Together with

Good Morning,

Trump filled out his economic team, JPMorgan expects a tough 2025 for emerging markets, the Fed switched focus to where rate cuts will end, and Japan's PM has significantly beat stock benchmarks in recent years.

It's that time of the year again with The Lit Holiday Sale! Grab some holiday season merch and other hot off the press apparel at shop.litquidity.co with 20% off on all orders through December 2nd!

Fintech Mode Mobile is on a mission to turn smartphones into an income-generating asset and after earning venture backing, they're inviting retail investors to help them expand their smartphones disruption. Check out the offering.

Let's dive in.

Before The Bell

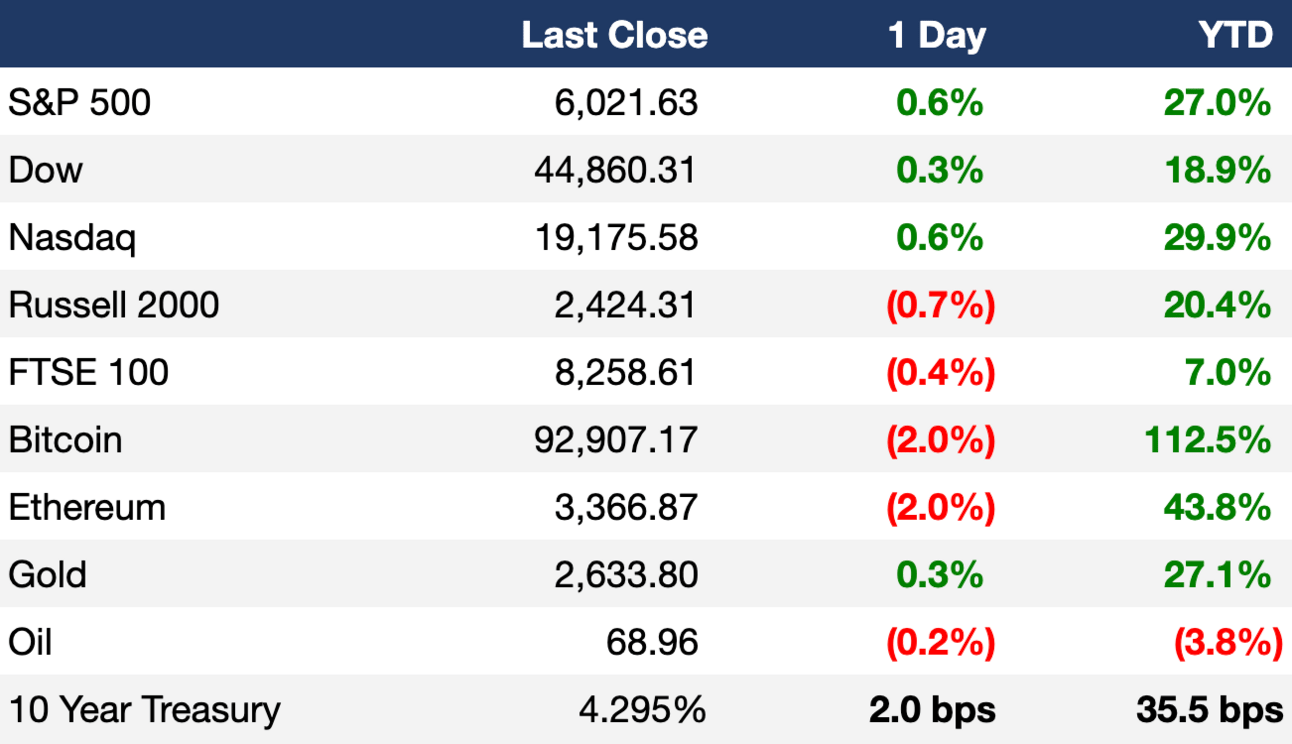

As of 11/26/2024 market close.

Markets

US stocks rose as investors shook off the threat of Trump's tariffs

Dow and S&P continued notched new ATHs

Traders are betting on a deep Treasuries selloff within weeks, with some targeting a 4.9% YTM on the 10Y

Canadian dollar fell to the lowest since Covid

Russian ruble hit its lowest against the dollar since the Ukraine war

Bitcoin rally fizzled before it could hit $100k

Earnings

Dell fell 11% despite beating Q3 earnings estimates as it missed on Q4 forecasts amid expectations of non-linear growth in AI sales (CNBC)

CrowdStrike fell 6% despite beating Q3 EPS and revenue estimates as investors saw light Q4 guidance as a sign of slow recovery from the global IT fallout (BBG)

Best Buy fell 5% after missing Q3 EPS estimates and cutting FY guidance due to softer consumer demand for electronics (CNBC)

Abercrombie & Fitch fell 5% despite a Q3 beat-and-raise as earnings failed to impress an incredibly high bar (BRN)

Full calendar here

Headline Roundup

Trump rounded out his economic team (WSJ)

Fed officials see rate cuts ahead, but only 'gradually' (CNBC)

Some Fed officials are open to lowering overnight repo rate (RT)

US consumer confidence rose to a sixteen-month high (BBG)

New Zealand cut rates by 50 bps to 4.25% (RT)

Wall Street banks back UK stocks to outshine Europe under Trump tariffs (FT)

EM is in for tough 2025 amid US policy shift and China struggles (RT)

Australia pension assets topped $2.6T as inflows surge (BBG)

China firms cut foreign-currency debt just in time for Trump (BBG)

Wall Street banks get lift from Israeli bonds and FX trading (RT)

Top law firms target Luxembourg in PE push (FT)

