Good Morning,

J Pow doesn't think we're in a recession, interest rate hikes will likely slow down moving forward, mortgage refinancing demand is down 83% YoY, Sequoia Capital is opening an NYC office, Porsche is buying a stake in Red Bull Racing, and Sen. Manchin now supports the new climate and tax bill which also calls for taxing carried interest as ordinary income (a tale as old as time!)

Oh, and our friends over at Launch House closed on a new $10M venture fund: House Capital. Proud to be an LP. Congrats to the team! 🤝

Let's dive in.

Before The Bell

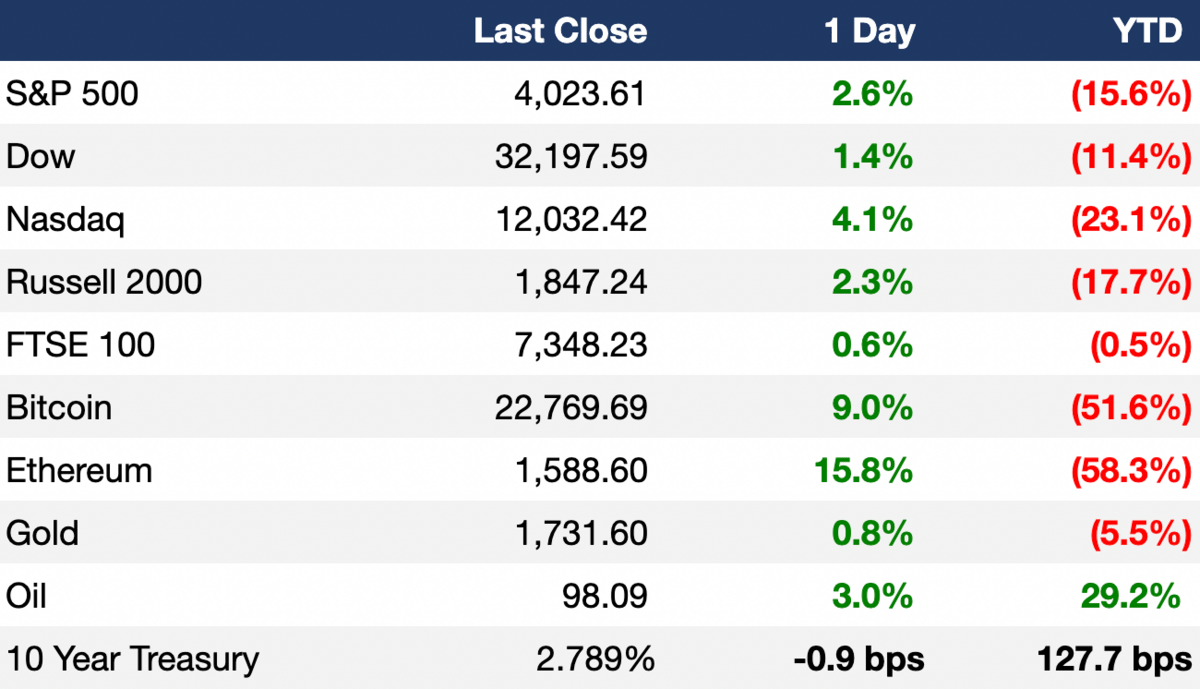

As of 7/27/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Markets rallied to close green across the board in response to the Fed’s latest rate hike announcement

The Fed raised interest rates by 0.75%, its fourth rate hike this year and first ever double 75 bps increase

Crypto outperformed yesterday, with Ethereum and Bitcoin gaining 16% and 9% respectively

All eyes will be on the 8:30 release of GDP numbers, which could make or break the recent market momentum

Earnings

Shopify missed Q2 earnings and revenue estimates and issued gloomy guidance for H2 2022. Their stock rallied 11.6% on encouraging Fed remarks (CNBC)

Boeing posted a wider-than-expected Q2 loss and missed on revenue estimates, but the aircraft manufacturer reported positive operating cash flow and did not see any charges related to the production of its 737 MAX jet. Shares jumped 4.4% in premarket action before closing flat (CNBC)

Spotify jumped 12% on the day after beating revenue estimates thanks to 14% paid subscriber growth and 31% YoY advertising revenue growth (CNBC)

Meta reported its first ever YoY revenue decline due to a slowing advertising environment, and the company issued weak guidance for the next quarter. Shares fell 4% in AH trading (CNBC)

Ford beat estimates and more than tripled operating income from a year ago to $3.7B, while also announcing plans to increase its quarterly dividend. Shares jumped more than 6% in AH trading (CNBC)

What we’re watching this week:

Today: Pfizer, Southwest, Apple, Amazon, Intel

Friday: ExxonMobil, Chevron

Full calendar here

Headline Roundup

Fed Chairman Jerome Powell does not think the US is currently in a recession (CNBC)

Jerome Powell hinted that the Fed will slow the pace of rate hikes (CNBC)

In reversal, Senator Manchin announced support for the new climate and tax bill (NYT)

Russia delivered less gas to Europe on Wednesday in a further escalation of an energy stand-off between Russia and the EU (RT)

Demand for mortgage refinances are down 83% from a year ago (CNBC)

The space economy grew at the fastest rate in 7 years to $469B in 2021 (CNBC)

Japan Exchange Group 'JPX' is looking to revamp the process for local IPOs under PM Kishida’s ‘New Capitalism’ initiative (BBG)

Microsoft is rallying Google and Oracle to help loosen Amazon’s stronghold on cloud business with the US government (WSJ)

German chemical producer BASF may sell unused natural gas back to Germany’s grid in case Russian deliveries are halted (BBG)

The CEO of Lloyds Bank said the bank will look into more fintech acquisitions to bolster its digital offering (BBG)

The FTC sued to block Meta Platforms' acquisition of VR company Within Unlimited, citing monopoly concerns (BBG)

Meta will look to acquire more companies as they bet on an M&A strategy (WSJ)

Canadian technology firm CGI sees a 'perfect' environment for acquisitions as valuations improved following a sector-selloff (BBG)

Sequoia Capital plans to open an office in New York City, its first US facility outside Silicon Valley (TI)

The DOJ settled with a Warren Buffett-owned Pennsylvania mortgage company over discrimination against Black and Latino homebuyers (AP)

AbbVie’s Allergan unit will pay over $2B to resolve thousands of local and state government lawsuits related to their marketing of its Kadian opioid painkiller (BBG)

Elliott Investment Management may get representation on the board of PayPal (BBG)

The US will release 786k additional monkeypox vaccine doses as outbreak spreads (CNBC)

A Message From Masterworks

Your boomer portfolio getting clapped by inflation? You need to check out this app (respectfully).

Real talk: today’s markets are not hitting like they used to. Even CalPERS—these guys almost never miss—is down 6.1% in the last 12 months. They haven’t seen results this mid since the Great Recession (some boomer thing idk).

But one thing that's actually lowkey slapping for them? Alternatives. Their real assets allocation towards things like real estate and art is up 21.3%. On god.

I know what you’re thinking.

Art? That's cap.

Nah fam, it's a $2 trillion asset class that outperformed the S&P 500 by more than 3x in the last 25 years (damn thats hella old). The problem is most people just haven’t vibed with it cause usually you gotta make bread like my dad to invest (he's a lawyer btw).

Not anymore. With Masterworks it's mad easy to invest in banger artists like Picasso, Banksy, and Basquiat. And since inception in Sep. 2019, their investments have generated 15.3% net annualized appreciation. That's bussin fr fr.

And when it comes to payday, they’re toting 4 exits, each achieving an annualized return of over 25% for their investors… based.

When my boys told me I had to get on this platform, I had one word: “bet.”

Now my portfolio drip is on another level.

Already more than 492,000 chillers have signed up. Most offerings sell out in just a few hours (yesterday, their new Banksy was so fire the shares got swept up in just 14 minutes), but you can skip the waitlist with this special link. Say less.

See important Regulation A disclosures at masterworks.io/cd

Deal Flow

M&A / Investments

PE firm Clayton Dubilier & Rice’s efforts to sell UK gas station operator Motor Fuel Group are stalling amid concerns over their ~$6B valuation and unavailability of financing (BBG)

Spirit Airlines canceled its $2.7B sale to Frontier Airlines amid lack of shareholder support (RT)

Public sector cloud solutions startup OpenGov will acquire public sector software provider Cartegraph Systems, valuing the combined entity at ~$1.25B (BBG)

PE firm MBK Partners is considering a takeover bid for Chinese data center company and rival Vnet at a potential $1.1B valuation (BBG)

Business payments vendor Billtrust is exploring a potential sale to PE firms (RT)

BlackFin Capital Partners is considering a sale of insurance company CED Group at a potential ~$406M valuation (BBG)

Canadian energy company Suncor Energy is weighing a sale of its retail gas station business Petro-Canada, which has over 1.5k locations (BBG)

Cerberus Capital Management plans to sell its Spanish debt-servicing company Haya Real Estate (BBG)

Amancio Ortega's family office Pontegadea bought a 5% stake in Spanish energy company Enagas's renewable energy unit for an undisclosed amount (BBG)

Sports car manufacturer Porsche is reportedly buying a 50% stake in F1 team Red Bull Racing (MRC)

VC

Cybersecurity provider Acronis raised $250M in new funding earlier this year at a $3.5B+ valuation (BBG)

AI-based contextual advertising leader Seedtag raised over $254M in funding from Advent International (PRN)

Sustainable crop health company Enko raised a $70M Series C led by Nufarm (PRN)

Web3 digital identification startup Unstoppable Domains raised a $65M Series A at a $1B valuation led by Pantera Capital (PRN)

RPA Supervisor, a software platform for companies to manage their automation processes, raised a $20M Series A led by Dawn Capital (TC)

Restorative sleep technology developer Bryte raised a $20M strategic investment round led by Tempur Sealy International (PRN)

Award-winning property management platform Latchel raised a $16.7M Series A led by F-Prime Capital (PRN)

Paragon, a startup that integrates various SaaS apps for enterprise clients, raised a $13M series A led by Inspired Capital (TC)

Hybrid-electric aircraft manufacturer VerdeGo Aero raised a $12M Series A led by Raytheon's venture arm RTX Ventures (PRN)

YorkTest, a health and wellness company focused on food sensitivity testing, secured an $11M investment from PE firm NVM (PRN)

ChiselStrike, an infrastructure platform for web developers, raised a $7M seed round led by Norwest Venture Partners (PRN)

Drover AI, an AI-based platform improving e-scooter safety, raised a $5.4M Series A led by Vektor Partners (TC)

Brazil's leading online credit marketplace FinanZero raised $4M in a funding round led by Swedish investors VEF, Dunross & Co, Atlant Fonder and Webrock Ventures (PRN)

IDEAL, an Indonesian efficient mortgage application platform, raised a $3.8M pre-seed round led by AC Venture and Alpha JWC (TC)

Shypyard, a business-planning platform for ecommerce merchants, raised $3M in funding led by Gradient Ventures (PRN)

Root Global, a startup that helps food companies achieve carbon neutrality, raised a $2.6M pre-seed round led by Project A (TC)

ILUMA, an AI operating system for DAOs, raised a $2.5M pre-seed round led by Acrew Capital (PRN)

Packworks, a B2B platform for community-based micro-retailers, raised $2M in funding led by FastGroup and CVC Capital Partners (TC)

IPO / Direct Listings / Issuances / Block Trades

Fundraising

VC firm FINTOP Capital secured $220M for its FINTOP Fund III to continue investing in B2B SaaS fintechs (PRN)

Asset manager Arena Investors and transportation-focused investor Mobility Capital announced a $200M JV to make non-equity investments in growth-oriented transportation and logistics sectors (PRN)

VC firm Struck Capital raised a $15M fund to launch Struck Studio, an in-house studio that spins up startups from within (TC)

Exclusive entrepreneur community Launch House debuted their venture arm House Capital to focus on early-stage startups with a $10M fund backed by investors such as Serena Williams, Andrew Chen (a16z), Steve Chen (co-founder of YouTube), Michael Ovitz (founder of CAA), and your boyyyy Litquidity among others (BW)

Crypto Corner

Exec's Picks

The Verge's Alex Heath and David Pierce wrote a fantastic piece on Zuck turning up the heat on Meta employees. Check out their latest here.

Noah Smith's most recent article highlights several important issues that have stemmed from our focus on "the financialization of tech" over the last few years.

In case you missed yesterday's pre-seed investment opportunity that we circulated to our audience and would like to take a look, please hit up Lit at [email protected] (ONLY if you are an accredited investor).

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.