Together with

Good Morning,

Investors are planning trips to Venezuela to gauge business opportunities, hedge funds are making a killing on soaring Venezuela bonds, JPMorgan launched a consulting unit for select clients, OnlyFans creators are dominating O-1 visas, and the CIA sees regime loyalists as best placed to temporarily lead Venezuela amid Maduro's ouster.

Is your startup finally signing customers? Join Vanta on Jan 15 for a live demo on automating compliance stacks to have it serving as a deal accelerator, not a blocker. Register here.

Let's dive in.

Before The Bell

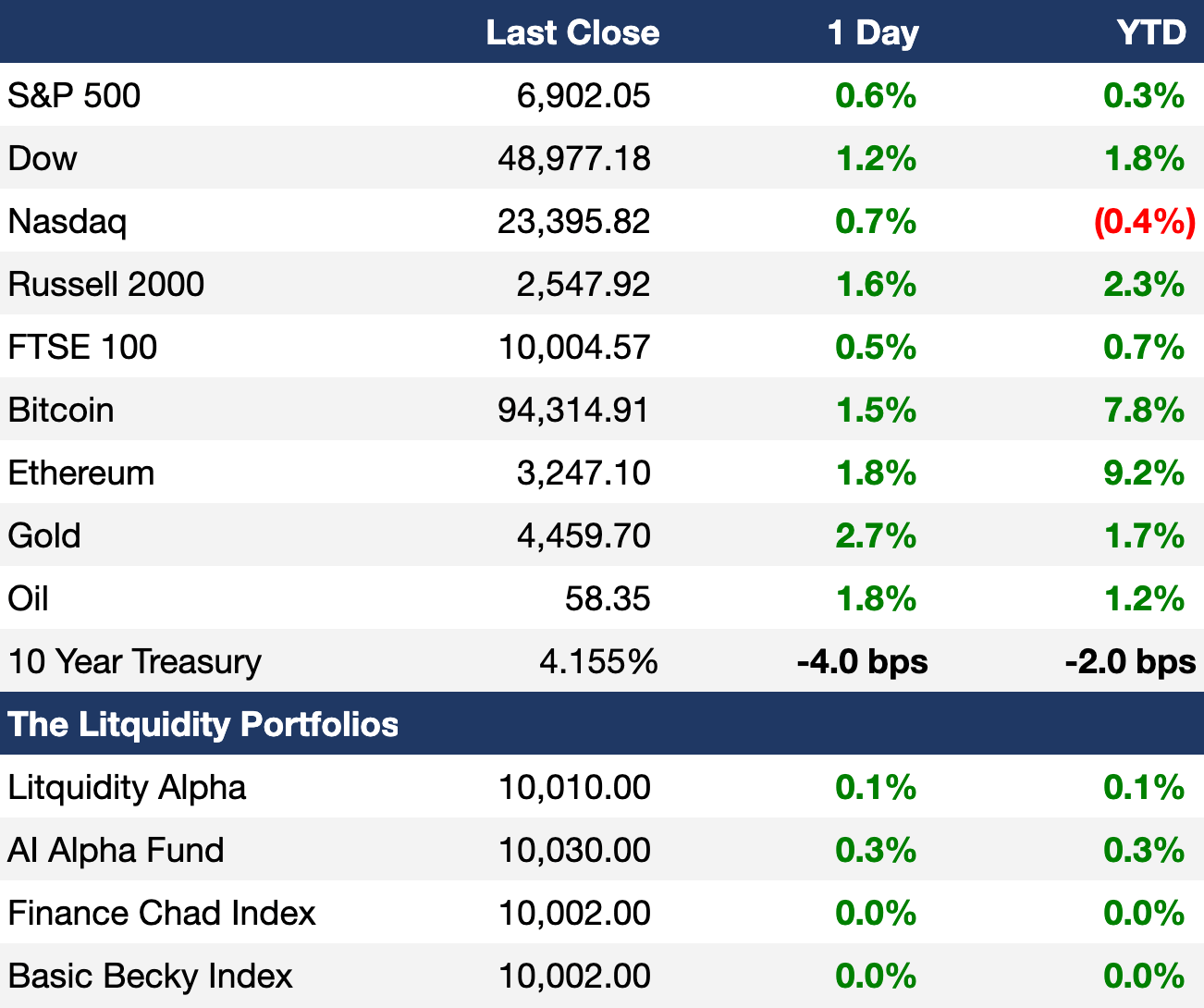

As of 1/5/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied yesterday as investors continued to monitor the situation in Venezuela

