US ambassador meets with detained WSJ reporter (WSJ)

Lloyd Blankfein says he ‘can’t imagine’ returning to Goldman Sachs (CNBC)

Trump indicted over attempts to overturn Georgia’s 2020 presidential vote (BBG)

A Message From Hims

Life is Hard, You Should Be Too

We get it. You’re dealing with strict deadlines, an unreasonable boss, and long hours. Work has been hard lately… but something else hasn’t been.

It’s time to fix that (your love life, not your career) with Hims.

Hims offers 100% online, FDA-approved treatment options with free, discreet shipping (if prescribed) so you can get back on your A-game as soon as possible, and they offer treatments that are up to 95% cheaper than brand names.

It’s time to stop being soft in the one area that matters. Get started with Hims today.

*Prescription products require an online consultation with a healthcare provider who will determine if a prescription is appropriate. Restrictions apply. See website for full details and important safety information. Actual price to customer will depend on product and subscription plan purchased.

Deal Flow

M&A / Investments

Abu Dhabi National Oil is prepared to boost its informal offer to acquire German plastics and chemicals maker Covestro to ~$12.7B after Covestro rejected its previous ~$12B offer for being too low (BBG)

Privately-held industrial conglomerate Esmark made a $7.8B cash offer to buy US Steel Corp., which rejected a $7.3B offer from Cleveland-Cliffs on Sunday (RT)

Mastercard agreed to acquire a minority stake in South African telecom MTN’s mobile money arm in a deal that values the fintech arm at $5.2B (RT)

Uruguay-based Dlocal, a $3.7B market cap payment services provider to companies in emerging markets, is exploring options including a potential sale (RT)

The Agnelli family’s Dutch holding company Exor bought a 15% stake in troubled Dutch medical company Koninklijke Philips for $2.8B (BBG)

Warren Buffett’s Berkshire Hathaway disclosed new $726M, $71M, and $17M stakes in homebuilders DR Horton, NVR, and Lennar (RT)

Silverbow Resources will acquire US natural gas producer Chesapeake Energy’s remaining assets in Texas’ Eagle Ford basin for $700M (RT)

PE firm Apax Partners will buy Bazooka Candy Brands from former Disney CEO Michael Eisner for ~$700M, including debt (WSJ)

Index provider MSCI will acquire a remaining 66% stake in Burgiss Group, a provider of data and analytics solutions for investors, for $697M cash (RT)

Dubai-based startup NWTN will invest $500M in Chinese defaulted property developer Evergrande’s EV unit NEV in exchange for a 28% stake in the company and a majority of the board (BBG)

United Airlines and Ark Investment Management invested in the oversubscribed PIPE for Archer Aviation’s $215M round led by Stellantis (BW)

Flooring retailer LL Flooring, which has a market cap of $115M, jumped 15% after announcing that it was exploring alternatives (MW)

US food product and pet food giant Mars will acquire German medical diagnostics provider Synlab’s veterinary business (RT)

Insight Investment Group will acquire French carmaker Renault's RCI Banque division, a Russian leasing subsidiary (RT)

VC

Kenyan low-income household product and finance provider d.light raised $125M in financing through a securitization facility from the Eastern and Southern African Trade and Development Bank Group (FN)

Match Masters, the multiplayer match-3 puzzle game, raised a $100M round led by Haveli Investments (BW)

Xeltis, a Dutch medtech startup developing implants to enable the natural creation of living vessels, raised an additional $13.6M in a final close of a D2 round led by the European Investment Council (FN)

Caelux, a startup using perovskite tech for solar energy, raised a $12M Series A3 led by Temasek (FN)

CodeScene, a Swedish SaaS startup specializing in software engineering intelligence, raised an $8.2M round led by Neqst (FN)

EthStorage, a remote Ethereum storage scalability startup, raised a $7M seed round at a $100M valuation led by dao5 (FN)

German restaurant app Neotaste raised a $6.4M Series A led by Burda Principal Investments (FN)

Stable Money, an Indian wealthtech platform, raised a $5M seed round led by Matrix Partners India and Lightspeed (FN)

Xverse, a Hong Kong-based Bitcoin Web3 wallet supporting Ordinals and BRC-20 inscriptions, raised a $5M seed round led by Jump Crypto (FN)

Clean Food Group, a food tech startup delivering sustainable oils and fats solutions, raised a $2.9M round from Doehler Group, Alianza Team, Agronomics, and SEED Innovations (FN)

Fieldwork Robotics, a startup developing harvesting tools for berry farms, raised a $1.9M seed round from Elbow Beach Capital, Frontier IP, and others (FN)

IPO / Direct Listings / Issuances / Block Trades

European PE giant CVC Capital Partners revived plans for a multibillion-euro Amsterdam IPO as soon as the end of this year (FT)

SPAC

Chinese P2P ride-hailing marketplace Wanshun Technology Industrial Group will merge with AlphaVest Acquisition Corp. in a $300M deal (GNW)

Debt

Bankruptcy / Restructuring

Macquarie Asset Management provided a $700M equity injection to highly levered UK utility Southern Water, which had been seeking funding to reduce its gearing ratio and steady its balance sheet (BBG)

Fundraising

Coca-Cola is partnering with Greycroft Partners to launch its Greycroft Coca‑Cola System Sustainability Fund, which has raised $138M to focus on reducing its carbon footprint (AX)

Crypto Corner

FTX founder SBF was charged with using over $100M in stolen customer funds to make campaign donations ahead of the 2022 midterm elections (RT)

SBF is heading to a Brooklyn jail notorious for its poor conditions (RT)

Bankrupt crypto lender Celsius Network received court permission to seek creditor approval for its bankruptcy plan (RT)

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter