Together with

Good Morning,

The US GDP grew by 3.3% last quarter, Jamie Dimon is shaking up JPM’s leadership team, Tesla erased $80B in market cap after Musk’s sales warning, Microsoft cut 1,900 jobs in gaming, China may have more stimulus coming, and Aramco is searching for deals in Asia.

Want to upgrade your wardrobe for 2024? Check out today's sponsor, Mizzen+Main, for one of the most comfortable men's dress shirts in the game.

Let’s dive in.

Before The Bell

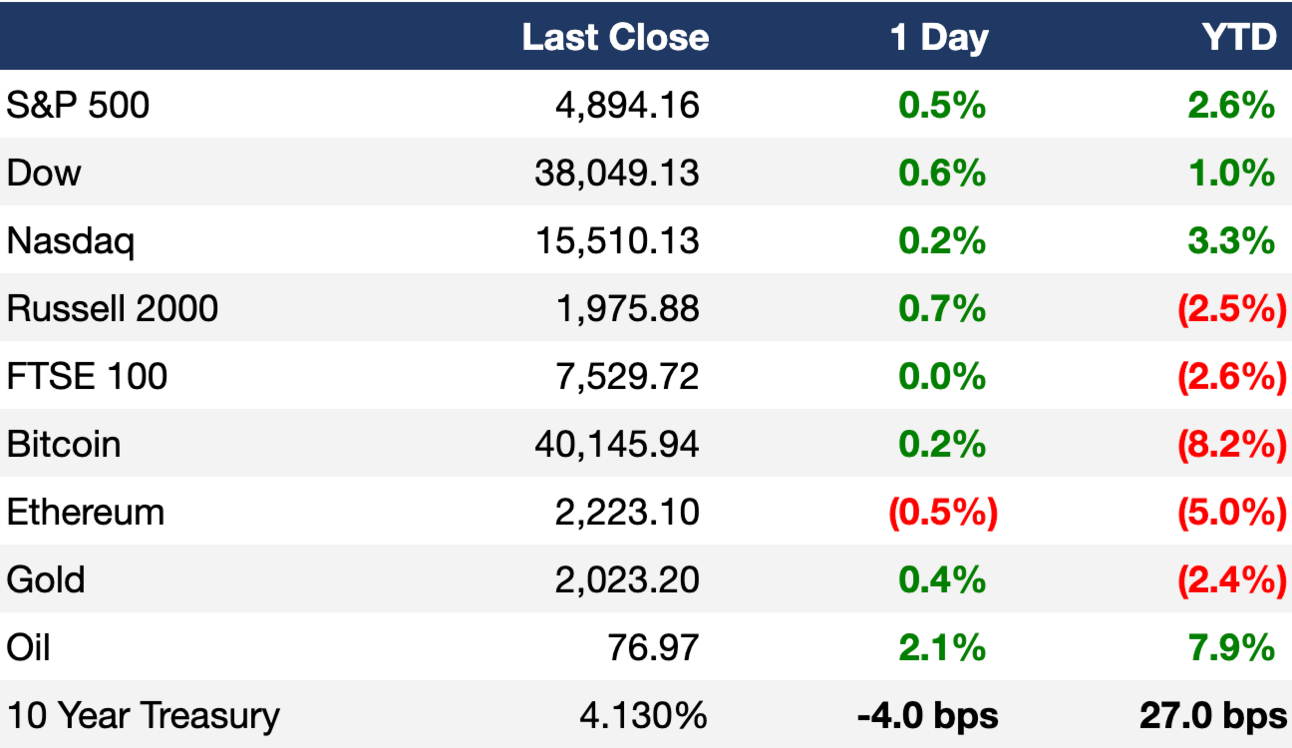

As of 01/25/2024 market close.

Markets

US stocks rose thanks to faster-than-expected GDP growth of 2.5% for the full year

The Dow led indices with a 0.64%

Asian stocks mostly rose, led by Chinese stocks amid Chinese stimulus

Earnings

Intel shares fell ~11% despite beating Q4 earnings and revenue expectations due to an underwhelming Q1 forecast (CNBC)

Blackstone reported 4% growth in its Q4 distributable earnings, while net profit from asset sales rose 16% (RT)

American Airlines shares jumped 10% after beating Q4 earnings and revenue expectations and forecasting 2024 profit largely above expectations (RT)

Comcast beat Q4 earnings and revenue expectations and lost fewer broadband subscribers than expected (CNBC)

What we're watching this week:

Today: American Express

Full calendar here

Headline Roundup

US GDP grew 3.3% last quarter, capping unexpectedly strong year (BBG)

Jamie Dimon shakes up JPMorgan’s leadership once again (WSJ)

Alphabet, Microsoft and Meta close at all-time highs (CNBC)

Tesla erases $80B in valuation after Musk’s sales warning (RT)

US extends lead over China in race for world’s biggest economy (BBG)

Microsoft cuts 1,900 jobs in gaming, including at Activision (BBG)

Salesforce laying off 700 workers in latest tech industry downsizing (WSJ)

ECB holds rates and signals cuts are still some way off (BBG)

Singapore home rents fall for the first time in over three years (BBG)

China signals more targeted stimulus to come (BBG)

Dubai’s property boom shows signs of fizzling out (RT)

Hedge fund demands $100M from its compliance team after SEC probe (BBG)

Starbucks, Coke boycotts over Gaza War are boosting Middle East rivals (BBG)

Riot Games shuts down effort to build a streaming rival to Twitch (BBG)

US is investigating GM’s driverless car’s collision with pedestrian (WSJ)

Trump’s momentum has world leaders bracing for Round Two (WSJ)

Aramco hunts for Asia deals to boost refining and chemicals (BBG)

A Message From Mizzen+Main

“I legit love my Mizzen+Main shirts” - Lit, CEO of Litquidity

A new year means it’s time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don’t stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey t-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant—so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use make sure to use code EXECSUM and take $35 off any order of $125+ today

Deal Flow

M&A / Investments

Bain Capital and Parthenon Capital, the PE owners of Zelis, are weighing options for the healthcare tech company, including a sale or IPO, at a valuation of at least $15B (BBG)

PE firm EnCap Investments is exploring a sale of Grayson Mill Energy that could value the Bakken shale-focused oil and gas producer at ~$5B, including debt (RT)

Hitachi and NEC are seeking to raise $2.1B by selling their stakes in Japanese chipmaker Renesas Electronics (BBG)

Software company Roper Technologies will acquire child-care management software provider Procare Solutions for $1.9B, including debt (BBG)

Global investment firm Hillhouse is one of the final few bidders for Everlife Holdings in a deal that could value the Asian healthcare services company at up to $1B (RT)

Suave Brands, which is owned by PE firm Yellow Wood Partners, will acquire lip balm brand Chapstick from Haleon in a ~$510M deal (BBG)

US natural gas developer Tellurian, which has a $364M market cap, is exploring commercial opportunities, including a potential sale of the company (BBG)

The FTC sued to block Novant Health’s $320M acquisition of two North Carolina hospitals from Community Health Systems (MW)

VC

Mycelium startup Infinite Roots raised a $58M Series B led by Dr. Hans Riegel Holding (TC)

Wireless threat intelligence technology supplier Bastille Networks raised a $44M Series C led by Goldman Sachs Asset Management (BW)

Digital asset banking group Sygnum raised a $40M+ round at a $900M valuation led by Azimut Holding (FN)

AVLA, a global insurance group, raised $25M in funding from Creation Investments (PRN)

Doppel, an AI-native digital risk protection startup, raised a $14M Series A led by a16z (FN)

Ceezer, a carbon credits startup, raised an $11.2M Series A led by HV Capital (TC)

Swift Medical, a digital health technology company serving wound care providers, raised an $8M round led by BDC Capital and Virgo Investment Group (BW)

Digital investment and wealth planning firm Marstone raised an $8M Series B led by Mendon Venture Partners and South Rose Capital (BW)

Dupr, a provider of a pickleball international rating system (lol), raised $8M in funding from David Kass, Andre Agassi, Raine Ventures, and more (FN)

Plant-based whole cuts startup Chunk Foods raised a $7.5M seed extension round led by Cheyenne Ventures (TC)

Tynt Technologies, the developer of the first-ever blackout dynamic ultra-energy-efficient window, raised a $7.1M seed II round led by KOMPAS (VC)

Digs, a collaboration platform for home builders, closed a $7M seed extension round led by Oregon Venture Fund and Legacy Capital Ventures (TC)

AI automation startup bluesheets raised a $6.5M Series A led by Illuminate Financial (FN)

Isaac Health, a digital health startup focused on brain health, raised a $5.7M seed round led by Meridian Street Capital and B Capital (BW)

Being Health, a mental health practice, raised $5.4M in funding from 18 Park and HDS Capital (BW)

Prompt Security, a platform for enterprise generative AI security, raised a $5M seed round led by Hetz Ventures (FN)

Edge AI platform OctaiPipe raised a $4.5M pre-Series A led by SuperSeed (FN)

Axyon AI, an Italian fintech startup, raised a $4.2M round led by Montage Ventures (FN)

UAE-based conversational AI startup DXwand raised a $4M Series A led by Shorooq Partners and Algebra Ventures (TC)

Krepling, an e-commerce channel management platform, raised a $3.3M seed round led by LAUNCH, Brickyard, Front Porch Ventures, and more (PRN)

Birdwatch, a Washington D.C.-based home maintenance tech and services company, raised a $3.2M seed round led by Social Leverage, Starting Line, and more (FN)

ViralMoment, a startup using AI to analyze social videos, raised a $2.5M seed round led by Supernode Global (PRN)

Banking customer engagement platform Attune raised a $2.2M seed round led by Tribeca Early Stage Partners (PRN)

Bitflow Labs, a decentralized exchange company, raised a $1.3M pre-seed round led by Portal Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

KKR-backed BrightSpring Health Services raised $693M in its IPO after pricing shares below a marketed range (BBG)

Indian tech company Perfios Software Solutions, which is backed by Warburg Pincus, is considering an IPO in India that could raise as much as $500M (BBG)

Chinese EV charging equipment provider StarCharge is considering a Hong Kong IPO that could raise ~$500M (BBG)

Shares in CG Oncology soared 96% on its debut day of trading after the US biotech raised $380M (BBG)

Debt

Bankruptcy / Restructuring

Struggling telecom Lumen Technologies, which is struggling with $20B of debt, reached an agreement with creditors to receive fresh financing and extend its debt (BBG)

Lenders to Byju’s Alpha filed an insolvency petition after the Indian edtech missed a payment on a $1.2B loan (BBG)

Brazilian low-cost airline Gol Linhas Aereas Inteligentes filed for Chapter 11 bankruptcy in the US (BBG)

Fundraising

Crypto Corner

Exec’s Picks

Anon Twitter account High Yield Harry joined the Odd Lots podcast to discuss credit markets, banking bonuses, and more.

Lulu Cheng Meservey wrote an excellent piece on Anduril’s comms strategy.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter