Together with

Good Morning,

Market volumes remained thin and deal flow came in light amid a holiday hangover. But the end of 2024 is cementing various records across global financial markets. Unsurprisingly, this includes a massive wealth boost for PE and private credit tycoons.

Fintech Mode Mobile is on a mission to turn smartphones into an income-generating asset and after earning venture backing, they're inviting retail investors to help them expand their smartphones disruption. Check out the offering.

Let's dive in.

Before The Bell

As of 12/27/2024 market close.

Markets

All three major US indexes saw a broad selloff to end the holiday-shortened trading week

Dow snapped a three-week losing streak

S&P is on track for its best back-to-back annual run since 1990s

Japan's Nikkei 225 is up 20% YTD, on track for a record year-end close for the first time since 1989

Europe's Stoxx 600 rose 0.7% in its best day in a month

The index snapped a two-week losing streak

France's CAC 40 is down 2% YTD versus the Stoxx 600's 6% gain, putting it on course for its worst year since the Eurozone crisis

India's NIFTY 50 is on track for a record ninth-straight year of gains

Bloomberg Treasuries index is up 0.4% YTD

Iron ore fell below $100/ton to a five-week low on China demand woes

Indian rupee fell 0.6% to a record low in its worst day in two years

South African rand slumped to its lowest since May

Earnings

Full calendar here

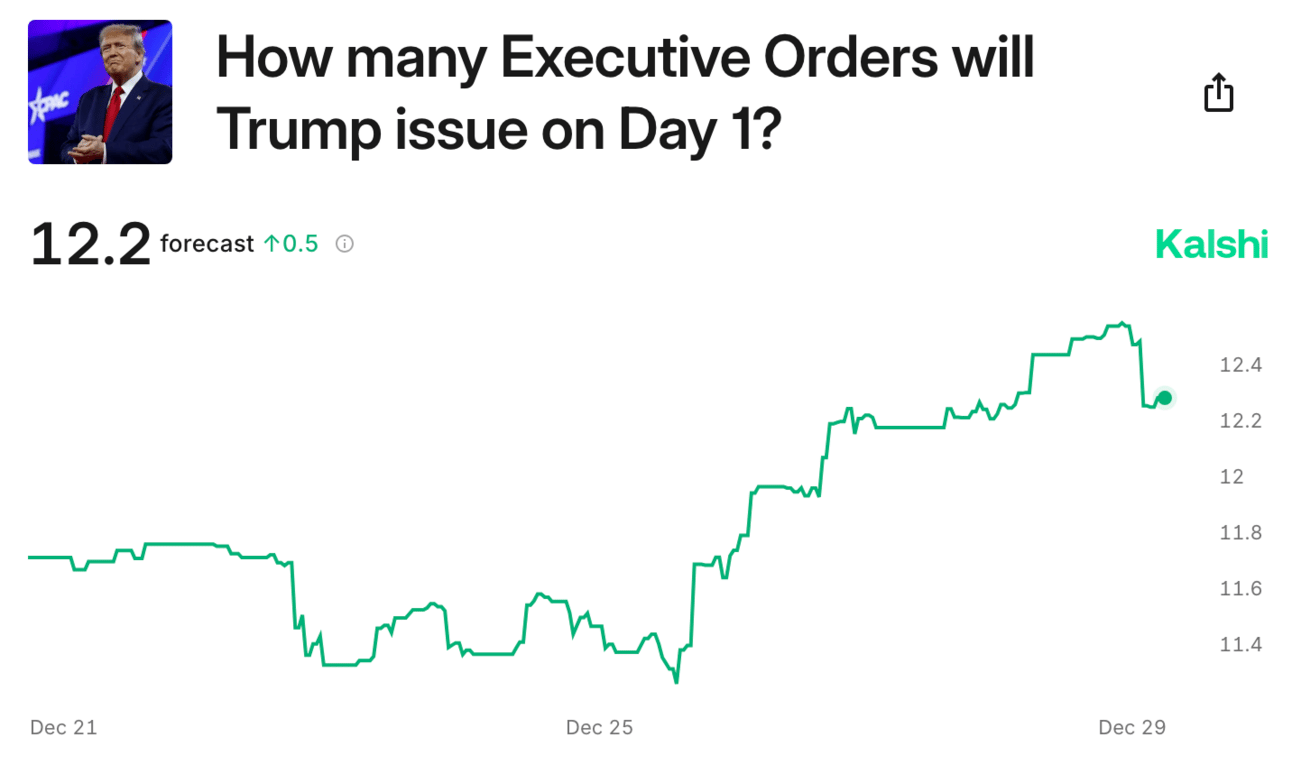

Prediction Markets

The turn of the new year brings us just three weeks away from a new administration, raising speculation on the agenda ahead.

Headline Roundup

Wealth of US PE bosses jumped by $56B this year (FT)

Tapped-out PE investors are declining new commitments (WSJ)

Celebrity activist investing is going extinct (WSJ)

Global corporate borrowing climbed to a record $8T in 2024 (FT)

Momentum trade is set for its best year in over two decades (BBG)

S&P 500's record rally shocked forecasters expecting it to fizzle (BBG)

Options trading hit a record high this year (WSJ)

US may hit new debt limit as early as mid-January (RT)

US economy surprised again in 2024 despite Fed and election drama (BBG)

Roaring debuts mark end to bumper year for India IPOs (BBG)

Bank bull run seen thundering onward with hedge funds loaded up (BBG)

Macquarie expects Asia infrastructure to drive more deals in 2025 (FT)

PE steps up bets on UK rental sector (FT)

Macau sees record bond listings in pivot away from gambling (BBG)

China's record dividend payout intensifies pressure on yuan (BBG)

China dividend ETF flows surge as investors shift from bonds (BBG)

China industrial profits are set to be the worst in two decades (RT)

Chinese youth are flocking to civil service (RT)

Number of Singapore stock exchange listings hit a 20-year low (FT)

Vanguard reaches deal with FDIC over stakes in US banks (RT)

Buybacks surge in Brazil as high rates drain stock market (BBG)

OpenAI needs 'more capital than imagined' (CNBC)

Nvidia bets on robotics to drive future growth (FT)

Trump asked SCOTUS to pause TikTok ban (RT)

Activist Jana may seek to replace majority of Lamb Weston's board (RT)

US court halts enforcement of anti-money laundering law (RT)

Fired McKinsey 'scapegoat' expands damages claim against firm (FT)

South Korean plane crash was the deadliest in years (WSJ)

US homelessness hit a record high (RT)

Jimmy Carter passed away at 100 (WSJ)

US credit card defaults jumped to highest level since 2010 (FT)

A Message from MODE

Elon Dreams and Mode Mobile Delivers

As Elon Musk puts it, "Apple used to really bring out products that would blow people's minds." Those days, however, seem to be behind us. Meanwhile, a new smartphone company, boasting an astonishing 32,481% revenue growth rate over three years, is stepping up to deliver the kind of groundbreaking moments we've been missing in the industry... They've just secured their Nasdaq ticker $MODE, and you can still make an investment in their pre-IPO offering.

Turning smartphones from an expense into an income stream, Mode has already helped users earn and save an eye-popping $325M+, driving $60M+ in revenue and a massive 45M+ consumer base. This ranked them last year’s #1 fastest-growing software company in North America, according to Deloitte. Uber did it to taxis, Airbnb did it to hotels...And now, Mode Mobile is doing it to the $1 trillion smartphone industry.

This is your last chance to invest in Mode before 2025. Join 30,000+ shareholders and invest at $0.26/share today.*

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. A minimum investment of $1,950 is required to receive bonus shares. 100% bonus shares are offered on investments of $9,950+. Please read the offering circular and related risks at invest.modemobile.com. This is a paid advertisement for Mode Mobile's Regulation A+ Offering.

Deal Flow

M&A / Investments

German engineering conglomerate Siemens is reviewing its 75% stake in medical technology subsidiary Siemens Healthineer

Mexican billionaire Ricardo Salinas Pliego will delist $3.9B retail and finance conglomerate Grupo Elektra

India's JSW Energy will acquire renewable energy platform O2 Power's subsidiaries in a $1.5B deal

IPO / Direct Listings / Issuances / Block Trades

Brookfield acquired a 53% stake in French renewables developer Neoen for ~$3.4B, paving way for a takeover

Debt

Bank of America agreed to acquire $990M of multifamily CRE loans from HomeStreet Bank

Bankruptcy / Restructuring / Distressed

Discount retailer Big Lots reached a bankruptcy deal with Gordon Brothers and Variety Wholesalers to save hundreds of stores and prevent closure

Aerospace supplier Incora won court permission to exit Chapter 11 after creditors Silver Point Capital, PIMCO, JPMorgan, BlackRock, and others agreed to support a restructuring after years of disputes

German trader BayWa reached a restructuring agreement that includes a $156M capital increase in 2025

Crypto Sum Snapshot

Terraform Labs founder Do Kwon will be extradited to US (BBG)

Tokenization is Wall Street's latest favorite buzzword (BBG)

Check out Crypto Sum to stay on top of everything crypto!

Exec’s Picks

Diversify your portfolio with private credit deals with up to 20% return potential. Get started with just $500 on Percent.

With high-skilled/tech immigration being all the talk and debate over the weekend, Noah Smith shared some insights on the case for legal Indian immigration.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.