Together with

Good Morning,

Musk's favorite banker rejoined Morgan Stanley to advise on SpaceX's IPO, Zuckerberg is taking his talents (tax residency status) to South Beach, Blue Owl is at risk of getting margin called, Google is reviving the dot-com era 100-year bond, and MrBeast acquired a Gen Z-focused banking app.

You blinked and it's already February. If your current tax firm is waiting for K-1s to drop before starting the conversation about your 2025 tax bill, that's not real tax advisory. Upgrade your traditional CPA to the private client service at OLarry. A proactive, year-round tax advisory all for a transparent flat price.

Let's dive in.

Before The Bell

As of 2/9/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks recovered some more from their selloff last week as tech regained footing

Dow notched a second-straight ATH

Asia stocks continued to surge as Japan and Korea's record-breaking rallies resumed

Sterling fell 0.7% to its weakest in three weeks on risks to PM Starmer's leadership

Hedge funds boosted bullish Aussie dollar bets to the highest in eight years as RBA becomes the first major central bank to resume rate hikes

Earnings

Apollo beat Q4 earnings and raised a record $228B in 2025 to take AUM to a record $938B amid a record lending year as the firm expands beyond traditional PE and credit and into individuals and retirement plans (BBG)

What we're watching this week:

Today: Coca-Cola, Robinhood, CVS, Spotify, Lyft, Ford

Wednesday: McDonald's, Shopify, AppLovin, Cisco, Kraft Heinz

Thursday: Coinbase, Brookfield, Rivian, DraftKings, Applied Materials

Friday: Moderna, Wendy's

Full calendar here

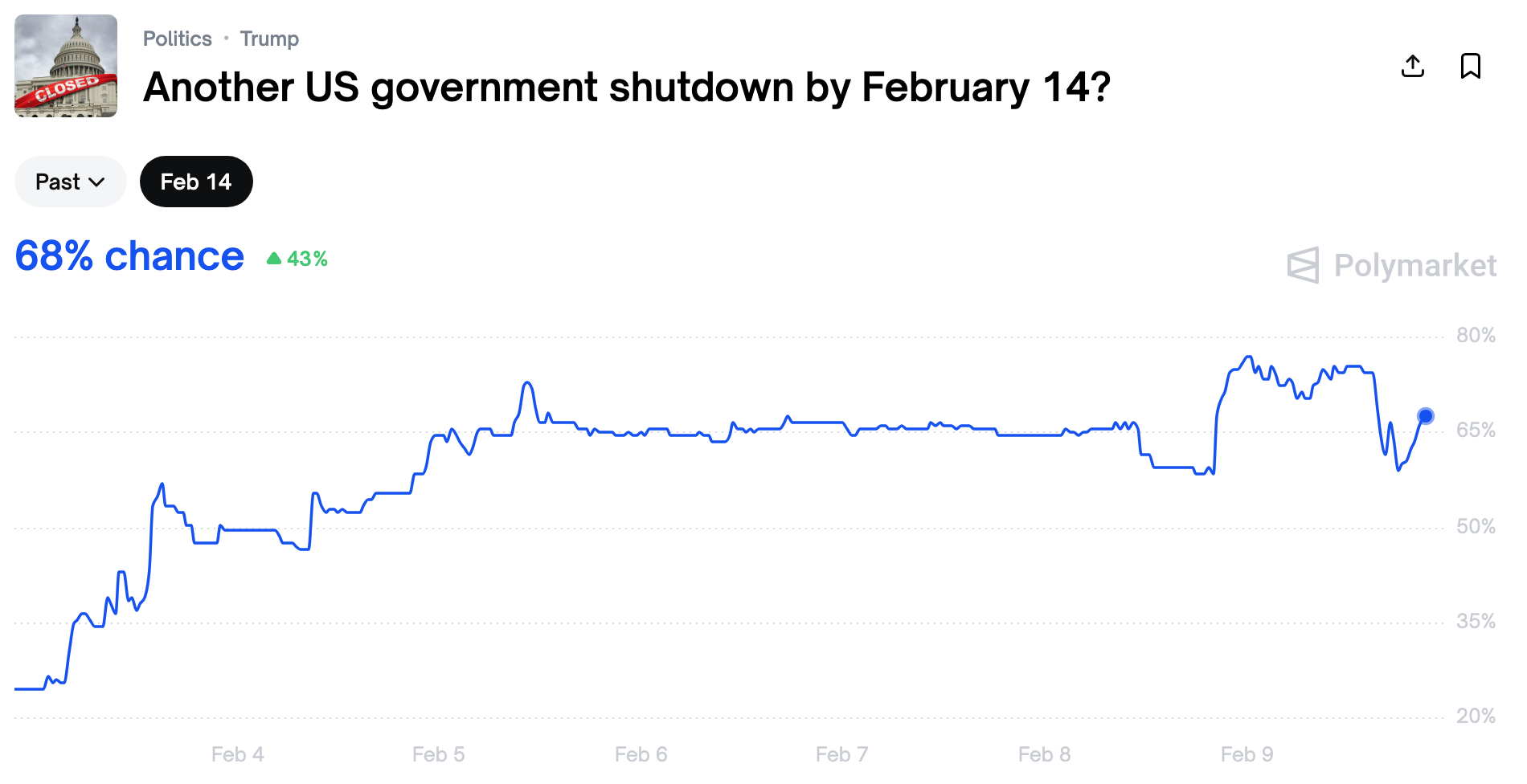

Prediction Markets

Deal or no deal?

Trade event contracts on Polymarket, the world's largest prediction market

Headline Roundup

Fed's Miran says Americans aren't shouldering tariff hit (RT)

US plans Big Tech carve-out from next chip tariffs (FT)

China urged banks to curb exposure to US Treasuries (BBG)

Wall Street's hunt for cheaper stocks goes global (WSJ)

Korea stocks are still cheap despite record $1.7T rally (BBG)

Single stock notional short selling hit a record high last week (BBG)

Memory chip crunch ripples through markets, with worse to come (BBG)

US IPO proceeds to quadruple to a record $160B this year (RT)

CLO deals are booming despite growing risks (BBG)

Japan bond bear market funnels corporates to convertibles (BBG)

Big Tech groups race to fund record $660B AI spending spree (FT)

Global regulators will probe PE ownership of audit firms (FT)

Blue Owl is at risk of getting margin called (BBG)

Apollo avoided pain of PE peers by steering clear of software (FT)

Morgan Stanley re-hired veteran Michael Grimes as chairman of IB (WSJ)

OpenAI's ChatGPT monthly growth is back to over 10% (CNBC)

Meta and Google youth addiction trial began with Zuck set to testify (RT)

Zuckerberg purchased a $200M Miami mansion in California exodus (WSJ)

A Message from OLarry

Waiting for K-1s shouldn't be an excuse to delay kicking off 2025 tax conversations.

OLarry was created with this in mind. They are a year round Private Client service for individuals and businesses with complex taxes, all for a transparent flat fee.

Go beyond traditional tax filing with:

Unlimited Strategy: Unlimited year round service, whether you want to meet 4 or 52 times per year

Zero Cross-Selling: Real strategy without the worry about being sold annuities, insurance or other financial products

Proven Track Record: Trusted by thousands of individuals and businesses

Multidisciplinary Advisory: Specializing in K-1s, Multi-State Compliance, Trusts/Estates, and Corporate Entities (S-Corp, C-Corp, Partnerships) and more

"Easily the best and most strategic tax convos I've had." -Raj, CEO

Book a free consultation today and get 10% off with code Execsum.

Deal Flow

M&A / Strategic

PE firm Advent and FedEx are seeking to buy Polish parcel-locker company InPost in a $9.3B cash deal at a 50% premium

Abu Dhabi's Mubadala Capital agreed to acquire billboard advertising firm Clear Channel Outdoor at a $6.2B valuation at a 70% premium

Offshore oil driller Transocean agreed to acquire rival Valaris in a $5.8B stock deal at a 32% premium

UK lender NatWest agreed to buy wealth manager Evelyn Partners from PE firms Permira and Warburg Pincus for $3.7B, including debt

CVC agreed to acquire chemical and ingredient company DSM-Firmenich's animal nutrition and health business at a $2.6B valuation

Eli Lilly agreed to buy biotech Orna for up $2.4B cash

Energy trader Mercuria is nearing a deal to acquire a refinery and hundreds of gas stations in Argentina from Brazilian energy company Raizen in an over $1B deal

Uber agreed to buy Turkish food delivery company Getir's delivery operations from Mubadala for $435M

YouTuber MrBeast's Beast Industries acquired Gen Z-focused banking app Step

VC

Payments fintech Stripe is seeking to sell secondary shares at a $140B valuation

Legal AI startup Harvey is raising a $200M round at an $11B valuation led by Sequoia and Singapore's GIC

Quant trader Jump Trading is set to take stakes in prediction market startups Polymarket and Kalshi in exchange for providing liquidity on their platforms; both startups are valued at ~$10B

Warehouse-drone startup Gather AI raised a $40M Series B led by Smith Point Capital

Safqah Capital, a fintech/proptech crowdfunding platform, raised a $15.2M seed round led by Shorooq

AI-native biology startup Phylo raised a $13.5M seed round co-led by a16z and Menlo Ventures’ Anthology Fund

Modveon, a verified OS startup for governments and citizens, raised a $10M funding round from Coinbase Ventures, Firebolt Ventures, and others

Geolinks Services, a European underground geophysical monitoring startup, raised a $7.1M round from Calderion

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Bain Capital offered an unregistered block of semiconductor manufacturing firm Coherent shares for $2.3B at a 2% discount

Apax Partners and Warburg Pincus-backed Dutch telecoms group Odido postponed plans for an Amsterdam IPO after a muted response from investors

Debt

Alphabet attracted over $100B in orders for a bond sale including a rare 100-year note that is expected to raise well over $20B in US, UK, and Swiss markets

Australian AI infrastructure company Firmus finalized a $10B debt funding package led by Blackstone and Coatue

Brazil raised $4.5B in a dollar bond sale

Apollo is close to finalizing a $3.4B loan to a SPV that plans to buy Nvidia chips and lease them to Musk's xAI

German AI chipmaker Infineon Technologies raised $2.4B in its first euro debt sale in a year

Funds / Secondaries

Canada's La Caisse is seeking to sell $1.5B of China-focused PE LP stakes in HSG (formerly Sequoia Capital China), Warburg Pincus, and Boyu Capital Investment Management

Ex-General Atlantic exec Anton Levy launched new VC firm Layer Global with over $1B to invest in 'hypergrowth companies'

Singaporean real assets investor Keppel raised a $125M commitment from Asian Infrastructure Investment Bank for its third private credit fund

Private markets FOF StepStone Group is eyeing first closes for its debut GP-led secondaries fund and its flagship secondaries fund

French secondaries specialist Committed Advisors filed for its sixth secondary flagship fund

Crypto Sum Snapshot

South Korea says tougher crypto rules needed after $40B giveaway

Crypto crashes rattle VCs after $19B haul

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Upcoming Events👩💻💆♀️🧘♀️

Litquidity and Ramp's women founder community are getting together for an after-work destress on Tuesday, March 3 in a penthouse on Billionaires' Row. Featuring a self-care 'happy hour' of mini facials, vitamin shots, pop-up wellness brands, and epic views, this is a great excuse to destress and meet other NYC women entrepreneurs! RSVP here.

A special shoutout to Manhattan Laser Med Aesthetics and Chelsea Bizub for contributing to the experience.

Feel free to share this event with your peers 👩

Powered by Palm & Park

Exec’s Picks

TechCrunch published a list of the 55 US AI startups that raised $100M or more in 2025.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.