Dow hit an ATH

S&P 500 energy index rose 2.7% to its highest since March 2025

Global stocks also rallied to fresh ATHs

Europe's Stoxx 600 hit an ATH

UK's FTSE 100 hit an ATH

Japan's Nikkei 225 surged 3%

China's CSI 300 gained 1.9%

Venezuela stocks surged 17%

Argentina sovereign risk fell to a seven-year low

Oil prices rose

Bitcoin rose to a four-week high

Earnings

What we're watching this week:

Wednesday: Constellation Brands, Jefferies

Full calendar here

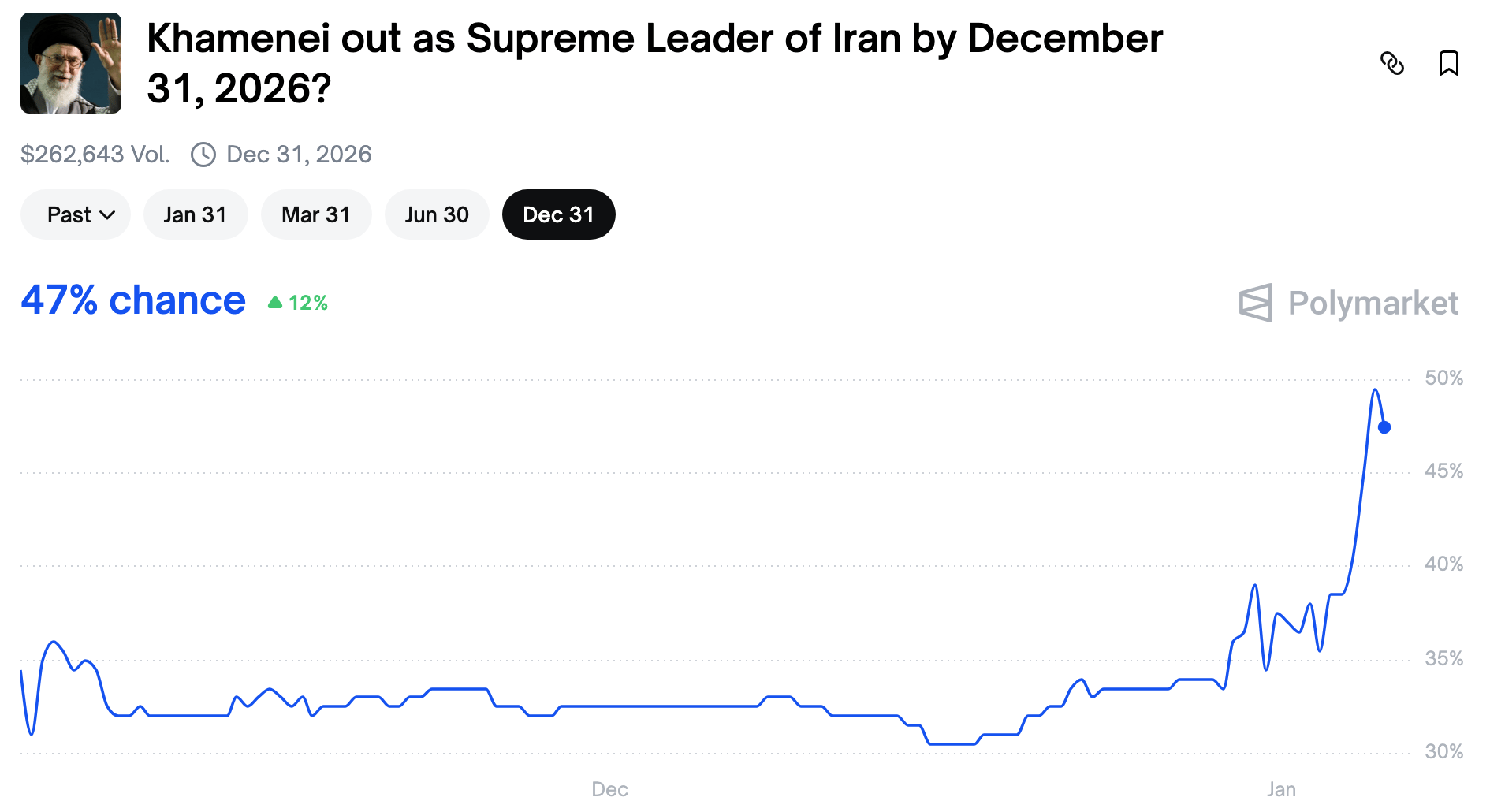

Prediction Markets

The year of the neocon?

Greenland and Cuba are also on the table. Trade your prediction on regime changes on Polymarket.

Headline Roundup

CIA found regime loyalists best placed to lead Venezuela after Maduro (WSJ)

Investors are traveling to Venezuela to gauge business opportunities (CNBC)

US will meet with oil execs on Venezuela revival (BBG)

Fed governor Kashkari believes rates are close to neutral now (BBG)

BOJ chief vowed to keep raising rates (RT)

Hedge funds ramped up bullish oil bets ahead of Maduro's capture (BBG)

Investors may go value hunting in 2026 as AI rally matures (RT)

US manufacturing contracted for a tenth-straight month (BBG)

US IPOs lagged S&P 500 in 2025 on AI and crypto scrutiny (BBG)

US asset managers spent a record $38B on M&A in 2025 (FT)

High-grade corporate bond market had its busiest day since September (BBG)

Banks are betting big on mortgage bonds (BBG)

Activist investors set record number of campaigns in 2025 (RT)

Investors are pulling money from Australia (BBG)

JPMorgan launched a consulting unit for select clients (RT)

Deutsche Bank is trading above book value for the first time since 2008 (FT)

Melqart joins wave of hedge funds expanding in Dubai (BBG)

Journalism-powered hedge fund finds good news can be profitable (WSJ)

US firms will be exempt from global minimum corporate tax (FT)

Data centers added $6.5B to secure power for big US grid (BBG)

Goldman investment comes under spotlight in FTI Consulting lawsuit (FT)

Nvidia will test robotaxis in 2027 in self-driving push (CNBC)

Europe saw record surge in negative power prices in 2025 (BBG)

Smart ring sales are outpacing smart watches for the first time (BBG)

Maduro pleaded not guilty in narco-terrorism case (BBG)

Influencers and OnlyFans models dominate US 'extraordinary' artist visas (FT)

Minnesota governor Tim Walz dropped reelection bid amid fraud (AX)

A Message from Vanta

Turn Compliance Into a Deal Accelerator: Join Live on Jan 15

Ready to turn compliance into a deal accelerator, not a blocker? Vanta's Agentic Trust Platform helps fast-moving startups and security teams get audit-ready fast and stay continuously compliant.

Join the live demo to learn how Vanta can help you:

Automate evidence, policies, and remediation across SOC 2, ISO 27001, HIPAA, HITRUST, ISO 42001, and more

Build real security foundations, not check-the-box fixes

Show credibility faster with a public Trust Center and AI-powered questionnaires

Keep engineers focused with guided workflows and developer-native automation

Deal Flow

M&A / Investments

Australian industrials holding company SGH and US-based Steel Dynamics submitted an $8.8B all-cash takeover bid for Australia's largest steel producer BlueScope Steel, representing a 27% premium

Utility giant Vistra agreed to acquire ten natural gas-fired power plants from Quantum Capital-backed Cogentrix Energy for $4B

