Together with

Good Morning,

Investment banking is set to extend its worst run in over ten years, European VCs are on pace for their worst fundraising year in a decade, commodity traders are looking at a massive windfall on tariff-fueled trading, and EU will hold talks with X after Grok turned into Hitler.

UpSlide and Litquidity are hosting a fun happy hour later this month in NYC. We're bringing together investment bankers at Cask Cellar on Thursday, July 24th for a laid-back yet high-powered networking experience, with great drinks, fun company, and a chance to unwind after markets close. We'd love for you to join! RSVP here.

Neutral is taking over multi-family real estate development by focusing on the booming health and wellness industry and they're currently raising across some interesting projects. Schedule a call with their IR team and explore an investment today. Read more below.

Let's dive in.

Before The Bell

As of 7/14/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks inched slightly upwards as investors looked ahead to major bank earnings, inflation data, and tariff updates

Nasdaq posted its seventh record close since June 27

Nigerian stocks hit an ATH in its longest gain since March 2024

US 30Y yield rose for a third-straight day to 4.97%

Japan 10Y yield climbed 1.595% to its highest since 2008

Dollar held near a three-week high

Bitcoin hit $123k for a new ATH

Earnings

What we're watching this week:

Today: JPMorgan, Citigroup, Wells Fargo, BlackRock, State Street

Wednesday: Bank of America, Goldman Sachs, AMSL, United Airlines, Progressive, Johnson & Johnson

Thursday: TSMC, Netflix, PepsiCo

Friday: Truist, American Express, Charles Schwab, 3M

Full calendar here

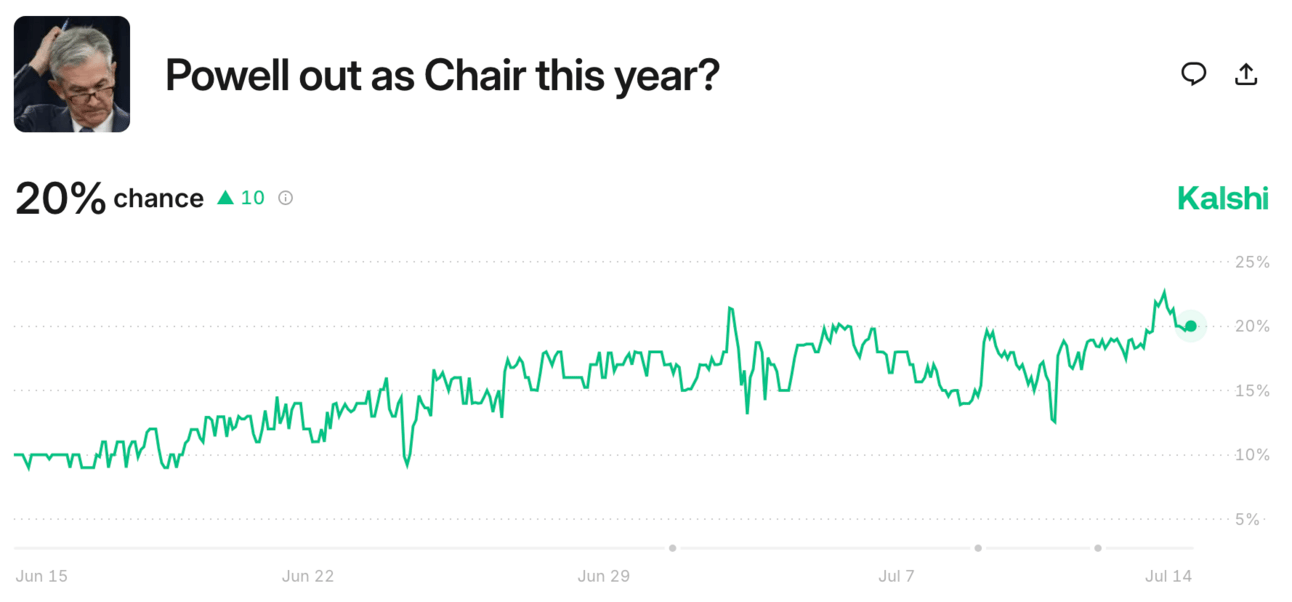

Prediction Markets

Some reports suggest that J Pow might resign before his term ends in May 2026.

Headline Roundup

EU finalized new trade countermeasures against US (BBG)

US is open to tariff talk with EU after threatening 30% levies (BBG)

Investment banking set to extend its worst run in over a decade (FT)

Hedge funds are dumping banks and buying the dip in consumer staples (RT)

US bank M&A hopes revive under Trump (RT)

Europe VCs are on pace for lowest fundraising year in a decade (BBG)

US leveraged loan market had its busiest day since January (BBG)

Hong Kong dollar bond sales soared to a record as costs shrink (BBG)

High-yield bond trading daily volume hit a record high this year (BBG)

Commodity traders poised for $300M windfall from US copper rush (FT)

CalPERS pushes further into PE after best results in four years (FT)

China rare-earth metal exports hit the highest since 2009 (BBG)

Morgan Stanley, Goldman, and Wells Fargo will settle Archegos lawsuit for $120M (BBG)

Meta pledged to invest hundreds of billions in AI data centers push (RT)

US will allow Nvidia H20 AI chip sales to China to resume (CNBC)

Kenvue fired its CEO (RT)

Starbucks called employees to office four days / week (BBG)

Meta investors and Zuckerberg will square off at $8B trial over Cambridge privacy scandal (RT)

EU will hold talks with Musk's X after Grok's antisemetic outburst (BBG)

US threatened Russia with 'severe' tariffs and sanctions over Ukraine war (FT)

'Vibe coding' has arrived for businesses (WSJ)

Andrew Cuomo will run for NYC mayor as independent (WSJ)

A Message from Neutral

Invest In Midwest

According to the Wall Street Journal, Milwaukee, WI is one of the most competitive rental markets in the country. The Midwest is quickly becoming a hidden gem for multifamily investing.

Neutral is a multifamily developer with active projects in Milwaukee and Madison, WI, two markets projected to have over 97% multifamily occupancy in the next five years.

Discover more about these thriving markets, Neutral's investment strategy, and explore available investment opportunities. Visit our website or connect with the investor relations team today.

Deal Flow

M&A / Investments

Engineering software firm Autodesk dropped its cash-and-stock pursuit of $23B-listed rival PTC

Medtech firm Waters Corp. will acquire peer Becton Dickinson's biosciences and diagnostics unit in a $17.5B deal

Bain Capital and Kohlberg & Co. are co-leading an investment in drug packaging firm PCI Pharma Services at a ~$10B valuation, including debt

Huntington Bancshares agreed to acquire commercial bank Veritex in a $1.9B all-stock deal

A consortium led by a South African billionaire Nathan Kirsh's family office made a sweetened $1.4B takeover offer for Australian self storage firm Abacus Storage King

AI coding startup Cognition agreed to acquire the remaining assets of peer Windsurf, following Google's $2.4B deal for their top talent and licensing rights

Canadian billionaire Pierre Karl Peladeau remains intent on acquiring travel company Transat

VC

Musk's xAI raised $5B at a $113B valuation

Enterprise browser company Island raised a Series E at a $5B valuation led by Coatue

MOTOR Ai, a startup developing cognitive autonomous driving tech, raised a $20M seed round led by Segenia Capital

Murphy, a Spanish startup building AI agents for debt collection, raised a $15M round led by Northzone

Zip Security, an all-in-one cybersecurity platform, raised a $13.5M Series A led by Ballistic Ventures

Unblock, an energy infrastructure startup that converts stranded energy into computing power, raised a $13.5M round led by Goldcrest Capital and Collaborative Fund

HaloTech, a European industrial safety startup using AI, raised a $12M round at a $117M pre-money valuation

XerpaAI, a Singapore-based AI-driven growth platform for emerging tech businesses, raised a $6M seed round led by UFLY Capital

IPO / Direct Listings / Issuances / Block Trades

Advent and KKR-backed consumer market research firm NIQ Global Intelligence is seeking to raise $1.2B at a $7B valuation in its US IPO next week

Education publisher and software firm McGraw Hill is aiming to raise up to $537M at a $4.2B valuation in its US IPO

Tungsten producer Almonty Industries raised $90M in its US IPO

Crypto-focused asset manager Grayscale confidentially filed for a US IPO

Debt

A consortium of banks led by JPMorgan is marketing $4.3B in debt to finance Sycamore Partners' buyout of UK pharmacy chain Boots, part of its $10B LBO of Walgreens Boots Alliance

Japanese chip maker Kioxia plans to raise $3B in its first-ever dollar bond sale

Credit investor Castlelake agreed to buy up to $2.5B of consumer loans from fintech Pagaya Technologies

UK fiber optic infrastructure firm CityFibre raised $3.1B in a debt and equity raise

India's Manipal Education & Medical Group is in talks with a global lenders to raise ~$466M to help fund its ~$700M purchase of Sahyadri Hospitals

Indian liquor makers Inbrew Beverages and Tilaknagar Industries are each seeking to raise $500M in private credit as they compete to acquire Pernod Ricard's Imperial Blue unit

Norway's SWF Norges Bank bought $420M of downgraded Colombian peso bonds

Jersey Mike's is planning a $400M ABS sale to fund a payout to majority owner Blackstone after their $8B buyout

Bankruptcy / Restructuring / Distressed

Hong Kong's struggling New World Development missed its target date to close a $2B loan led by Deutsche Bank, with talks ongoing amid refinancing challenges

Platinum Equity-backed glucose-monitor maker LifeScan Global is negotiating a restructuring deal that would hand control to second-lien lenders

Washington casino operator Maverick Gaming filed for Chapter 11 bankruptcy two years after a debt restructuring

Bank lenders to care home operator Colisee are offloading debt at steep discounts as an August deadline looms over restructuring talks between the firm and creditors

Fundraising / Secondaries

PE firm Stone Point Capital raised $11.5B for its tenth fund

Ex-Founders Fund partner Brian Singerman and Quiet Capital partner Lee Linden are seeking to raise over $500M for a new fund GPx, a dual emerging managers VC FOF and late-stage fund partnering with other emerging managers

Healthcare-focused PE firm Lorient Capital raised $500M for its third fund

Kibo Ventures-backed PE fund Nzyme raised ~$175M for Spanish B2B buyouts

Crypto Sum Snapshot

Congress heads into 'crypto week' with key votes on Wednesday and Thursday

Mastercard's CPO says stablecoins are long way from becoming everyday payment tool

Strategy's Bitcoin holdings topped $73B

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Intern just #REF'd out your Excel model? It's time to try Carousel.

Carousel is an AI assistant for Excel that builds, edits, and formats models for you. And unlike your intern, Carousel is competent, doesn't complain when asked to fix spreadsheet formatting, and doesn't need a return offer.

VC Tanay Jaipuria wrote a great piece on renewed interest in the new fundraising playbook: seed-strapping. He dives deep into what seed-strapping means, why it's become possible now, and whether it's truly a sustainable model for building enduring companies. It's a really insightful read.

Finance & Startup Recruiting 💼

If you're down bad, realizing that finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.