US charges against Adani put Jefferies on the spot (FT)

SEC is probing hedge fund RTW over role in Masimo proxy fight (BBG)

Wells Fargo asset cap will likely be lifted next year (RT)

Citigroup named BlackRock's Kate Moore as wealth CIO (RT)

Starbucks employees to get only 60% bonus on worst year since Covid (BBG)

Dell, HP earnings reveal stalling PC market recovery (BBG)

Japanese prime minister's portfolio is outperforming stock benchmarks (FT)

Israel and Hezbollah agreed to a ceasefire (AP)

A Message from Mode Mobile

Today's fastest-growing software company might surprise you 🤳

🚨 Heads up! It's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators. Investors are buzzing about the company's pre-IPO offering.1

📲 Mode saw 32,481% revenue growth from 2019 to 2022, ranking them the #1 overall software company on Deloitte's most recent fastest-growing companies list2 by aiming to pioneer "Privatized Universal Basic Income" powered by technology—not government. Their flagship product, EarnPhone, has already helped consumers earn & save $325M+.

🫴 Mode's Pre-IPO offering is live at $0.26/share — 20,000+ shareholders already participated in its previous sold-out offering. There's still time to get in on Mode's pre-IPO raise and even lock in 100% bonus shares3… but only until their current raise closes for good. Claim this exclusive bonus while you can!4

1Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. 2The rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. 3A minimum investment of $1,950 is required to receive bonus shares. 100% bonus shares are offered on investments of $9,950+. 4Please read the offering circular and related risks at invest.modemobile.com. This is a paid advertisement for Mode Mobile’s Regulation A+ Offering.

Deal Flow

M&A / Investments

Italian lender Banco BPM rejected a $10.5B takeover proposal from domestic rival UniCredit

PE firm GTCR will acquire a $1.3B minority stake in software-testing firm Tricentis at a $4.5B valuation, including debt

TPG is in advanced talks to buy the Indian wind energy assets of Siemens Energy's Gamesa unit in a potential $300M deal

Italian drugmaker Angelini Pharma is in talks to merge with CVC-backed peer Recordati

Värde Partners is exploring the sale of credit card platform Mercury Financial

VC

Cloud backup platform Eon raised a $70M Series C at a $1.4B valuation led by Bond

Cardless, a next-gen co-branded credit card platform, raised a $30M round led by Activant Capital

AI WealthTech platform Range raised a $28M Series B led by Cathay Innovation

EV charging platform Ampeco raised a $26M Series B led by Revaia

Wherobots, the Spatial Intelligence Cloud, raised a $21.5M Series A led by Felicis

Fresho, a fresh food technology platform, raised a $17M Series B from Geoff Tarrant

Roon, a startup replacing 'Dr. Google' with real doctor interaction, raised a $15M round at a $68M valuation co-led by Forerunner Ventures and First Mark

Volta, a SaaS platform for B2B sales, raised a $6.3M pre-seed round led by Emblem

UK healthtech startup PocDoc raised a $6.5M pre-A led by MMC Ventures, Molten VC, and Simplyhealth Ventures

IPO / Direct Listings / Issuances / Block Trades

Chinese express delivery firm SF Holding raised $749M in its Hong Kong IPO

Miner Anglo American will sell another 6.6% stake in Anglo American Platinum to raise $527M ahead of a spinoff

Online pharmacy Apotea is seeking to raise $149M in a Stockholm IPO

Debt

Mars is readying an investment-grade bond sale to help fund its planned $36B acquisition of food giant Kellanova

Sri Lanka kicked off a $12.6B dollar-denominated distressed debt exchange

Siemens secured a $10.5B bridge loan to support its $10B acquisition of software maker Altair Engineering

KKR, Canada's CPP, and German billionaire Mathias Döpfner are seeking $4.2B of debt to finance their bid to separate media conglomerate Axel Springer's classified ads businesses from its news operations

Peabody Energy secured a $2.1B bridge loan from banks and private credit lenders to back its $3.8B acquisition of Anglo American's steelmaking coal business

India-focused miner Vedanta Resources launched an $800M dollar-bond sale

$12B climate fund The Climate Investment Funds is planning a $500M bond issuance

Stonepeak-backed Digital Edge is seeking a $400M-$500M bank loan to fund an Indian data center

Canadian pipeline firm Husky Midstream is seeking to sell over $284M of loonie bonds

Bankruptcy / Restructuring / Distressed

Thai Airways is planning a $1.27B share sale to exit a debt restructuring and resume stock trading

HIG Capital-owned Brazilian healthcare firm Kora Saude is in talks for a debt restructuring that would include a $259M capital injection

Fundraising

MM PE Firm JLL Partners is seeking to raise $900M for its ninth flagship fund

Crypto Corner

Exec’s Picks

Elon Musk and Vivek Ramaswamy recently published a joint op-ed in WSJ outlining their plans for the Department of Government Efficiency.

WSJ published an exclusive piece on how Morgan Stanley courted dodgy customers to build a wealth management empire.

This Smart Home Company Has Already Hit $10 Million in Revenue—and It’s Just Getting Started

What if your window shades could do more than just block sunlight?

Meet RYSE, the company transforming everyday window shades into smart, automated devices. With over $10 million in total revenue, 10 granted patents, and products already available in 127 Best Buy locations, RYSE is growing at an incredible pace—200% over the last month, to be exact.

And they’re only getting started. With plans to expand internationally and partnerships with major retailers like Home Depot and Lowe’s, RYSE is set to become a household name in the rapidly growing smart home market.

Now, you have the chance to invest for just $1.75 per share and join a company poised for explosive growth.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.