Together with

Good Morning,

Musk wants a larger Tesla stake, Nvidia is off to a strong start in 2024, taxes will be a hot topic in this year’s election, Goldman is doubling down on lending to the wealthy, the US was hit by waves of extreme cold, and Trump won the Iowa Caucus.

Need some high-quality creative content on short notice? Check out today’s sponsor, Superside, to get in touch with some of the top designers in the world in under 24 hours.

Let’s dive in.

Before The Bell

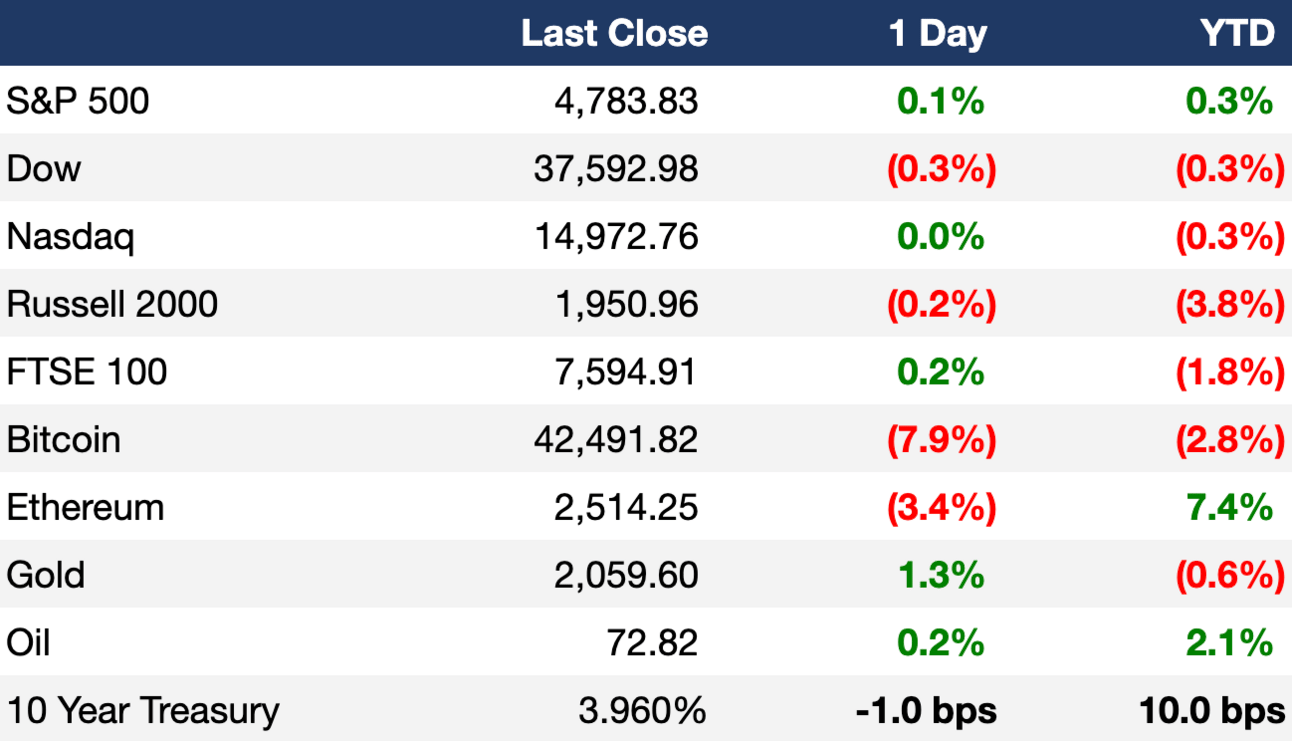

As of 1/12/2024 market close.

Markets

US stocks closed slightly down as traders digested corporate earnings

The Dow fell 0.31%, while the S&P rose 0.08%

European stocks fell as bond yields rose and China’s central bank skipped an expected rate cut

Earnings

Citigroup reported a $1.8B Q4 loss due to several large charges tied to overseas risks, last year’s regional banking crisis and its corporate overhaul; the bank expects to reduce its headcount by 20,000 and incur up to $1B in additional severance costs (CNBC)

JPMorgan Chase reported that its Q4 profit declined due to a $2.9B fee tied to the government’s seizure of failed regional banks last year; the bank beat revenue expectations and beat on earnings when excluding the fee (CNBC)

Delta shares fell 9% despite beating Q4 adjusted earnings and revenue due to cutting its full-year profit outlook (CNBC)

UnitedHealth Group shares fell ~3%, despite reporting better-than-expected Q4 earnings, due to medical costs soaring 16% (AP)

What we're watching this week:

Tuesday: Goldman Sachs, Morgan Stanley, Interactive Brokers

Wednesday: Charles Schwab, Discover, Prologis, Kinder Morgan

Thursday: TSMC, Truist

Friday: Ally Financial, State Street

Full calendar here

Headline Roundup

$6T in taxes are at stake in this year’s elections (WSJ)

Nvidia’s red-hot 2024 start a bright spot as S&P 500 eyes record (BBG)

Elon Musk wants more control of Tesla, seeks 25% voting power (CNBC)

Goldman Sachs goes big on lending to the wealthy (WSJ)

Apple to shutter 121 person San Diego AI team in reorganization (BBG)

Hertz makes ‘agile’ decision to shift strategy and sell EVs, Teslas (CNBC)

US urges India not to restrict trade with laptop import policy (BBG)

Biotech and pharma companies are betting on a promising class of cancer drugs to drive growth (CNBC)

AI fever takes over Davos, pushing crypto aside as the new cool kid on the block (CNBC)

Donald Trump wins Iowa Caucus (WSJ)

Boeing to add further quality inspections for 737 MAX (RT)

Retirement savers are putting more money into stocks, survey shows (BBG)

Dish launches debt swap after controversial asset transfer (BBG)

Bill Ackman gives $1M to long-shot Biden challenger (WSJ)

Deflation worries deepen in China (WSJ)

Extreme cold hammers wide swath of US over holiday weekend (BBG)

A Message From Superside

Your Answer To Time-Consuming High-Quality Content

It's 3 am, and you find out you need creative for an ad campaign.

