Together with

Good Morning,

Empower will open 401(k)s to PE and credit, CoreWeave reported its first earnings since going public, India overtook Japan to become Asia's most favored stock market, Tesla's board is exploring a new pay deal for Elon Musk, and Warren Buffett opened up about his decision to step down.

Did you know that genetics are not the sole cause of hair thinning? Check out how Nutrafol Men hair growth supplements address root causes of hair thinning.

Let's dive in.

Before The Bell

As of 5/14/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks ticked slightly higher as traders awaited further clues on the economy

Nvidia became the third 'Magnificent 7' stock to turn positive YTD after reclaiming a $3T market cap

US 10Y yield rose to a one-month high

US 2Y yield hit 4.06%, the highest since March

Chinese short-term corporate bond spreads hit 41 bps, a record low

Earnings

Cisco beat Q1 earnings and revenue estimates and issued strong guidance as product orders rose 20% YoY on growing demand for AI infrastructure (CNBC)

Sony beat Q1 earnings estimates but missed on revenue and issued weak guidance on declining PS5 sales and uncertain tariff impacts (CNBC)

CoreWeave beat Q1 revenue estimates on 400% growth but missed on earnings as accelerated AI investments weighed on profits; CapEx plans remain strong despite macro concerns and emerging cost-efficient LLMs (BBG)

Tencent missed Q1 earnings estimates but beat on revenue on a 24% surge in China gaming sales and strong ad growth across WeChat; CapEx jumped 91% YoY as the firm ramps up AI-related investments (CNBC)

What we're watching this week:

Today: Alibaba, Applied Materials, Cava, Walmart, John Deere, Take-Two Interactive

Full calendar here

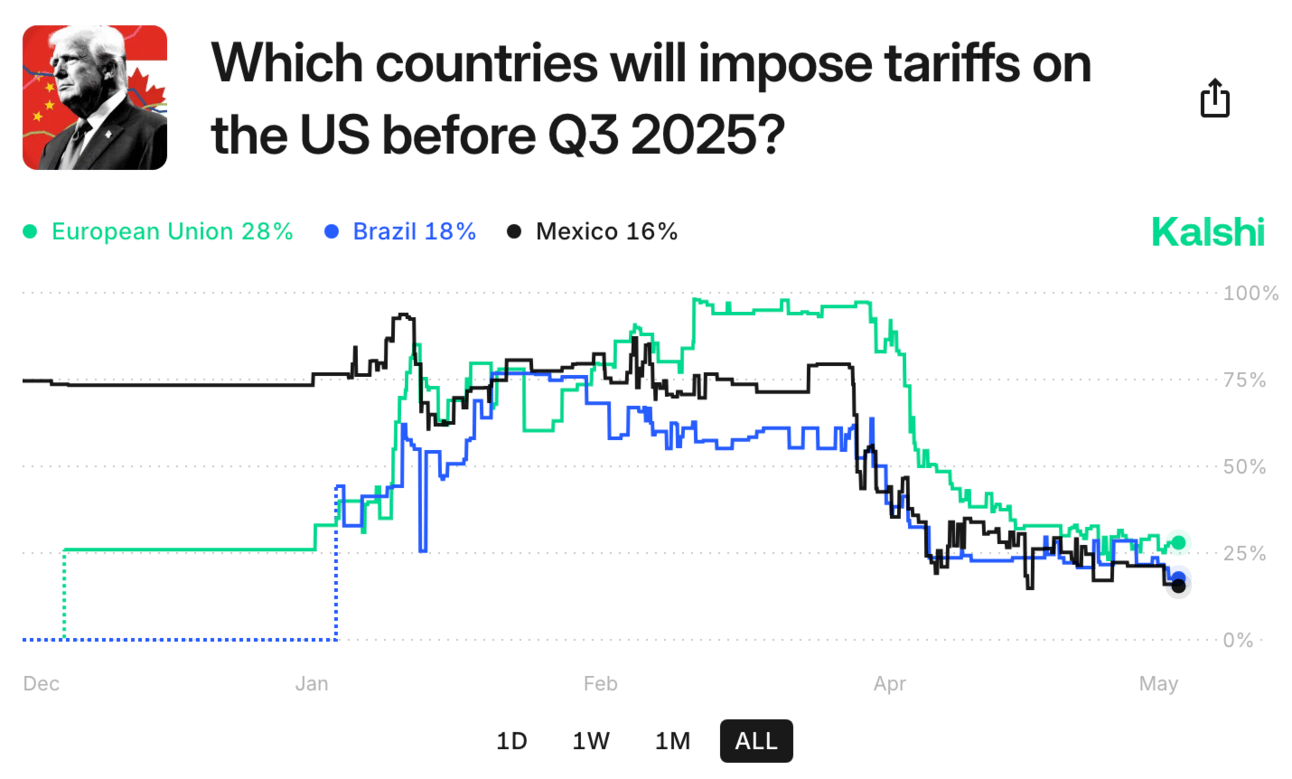

Prediction Markets

How the turn tables…

Headline Roundup

US will cut capital requirements for banks imposed after 2008 (FT)

Steve Cohen sees chance of US recession at 45% (BBG)

Wall Street's sudden rebound has caught investors offside (FT)

Quant funds chasing trends in exotic markets hit by commodity turmoil (BBG)

US firms are snapping up short-term Treasuries (BBG)

Stock ETFs inflows re-passed fixed income (BBG)

Private credit's latest golden moment is hiding the cracks (BBG)

India overtook Japan to become most favored Asian stock market (BBG)

401(k) giant Empower will open funds to PE and private credit (WSJ)

Hong Kong IB jobs show signs of picking up (BBG)

UK told antitrust regulator to focus on economic growth (RT)

Qatar pledged to invest ~$250B in US (BBG)

Deutsche Bank named Sam Kim as global head of M&A (BBG)

Tesla board is exploring a new pay deal for Elon Musk (FT)

US is investigating UnitedHealth Group for criminal medicare fraud (WSJ)

HBO's Max rebranded again to HBO Max (BBG)

Burberry will cut 20% of jobs (RT)

US spring home buying season had its weakest start in five years (BBG)

Protestors vandalized JPMorgan's historic London office (BBG)

Manhattan rents are at record high (BBG)

Warren Buffett says he stepped down after finally feeling his age (WSJ)

A Message from Nutrafol Men

81% of men believe their appearance impacts their career growth.1

And they might be onto something. Because when you feel good about how you look, it shows—in the mirror and on the job. But long hours, high-stress days, and client dinners that end with a ribeye and a double pour? They can take a toll on your hairline.

Enter: Nutrafol Men. It’s a 100% drug-free hair growth supplement with vitamins, minerals, and natural ingredients that targets key root causes of hair thinning from within.

Even better? No impact on sexual performance. Just stronger-feeling, fast-growing hair—without the trade-offs.

Here's the key: Results come from consistency. Nutrafol Men is clinically proven to improve hair growth in 3-6 months, so when taken daily, you can join the 84% of guys who saw better hair and the 72% who saw more scalp coverage.2

1. Goodques Idea Customer Data. 2. Stephens T, et al. JCAD. 2022./Nutrafol. Data on file. 2022. These statements have not been evaluated by the Food and Drug Administration. This product is not intended to diagnose, treat, cure, or prevent any disease.

Deal Flow

M&A / Investments

Apollo, Australia's Macquarie, and BlackRock-owned Global Infrastructure Partners are among investors in talks for an up to $13B minority stake in Dutch state-owned power grid operator TenneT's German unit

UK's regulator will review UK insurance firm Aviva's $4.9B acquisition of auto insurer Direct Line

Sports goods retailer DICK'S Sporting Goods is in advanced talks to acquire shoe retailer Foot Locker for ~$2.3B cash, a 90% premium

Pharmaceutical company GSK agreed to acquire experimental liver drug efimosfermin for up to $2B

Thai conglomerate TCC Group is pursuing a second bid to privatize Singapore-based REIT Frasers Hospitality Trust at a $1.1B valuation, a 7% premium

Data analytics software firm Databricks agreed to acquire database startup Neon for $1B to boost AI-agent capabilities

Brookfield is nearing a deal to acquire the European arm of hostel chain Generator Group from real estate PE firm Queensgate Investments for $900M

Lenore Sports Partners acquired a 5.24% minority stake in Portuguese soccer team Benfica at a ~$700M valuation

Brookfield is seeking to acquire an industrial portfolio in Singapore from Temasek-backed REIT Mapletree Industrial Trust for $384M

Italian investment firms Borletti and Quadrivio will acquire Italian fashion brand Twinset from Carlyle at a $225M valuation

Norwegian energy focused PE firm HitecVision agreed to acquire a 50% stake in TotalEnergies' Polish biogas unit Polska Grupa Biogazowa at a $214M valuation, including debt

Carlyle and SK Capital Partners raised their upfront bid for $50M-listed gene therapy maker bluebird bio

DHL eCommerce UK, a unit of logistics giant DHL, will merge with Apollo-backed UK rival Evri which will see DHL take a significant minority stake in Evri

TV broadcaster MFE-MediaForEurope is considering raising its offer for German mass media firm ProSiebenSat.1 in response to Czech investor PPF's plan to increase its stake

Starbucks is weighing a stake sale of its China business to PE firms, tech firms, or others

VC

Legal AI startup Harvey AI is in advanced talks to raise an over $250M round at a $5B valuation led by Kleiner Perkins and Coatue

AI infrastructure startup TensorWave raised a $100M Series A led by Magnetar and AMD Ventures

Flock Freight, a shared truckload freight brokerage, raised a $60M Series E led by O'Neil Strategic Capital

AI note-taking app Granola raised a $43M Series B at a $250M valuation led by NFDG

Cohere Health, a provider of clinical intelligence solutions for health plans and risk-bearing providers, raised a $90M Series C led by Temasek

Samaya AI, a startup creating AI models that assist financial analysts, raised a $43.5M round led by NEA

OroraTech, a startup focused on wildfire intelligence and risk assessment, raised a $41M Series B led by BNP Paribas Solar Impulse Venture Fund

