Good Morning,

Musk sold more Tesla stock after stating he was done selling back in April, Carlyle's CEO quit because he didn't get a $300M comp package approved (lol), the Trump FBI raid memes were hittin' on social media, and Serena Williams announced she's retiring from professional tennis this year.

We've got a few exciting updates / messages for y'all. See below for more info on Wall Street comp report, early stage investment opportunities, and partnership opportunities.

Let's dive in.

Before The Bell

Markets

Stocks fell across the board on Tuesday as investors monitored several earnings reports and economic data points

The S&P 500 fell for the fourth straight trading session

The Labor Department reported that labor productivity fell for the second straight quarter

The Bureau of Labor Statistics will release July's CPI report today at 8:30am EST

Earnings

Ralph Lauren beat revenue and profit expectations, demonstrating an unwavering demand for luxury apparel from wealthy consumers who remains largely unscathed by inflation, but its stock still fell 4.5% on the day (RT)

Spirit Airlines fell 0.2% after it beat earnings expectations but still recorded a Q2 loss as strong travel demand and higher fares weren’t enough to overcome a surge in costs (CNBC)

Coinbase reported Q2 results after hours, recording a 63% decline in revenue and a $1.1B loss driven by the crypto market’s spring meltdown (WSJ)

RCI Hospitality surpassed earnings estimates for the third time in four quarters but came up just short of revenue expectations; its stock fell 0.37% on the day (YHOO)

What we're watching this week:

Today: Jack in the Box, Wendy’s, Walt Disney

Thursday: Cardinal Health

Full calendar here

Headline Roundup

Biden signed a $280B semiconductor funding bill (AX)

Carlyle’s CEO quit after failed request for $300M pay package (FT)

Chip company Micron Technology warned investors of a drop in its Q4 revenue guidance, causing its stock to fall 3.7% (BRRN)

China's top auditor is conducting a review of the $3T trust industry (RT)

Russia halted oil flow to three EU countries, citing payment disputes (NYT)

Elon Musk sold nearly $7B worth of Tesla (WSJ)

US solar shipments are slow due to an import ban on China’s Xinjiang region (WSJ)

Ford raised prices of their F-150 Lightning by up to $8.5k due to ‘significant’ battery cost increases' (CNBC)

Average hourly earnings grew 5.2% in July YoY and annual wage gains have exceeded 5% each month this year (WSJ)

Walmart held talks on a streaming deal with Disney, Comcast and Paramount (NYT)

Social media marketing firm Hootsuite slashed its workforce by 30% (TC)

Public pension plans had their worst annual performance since 2009 in the year ended June 30 (WSJ)

Microsoft is asking teams across the company to rein in employee expenses (WSJ)

US ratified Sweden and Finland's NATO applications (AX)

Serena Williams will retire from tennis sometime after the US Open (NYT)

A Message from Litquidity

Got a few updates on things we're working on, some of which we could use your help:

Wall Street comp report: I'm compiling one of the most comprehensive data sets spanning sell-side and buy-side finance roles across rank and geographies. A lot of banks have recently announced bonus figures for their analyst classes so I'm looking to get the latest in order to provide transparency and help y'all get paid. Please feel free to submit your comp data here. All info will be anonymous. I'll be sharing it later this week or early next week.

VC investment opportunities: got a few opportunities to bring the community into some Seed and Series A funding rounds. If you're an accredited investor / qualified purchaser and want access to Litquidity Syndicate deals, please fill out this survey. Priority given to the most active community members through newsletter signups and open rates!

Partnership opportunities: if you want to partner with me across social media, email newsletters, or other mediums, you can submit an inquiry here.

Deal Flow

M&A / Investments

Gaming software company AppLovin made an offer to buy peer Unity Software in a $17.5B all-stock deal (RT)

Shale producer Devon Energy will buy Eagle Ford basin operator Validus Energy for $1.8B in cash (RT)

TikTok parent company ByteDance acquired Amcare Healthcare, one of China’s largest private hospital chains, for ~$1.5B (BBG)

PE firm TA Associates revived its sale of French cosmetics company Laboratoires Vivacy, which could be valued at ~$1B (BBG)

Canadian financial group Fairfax Financial proposed to take local restaurant operator Recipe Unlimited private for ~$955M (RT)

Canadian engineering group WSP Global acquired UK consulting firm RPS Group $755M including debt (BBG)

Diamond jewelry retailer Signet Jewelers will acquire online jewelry retailer Blue Nile in a $360M all-cash deal (CNBC)

Russia plans to give up part of its ~66% stake in Eurasian Development Bank amid fear of sanctions (BBG)

Japanese conglomerate SoftBank is selling part or all of its 9% stake in personal finance company SoFi (BBG)

Consumer data company Nielsen's largest shareholder WindAcre is nearing a deal to join Nielsen's buyout consortium led by Elliot Investment Management and Brookfield (BBG)

Spanish transportation giant Ferrovial is considering options for its 25% stake in London's Heathrow Airport (RT)

HarperCollins Publishers wants to buy Simon & Schuster if rival Penguin Random House’s takeover bid for Simon fails on antitrust grounds (BBG)

Dyal Capital is in talks to acquire a stake in PE firm PAI Partners (BBG)

VC

Overtime, a sports media company which began as an Instagram account, raised a $100M Series D led by Liberty Media (FBS)

Blend360, a global provider of data, analytics, and talent solutions, received a $100M minority investment from Recognize (PRN)

StradVision, an AI-based perception processing company for autonomous vehicles and driving assistance systems, raised an $88M Series C led by ZF and Aptiv (PRN)

Boulevard, a digital platform for beauty service appointments, raised a $70M Series C led by Point72 Private Investments (TC)

WiTricity, a developer of wireless charging for EVs, raised a $63M funding round led by Siemens AG (PRN)

Truework, an income and employment verification platform for lenders, raised a $50M Series C led by G Squared (TC)

REVA Medical, a medical device company with bioresorbable polymer technologies for vascular applications, raised a $45M Series B led by BioStar Capital and a 'global strategic investor' (PRN)

Shopic, a digital solutions platform for retailers, raised a $35M Series B led by Qualcomm Ventures (TC)

DD360, a Mexican real estate tech platform, received a $25M investment from Creation Investments (PRN)

PreciTaste, an AI-based food quality tester for restaurants, raised a $24M Series A co-led by Melitas Ventures and Cleveland Avenue (TC)

Pinata, an NFT distribution platform, raised $21.5M in both seed and Series A funding; the Series A was co-led by Greylock and Pantera while the seed was co-led by Greylock and Offline Ventures (PRN)

Evidence Partners, an AI-based literature review automation software, raised a $20M funding round led by Thomvest Ventures (PRN)

CreatorDAO, a decentralized community that invests in creators, raised a $20M seed round led by a16z crypto and Initialized Capital (PRN)

Spin Technology, a data protection software vendor for SaaS apps, raised a $16M Series A led by Blueprint Equity (TC)

Bigspoon, an India-based cloud kitchen startup, raised a ~$12.6M funding round led by Indian Angel Network (ENTPR)

Nanopath, a molecular diagnostics company, raised a $10M Series A co-led by Norwest Venture Partners and the Medtech Convergence Fund (PRN)

ReturnLogic, an ecommerce returns solution, raised an $8.5M Series A led by Mercury (TC)

Privya, an AI-based data privacy platform for the coding stage, raised a $6M seed round led by Hyperwise Ventures (TC)

Bluestem Biosciences, a renewable chemicals company focusing on synthetic biology in agriculture, raised a $5M pre-seed round led by Zero Infinity Partners (PRN)

Vespene Energy, a methane mitigation company, raised a $4.3M funding round led by Polychain Capital (PRN)

Atreo, a SaaS company focused on modernizing and simplifying clinical trials, raised a $4M seed round (PRN)

Auddy, a London-based podcast platform provider, raised a ~$3M seed round led by Pembroke VCT (FSMS)

Sella, a Portland-based resale platform, raised a $3M seed round led by Flying Fish Ventures (FSMS)

Smartfluence, a SaaS influencer marketing platform, raised a $2.15M seed round led by PACA Ventures (PRN)

She Matters, a postpartum-focused healthcare startup for underrepresented women, raised a $1.5M pre-seed round from Oxeon Ventures, Chingona Ventures, The Fund, and Emmeline Ventures (TC)

Five Flute, an issue-tracking platform for physical product development, raised a $1.2M pre-seed round led by Baukunst, Fenton Founders Fund, and others (TC)

IPO / Direct Listings / Issuances / Block Trades

US insurer AIG set a tentative September date for the delayed IPO of its life and retirement business Corebridge Financial (BBG)

SPAC

Blue laser technology company NUBURU will merge with Tailwind Acquisition in a $350M deal (SA)

Wag Labs, an American pet services marketplace, completed its business combination with CHW Acquisition Corporation (YHOO)

Equity Distribution Acquisition Corp will redeem all outstanding Class A common stock shares and liquidate (MW)

Debt

Tech giant Meta Platforms raised $10B in its first-ever bond offering, as it looks to fund share buybacks and investments to revamp its business (RT)

Bankruptcy / Restructuring

Crypto exchange CoinFlex has filed for restructuring in a Seychelles court, as it seeks to resolve an $84M shortfall due to a counterparty failing to make a margin call (BBG)

Pharmaceutical company Endo International is likely to file for Chapter 11 bankruptcy amid thousands of outstanding opioid crisis-related lawsuits (WSJ)

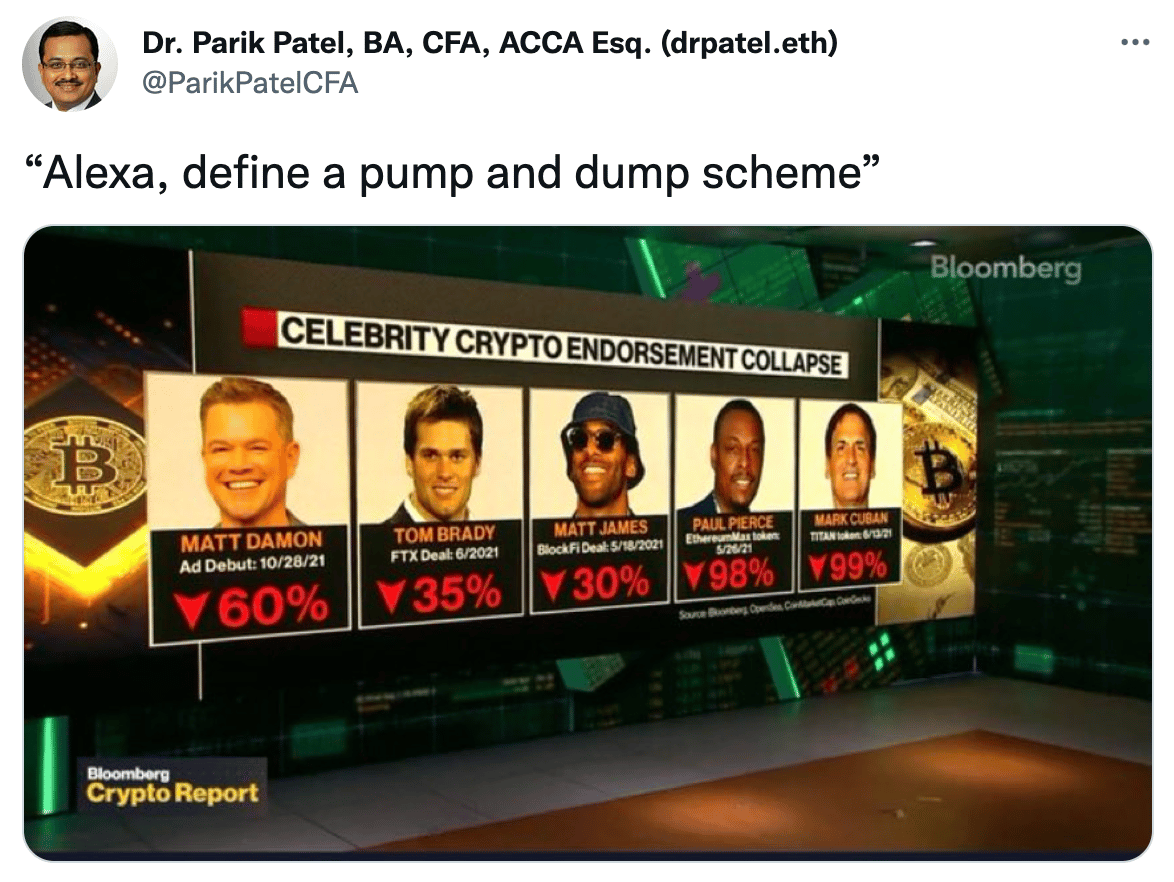

Crypto Corner

Exec's Picks

Exponential is a new platform that allows users to discover new DeFi yield pools, get a custom risk analysis on your wallet, and invest in one click. Want to know if some yield play that's going viral is overhyped or legit? Check out Exponential. They're in early beta, which can be accessed here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started and building your own audience.