Together with

Good Morning,

Microsoft is willing to let Altman rejoin OpenAI, Citi cut more than 300 senior manager roles, Amazon launched free AI classes to win a talent arms race, OpenAI employees threatened to quit if its board doesn’t resign, Argentina’s new president wants to replace the peso with the US dollar, and Musk sued Media Matters.

Want the best coverage of OpenAI news, as it develops? Check out and subscribe to The Information.

Let’s dive in.

Before The Bell

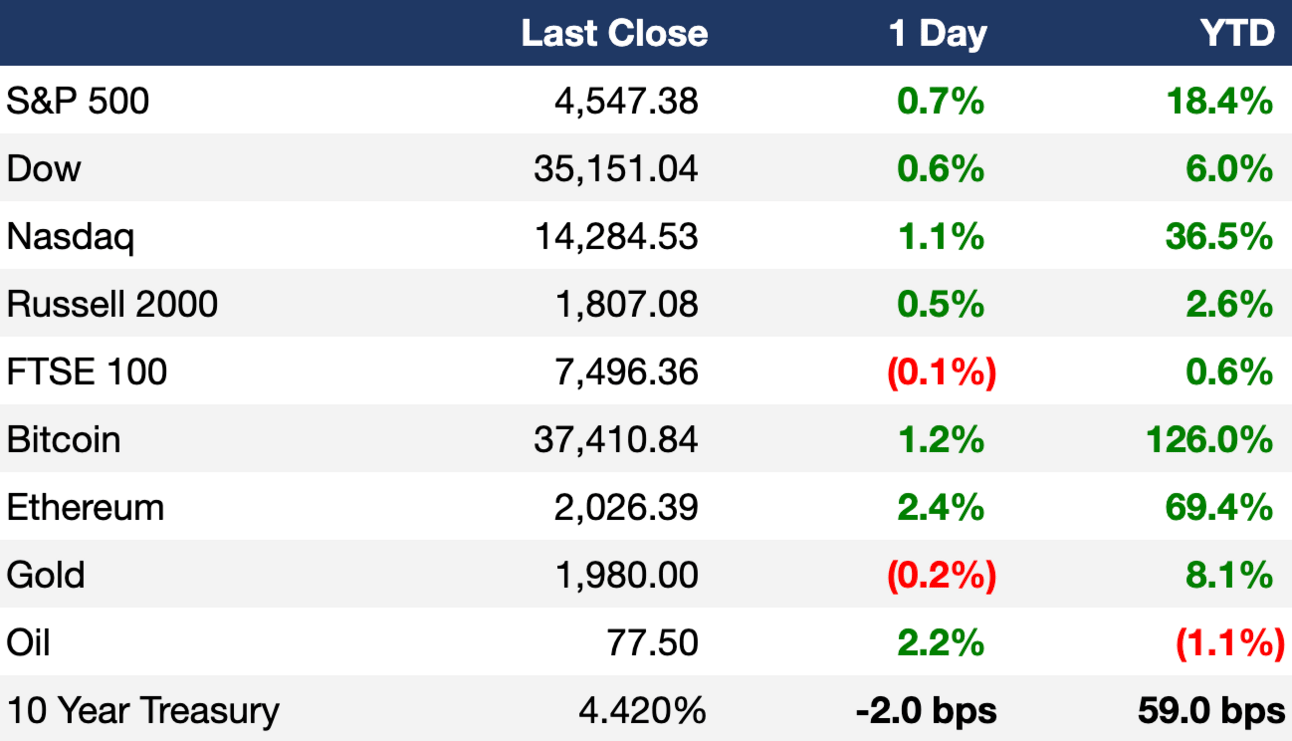

As of 11/20/2023 market close.

Markets

US stocks jumped, boosted by strong tech gains

The Nasdaq led indices with a 1.13% gain as Microsoft hit a record high thanks to former OpenAI chief Sam Altman joining the tech giant

Earnings

Headline Roundup

Microsoft signals willingness to have Altman rejoin OpenAI (BBG)

Citigroup cuts over 300 senior manager roles in latest restructuring (BBG)

Amazon launches free AI classes in bid to win talent arms race (WSJ)

OpenAI employees threaten to quit unless board resigns (WSJ)

Argentina’s new president wants to adopt US dollar as the national currency (WSJ)

California’s pump prices fall below $5 for first time since July (BBG)

Brewing storm system likely to snarl Thanksgiving travel (AX)

Bitcoin ETF hype has Wall Street eyeing $100B crypto potential (BBG)

X sues Media Matters after report about ads next to antisemitic content (RT)

United Steelworkers union complains it’s in the dark on US Steel auction (BBG)

Hundreds convicted as Italy’s largest mafia trial in decades ends (WSJ)

Amazon sued by three employees who allege gender discrimination and ‘chronic’ pay inequity (CNBC)

Puerto Rico sales-tax boon means $400M windfall for bondholders (BBG)

The NFL’s billion dollars’ worth of injured quarterbacks (WSJ)

A Message From The Information

It seems like there has been a new twist to the OpenAI story every five minutes, from Sam Altman being fired, to rehired, to fired again, and no one knows where to turn for reliable, timely information.

Personally, I kept up with everything by reading The Information. Who turned down the OpenAI CEO role? Where are OpenAI customers considering defecting to? Will the board resign? You can find the answers to all of these questions and more by reading The Information. Click below to get started:

Deal Flow

M&A / Investments

US PE firm TPG is weighing a sale of its 35% stake in Singapore Life Holdings in a deal that could value the insurer at ~$3B (BBG)

Italy blocked French group Safran’s planned $1.8B purchase of the flight control systems arm of Collins Aerospace due to the risk of disruption for its armed forces (RT)

Coca-Cola Europacific Partners and Aboitiz Equity Ventures will jointly acquire Coca-Cola Beverages Philippines from The Coca-Cola Company for $1.8B (BZ)

Canadian energy company Capital Power will acquire two US-based natural gas-fired generation facilities in California and Arizona for $1.1B (RT)

French oil major TotalEnergies and Saudi Basic Industries are considering the sale of a jumbo US chemical ingredients plant, which may fetch at least $1B (BBG)

Italy sold ~25% of Banca Monte dei Paschi di Siena for ~$1B as part of a plan to divest from the bailed out lender (BBG)

Poland’s largest refiner Orlen will acquire oil and gas assets on the Norwegian continental shelf from Kuwait Foreign Petroleum Exploration for $445M (BBG)

McDonald’s agreed to buy back Carlyle Group’s minority stake in the partnership that runs the restaurant chain’s Chinese, Hong Kong, and Macau businesses (BBG)

Ackerley Partners, a private holding company for the Ackerley family, acquired a minority stake in Leeds United Football Club from 49ers Enterprises (BBG)

British telecom BT is in talks to buy smartphone reseller musicMagpie (FT)

Mixed martial arts company the Professional Fighters League, which is backed by the PIF, bought rival Bellator MMA in a bid to take on the Ultimate Fight Championship (BBG)

Cryptocurrency exchange Bullish acquired crypto news website CoinDesk from Barry Silbert's Digital Currency Group (RT)

VC

On-demand file streaming startup LucidLink raised a $75M Series C led by Brighton Park Capital (TC)

Matsmart-Motatos, a Swedish D2C e-commerce retailer of overstock dry foods and consumer products, raised $43.8M in growth capital led by Circularity Capital (EU)

Edamama, a Manila, Philippines-based provider of an online-to-offline parenting platform, raised a $35M Series A+ led by Ayala Corporation Technology Innovation Venture Fund (FN)

TSUN, a Suzhou-based PV manufacturing company, raised a $21M Series B led by IDG Capital (FN)

VaultSpeed, a Leuven-based automated data transformation company, raised a $15.9M Series A led by Octopus Ventures (FN)

Dwellsy, a rental marketplace with comprehensive data and listings, raised $11.5M in funding led by Ulu Ventures (FN)

Malou, an AI-powered platform that helps restaurants increase sales, raised $10M in funding led by henQ, Bleu Capital, Bertrand Jelensperger, and others (PRN)

Cantai Therapeutics, a biotech company focused on developing drugs to treat autoimmune and inflammatory disorders, raised a $9.5M seed round led by Agent Capital and 82VS (VC)

Medmo, an NYC-based medtech company, raised $9M in funding led by Lerer Hippeau (FN)

Open-source project management platform AppFlowy raised a $6.4M seed round led by OSS Capital (TC)

Layer-1 protocol developer Saga raised a $5M seed extension round led by Placeholder (FN)

Salus, a Turkish startup building a personalized mental health platform, raised a $4.7M seed round led by Northzone (EU)

Union Labs, a startup creating a hyper-efficient, zero-knowledge interoperability layer, raised a $4M seed round led by Galileo, Semantic Ventures, Tioga Capital, and Nascent (PRN)

IPO / Direct Listings / Issuances / Block Trades

Figure Technologies is working on a potential IPO for its lending arm, its so-called LendCo division, at a $2B-$3B valuation in the first half of 2024 (BBG)

Debt

Birla Carbon India, a unit of billionaire Kumar Mangalam Birla-controlled Aditya Birla Group, is raising an offshore loan of ~$1.5B (BBG)

Uber Technologies will raise $1.2B through a five-year convertible bond issuance (BBG)

Westpac Banking, Australia’s third-largest bank by market cap, will raise $488M in an Additional Tier 1 capital transaction (RT)

Fundraising

Alternative asset manager Cheyne Capital is targeting $9.3B for its latest UK and European real estate debt fund series (BBG)

PE firm Riverwood Capital raised $1.8B for its Riverwood Capital Partners IV to invest in high-growth technology companies (WSJ)