Nortian, a biotech company producing collagen, raised a $41M round at a $100M valuation led by AJ Hollander, Hubbard Ingredients, XPTO, and family offices

Arkestro, a predictive procurement platform, raised $36M in funding led by Altira Group and Aramco Ventures

TurbineOne, a defense software company, raised a $36M Series B led by The General Partnership

UK spacetech startup Space Forge raised a $30M Series A led by the NATO Innovation Fund

WakeCap, a sensor-powered project intelligence and controls platform, raised a $28M Series A led by UP.Partners

Embodied AI startup Persona AI raised a $27M pre-seed round led by Unity Growth and Tides Ventures

Forethought, a startup specializing in agentic AI for customer experience, raised a $25M Series D led by Blue Cloud Ventures

Origin, a UK-based global benefits intelligence platform, raised a $21M Series A at a $106M valuation led by Felix Capital

Reflect Orbital, a constellation of satellites to reflect sunlight for large-scale lighting and energy applications, raised a $20M Series A led by Lux Capital

Cronofy, a UK-based embedded scheduling infrastructure, raised a $20M round led by BGF

Openlayer, a platform for evaluation and governance of enterprise AI systems, raised a $14.5M Series A led by Race Capital

Layer, an AI application gateway built specifically for game developers, raised a $6.5M seed round led by Arcadia

Veritree, a Canadian platform improving verified nature restoration, raised a $6.5M Series A led by Pender Ventures

Plexus, an Australian AI-powered legal automation platform, raised a $6M round led by Lighter Capital

Nekuda, a startup building infrastructure for agentic payments, raised $5M in funding led by Madrona Ventures

Tensor9, a startup helping vendors deploy their software into any environment using 'digital twins,' raised a $4M seed round led by Wing VC

Pluto Bio, an AI-powered platform for computational biology, raised $3.6M in funding led by Kickstart

IPO / Direct Listings / Issuances / Block Trades

Chinese EV battery giant CATL is set to raise ~$4B in a Hong Kong listing priced at the top of a marketed range in the biggest IPO YTD

Trading platform eToro surged 29% in its US debut after raising $620M in an upsized offering

Connected TV advertising platform MNTN is seeking to raise $187M in a US IPO

Self-driving vehicle startup Pony AI confidentially filed for a Hong Kong listing after recently raising $413M in a US IPO and private placement

Eagle REIT is seeking to raise $62M in an IPO on Zimbabwe's US dollar-denominated Victoria Falls Exchange

Debt

Latin America's largest utility Sabesp plans to sell $13.5B in bonds to fund investments tied to its privatization and pursuit of an investment-grade rating

Pfizer plans to raise $3.7B in its first euro bond sale in seven years

Indian real estate and infrastructure conglomerate Shapoorji Pallonji is aiming to raise $3.4B in India's biggest private credit deal ever from Ares, Cerberus, Davidson Kempner, Farallon, Deutsche Bank and others

Indian conglomerate Reliance Industries raised a $3B dual-currency loan from 55 lenders in India's biggest offshore loan deal in two years

Australia's Queensland state intends to issue more euro-denominated debt after raising $1.4B

Eight banks including Citigroup, Deutsche Bank, and HSBC are underwriting a $1.2B syndicated loan at a 333 bps premium to refinance Carlyle's LBO debt for Indian software firm Hexaware Technologies

Credit investor Bayview Asset Management Blackstone acquired $395M of CRE loans tied to NY-area properties at slight discount from a Blackstone and CPPIB JV

Hong Kong-developer CSI Properties raised $150M in its first dollar bond sale in four years

Chinese state-owned bank ICBC is planning a multi-currency carbon neutrality-themed green bond deal

Bankruptcy / Restructuring / Distressed

Nord Stream 2 reached a debt restructuring agreement with creditors ahead of a Swiss court deadline, avoiding bankruptcy

Bankrupt movie studio Village Roadshow Entertainment and Warner Bros delayed a dispute over $100M in unpaid debt related to The Matrix films; an auction of Village Roadshow's film library will proceed amid ongoing negotiations

Brazilian airline Azul and creditors are weighing restructuring options including a Chapter 11 filing

Fundraising / Secondaries

Canadian investment firm Northleaf Capital Partners closed its fourth flagship infrastructure fund at $2.6B

European private credit firm Metric Capital Partners closed its fifth flagship fund at $1.1B

JPMorgan Asset Management raised $1B for a private markets fund tailored to individual investors

Blackstone raised an $800M commitment from Norway's $1.8T SWF Norges Bank Investment Management to invest in warehouses and logistics

Aerospace-focused AE Industrial Partners raised $418M for a second fund focused on aerospace, defense, and government services leasing investments

Nexa Equity raised $390M for a second fund to back high-growth vertical SaaS firms

Crypto Sum Snapshot

Morgan Stanley's head of digital asset markets left to start a new DeFi fund

M&G-backed UK crypto derivatives trading venue GFO-X debut this week

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

I recently wrote a Deep Dive on Bigdata.com, exploring how the specialized AI for finance platform streamlines, automates, and executes nuanced investing/trading workflows to help seamlessly handle day-to-day challenges of active portfolio management. It's a platform you must try.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.