Together with

Good Morning,

Bankers are looking to PE to keep the IPO revival going, Citadel is leading hedge fund league tables this year, Meta is cutting back on its metaverse ambitions, Polymarket is building an internal market making team, PIMCO's contrarian bond bet put them back on the top, and Diarmuid Early won the 2025 Excel World Championship.

Has AI reduced the workload in M&A – or just moved it around? UpSlide's report, The AI Paradox in M&A, shows how firms lose time making AI-enabled work client-ready and how your firm can fix it. Read the report here.

Let's dive in.

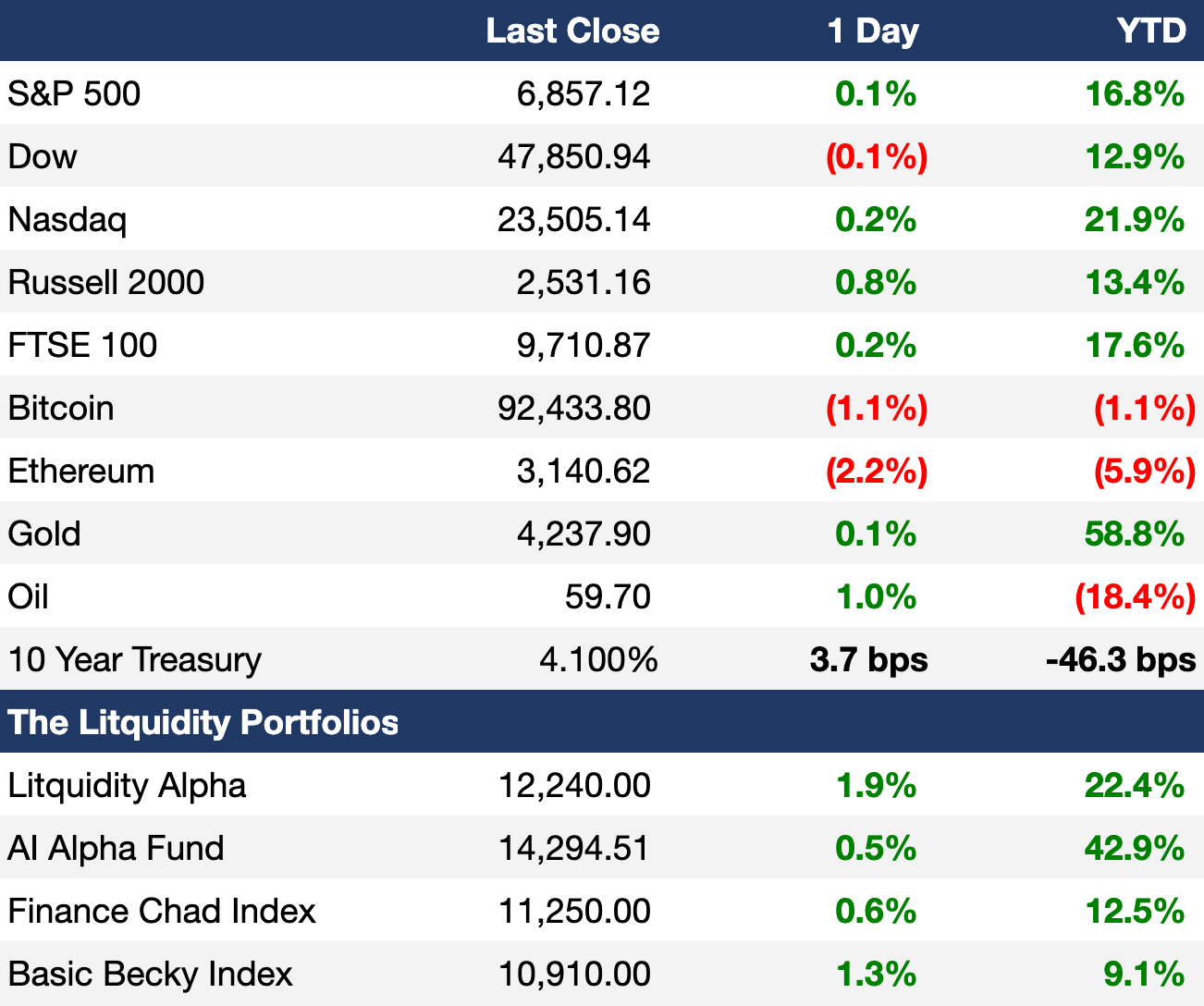

Before The Bell

As of 12/4/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mostly flat yesterday as investors braced for the Fed's rate decision next week

S&P and Nasdaq gained for a third-straight day

Traders priced in 90% chance of a third 25 bps rate cut

Japan's Nikkei 225 index surged 2.3% following a strong government bond auction

Silver pulled back 3.4% from ATHs after an eight-day rally as traders took profits

Dollar snapped a nine-day losing streak

Earnings

TD Bank Group beat underlying Q4 earnings and revenue and raised its dividend, even as reported results were weighed down by restructuring and AML-related costs (WSJ)

Kroger beat on Q3 earnings but missed revenue estimates and trimmed its FY outlook as intensifying price competition and a widening split across income groups are weighing on increasingly cautious consumers (BBG)

Ulta Beauty issued another beat-and-raise in Q3 as resilient beauty spending continued to outpace other discretionary categories (CNBC)

Dollar General issued a Q3 beat-and-raise as bargain-hunting consumers flocked to its low-price assortment, sending shares to a 15-month high (RT)

Docusign issued a Q3 beat-and-raise as subscription growth continued to drive momentum (WSJ)

What we're watching this week:

Today: Victoria's Secret

Full calendar here

Prediction Markets

Let's not forget that the Epstein files are set to be released by law. But with Trump, who knows when what stalls? Trade the release of the Epstein files on Polymarket.

Headline Roundup

US government debt topped $30T for the first time (BBG)

Canada's banker bonus pools rose by 15% (BBG)

Bankers urge PE to keep IPO revival going in 2026 (BBG)

Private credit profits come under threat as loan margins narrow (BBG)

Secondary investors are turning to MM continuation funds (PB)

One-third of UBS's billionaire clients plan to cut PE exposure (BBG)

Citadel and AQR are leading major hedge fund gains YTD (RT)

PIMCO wins big after going contrarian on 'Sell America' bond bets (BBG)

Jane Street's results were juiced by a surging bet on Anthropic (BBG)

UK equity outflows continued at record pace ahead of the fiscal budget (BBG)

Google exec sees AI search as expansion for internet (RT)

Young Koreans dump homeowner dreams to pile into soaring stocks (BBG)

PepsiCo is nearing a settlement with activist investor Elliott (WSJ)

Mubadala sued a US PE firm for self-dealing (FT)

Mubadala backs private credit bets after plowing in $20B (BBG)

Polymarket is building an internal market making team (BBG)

Apple poached Meta's legal chief as Big Tech exec turnover heats up (BBG)

Vanguard plans Miami expansion to tap more LatAm wealth (BBG)

Meta will cut metaverse spending by 30% (BBG)

Diarmuid Early won the 2025 Excel World Championship (X)

A Message from UpSlide

AI is helping M&A firms create pitchbooks and reports faster, but making them client-ready? That's still as time-consuming as ever.

Which leaves bankers still burning the midnight oil, and firms struggling to realize AI's biggest promise: accelerated deal cycles.

UpSlide's latest report reveals the truth behind AI adoption in M&A.

Drawing insights from M&A professionals across the U.S. and the U.K., the report uncovers:

Why AI-enabled outputs get stuck in a 'review bottleneck'

How disconnected tools slow down M&A workflows

Why the industry is optimistic about AI’s impact – but still worries about its accuracy

Read the report to see how outlooks on AI deployment are changing across the industry – and how your team can make sure AI actually delivers on its productivity promises.

Deal Flow

M&A / Investments

Netflix emerged as the highest bidder for $60B-listed Warner Bros. Discovery with an 85% cash offer; Paramount Skydance accused WBD of running an unfair sale process that favors Netflix over other bidders

Infrastructure investor Stonepeak is in talks to acquire lubricant business Castrol from oil giant BP for $8B

India is seeking bids for its 61% stake worth $7B in previously-distressed lender IDBI Bank

Industrial components manufacturer ITT is in advanced talks to buy heavy equipment manufacturer SPX Flow from PE firm Lone Star at a $4.5B valuation

UK self-storage company Big Yellow Group terminated talks with Blackstone on a potential $3.6B deal

South Africa's biggest mobile operator Vodacom agreed to take control of East Africa's largest telecom Safaricom from Kenya and Vodafone International Holdings in a $2.4B deal lifting its stake from 35% to 55%

Global paper and pulp giants UPM and Sappi plan to combine their graphic paper assets into a JV valued at $1.7B

Citadel-owned Apex Natural Gas agreed to buy natural gas assets in Texas from Comstock Resources for $430M and some Louisiana shale play assets from Azul Resources

Blackstone is once again weighing a sale of a London office building it bought for $220M in 2014

Activist hedge fund Barington Capital joined Elliott and Starboard Value with a $25M stake in $5.3B-listed SME fintech BILL and is pushing for a sale

Apollo co-founder Josh Harris's 26North Partners agreed to acquire a 51% stake in $6.3B-listed cooking equipment firm Middleby's kitchen products unit, including luxury cookware equipment brands such as Viking, Rangemaster, Lynx, and Aga at an $885M valuation

VC

Paradigm Health, a clinical-trial infrastructure platform, raised a $78M Series B led by ARCH Venture Partners

Flex, an AI startup offering finance tools to SMBs, raised a $60M Series B at a $500M valuation led by Portage Ventures

Spark Cleantech, a European heavy-industry decarbonization startup, raised a $35M Series A led by 360 Capital

AI platform startup Lemurian Labs raised a $28M Series A co-led by Pebblebed Ventures and Hexagon

AI conversational commerce startup Vambe raised a $14M Series A led by Monashees

AI-native construction startup Unlimited Industries raised a $12M seed round led by a16z and CIV

Interpretable-AI startup Guide Labs raised a $9M seed round led by Initialized Capital

Alinia AI, a real-time compliance infrastructure startup for financial-sector AI agents, raised a $7.5M seed round led by Mouro Capital

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

Indian conglomerate Reliance started work on an IPO of its telecoms unit Jio Platforms at a $170B valuation in what could be India's largest IPO ever

Lending fintech SoFi is seeking to raise $1.5B in a share sale at a 7% discount

Chinese AI chipmaker Moore Threads surged 470% after raising $1.13B in China's second-largest IPO this year

SoftBank agreed to sell a large portion of its stake in Indian mobile advertising InMobi back to the firm for $250M

Airport ground-services provider Menzies Aviation is considering an IPO in 'a few years'

Advent and Cinven-owned TK Elevator is set to hire banks for what could be Germany and Europe's biggest IPO in years

Japan luxury travel agent Xperisus is eying an IPO

Debt

Blackstone and Antares Capital are lending over $2B in private credit to help Canada's OTPP-owned software maker Mitratech refinance a bank loan package

Goldman Sachs paused a planned $1.3B MBS sale for exchange operator CME Group's data center operator CyrusOne following a major outage last week

South Africa sold $1.75B in dollar-denominated bonds for the first time in a year

Bankruptcy / Restructuring / Distressed

Real estate developer Dynamic Star filed for bankruptcy to halt a foreclosure sale on Bronx, NYC housing development Fordham Landing

Fundraising / Secondaries

Healthcare PE firm WindRose raised $2.6B for its seventh flagship fund

Bain Capital and Japanese lender SMBC are launching a $1.75B European loan platform targeting corporate borrowers in Europe and UK

Blue Owl raised $1.7B for a fund to invest in data centers

Quant hedge fund Two Sigma is raising for two new funds despite their internal exec drama; the firm raised over $1B across three new vehicles this year alone

UK PE firm Stafford Capital Partners raised a $1.2B continuation fund for a roll-up of three of its previous core timberland vehicles

Consulting firm Alvarez & Marsal's PE arm A&M Capital plans to raise $500M for a debut secondaries fund to focus on single-asset CVs

Indian VC Nexus Venture Partners raised a $700M fund to be split between Indian tech startups and AI

BlackRock halted plans for an infrastructure fund targeting wealthy Europeans

Crypto Sum Snapshot

CFTC approved crypto spot trading on registered exchanges

BlackRock and Coinbase CEOs say crypto is edging further into mainstream finance

Big banks are partnering with Coinbase on crypto pilots

Bank of America expanded crypto access for wealth management clients

Ex-Signature Bank execs launched new blockchain-based bank N3XT

A crypto investor donated record $12M to Reform UK political party

Malaysia is hunting Bitcoin miners who stole $1B of electricity from grid

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Noah Smith wrote a cool essay on why so many Americans hate AI.

Howard Lindzon shared some advice on how to defend yourself in this increasingly degenerate economy.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.