Canada's Crestpoint Real Estate Investments agreed to take-private Canadian landlord Minto Apartment REIT at a $1.7B valuation, including debt, at a 32% premium

An investor group led by Apollo agreed to invest $1.2B in building products company QXO

UK PE firm Bridgepoint agreed to buy KPMG's ex-restructuring business Interpath at a $1.1B valuation

AE Industrial Partners agreed to acquire a 60% stake in L3Harris' space propulsion and power systems business for $845M

UK auction and listing platform firm Auction Technology rejected a $585M take-private bid from UK distressed debt specialist FitzWalter

Record label Universal Music Group's India unit agreed to invest $80M for a minority stake in Bollywood production giant Excel Entertainment

PE firm Oakley Capital agreed to acquire a majority stake in debt administration services provider Global Loan Agency Services for $74M

VC

Erebor Bank, a tech-focused digital bank founded by Palantir and Anduril execs, raised a $350M round led by Lux Capital

Advanced materials startup Cambium raised a $100M Series B led by 8VC

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

India's largest asset manager SBI Funds Management hired nine banks to advise on an India IPO that may raise $1.4B at a $14B valuation

Utility management platform Kraken Technologies raised $1B at an $8.65B valuation led by D1 Capital Partners to spinoff from UK renewable energy startup Octopus Energy

Versant Media, the parent of CNBC, USA, and other cable-TV networks, dropped 15% in its trading debut for a $5.95B market cap after spinning off from Comcast

PicPay, the Brazilian fintech controlled by Brazilian conglomerate J&F, filed for a US IPO that could raise $500M

Biotech Aktis Oncology is seeking to raise $212M at a $840M valuation in a US IPO

Debt

UBS drew $21B of investor bids for a $3B AT1 bond sale

Saudi Arabia raised $11.4B in a dollar bond sale

Mexico raised $9B in a dollar bond sale

Real estate developers Related and Oxford Properties secured a $1.6B construction loan and lined up more equity investors for 70 Hudson Yards, a new Manhattan skyscraper for Deloitte's US HQ

Slovenia is seeking to sell $2B in bonds

Bankruptcy / Restructuring / Distressed

$60B worth of long-time defaulted bonds of Venezuela and its state-owned oil company PDVSA soared to 41¢ and 33¢ respectively with investors including Elliott, Winterbrook Capital, Allianz, and RBC BlueBay booking massive profits

Ethiopia's $1B defaulted bond jumped 3¢ after the government agreed to a restructuring with a relatively modest 15% haircut

Energy giant Phillips 66 agreed to acquire UK's Lindsey Oil Refinery's assets following its liquidation but will not reopen the site and instead integrate facilities into its Humber Refinery

FitzWalter Capital acquired UK broadband operator G.Network after lenders triggered a sale

A court may block asset sales in Brazilian lender Banco Master's liquidation after Brazil's central bank shut it down on liquidity concerns in November

Creditors to collapsed auto parts supplier First Brands accused financier Onset Financial of orchestrating a kickback scheme with founder Patrick James' brother that loaded the firm with expensive debt generating over 300% IRRs

Funds / Secondaries

Amos Global Energy Management, an energy platform led by ex-Chevron LatAm execs, is raising $2B for Venezuelan oil projects

Wealth manager Granite Harbor Capital launched a debut private markets fund targeting PE, real estate, and credit deals

European MM infrastructure investor Vesper raised over $215M for its debut fund

Crypto Sum Snapshot

US may seize Venezuela's crypto reserves

Strategy recorded a $17.4B unrealized loss in Q4 from Bitcoin

Crypto market structure bill could be delayed to 2027

Crypto users face home invasions as physical attacks double

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Another classic banger by Ben Carlson, reminding readers of the timeless investing lessons that don't change on January 1st.

Bloomberg Odd Lots sat down with Goldman execs Jan Hatzius and Ben Snider to make sense of 2025 and their outlook for the new year. Take a listen.

EM stocks outperformed US for the first time since 2020. Check out this breakdown of EM returns, updated for 2025.

Also, concurrent developed markets data, updated for 2025.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.