Together with

Good Morning,

Jane Street's co-founder was duped into funding AK-47s for a South Sudan coup planned by a Harvard fellow. One slip up in due diligence and next thing you know, you're overthrowing governments 🤦

Also, lots of mixed reactions to the NYC mayor Democratic primary but Twitter sums up the sentiment perfectly…

Plaid Effects 2025 is live. Their latest event unveils 20+ product updates, plus insightful interviews, deep dives, and insights on the future of finance. Watch it here.

Let's dive in.

Before The Bell

As of 6/25/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed flat yesterday as investors digested comments from J Pow's Congressional testimony

Nasdaq 100 hit another ATH

Nvidia re-passed Microsoft as the world's most valuable company after hitting a new ATH

Traders fully priced in a 25 bps rate cut in September

EM assets are outperforming developed markets YTD

US 5Y-30Y yield curve steepened to its most since 2021

Euro hit its highest since October 2021

Hong Kong intervened to defend dollar peg as local currency drops

Earnings

Micron beat Q3 earnings and revenue estimates and issued upbeat Q4 guidance on strong data center-related sales (CNBC)

Jefferies missed Q2 earnings estimates as profit slumped 40% YoY on weaker IB and muted capital markets activity amid geopolitical uncertainty, though the firm noted improving sentiment around global tariffs (BBG)

General Mills beat Q4 earnings but missed revenue estimates and issued a downbeat profit outlook citing consumer pullback and ongoing macro pressures from tariffs, global conflicts, and regulatory uncertainty (BBG)

What we're watching this week:

Today: Nike, Walgreens Boots Alliance

Full calendar here

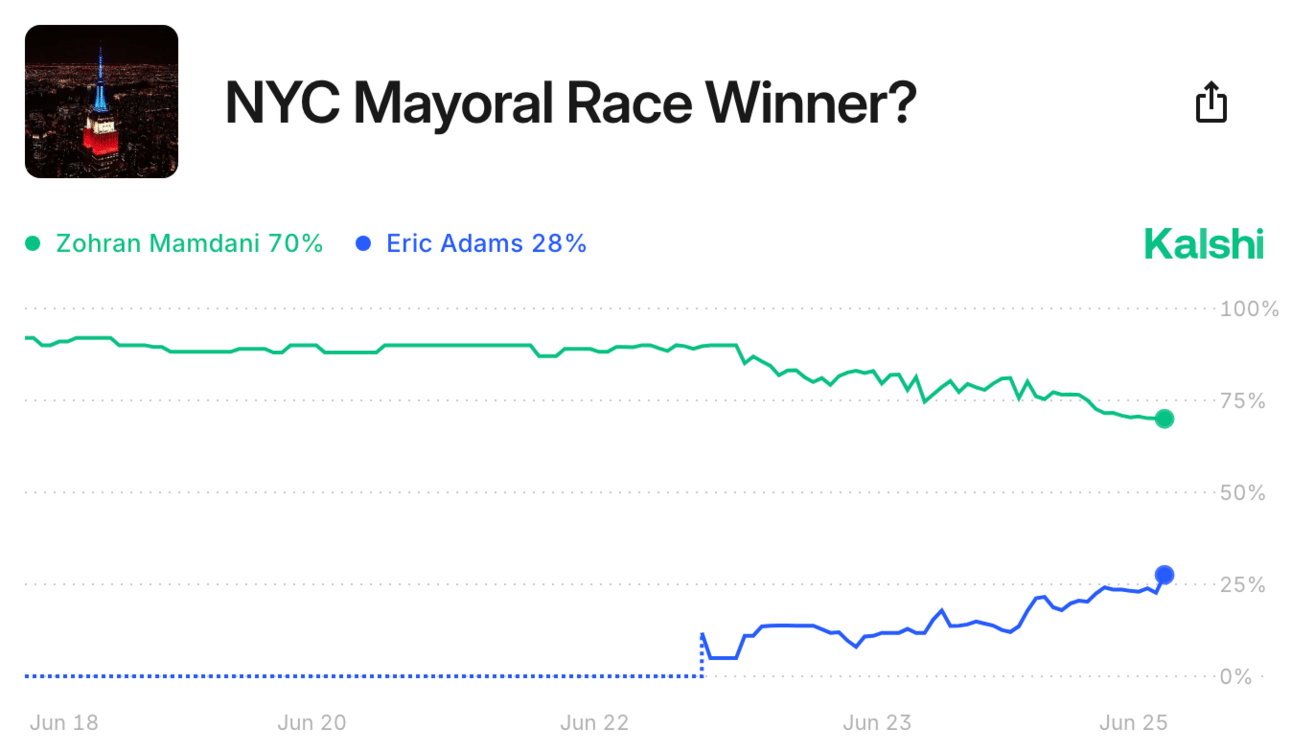

Prediction Markets

Aah sh*t, here we go again…

Headline Roundup

Jane Street's co-founder was 'duped' into funding AK-47s for South Sudan coup (BBG)

J Pow emphasized focus on taming inflation in Congress testimony (CNBC)

Trump considers naming New Fed chair early to undermine J Pow (WSJ)

Fed plans to reduce post-2008 bank capital requirements (BBG)

Senator Warren demanded information on PE firms' tax break lobbying (FT)

US long-term bond funds saw the largest inflows in two years in May (RT)

JPMorgan launched its largest active ETF (RT)

State Street's private credit ETF inflow drought finally ends (BBG)

Wealth managers gear up to put UK retail savings into private assets (FT)

UBS will merge its M&A and Sponsor Advisory units in IB revamp (BBG)

China collateral demands are curbing EMs' ability to manage finances (RT)

EU agreed to rules on winding down failed banks (BBG)

OpenAI and Microsoft CEOs discussed future of current partnership (RT)

Mideast crisis is testing Dubai and Abu Dhabi's haven status (BBG)

Nestle USA will eliminate synthetic food colors (RT)

Bumble will layoff 30% of its staff (BBG)

A Message from Plaid

Plaid’s biggest product updates of 2025

Plaid has been awfully busy this year, dropping 20+ product updates to help you build faster, reduce risk, and make smarter lending decisions. From stopping fraud in real time to harnessing the power of AI and making cash flow data more accessible, they're churning out innovation like no other.

If you want to win in financial services, you need to watch Plaid Effects 2025—a collection of keynotes, interviews with industry leaders, and deep dives featuring their latest integrations, groundbreaking insights, and next-gen fraud solutions. Ready to rock? Check out the link below.

Deal Flow

M&A / Investments

Shell denied reports of talks to acquire $80B-listed oil rival BP

Josh Harris' 26North Partners agreed to acquire a controlling stake in AV systems provider AVI-SPL from Marlin Equity Partners at an over $1B valuation

Tritax Big Box REIT agreed to acquire UK's Warehouse REIT for $663M, beating out a prior bid from Blackstone

Italy's top football league Serie A is considering selling a stake in its international media rights business

Community Bank First Commonwealth will acquire seven Santander branches in Pennsylvania from Santander Bank, adding ~$525M in deposits

VC

AI-powered healthcare company Abridge raised a $300M Series E at a $5.3B valuation led by a16z

Prediction market platform Kalshi raised a $185M round at a $2B valuation led by Paradigm

Prediction market platform Polymarket is set to raise a $200M round at a $1B valuation led by Founders Fund

Cryptography startup Zama raised a $57M Series B at a $1B+ valuation led by Blockchange Ventures and Pantera Capital

UK HR tech platform Metaview raised a $35M Series B led by GV

Synthflow, a German easy-to-setup enterprise-grade conversational AI platform, raised a $20M Series A led by Accel

SuperDial, a voice AI startup, raised a $15M Series A led by SignalFire

Integrated Indian e-commerce products startup GoKwik raised a $13M round at a $450M pre-money valuation led by RTP Global

Skyramp, an AI-driven testing platform, raised a $10M seed round led by Sequoia Capital

Quantum networking platform Qunnect raised a $10M Series A extension led by Airbus Ventures

Unchained Robotics, a startup automating industrial processes, raised a $10M Series A extension from Direttissima, Navivo Capital, and more

Claira, an AI-powered deal intelligence platform for financial institutions, raised a $7M seed round led by Barclays, Citi, and Reimagine Tech Ventures

Holographic display technology startup Swave Photonics raised a $7M Series A follow-on led by IAG Capital Partners

BackOps, an AI operations platform for supply chain workflows, raised a $6M seed round led by Construct Capital

Better Auth, an open source framework for devs to simplify user authentication, raised a $5M seed round from Peak XV, Y Combinator, P1 Ventures, and Chapter One

AI dating app Sitch raised a $5M seed round from M13 and a16z

Lux Aeterna, a startup building reusable satellites, raised a $4M pre-seed round led by Space Capital, Dynamo Ventures, and Mission One Capital

Bruce Markets, an extended hours platform for trading US equity markets, raised a strategic investment round from Apex Fintech, Fidelity Investments, Nasdaq Ventures, Robhinhood, Webull, and others

IPOs / Direct Listings / Issuances / Block Trades

TSMC's overseas unit TSMC Global will issue $10B in new stock to bolster FX hedging

HDB Financial Services, the shadow lending unit of India's HDFC Bank, began taking orders for an India IPO that could raise $1.5B at a $7B valuation

German stock exchange operator Deutsche Boerse is preparing a $1B IPO of its data unit ISS Stoxx

Hong Kong insurance company FWD Group is seeking to raise $442M in a Hong Kong IPO, with Abu Dhabi's Mubadala Capital and Japan’s T&D Holdings serving as cornerstone investors

WuXi AppTec-backed life-sciences AI and robotics company MegaRobo Technologies is planning a Hong Kong IPO to raise over $300M

Canadian miner OceanaGold plans a 'boring' dual listing in the US to boost its share liquidity without issuing new shares

SPAC

M3-Brigade Acquisition V Corp., a SPAC backed by Tether's co-founder and an ex-Blackstone dealmaker, is raising $1B to invest in crypto

Debt

Indian telecom operator Vodafone Idea is seeking $2.9B in loans to bolster its network and compete with larger rivals

Czech defense firm Czechoslovak Group is marketing $1.3B of junk bonds

Bain Capital raised ~$1B in debt to fund its $1B LBO of major fast-food chain franchise Sizzling Platter

Egypt raised $1B in an Islamic bond sale to Kuwait's largest bank Kuwait Finance House

Saudi bank Banque Saudi Fransi is seeking a $750M loan from banks in Asia

Italian lender BMPS plans to raise $580M in debt after the ECB cleared its Mediobanca takeover

Ghana plans to raise $290M in its first domestic bond sale since defaulting in 2022

Bankruptcy / Restructuring / Distressed

Black Lion Citgo Group, a consortium including family office Black lion, Quazar Investment, Fortress Management, and Anex Management, entered the court-ordered auction for Citgo Petroleum with an $8B bid

Saks Global Enterprises is negotiating with bondholders to secure ~$600M in new debt financing to bolster its liquidity position

Cle Elum, a small town in Washington, filed for rare munis bankruptcy after a dispute with developer City Heights Holdings led to a $26M court judgment it couldn't pay

Fundraising / Secondaries

Vista Equity Partners raised $5.6B for a single-asset continuation fund to retain ownership of Citrix and TIBCO-owner Cloud Software Group from its own funds and investors including secondaries specialist Coller Capital

Sentinel Global, founded by ex-GIC tech investment co-head Jeremy Kranz, raised $213M for its debut enterprise tech-focused VC fund

Quant hedge fund AQR launched its first new US mutual funds in four years, betting on levered strategies to boost returns

Crypto Sum Snapshot

EU will disregard ECB warnings over stablecoin rules

US ordered Fannie and Freddie to find ways to count crypto as an asset

US Treasuries face stablecoin-driven demand surge as supply looms

Crypto coin designed to evade Russian sanctions has moved $9B

SoFi reintroduced crypto spot trading and global remittances

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

💥You can just do things. Get unlimited access to Brightwave's powerful AI investment research platform for 14 days. Rapid deal screens, instant memos, and real-time market insights - Brightwave does the grunt work for you. Start your free trial today.

Step it up from mediocre razors to the shaving brand built for elite performers. The House of Atlas high-precision Grooming Set delivers on all your shaving needs at any time, on any day. Upgrade your shave with House of Atlas. Shop The Grooming Set here.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.