Together with

Good Morning,

Satya Nadella has made $1B+ in Microsoft comp, UPS and the Teamsters union have returned to the bargaining table to avoid a strike, Nasdaq dropped its plans for a crypto custodian business in the US, Microsoft and Activision extended their window for closing their deal, and there’s no word from the US soldier who crossed the border to North Korea.

Today’s sponsor, Plaid, just released their 2023 Fintech Spotlight report. If you work in finance and/or care about the Fintech ecosystem, this is your must-read content for the week.

Let’s dive in.

Before The Bell

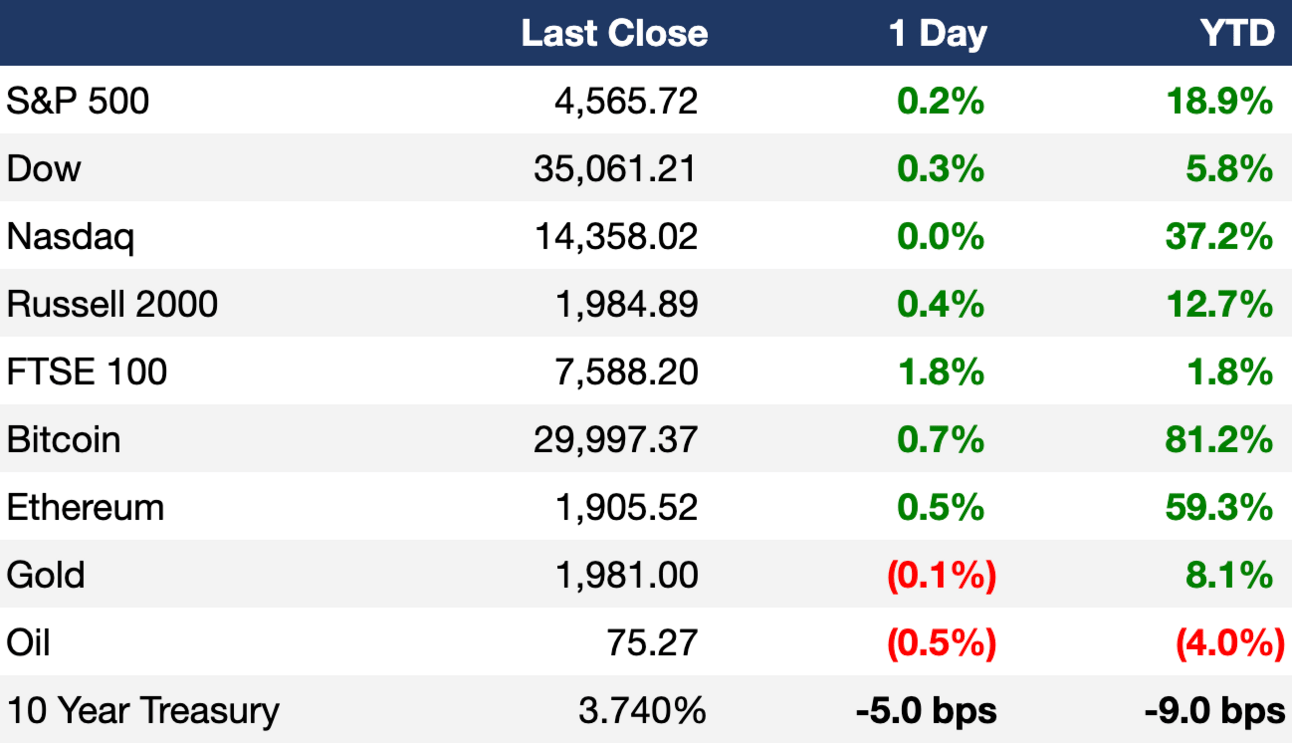

As of 7/19/2023 market close.

