Together with

Good morning,

Or shall we say, "gm wagmi". Markets took a brief hiatus from mooning yesterday, with all three indexes ending slightly in the red despite jobless claims falling to their lowest level since ‘69 (nice). The reboot of Sex and the City dropped on HBO Max yesterday in time for Starbucks baristas to unionize and DeBlasio to allow for some non-citizens to vote in NYC.

Lastly, applications are due TODAY for our student-athlete programs - applications here.

Let's dive in.

Before The Bell

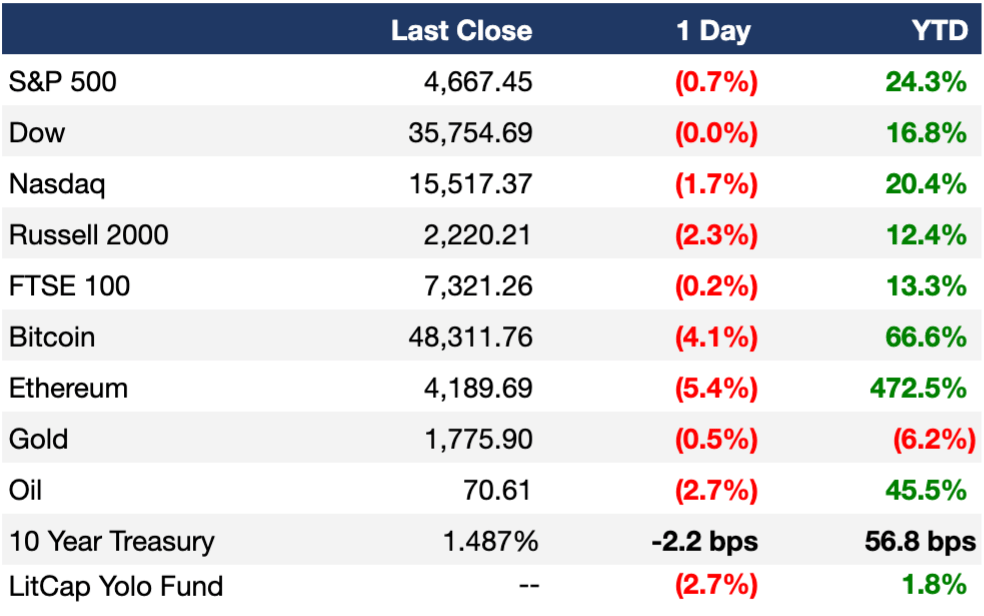

As of 12/09/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US markets took a pause from their rebound, with all three major averages closing lower yesterday as investors await new inflation data this morning

Today’s numbers may give insight into when/if the Fed might speed up its bond buyback tapering

Economists are expecting the CPI YoY growth rate to be 6.7%, which would be the steepest since June 1982

In better news, the US initial jobless claims fell to 184K last week (vs 211K expected), the lowest level in 52 years

Crypto is taking a hit this week with BTC falling ~6% after execs from six of the largest crypto companies testified before the US House Financial Services Committee on Wednesday

Earnings

Chewy fell 6%+ in extended trading despite net sales growth of 25% YoY due to decreased profitability caused by supply chain disruptions, labor shortages, and inflation (YHOO)

Lululemon shares fell in AH trading after posting a beat-and-raise Q3 report driven by increased spending on workout apparel and the holiday season, but discounted sales expectations for Mirror, its at-home fitness device (CNBC)

Oracle rose 6% in extended trading thanks to better-than-expected EPS numbers and a revenue increase of 6% YoY; the firm ended in a net loss due to a payment due in the dispute over former CEO Mark Hurd’s employment (CNBC)

Costco edged higher in extended trading after posting better-than-expected earnings and same-store sales; the retailer’s size helped them circumvent the same supply chain troubles and rising costs that the industry is facing worldwide (INV)

Full calendar here

Headline Roundup

US homeowners gained an average of $57K in equity in one year (BBG)

Business intelligence company MicroStrategy buys 1,434 more bitcoin for $82.4M (TBC)

Kickstarter will move its crowdfunding platform to blockchain (BBG)

Media mogul Rupert Murdoch buys $200M Montana ranch from the Koch family (WSJ)

US to add AI startup Sensetime to investment blacklist ahead of IPO (BBG)

Australia regulator greenlights $17B Sydney Airport takeover (RT)

American Airlines to reduce international flights due to Boeing Dreamliner delays (WSJ)

US jobless claims fall to lowest in 52 years (WSJ)

Amazon fined $1.3B in Italian antitrust case (WSJ)

Senators want social-media apps to share research (WSJ)

Uber workers would be classed as employees under EU proposal (WSJ)

New Zealand to ban young people from ever being able to buy cigarettes (CNBC)

Arizona Coyotes facing eviction from arena for unpaid bills (CNBC)

Google execs tell employees they won’t raise pay companywide to match inflation (CNBC)

Trump loses appeal to block Jan. 6 Capit

ol riot probe from getting White House records (CNBC)

Omicron 4x more transmissible than delta in new study (BBG)

Advent raises $4B for second technology fund (BBG)

Bain Capital closes $3B fund for US real estate deals (BBG)

A Message From NowRx

NowRx is disrupting the $480B retail pharmacy industry with proprietary software & robotics that provide a more convenient, hassle free pharmacy experience.

In 2020, NowRx generated $13.4M in revenue – a 90% YoY increase – and this year, they’re on pace to top more than $22M in revenue. And it doesn’t stop there. Their newest telehealth product has grown over 1,081% from Q1 to Q3 of this year!

Having already increased their share price 1,650% since 2016, NowRx’s potential for growth is massive. Join the 3,000+ investors who have already invested $9M+ and invest in NowRx today.

Deal Flow

M&A

PE firms including Advent, Apollo, CVC, and Carlyle are considering bidding for chemical maker DuPont’s mobility and materials unit that could fetch up to $12B (BBG)

The Canada Pension Plan Investment Board is seeking to sell its Wilton Re and Ascot Group insurance platforms; Wilton is expected to fetch $4B+ in a sale (RT)

Brookfield Asset Management is exploring a sale of a stake in NYC office tower One Manhattan West at a potential ~$2.8B valuation (BBG)

LabCorp announced a $2.5B buyback and will offer shareholders a dividend starting in Q2 (BBG)

CVC Capital and Bain Capital are preparing preliminary bids for a $1.7B stake in the French Football League’s media rights business (RT)

Agribusiness company InVivo has completed the $2.5B acquisition of French peer Soufflet (RT)

Local news, information, and advertising services company Lee Enterprises’ board rejected an unsolicited purchase proposal from hedge fund and US newspaper consolidator Alden Global Capital (WSJ)

New Zealand healthcare products distributor EBOS agreed to buy Australian peer LifeHealthcare for $839.6M (RT)

Crypto platform Polygon agreed to buy startup Predicate Labs, the developer of the Mir blockchain protocol, in a ~$500M deal (BBG)

Northam Platinum made an unsolicited offer to buy some or all of South African platinum miner RBPlat, signaling an impending bidding war for the company (BBG)

French online advertising firm Criteo is in exclusive talks to buy ad-trading platform Iponweb for $380M (BBG)

VC

European e-commerce aggregator SellerX raised $500M in debt / equity led by Sofina (PRN)

Embedded finance and banking API startup Mambu raised a $266M Series E at a $5.5B valuation led by EQT Growth (TC)

Self-driving tech startup Robotic Research raised a $228M Series A led by SoftBank Vision Fund 2 and Enlightenment Capital (TC)

Supply chain finance platform Tradeshift raised $200M in debt and equity funding from Koch Industries, Fuel Capital, IDC Ventures, and more (TC)

Expense management startup Pleo raised a $200M round at a $4.7B valuation led by Coatue (BBG)

CloudBees, a software delivery platform for enterprises, raised a $150M Series F led by GSAM (BW)

Web3 talent network Braintrust raised $100M via a private token sale led by Coatue (PRN)

Corporate spend and cash management startup Rho raised a $75M Series B led by Dragoneer Investment Group (TC)

LatAm e-commerce aggregator Merama received a $60M follow-on investment led by Advent International and SoftBank (TC)

Inrupt, a platform allowing internet users to control their data, raised a $30M Series A led by Forte Ventures (TC)

Robotic excavation startup Petra raised a $30M Series A led by DCVC (TC)

Mexican fast casual restaurant chain Tacombi raised a $27.5M round led by Enlightened Hospitality Investments (BBG)

B2B BNPL startup Resolve raised a $25M round led by Insight Partners (TC)

Atom Learning, a UK startup building AI-based online primary education materials, raised a $25M Series A led by SoftBank Vision Fund 2 (TC)

African edtech uLesson raised a $15M Series B from Tencent, Nielsen Ventures, Owl Ventures, TLcom Capital, and Founder Collective (TC)

First Resonance, a software developer for hardware production, raised a $14M Series A led by Craft Ventures (TC)

Ikigai, a startup building automated workflows that involve humans, raised a $13M Series A from Foundation Capital, 8VC, Underscore VC, and angels (TC)

Deed, a workplace giving platform, raised a $10M Series A led by Earlybird (TC)

Mio, a startup helping enterprise teams collaborate across messaging services, raised an $8.7M Series A led by Zoom and Cisco Investments (TC)

Livestream shopping app Upmesh raised a $7.5M pre-Series A led by Monk’s Hill Ventures (TC)

Web3 identity startup Burrata raised a $7.75M seed round led by Stripe and Variant (CD)

Egyptian ‘save now, pay later’ fintech Sympl raised a $6M seed round led by Beco Capital (TC)

Kenyan fintech Kwara raised a $4M seed round led by Breega VC Firm (TC)

Shabodi, a startup navigating app development on 5G networks, raised a $3.4M seed round led by Blumberg Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

Brazilian digital bank Nu raised $2.6B at a market valuation of $41B in their US IPO priced at the top of a marketed range (BBG)

Saudi food delivery startup Jahez is targeting a $2.4B valuation in an IPO (BBG)

Software company HashiCorp raised $1.2B in its IPO, exceeding goals for the share sale (BBG)

Chinese weight management firm Lvshou is considering a Hong Kong IPO that could raise ~$150M (BBG)

GumGum, a company that uses contextual intelligence rather than personal data to curate digital advertisements, is weighing an IPO (BBG)

Rolf, Russia’s biggest car dealership, is considering a 2022 IPO despite a criminal case against its former owner (BBG)

Digital media company Buzzfeed is down 39% since its debut on Dec. 6 (BBG)

SPAC

Berlin-based VC fund 468 Capital is planning to seek $268M from a listing of its second SPAC (BBG)

Exec's Picks

Keep Your 2021 Gains But You Must Do This BEFORE December 31st

If you are facing hefty U.S. taxes on cap gains from the sale of a business, stock, BTC, real estate, or other investments…

Unlock tax incentives and put your gains to work making an impact in up-and-coming areas.

Extra Picks

🚨 GIVEAWAY ALERT: 1.5 million people read The Hustle’s business, tech, and crypto newsletter. Join this week to enter to win $7,000+ in tech prizes (Macbook Pro, iPhone 13, and more!) Ends 12/10. Sign up here

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board. If you want the role to be featured on Exec Sum, check out our "Featured" and "Premium" tiers.

To Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