Sound familiar?

If you are getting panic sweats, we're sorry. 🤣

As marketers, we know the exhausting game of producing high-quality content in a short time frame.

Imagine getting a piece of content from some of the top 1% of designers IN THE WORLD in less than 24 hours. 🌎

No joke, it's possible with Superside. The #1 creative-as-a-subscription service, trusted by over 450 brands, including Google, Meta, Reddit and Shopify. 🥇

Wasting energy on small tasks? - Superside

Inundated by too many requests? - Superside

Not feeling creative? - Yep, Superside

No more vetting freelancers, and no more panic sweats.

Superside's CaaS (Creative as a Service) removes the weight of creating high-quality content. It's like instantly hiring 20 people.

👉🏼 And as an Exec Sum reader, you get a free consultation here

Deal Flow

M&A / Investments

BlackRock will acquire infrastructure investor Global Infrastructure Partners, which has $106B AUM, in a $12.5B cash-and-stock deal (FT)

PE firm PAI Partners is in the early stages of exploring options for Froneri, its ice cream JV with Nestle, which could be valued at over $10B (BBG)

EQT and KKR are among the PE firms interested in acquiring a $5B end-user computing unit being sold by Broadcom after its acquisition of VMware (BBG)

SoftwareOne Holding rejected a bid from Bain Capital that valued the Swiss IT company at $3.5B (BBG)

American pharmaceutical distributor McKesson is planning to sell Canadian drugstore chain Rexall Pharmacy Group seven years after it bought the business for $2.2B (RT)

Oil and gas company Talos Energy will acquire privately held exploration and production company QuarterNorth Energy in a $1.3B cash and stock deal (RT)

Starwood Capital Group agreed to pay ~$1B for a portfolio of London hotels from Edwardian Hotels (BBG)

CVC Capital Partners agreed to buy vitamin and supplement maker Sunday Natural in an $876M deal (BBG)

Thomson Reuters raised its offer to buy Sweden's Pagero by 25% to ~$789M and gained control of 54% of the e-invoicing and tax solutions firm to ward off rival bids (RT)

Hillhouse and Japan's Mitsui & Co emerged as final bidders competing for traditional Chinese medicine chain Eu Yan Sang International in a deal that could fetch over $700M (RT)

CoinShares International, a $4.5B crypto asset manager, exercised an option to acquire Valkyrie Funds after Valkyrie's spot bitcoin ETF won US regulator approval (RT)

Korean Air is expected to win EU antitrust approval to buy Asiana Airlines after pledging to sell the latter's cargo unit and divest routes to four European cities (RT)

VC

Grip Invest, a provider of a D2C investor-first digital investment platform, raised a $10M Series B led by Stride Ventures (FN)

Mercor, a startup automating talent selection for companies, raised a $3.6M round led by General Catalyst (FN)

Business onboarding platform Detected raised a $2.5M round from Thomson Reuters Ventures, Love Ventures, and others (EU)

Spot Technologies, an AI startup developing cloud technology that turns retail and logistics cameras into an intelligent system tracking behavior analysis and security, raised a $2M round led by Femsa Ventures, Bridge Latam, Daedalus, Kuiper, and Casque (TC)

IPO / Direct Listings / Issuances / Block Trades

Chinese fast fashion retailer Shein is seeking China’s permission for a US IPO; the company was valued at $66B in a fundraising in May (RT)

Indonesia’s largest private carrier, PT Lion Mentari Airlines, is considering reviving an IPO in Jakarta that could raise as much as $500M (BBG)

The London Tunnels, a company developing once-secret tunnels under central London into a tourist attraction, is planning to IPO on the city’s stock exchange and is seeking a valuation of $157M (BBG)

Air Astana, Kazakhstan’s flagship carrier, will proceed with a long-delayed IPO both in the UK and at home to fund expansion (BBG)

Greece’s Hellenic Republic Asset Development Fund is launching an IPO of its 30% stake in Athens International Airport (BBG)

Saudi Arabia’s Fourth Milling chose Riyad Capital for its local IPO as soon as the first half of this year (BBG)

Debt

The Dutch government will lend grid operator Tennet Holding $27.4B for grid investments as the sale of its German network remains on hold (BBG)

Insurance brokerage company The Ardonagh Group is seeking to raise as much as $5B to help refinance debt, re-organize its balance sheet, and fund fresh acquisitions in what would be the largest ever direct-lending deal (BBG)

Emerging Africa Infrastructure Fund raised $294M in debt funding to invest in projects on the continent and diversify into Asia (BBG)

Bankruptcy / Restructuring

Fundraising

Technology-focused investment manager Coatue Management raised $3B for a structured equity fund that allows closely-held companies to avoid raising money at lower valuations (BBG)

$16B macro hedge fund Rokos Capital Management is in talks to with investors to increase its assets by as much as $2B (BBG)

Crypto Corner

Exec’s Picks

Ben Carlson discussed why Americans are better off than most of us think.

Financial Times explained why BlackRock is buying infrastructure manager GIP.

Trung Phan explored whether or not the 48-year-old Heritage Auctions can topple the Sotheby’s and Christie’s duopoly.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter