Together with

Good Morning,

BlackRock abandoned "ESG" investing, Wall Street is retreating on DEI efforts, quantitative tightening is barely working, Super Micro is up 2000% in two years, Fitch downgraded NYCB to junk, Musk sued OpenAI, and Millennials are set to inherit $90 trillion.

Looking to invest in private markets alongside veteran Wall Street investors? Check out today’s sponsor, 10 East.

Let’s dive in.

Before The Bell

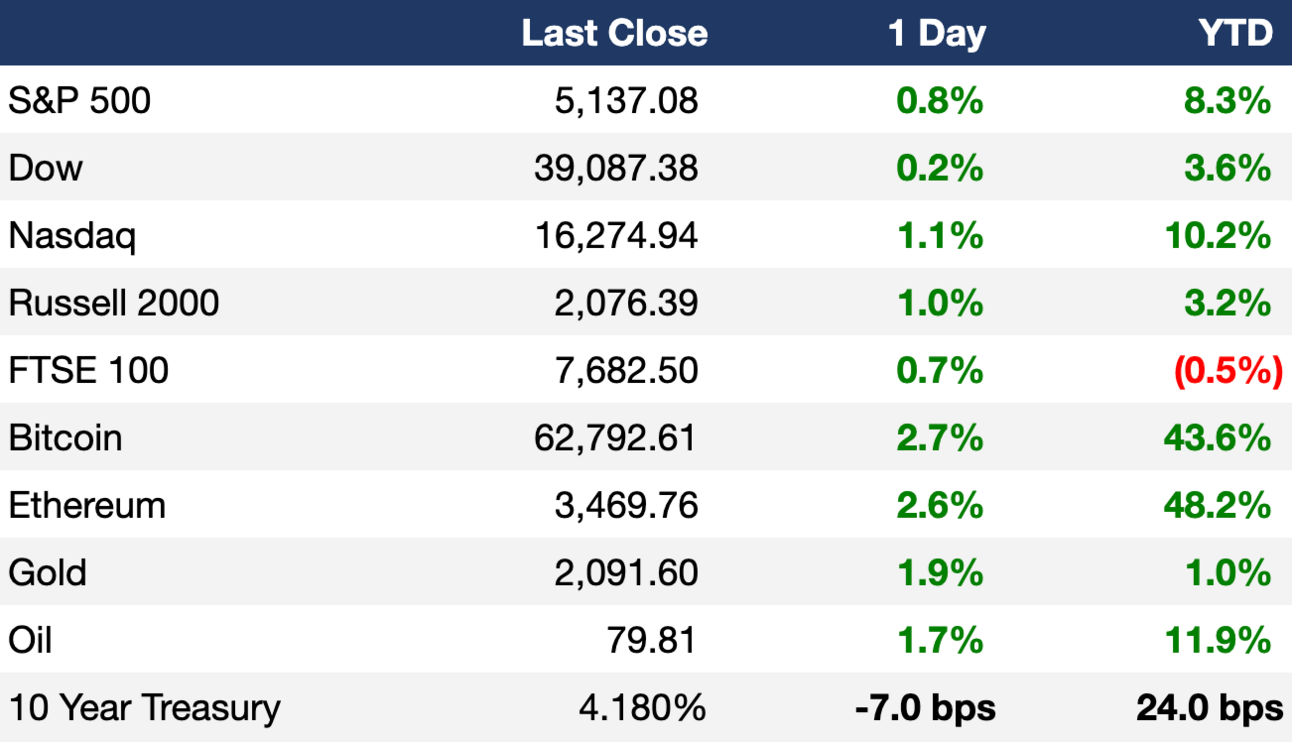

As of 03/01/2024 market close.

Markets

US stocks rallied, with investors betting on tech mega caps as the best way to play slowing inflation and AI

Europe's Stoxx 600 and Japan's Nikkei 225 also hit new record highs

US crude topped $80 for the first time since November

Earnings

What we're watching this week:

Today: Sea

Tuesday: Target, CrowdStrike, Nio

Wednesday: JD.com, Abercrombie & Fitch, Foot Locker

Thursday: Costco, Broadcom, Kroger, MongoDB

Full calendar here

Headline Roundup

BlackRock abandons ‘ESG’ investing for ‘transition investing’ (WSJ)

Wall Street banks retreat on DEI efforts (BBG)

Quantitative tightening has had virtually no impact so far (RT)

Musk sued OpenAI for pursuing profits (AP)

Pension funds turn to credit to bolster LDI trades (FT)

Super Micro will join the S&P 500 (CNBC)

Ex-Credit Suisse CEO's SPAC sued by a Chinese partner (FT)

Sweden’s largest pension fund chairperson resigned after a week (RT)

Fitch downgraded NYCB to junk (BBG)

Eurozone confidence struggles to recover (WSJ)

Blackstone’s property fund meets redemptions for first time in over a year (FT)

Invesco becomes fifth US asset manager to exit CA100+ climate group (RT)

Google trims jobs while others work ‘around the clock’ (BBG)

Rio Tinto CEO expects metal prices to remain volatile (RT)

US factory employment fell to a seven-month low (RT)

OPEC+ will extend oil output cuts to Q2 (RT)

Cruise's valuation was slashed by more than half (RT)

Ex-Macquarie star commodities trader Nick O’Kane will join Mercuria (FT)

Millennials stand to inherit $90T (CNBC)

A Message From 10 East

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

Arkhouse Management and Brigade Capital Management raised their offer for Macy’s to $6.6B after the retailer rebuffed their previous offer (RT)

International Game Technology will split its lottery unit from its gaming businesses, which will be merged with casino platform provider Everi Holdings to form a separate entity worth $6.2B, including debt (RT)

British private investment company Bridgepoint Group is in advanced talks to sell Dorna Sports, which holds the commercial rights to MotoGP, in a bid to raise $4.4B (RT)

Boeing is in talks to buy former subsidiary Spirit AeroSystems, which has a $3.8B market cap, to reintegrate its manufacturing operations to improve safety and quality (RT)

KKR is exploring a possible sale of its stake in Metro Pacific Health, the biggest private hospital operator in the Philippines, and could aim for a $3B+ valuation (BBG)

Investment firm MNC Capital offered to acquire sporting goods and outdoor products company Vista Outdoor for $2.9B, including debt (RT)

Italian asset manager Sosteneo will acquire a 49% stake in energy company Enel’s energy storage unit for $1.2B (BBG)

UK-based healthcare PE firm GHO Capital is seeking to sell contract research organization FairJourney Biologics for over ~$1.1B (FT)

New World Development sold a Hong Kong shopping mall for $514M to improve its financial health (BBG)

Technology services Endava will acquire global IT and business solutions provider GalaxE Group in a $405M cash-and-stock deal (BW)

Nissan is in advanced talks to invest over $400M in struggling EV maker Fisker in a deal that could give the Japanese automaker access to an electric pickup truck (RT)

BBC Studios acquired a 50% stake in ITV’s BritBox International, a subscription streaming service, for $298M (FT)

Czech billionaire Daniel Kretinsky is weighing a renewed takeover offer for parts of Atos after walking away from a previous bid for a unit of the embattled French IT company (BBG)

Spanish oil company Repsol hired Rothschild to advise on the sale of its Norwegian subsidiary Repsol Norge (RT)

Saudi Aramco completed their 100% acquisition of Chile's Esmax Distribución (RT)

VC

FogPharma, a clinical-stage biopharmaceutical firm, raised a $145M Series E led by Nextech Invest (BW)

Aktiia, a Swiss startup providing optical blood pressure monitoring devices, raised a $30M round led by Redalpine (FN)

Ether.fi, a startup developing a liquid restaking protocol, raised a $23M round led by Bullish Capital and CoinFund (FN)

Web3 infrastructure startup Taiko raised a $15M Series A led by Lightspeed, Generative Ventures, Hashed, and Token Bay Capital (TC)

Know Labs, a developer of non-invasive medical diagnostic technology, raised $4M in funding from Lind Global Fund II (BW)

TravelJoy, a startup providing tools for travel entrepreneurs, raised a $10M Series A led by Acrew Capital (TC)

Sitehop, a networking encryption solutions provider, raised a $6.4M seed round led by Amadeus Capital Partners and Manta Ray Ventures (FN)

Healthcare technology company Salvo Health raised a $5M seed round led by City Light Capital and Human Ventures (FN)

CommandBar, a B2B tool designed to make software easier to use, raised a $4.8M seed round from Thrive Capital and Y Combinator (TC)

Decentralized reputation protocol OpenRank raised a $4.5M round led by Galaxy and IDEO CoLab Ventures (TC)

Web3 development tools startup BuildBear Labs raised a $1.9M round led by Superscrypt, Tribe Capital, and 1kx (FN)

Clasp, a provider of modern employee benefits infrastructure, raised a $1.5M round from Base10 Partners, Eric Stromberg, and more (FN)

IPO / Direct Listings / Issuances / Block Trades

Reddit is seeking an potential $6.5B valuation in its IPO (BBG)

India's regulator approved Digit Insurance’s IPO after multiple delays due to compliance issues; Digit was last valued at $3.5B when it filed to list in August 2022 (RT)

Abu Dhabi sovereign wealth fund ADQ is considering a listing for Etihad Airways as soon as this year (BBG)

Greece will launch the sale of a 22% stake in Piraeus Bank today via a public offering to Greek investors and private placement for foreign ones (RT)

Debt

A group of debt arrangers led by Stone Point launched the sale of a $1.9B second-lien loan to help fund the LBO of Truist Financial's insurance business (BBG)

UBS will provide a loan of up to $757M to an ION Group holding company taking control of Italian asset manager Prelios (BBG)

Some holders of a Spirit Airlines bonds retained Ducera Partners and King & Spalding ahead of potential debt talks with the budget carrier (BBG)

Bankruptcy / Restructuring / Distressed

Crafts retailer Joann is considering a bankruptcy filing as soon as this week in a deal that would hand control of the company to lenders (BBG)

Deutsche Bank will file a liquidation lawsuit in Hong Kong against Chinese developer Shimao Group (RT)

EV startup Fisker issued a going concern and will lay off 15% of its staff (WSJ)

Fundraising

Crypto Corner

Exec’s Picks

The Verge published its take on why Elon’s case against OpenAI is “hilariously bad.”

WSJ explained Macy’s CEO’s turnaround plans amid Macy’s on-going takeover and activist battles.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter