Together with

Good Morning,

US jobs growth was revised down by the most ever, Apollo's president gave a bleak warning for PE firms, global bonds re-entered a bull market, activist hedge funds made BILL their latest target, and Oracle issued a blowout forecast causing its stock to rocket past JPMorgan, Visa, and Walmart to become a top-10 most valuable US company.

Investors at top funds use Tenzing MEMO to get up to speed quickly on nearly 6,000 public companies. Real-time research, topical briefings, intelligent Q&A, financial news, event transcripts, and SEC filings, and more…all at your finger tips. Check 'em out.

Let's dive in.

Before The Bell

As of 9/9/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as a massive downwards revision to jobs data boosted bets of Fed rate cuts

All three major indexes closed at ATHs

Money markets traders fully priced in three 25 bps rate cuts by year-end

China's chipmakers index surged by a record 28% last month

Global bonds re-entered a bull market after surging 20% from its 2022 low to its highest level March 2022

US Treasuries snapped a four-day win streak

Gold rallied to a new ATH

Arabica coffee premium jumped to the highest since 2011

Earnings

Oracle missed Q1 earnings but beat on revenue and absolutely smashed FY cloud infrastructure forecasts with booked cloud orders now seen at $500B; their stock surged 27% to become the tenth-most valuable US company and make Larry Ellison the world's second-richest person (CNBC)

GameStop beat Q2 earnings and revenue estimates on strong sales in its hardware and collectibles segment as it embraces digital storefronts to battle competition from larger retailers and e-commerce platforms; their Bitcoin stockpile hit $500M (WSJ)

What we're watching this week:

Today: Chewy

Thursday: Kroger, Adobe

Full calendar here

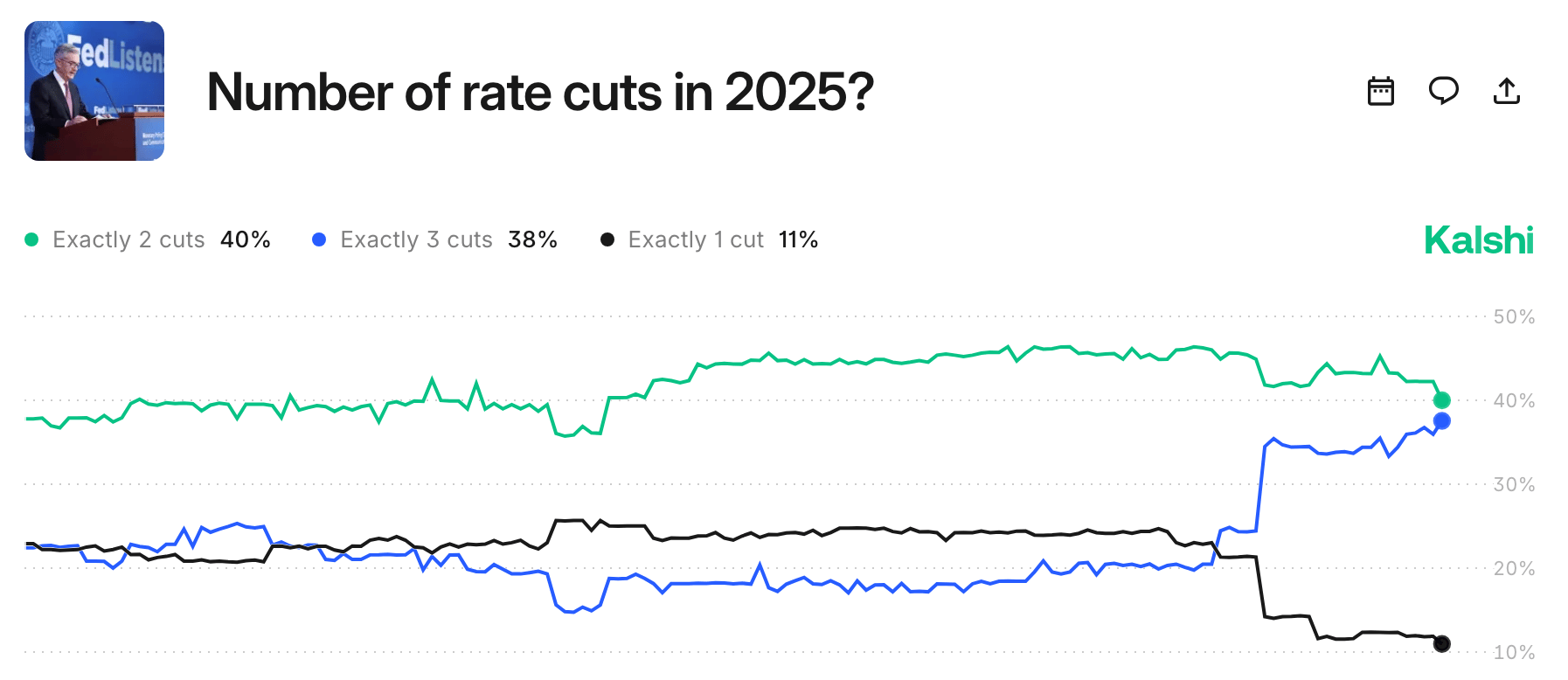

Prediction Markets

Traders are now pricing in two rate cuts at minimum.

Headline Roundup

US jobs growth was revised down by the most ever (CNBC)

US floats new tariffs on China and India to squeeze Russia (BBG)

Jamie Dimon said US economy is weakening (BBG)

US small-business optimism climbs but labor quality concerns persist (RT)

Apollo president predicts 'washout' for PE firms amid slowdown (BBG)

Hedge funds ride August highs to keep returns positive (RT)

Buyers' fatigue threatens US stock rally as fund flows weaken (BBG)

Looming listings put ailing European IPO market to test (FT)

JPMorgan named three insiders as global chairs of IB (RT)

Saudi's $1T SWF PIF will unveil a new investment roadmap (BBG)

Australia's SWF cut US exposure for Germany and Japan (RT)

CVC joined Amsterdam's AEX index (BBG)

HSBC legacy investors refuse to sell back high-coupon bonds (BBG)

China's green tech firms pour billions into overseas factories (BBG)

OpenAI execs rattled by campaigns to derail for-profit restructuring (WSJ)

Apple launched iPhone 17 Air and more (CNBC)

Microsoft will use AI from Anthropic in partial shift from OpenAI (TI)

United and Spirit execs feud on Twitter over business model (RT)

Big Oil slashes jobs and investments as low crude prices bite (FT)

Walmart will launch in Africa (RT)

Novo Nordisk will cut 9k jobs (CNBC)

Nearly half of Israeli tech startups incorporate abroad (RT)

Ally Lecornu was named new French PM (BBG)

Israel launched an attack on Hamas in Qatar (WSJ)

A Message from Tenzing MEMO

Get 5 Complimentary Research Credits

Tenzing MEMO gets professionals up to speed fast. Want to compress your ramp time, cover more ground, and stay sharp when it counts? MEMO delivers.

Active coverage on nearly 6,000 NYSE and Nasdaq-listed companies, with:

Real-time research reports and topical briefs

'Always on' Q&A chat for detailed answers to tough questions

Proactive news monitoring, scanning 14,000+ articles each week

No transcript dumps. No gaps in coverage. Just polished analysis and actionable intelligence rendered in a fraction of the time.

Investors at top firms agree: MEMO takes pros from 0 to 60 in seconds.

"I've spent considerable time this year testing out many different AI resources, and this is by far the best I've used. I use it almost daily and it saves me hours of work on internal research reports. I highly recommend trying it."

Shelley L. Anthony, Research & Operations Analyst

Accelerate your research with an extended free trial – Register with code EXECSUM to claim 5 complimentary research credits.

Disclaimer: Tenzing MEMO is available for professional use only. A valid work email is required for this offer. Approved users receive a 3-week free trial to evaluate 5 companies of their choosing with no commitment.

Deal Flow

M&A / Investments

Mining giant Anglo American and Canada's Teck Resources agreed to merge to create an $53B entity in one of the largest mining deals in a decade

O&G giant Phillips 66 agreed to acquire a 50% stake in JV partner Cenovus Energy's refining unit for $1.4B

Swiss pharma giant Novartis agreed to acquire biotech Tourmaline Bio in a $1.4B all-cash deal at an over 60% premium

Blackstone and Permira invested $525M in UAE property portal Property Finder

Financial services firm Baird acquired a stake in Canadian alternative asset manager Sagard

German logistics giant DHL will acquire healthcare logistics firm SDS Rx

VC

Superintelligence startup Reflection AI is close to raising $1B at a $5B valuation from Nvidia, Lightspeed, Sequoia, and DST Global

Singapore SWF GIC and Japan’s SoftBank are considering selling their stakes in Vietnamese fintech firm VNLife at an over $1B valuation

QuEra Computing, a startup building quantum computers with neutral atoms, raised a $230M Series B extension from NVentures

Harbor Health, a primary and specialty care clinic group and health insurance company, raised $130M in funding led by General Catalyst, 8VC, and Alta Partners

Scintil Photonics, a startup developing integrated photonic system-on-chip solutions for AI infrastructure, raised a $58M Series B led by Yotta Capital Partners and NGP Capital

ReOrbit, a Finnish startup focused on sovereign satellites, raised a $53M Series A from Varma, Icebreaker.vc, Expansion VC, 10x Founders, and others

Crypto exchange Gemini raised a $50M strategic investment from Nasdaq ahead of its IPO

Higgsfield, an AI native video reasoning engine, raised a $50M Series A led by GFT Ventures

Nitricity, a startup turning almond shell waste into organic fertilizer, raised a $50M round from Chipotle, Khosla Ventures, and others

AI-powered productivity assistant startup Fyxer.ai raised a $30M Series B led by Madrona

Palm Tree Crew, a global entertainment & investment holding company, raised a $20M Series B at a $215M valuation led by WME Group

Danish healthcare fintech Teton.ai raised a $20M Series A led by Plural

Fusion startup Proxima Fusion raised a $17M Series A extension from CDP Venture Capital, European Innovation Council Fund, and Brevan Howard

Nuclearn, a startup building AI tools for the nuclear industry, raised a $10.5M Series A led by Blue Bear Capital

Power quality and reliability solutions startup florrent raised a $9.5M seed-2 round led by MassVentures

Sphinx, a startup building AI for data, raised a $9.5M seed round led by Lightspeed

Parento, a provider of comprehensive paid parental leave insurance, raised a $5.9M seed II round led by ResilienceVC

Geothermal startup Dig Energy raised a $5M seed round led by Azolla Ventures and Avila VC

Architect AI, a startup building an agentic website platform, raised a $4.8M seed round led by Project A

IPO / Direct Listings / Issuances / Block Trades

Swedish BNPL fintech Klarna raised $1.4B at a $15B valuation in a US IPO priced above a marketed range

Blockchain-based lender Figure raised its IPO offering to $693M at a $4.7B valuation

Crypto exchange Gemini raised its IPO offering to $433M at a $3.1B valuation

Activist hedge fund Elliott built a 5% stake SME-focused fintech BILL and may push for a sale

Saudi gourmet food producer and restaurant chain Bateel International is exploring an IPO

Debt

Jeep maker Stellantis sold $2B of investment grade bonds

China Pacific Insurance is considering selling $2B of convertible bonds

Kenya plans to borrow $1B in a debt-for-food security swap

Canadian insurance firm Definity Financial plans to sell $723M of debt as it prepares to close its acquisition of Travelers Canada

Cloud software firm Dropbox raised another $700M in private credit from Blackstone

Blue Owl Capital-owned data center operator Stack Infrastructure is exploring a $700M debt deal linked to assets in Italy

Swedish digital infrastructure firm EcoDataCenter raised $700M in private credit from Deutsche Bank Private Credit and Infrastructure

Sri Lanka plans to secure a $500M yuan loan

Hawaiian Electric Industries is seeking to raise $400M in a senior, unsecured junk-bond deal

Vietnamese EV maker VinFast will announce a $200M loan from Indian state-owned banks as it continues to seek equity investors

Pollen Street Capital extended a $100M lending facility to UAE-based SME fintech CredibleX

Chinese tech giant Tencent is considering its first public debt offering in four years

Bankruptcy / Restructuring / Distressed

United Overseas Bank extended the maturity of a $1.3B loan tied to a luxury Hong Kong apartment complex from defaulted Chinese developer Shimao

Agri-commodities trader Cargill is in advanced talks to back hostile creditor Grassi's bid to take over distressed Argentine soy exporter Vicentin

Fundraising / Secondaries

Private credit-focused Pemberton Asset Management raised $1.7B for its debut NAV financing fund

Ex-King Street partner Paul Goldschmid will launch L/S credit hedge fund Harvey Capital Partners with over $1B in one of the biggest hedge fund debuts this year

Private real estate investment firm Cottonwood Group raised a $1B special situations fund

UK's largest asset manager Legal & General raised $704M for a digital infrastructure fund

Midwest PE firm Rockbridge Growth Equity raised $360M for its third fund

Ex-Fir Tree Partners PM Sachin Gupta launched Covara Capital, an opportunistic L/S credit hedge fund, with $250M in seeding from Blackstone

AI cloud computing firm CoreWeave launched CoreWeave Ventures to invest in AI startups

Crypto Sum Snapshot

Cboe will offer 'continuous' futures for Bitcoin and Ether

Democrats unveiled a new crypto framework to counter Trump's footprint

Trump Media will let Truth Social users convert 'gems' into CRO tokens

A unit of China’s Ant Digital put $8B of energy assets on its blockchain

Read our Crypto Sum newsletter for the most important stories on everything crypto.

Exec’s Picks

Bloomberg did a deep dive into one prestigious university booming in the Trump Era. So much to the envy of its peers…

WSJ explored an unusual off-court rivalry between Steph and LeBron: sneaker wars in China.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Featured role(s):

BlueFlame is seeking two Product Strategists, one focused on investment banking and another focused on private equity

The product strategy team bridges the capabilities of the technology they build with domain-specific needs and expectations of their clients

The ideal candidates will have between 3-5 years of front office experience at top-tier IB / PE firms

Opportunity for junior bankers or PE investors to break into the AI technology field

Competitive base of $175k-$200k + bonus

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.