Markets

Stocks ended the trading day higher as investors digested early earnings from large banks and awaited results from other major S&P 500 companies

The Dow notched its eighth consecutive positive day after regional banks posted earnings

Sentiment about US stocks is positive overall as strong earnings performances have investors feeling optimistic that the US will avoid a recession

Earnings

Goldman Sachs missed Q2 profit expectations with earnings down 58% and IB revenue down 20% YoY; the bank also had a $485M real estate impairment and a $504M markdown on its GreenSky acquisition (AX)

Tesla beat Q2 expectations with record-high quarterly revenue, but the auto manufacturer saw lower margins driven by price cuts, incentives, and greater R&D costs; the stock was down 4% AH (CNBC)

Netflix reported mixed Q2 results as the platform continues efforts to trim costs and boost engagement in an increasingly competitive streaming landscape; the stock fell 8% AH (YF)

United Airlines beat Q2 earnings and forecast a strong Q3 thanks to an unrelenting travel boom, led by an uptick in international travel (CNBC)

What we're watching this week:

Today: Johnson & Johnson, TSMC, American Airlines, Capital One

Friday: American Express

Full calendar here

Headline Roundup

Union, UPS return to bargaining to avert strike (RT)

Biden gets little credit on economy as he touts ‘Bidenomics’ (BBG)

Nadella’s Microsoft payouts top $1B on 1,000% stock boom (BBG)

Netflix scraps cheapest ad-free plan to boost ad-tier (RT)

China’s Washington envoy warns of retaliation against further US tech curbs (RT)

Senators to propose a ban on US lawmakers, Executive Branch members owning stocks (WSJ)

Musk says Tesla to spend $1B+ on Dojo supercomputer (BBG)

Apollo, Pimco show creditors can play nice with Carvana deal (BBG)

House committee takes aim at US VCs for investments in Chinese AI firms (CNBC)

US single-family housing starts to drop; building permits hit 12-month high (RT)

Microsoft to offer some free security products after criticism (RT)

Netflix subscriptions jump 8%, revenue climbs as password sharing crackdown takes hold (CNBC)

Apple tests generative AI tools to rival OpenAI's ChatGPT (RT)

Juul has a new high-tech vape and hopes the FDA won’t ban it (WSJ)

US SEC accepts six spot bitcoin ETF proposals for review (RT)

No word from North Korea on US soldier who dashed across military border (RT)

A Message From Plaid

The Entire Fintech Ecosystem, Summed Up

(Or should we say Exec Sum-ed Up. Nice.)

Whether you’re talking Amazon (the jungle) or Amazon (the company), ecosystems all have one thing in common: They’re big. And the fintech ecosystem is no exception.

In the current climate, there are a number of challenges for businesses to keep the bottom line humming along.

To help navigate, Plaid just released the 2023 Fintech Spotlight report that pushes companies to focus on profitability while protecting the golden geese (customers).

This report covers the most need-to-know insights on locking down profitability in the world of fintech including:

Optimizing operational costs

Increasing customer lifetime value

Managing risk and customer protection

Let’s put it this way – if you work in finance… or run a business… if you have a bank account, this report has something useful for you

(And don’t forget to say thanks to Plaid)

Deal Flow

M&A / Investments

Microsoft and Activision Blizzard agreed to extend the cutoff to close their $69B deal from July 18 to October 18 while they work to secure UK approval (RT)

Broadcom’s $61B acquisition of cloud computing firm VMware was provisionally approved by UK antitrust regulators (BBG)

The FTC has no ongoing talks to settle its legal challenge to Amgen’s $27.8B takeover of Horizon Therapeutics after it rejected a settlement overture earlier this year (BBG)

TPG agreed to acquire healthcare IT platform Nextech for $1.4B to expand its presence in the healthcare services industry (RT)

PE firm J.F. Lehman & Co agreed to acquire waste company Heritage-Crystal Clean for $1.2B cash (RT)

PE firm Apax Partners, BC Partners, and US media group Hearst Communications walked away from UK business media group Ascential’s auction of its consumer data unit WGSN over valuation differences, as Ascential wanted at least $906M for the business (RT)

A consortium of Singapore’s SC Capital Partners, an Abu Dhabi Investment Authority subsidiary, and Goldman Sachs Asset Management acquired a portfolio of 27 Japanese hotels for ~$900M (RT)

Sports and music marketing agency Wasserman agreed to acquire peer CSM Sport & Entertainment to improve its sports roster (RT)

VC

TP24, a UK-based fintech provider of flexible revolving business credit, raised $446.4M in funding from Barclays and M&G Investments (FN)

Korean online fashion platform MUSINSA raised a $190M Series C led by KKR (BW)

Live language learning platform Preply raised a $70M Series C led by Horizon Capital (TC)

Carbon credit ratings startup Sylvera raised a $57M Series B led by Balderton Capital (FN)

AI and robotics startup Neura Robotics raised $55M in funding led by Lingotto, Vsquared Ventures, Primepulse, and HV Capital (FN)

Risc Zero, a startup developing general-purpose zero-knowledge virtual machine tech, raised a $40M Series A led by Blockchain Capital (FN)

Hightouch, a startup helping companies sync customer data across systems, raised a $38M round at a $615M valuation led by Bain Capital Ventures (TC)

Intraoperative immunotherapy startup SURGE Therapeutics raised a $32M Series B led by Bioluminescence Ventures (BW)

Gardens, a provider of a globally distributed game studio, raised a $31.3M Series A led by Lightspeed Venture Partners and Krafton (FN)

At-home blood testing startup SiPhox Health raised $27M in new Series A and seed funding led by Intel Capital (TC)

Privacy-focused blockchain protocol Manta Network raised a $25M Series A at a $500M valuation led by Polychain Capital and Qiming Venture Partners (TC)

Terabase Energy, a startup building digital and automation solutions for solar power plants, raised a $25M round led by Fifth Wall (BW)

Verismo Therapeutics, a clinical-stage CAR-T company, raised a $17M pre-Series A led by DongKoo Bio and HLB Innovation (FN)

Komi, a creator commerce platform, raised a $12M Series A led by RTP, Third Prime, Antler, and more (FN)

GGWP, a game moderation platform, raised $10M in funding from Samsung Ventures and SK Telecom Ventures (FN)

Verse, a San Francisco-based provider of a software platform that uses generative AI to allow organizations to buy and manage clean power, raised a $5.8M seed round led by Coatue (FN)

KayoThera, a startup developing oral small molecules to inhibit the retinoid pathway, raised a $5.2M Series A led by Accelerator Life Science Partners (BW)

The Wound Company, a Minneapolis-based multi-channel on-demand wound and ostomy care delivery company, raised a $4.3M seed round led by Susa Ventures and Sozo Ventures (FN)

Cyber security startup PingSafe raised a $3.3M seed round led by Sequoia Capital India (BW)

Metafold, a cloud and API-based 3D engineering platform, raised a $1.8M seed round led by Differential Ventures (FN)

Nigerian insurance API startup MyCover.ai raised a $1.3M pre-seed round led by Ventures Platform (TC)

IPO / Direct Listings / Issuances / Block Trades

Oddity Tech's shares debuted at 40% above its IPO offering price, giving the Israel-based wellness and beauty company a $2.8B valuation (RT)

SPAC

Debt

Used car dealer Carvana reached a debt restructuring agreement to reduce its outstanding debt by $1.2B, lowering its yearly interest expenses by $430M per year for the next two years (CNBC)

Bankruptcy / Restructuring

Bron Studios, the Canadian finance and production company that backed ‘Joker’ and The Weeknd’s ‘The Idol’ filed for bankruptcy (V)

Fundraising

Crypto Corner

The SEC accepted spot bitcoin ETF applications from BlackRock, Bitwise, VanEck, WisdomTree, Fidelity, and Invesco, after previously rejecting dozens of applications (RT)

Australian regulators canceled the license of the local arm of bankrupt crypto exchange FTX (RT)

French bank Societe Generale became the first company in France to obtain a license for crypto services (RT)

Nasdaq abandoned its plans to launch a crypto custodian business in the US (BBG)

Exec’s Picks

Sweater Ventures (a Litquidity portfolio company) is helping both accredited and non-accredited investors support the next wave of groundbreaking startups. They are opening investments into the Sweater Inc fintech platform to the Exec Sum community, but this opportunity closes on July 31st. Interested in investing? Learn more here.

Cullen Roche wrote about what inverted yield curves really mean (hint: it’s not a guaranteed recession indicator).

Matt Levine covered the peculiar case of PE continuation funds.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter