Together with

Good Morning,

Junior banker work conditions are back in the spotlight, Tesla is rumored to have launched a search to replace Musk, US stocks clawed back almost all losses from 'Liberation Day,' and US GDP growth came in negative in a complicated reading.

Top firms like Evercore and CVC already use Mosaic to build LBO models in mere minutes. It's time that you do too.

Let's dive in.

Before The Bell

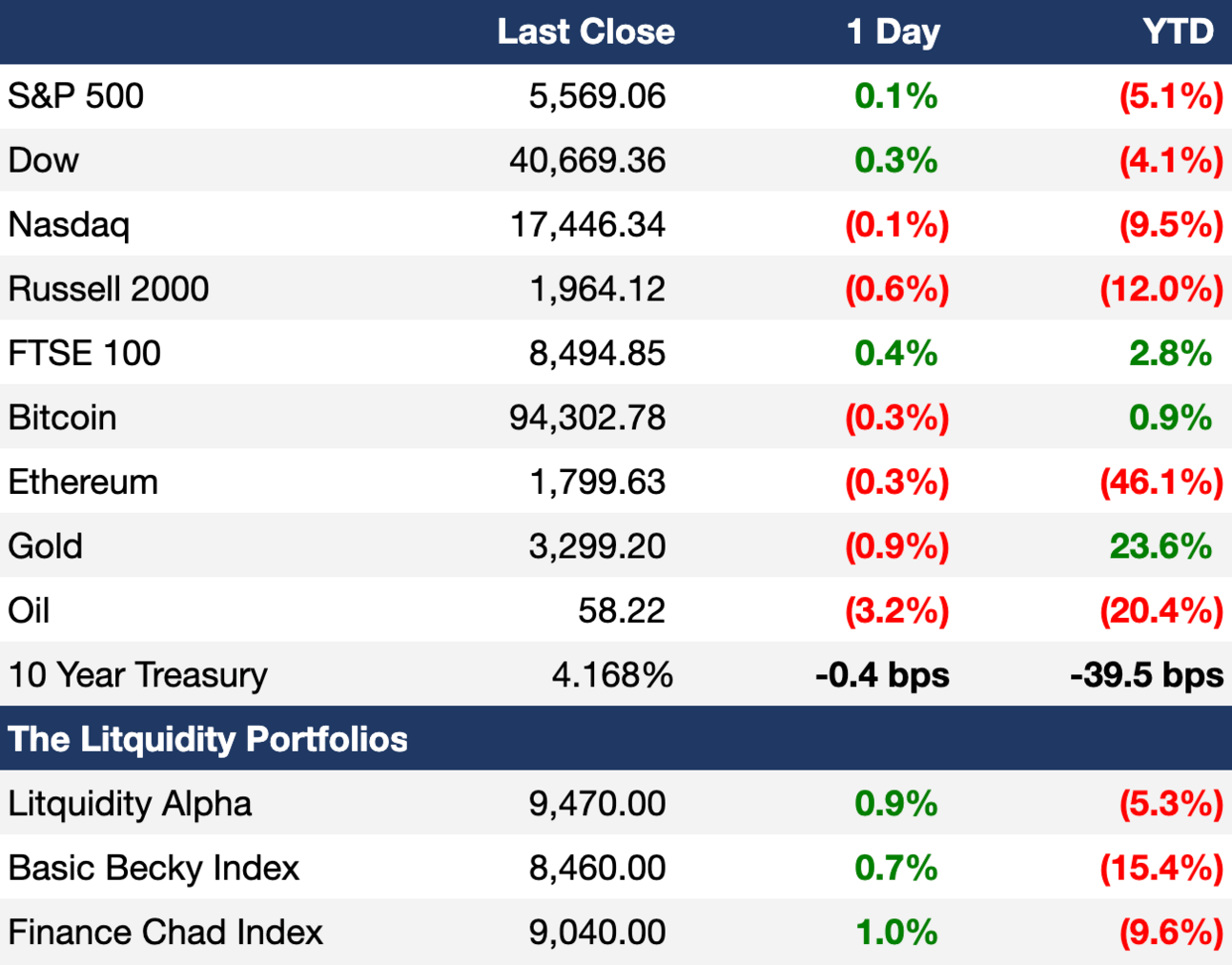

As of 4/30/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed relatively flat in a volatile trading session yesterday as investors digested a muddy GDP report

S&P rose for a seven-straight day in its best streak since November 2021

US leveraged loans posted their first two-month decline since 2022

Pakistan stocks and dollar bonds posted their worst month since 2023 on escalating India tensions

Oil fell to its lowest since 2021

Chinese yuan fell 2.7% in its worst month since 2019, though it remained strong versus dollar

Indian rupee surged to its highest in five months

Earnings

Microsoft beat Q3 earnings and revenue estimates and issued strong guidance on the back of strong cloud revenue growth, though their 2025 $80B CapEx plans may face higher costs from potential tariffs (CNBC)

Meta beat Q1 earnings and revenue estimates as strong advertising and AI-driven growth offset trade war concerns while maintaining Q2 revenue forecasts despite higher infrastructure costs amid supply chain shifts (BBG)

Qualcomm beat Q2 earnings estimates but issued a lighter-than-expected revenue forecast despite tariff immunity and confidence in navigating uncertainty (RT)

Robinhood topped Q1 estimates as transaction-based revenue jumped 77% and crypto revenue doubled YoY, supported by record net deposits, strong asset growth, and rising Gold subscriptions, though EBITDA missed on higher OpEx and slower net interest growth (BBG)

Caterpillar missed Q1 earnings and revenue estimates and warned of a FY sales decline if tariffs persist and a recession hits, though guidance remained within the target range under both base and downside scenarios (BBG)

Yum Brands beat Q1 earnings estimates but missed on revenue as strong growth in Taco Bell's sales failed to offset a decline at Pizza Hut (CNBC)

What we're watching this week:

Today: Apple, Amazon, McDonald's, Mastercard, CVS, Airbnb, Reddit, Eli Lilly

Friday: ExxonMobil, Chevron, Brookfield, Apollo

Full calendar here

Prediction Markets

The US economy contracted in Q1, albeit mostly due to trade disruptions.

Headline Roundup

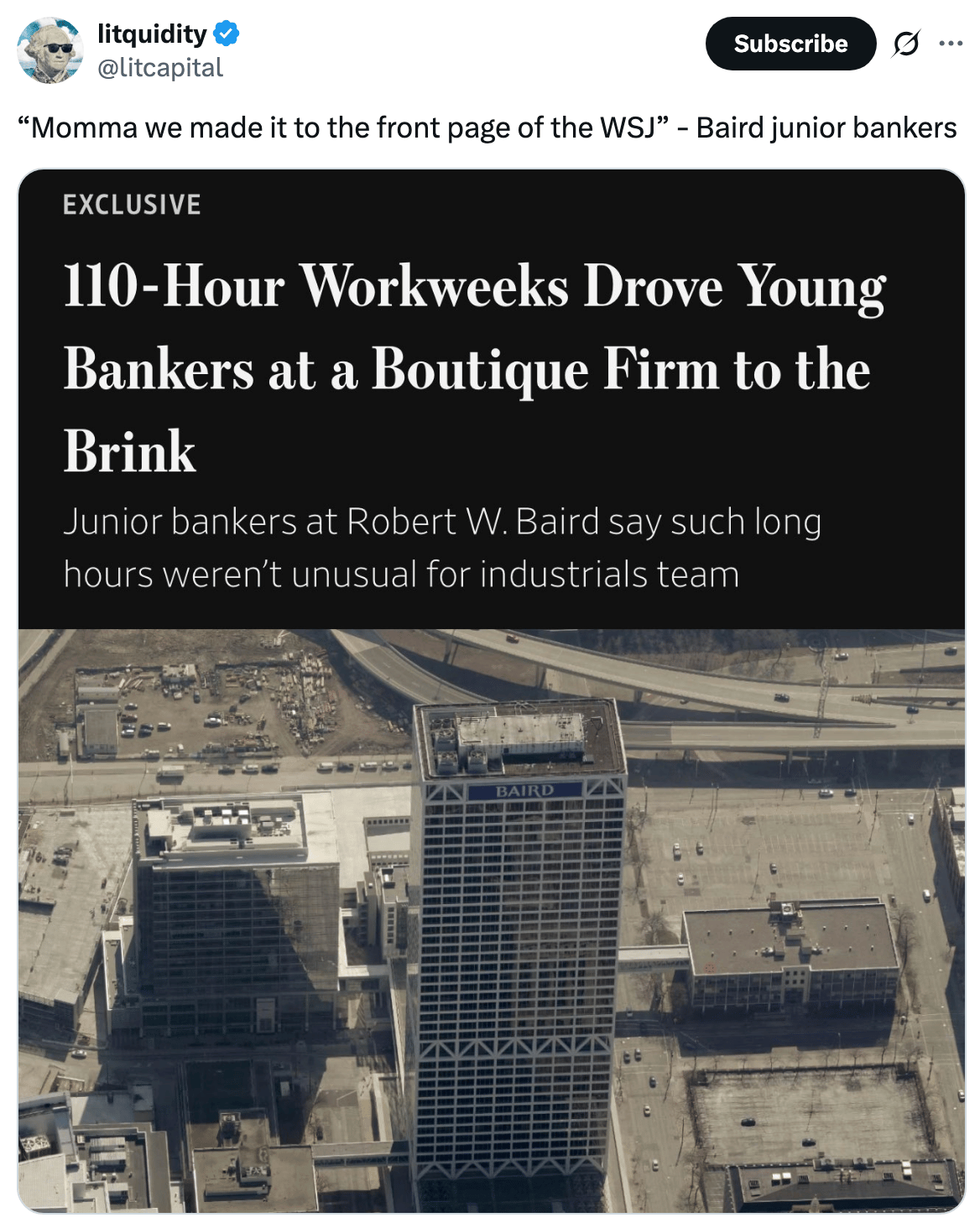

Junior bankers at Baird are pushing back against work conditions (WSJ)

Trump says tariffs are politically risky but he's not rushing deals

US firms added the fewest jobs since July 2024 (BBG)

US economy shrank 0.3% YoY in Q1 as imports surged ahead of tariffs (CNBC)

Eurozone GDP grew by 0.4% YoY in Q1 (RT)

BOJ kept rates unchanged at 0.5% (BBG)

Taiwan unexpectedly raised 2025 GDP forecast on strong tech demand (RT)

Australia posted rare trade surplus with US on gold frenzy (RT)

Australia inflation slowed to a three-year low (RT)

Millennium offered $100M pay package to poach BAM equities PM (BBG)

Hedge fund European stock selling hit a decade high in March/April (RT)

Asia hedge funds add Japan, India stocks after tariff shock (RT)

Bond mutual funds saw largest outflows since 2022 while ETFs gained (BBG)

Recent volatility caused spike in derivative-related margin calls (RT)

Citadel Securities sent 30 recommendations to SEC on emerging risks (BBG)

Panda bond sales hit a record high as firms hunt for China hedge (FT)

Central bank veterans says Fed should scrap current policy framework (RT)

Carlyle and State Street mull a partnership to tap retail wealth (BBG)

Shein is exploring US restructuring as tariffs threaten to derail London IPO (FT)

Tesla's board reportedly launched a search for a new CEO(WSJ)

Meta formed a lobbying group to take on Apple and Alphabet (BBG)

Apple violated order to reform App Store (RT)

BNY Mellon asked employees to RTO four days a week (RT)

US signed a deal with Ukraine giving US access to mineral wealth (WSJ)

A Message from Mosaic

Model with Mosaic

By now, I'm sure you've heard of the buzz-worthy deal modeling platform, Mosaic.

Mosaic was recently featured in Bloomberg and FT for their next-gen technology that allows investment professionals to build LBO models in minutes.

The platform was built by PE veterans themselves, and its accuracy, complexity and practicality virtually eliminates the tediousness of modeling tasks that many of us face daily.

I wish I had this tool during my PE days and I'm not surprised that Mosaic is emerging as the new industry standard in deal modeling.

Some of the biggest investors already use Mosaic to save hours on modeling workflows and it's something that you must try.

Deal Flow

M&A / Investments

Circle K-owner Couche-Tard and Seven & i Holdings signed an NDA allowing Couche-Tard access to Seven & i's financial data as it seeks to formalize a ~$55B buyout offer

Spain's regulator approved lender BBVA's $12.5B hostile bid for peer Sabadell

TWG Global, the investment firm led by Guggenheim founder Mark Walter, and financier Thomas Tull, will take a 5% minority stake in Mubadala Capital, the asset management subsidiary of SWF Mubadala

Crypto firm Ripple offered to acquire stablecoin provider Circle for $4B-$5B, which Circle rejected as too low

KKR and Intermediate Capital each offered to acquire UK analytics firm GlobalData at a potential $2B valuation

PE firm TSG Consumer Partners is in advanced talks to acquire a minority stake in cookie chain Crumbl, which is exploring a sale at a $2B valuation, including debt

Swiss pharma giant Novartis agreed to acquire Regulus Therapeutics in a $1.7B deal

$1B-listed restaurant software provider Olo is exploring a sale after attracting takeover interest

I Squared Capital-backed Hexa Climate Solutions acquired Finland-based Fortum's Indian renewables assets

Australian investment firm L1 Capital is in talks to acquire a 75% stake in peer Platinum Asset Management

A fund backed by conglomerate Shanghai Industrial Investment Holdings Is in talks to acquire Japanese pharma firm Otsuka's 20.9% stake in Chinese medical device maker MicroPort Scientific

French shipping giant CMA CGM offered to acquire Air Belgium

Brookfield is considering bidding for a stake in UK nuclear power plant development Sizewell C

VC

True Anomaly, a space security company, raised a $260M Series C led by Accel

Identity verification platform Persona raised a $200M Series D at a $2B valuation led by Founders Fund and Ribbit Capital

Cast AI, a startup helping businesses automate cloud infrastructure management, raised a $108M Series C at an ~$850M valuation led by G2 Venture Partners and SoftBank

Accounting practice management software startup Canopy raised a $70M Series C led by Viking Global Investors

Supio, an AI-powered legal analysis platform, raised a $60M round led by Sapphire Ventures

Plenful, an AI workflow automation platform for healthcare teams, raised a $50M Series B led by Mitchell Rales and Arena Holdings

Gruve.ai, a startup helping companies get AI solutions into production, raised a $20M Series A led by Mayfield

AI sales tax startup Kintsugi raised $18M in funding led by Vertex

VOC.AI, a customer service platform for e-commerce, raised $15M in funding led by Shanda Grab Ventures

InventWood, a developer of a building material that combines wood and other materials, raised a $15M Series A led by Baruch Future Ventures, Grantham, Builders Vision, and JLL Foundation

Cybersecurity startup Manifest raised a $15M Series A led by Ensemble VC

Field Materials, an AI platform for material and equipment procurement in construction, raised a $10.5M Series A led by Navitas Capital

Queens Carbon, a developer of new cement technology, raised a $10M seed round led by Clean Energy Ventures

Astrape Networks, a Dutch startup enhancing short-distance data networks, raised a $9M seed round led by PhotonVentures, Join Capital, and BOM

Terminal 3, a Hong Kong-based Web3 startup leveraging blockchain to develop new data privacy and security protocols, raised an $8M seed round led by Illuminate Financial and CMCC Titan Fund

TeamOhana, a headcount management and compensation planning startup, raised a $7.5M seed round led by Lerer Hippeau and Collide Capital

TeamOhana, a software uniting finance, HR, and talent teams, raised a $7.5M seed round led by Lerer Hippeau and Collide Capital

Swivel, a no-code AI workflow automation platform for advertising operations, raised a $5.8M Series A led by Tribeca Venture Partners and Ardent Venture Partners

Swivel, a no-code AI workflow automation platform for advertising operations, raised a $5.8M Series A led by Tribeca Venture Partners and Ardent Venture Partners

Ceto, a data-driven platform transforming maritime insurance, raised a $4.8M round led by Dynamo Ventures

Noma Therapy, a mental health tech startup, raised $4.25M in funding from Redesign Health

Structify, a startup parsing high quality data for any business problem, raised a $4.1M seed round led by Bain Capital Ventures

Solda.AI, a German AI-driven telesales automation startup, raised a $4M seed round led by Accel

Orb, an app measuring latency, packet loss, jitter, and speed to measure internet connection stability, raised $3.8M in funding from Sidekick Ventures and others

IPO / Direct Listings / Issuances / Block Trades

South Korean machine-tools maker DN Solutions shelved its $1.1B Korea IPO plans due to market uncertainty

Activist investor Irenic Capital Management built a stake in $1B-listed database software provider Couchbase

Uber founder Travis Kalanick's ghost kitchen startup CloudKitchens is exploring a UAE or Saudi IPO of its Middle East unit

Debt

Ares is in talks to lead a record $5.5B private credit deal to finance PE firm Clearlake Capital's $7.7B LBO of business data analytics firm Dun & Bradstreet, who is seeking to replace the $5.8B one-year bank bridge loan currently backing the LBO

Bahrain sold $2.5B of dollar bonds that also included an Islamic sukuk bond

Social media/messaging platform Telegram is weighing a $2B bond sale to refinance its 2021 debt

Four Indian state-run firms Power Finance Corp., NHPC, IREDA, and HUDCO are set to raise a combined $1.5B in bond sales

UAE-based port operator DP World sold $1.5B of sukuks

Saudi SWF PIF sold $1.25B of sukuks at a 110 bps premium

Yale University is considering raising $850M in a bond sale

Saudi lender Banque Saudi Fransi sold $650M of AT1 notes

Cookie chain Crumbl is in talks to raise $500M in private credit

Apollo, Carlyle, and KKR bought $375M of significant risk transfers (SRT) bonds tied to Sumitomo Mitsui Banking Corp's $3B in loans to private credit funds in an industry first

Bankruptcy / Restructuring / Distressed

Canadian EV bus maker Lion Electric's restructuring efforts suffered a major setback after Quebec's government declined to invest alongside local backers

Fundraising / Secondaries

Blackstone raised $10B for its PE fund targeting HNWIs

Ares is seeking to raise a $2B private credit fund to focus on sports and entertainment

Food and beverage investor Arbor Investments raised over $1.2B for its sixth PE fund

$1.3T SWF China Investment Corp. is weighing a $500M-$1B sale of US PE LP stakes amid a trade war

Asset manager Franklin Templeton partnered with secondaries investor Lexington Partners to raise an $875M secondaries PE fund for HNWIs

PE FOF Munich Private Equity Partners plans to raise $400M for a new flagship fund

Morgan Stanley launched a $150M evergreen PE fund for HNWIs

Turkish VC Revo Capital raised $86M for a targeted $100M third fund

Crypto Sum Snapshot

Crypto stocks emerge unscathed from April’s market turmoil

Crypto industry is pushing SEC for clarity on staking rules

BlackRock is bringing a blockchain push to a $150B Treasury fund

Visa launched stablecoin payments in Latin America

Subscribe to our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

I recently wrote a Deep Dive into Bigdata.com, exploring how the specialized AI for finance platform streamlines, automates, and executes nuanced investing/trading workflows to help seamlessly handle day-to-day challenges of active portfolio management. I highly recommend checking out their platform.

Bloomberg published a much welcomed explainer on why the VC secondaries market is so hot right now.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.