International Finance, the private sector arm of the World Bank Group, and T. Rowe Price are planning to raise over $500M in the next 12 months for a fund that will invest in emerging-market blue bonds (BBG)

Climate tech venture investor Blue Bear Capital is nearing $200M for its third fund (AX)

Crypto Corner

The US is seeking over $4B from Binance as part of a resolution to end its year-long investigation into the exchange (BBG)

USDC stablecoin issuer Tether froze $225M worth of its stablecoin following a US DOJ investigation into an international human trafficking syndicate in Southeast Asia (CD)

Cathie Wood’s ARK Investment Management and digital-asset firm 21Shares plan to charge a 0.80% management fee on their spot Bitcoin ETF (BBG)

Exec’s Picks

Emily Stewart discussed why economic data seems great, but we all feel miserable.

Ben Thompson explained how no matter what happens with OpenAI, Microsoft is the big winner.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

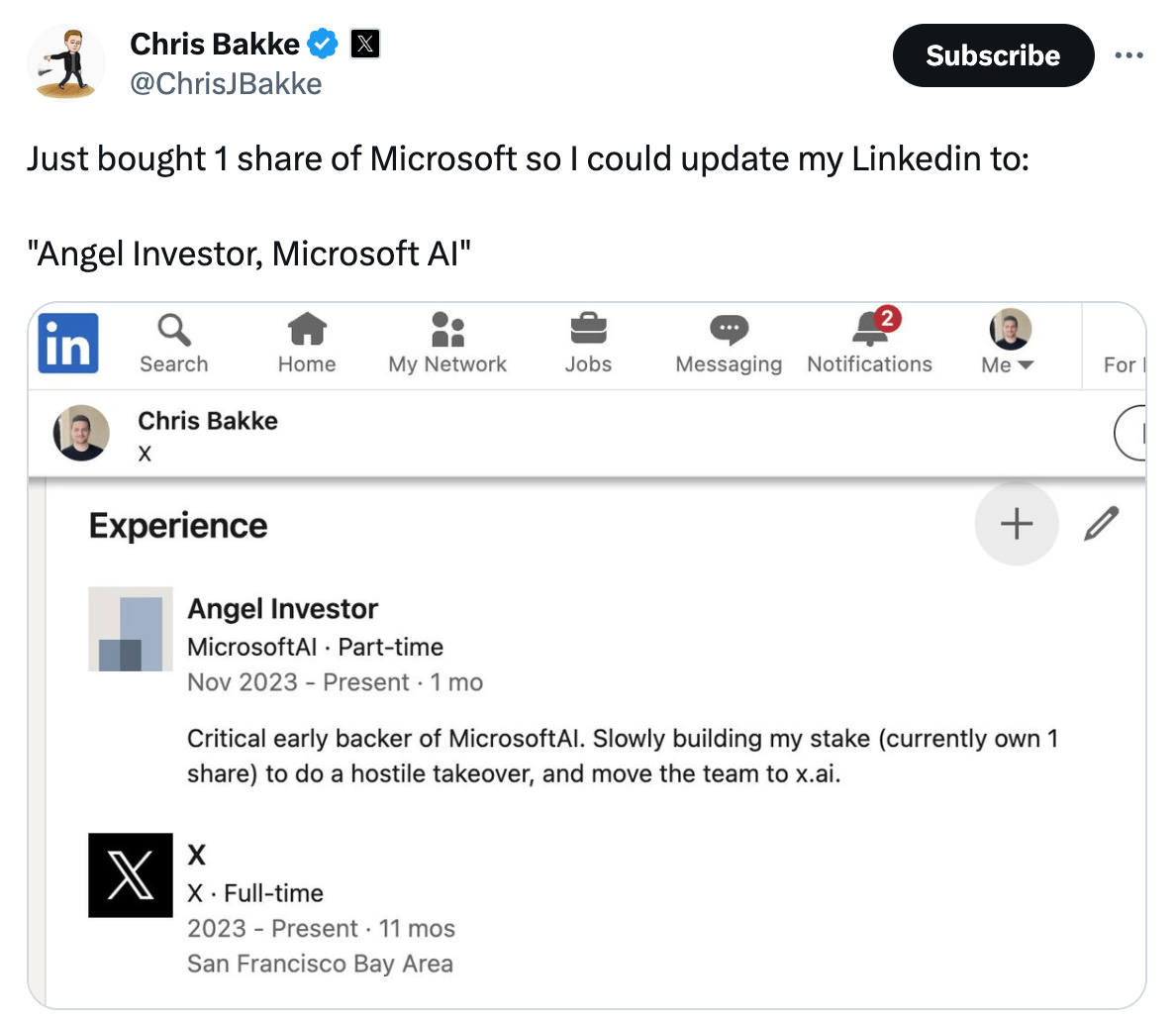

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter