Together with

Good Morning,

The IRS says Microsoft owes $29B in back taxes, China’s State Fund is buying shares in bank stocks, the Fed is divided on more rate hikes, Israel and Egypt want to create a safe passage for Americans stuck in Gaza, Hollywood suspended talks with actors, and YouTube passed Netflix as the top video source for teens.

If you’re tired of tedious expense reporting, try out a 20-minute demo of BILL’s expense management solution.

Let’s dive in.

Before The Bell

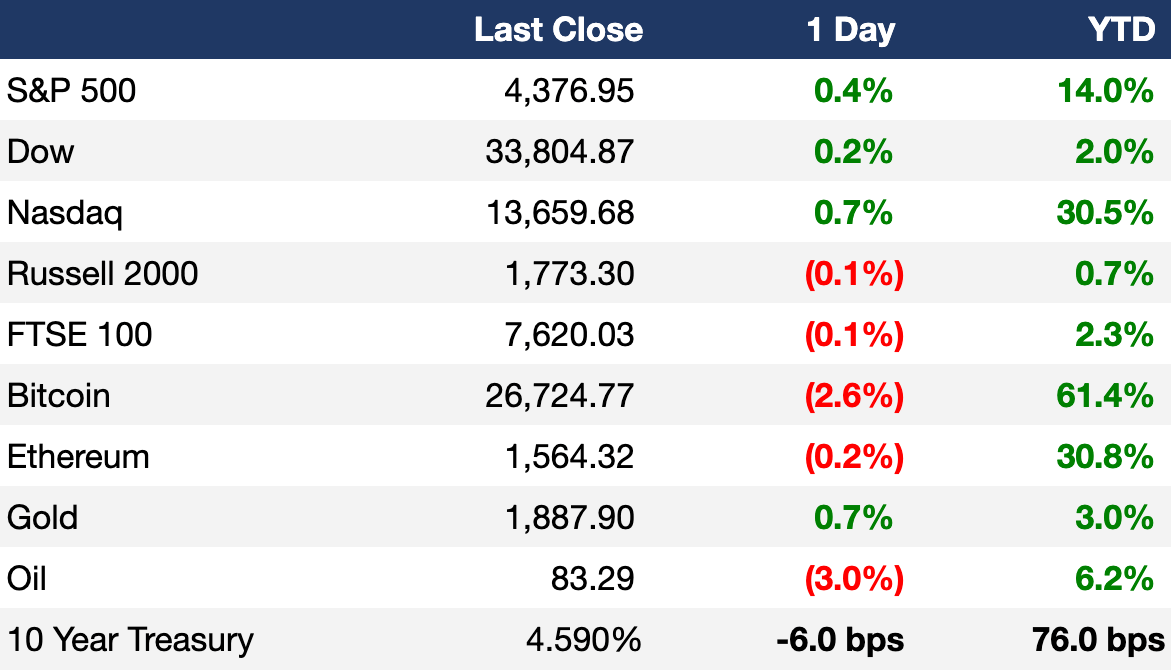

As of 10/11/2023 market close.

Markets

US stocks closed higher as Treasury yields continued to retreat and investors awaited today’s CPI report for September

The Nasdaq led indices with a 0.71% gain

Asian stocks advanced amid Chinese government stimulus hopes and retreating bond yields

Earnings

What we're watching this week:

Today: Delta Airlines, Domino’s Pizza, Walgreens

Friday: JPMorgan Chase, BlackRock, Wells Fargo, Citigroup, UnitedHealth Group

Full calendar here

Headline Roundup

Hamas invasion rewrites rules in Middle East (WSJ)

Israel’s Netanyahu forms unity government to direct war (WSJ)

IRS says Microsoft owes an additional $29B in back taxes (CNBC)

China State Fund buys bank shares, fueling rescue hopes (BBG)

Fed minutes show officials divided on future rate rise (WSJ)

Biden weighs freezing $6B for Iran after Hamas attack on Israel (BBG)

Israel and Egypt in talks to create safe passage out of Gaza for Americans (AX)

Bond traders are starting to bail on winning yield-curve bets (WSJ)

Republicans nominate Steve Scalise for House Speaker over Jim Jordan (WSJ)

Hollywood studios suspend talks with actors (WSJ)

Japan must focus on wage growth ahead of inflation - BOJ’s Noguchi (RT)

US raises Israel travel advisory to Level 3 - Reconsider Travel (AX)

YouTube passes Netflix as top video source for teens (CNBC)

Facing exclusion from US, Chinese EV suppliers map a circuitous route back in (WSJ)

EasyJet buys 157 Airbus jets, has option for more in upgrade (BBG)

A Message From BILL

Celebrate spooky season in style with BILL Spend & Expense. There’s nothing scarier than manual expense reporting, and we can help you ghost them for good. Take a 20-minute demo of our free expense management solution by Oct. 31st, and we’ll send you a $200 Lululemon gift card.1

What else can BILL Spend & Expense do for you?

Automated expense reports

Powerful, real-time reporting

Simple budget controls

Access to credit to keep your business growing2

Deal Flow

M&A / Investments

EU Commission announced that Microsoft’s $69B rehashed acquisition of Activision Blizzard will not have to go through a second EU approvals process (BBG)

UK’s competition watchdog is examining whether a $19B tie-up between telecom Vodafone’s UK operations and CK Hutchison's Three UK would substantially lessen competition (RT)

Illumina will expeditiously divest cancer test maker Grail, which it acquired for $7.1B, if the life sciences company loses either of the final appeals in US or European court (RT)

Billionaire Mat Ishbia is considering bringing new investors into NBA team Phoenix Suns and WNBA team Mercury at above a $4B valuation (BBG)

Canadian toys and games-maker Spin Master will acquire US toymaker Melissa & Doug for $950M cash (RT)

Codelco, the world’s biggest copper producer, is nearing a deal to acquire Lithium Power International that could value the lithium miner at ~$202M (BBG)

Fashion retailer Next is planning to buy rival UK fashion chain Fat Face for ~$123M (BBG)

Rocket-launch company Astra Space is considering a 51% stake sale in its in-space propulsion business that would value the unit at over $100M (BBG)

A consortium led by Sixth Street Partners will acquire Goldman Sachs Group’s installment lending platform GreenSky unit for an undisclosed amount; the deal will result in a 19-cent-per-share hit to Goldman’s Q3 earnings (BBG)

PE firm Triton will acquire Siemens Energy’s high-voltage component business, Trench (RT)

Saudi Aramco is in talks to acquire a 10% stake in Chinese refiner Shandong Yulong Petrochemical (RT)

Indian conglomerate Bharti Group will acquire French insurer AXA's 49% stake in JV Bharti AXA Life Insurance (RT)

EV maker VinFast Auto will acquire a 99.8% stake in battery maker VinES from its founder Pham Nhat Vuong (RT)

Printer maker Xerox Holding sold its Russian operations to local management for an undisclosed sum (RT)

VC

Agomab, a biotech focused on fibrosis, raised a $100M Series C led by Fidelity (BW)

SHINE Technologies, a next-generation fusion tech company, raised $70M in funding led by Baillie Gifford and Fidelity (PRN)

Indian insurer InsuranceDekho raised a $60M Series B at a $600M valuation led by Mitsubishi UFJ Financial Group, BNP Paribas Cardif, Beams Fintech Fund, and more (TC)

MinervaX, a Danish biotech company developing a prophylactic vaccine for Group B Streptococcus, raised $57.4M in financing from EQT Life Sciences, OrbiMed, and existing investors (PRN)

NY-based pharmacy benefit manager Capital Rx raised $50M in funding from Atlantic Health System, Banner Health, and more (FN)

Data transformation startup Prophecy raised a $35M Series B led by Insight Partners and SignalFire (TC)

MRI tech startup Orbem raised a $32M Series A led by 83North (TC)

Berlin-based fintech Upvest raised a $31.8M round led by BlackRock (EU)

Perch Energy, a community solar servicer, raised a $30M Series B from Nuveen (BW)

Robotics data and operations platform Formant raised a $21M round led by BMW i Ventures (PRN)

JetCool, a liquid cooling company for data centers, raised a $17M Series A led by Bosch Ventures (BW)

Carefull, a fintech platform aimed at helping banks protect seniors from fraud, raised a $16.5M Series A led by Fin Capital (TC)

3D printing startup Azul raised a $15M Series A led by DuPont (VC)

UK fintech startup Untangled Finance raised a $13.5M round led by Fasanara Capital (EU)

Conveyor, a startup automating security reviews, raised a $12.5M Series A led by Cervin Ventures (TC)

Canadian fabless semiconductor and software startup HaiLa Technologies raised $10.4M in funding from Murata Electronics and existing investors (BW)

Bedrock Energy, a startup designing, constructing, and delivering geothermal heating and cooling systems, raised an $8.5M seed round led by Wireframe Ventures (PRN)

Pickle, a P2P fashion rental marketplace, raised an $8M seed round led by FirstMark Capital and Craft Ventures (TC)

Atana, a workplace learning startup, raised a $6M Series A led by Alliance of Angels (PRN)

REPUBLIK, a global online community creator platform, raised a $6M seed round at a $75M valuation led by OKX Ventures, 6th Man Ventures, Arcane Ventures, and others (PRN)

No-code platform TransactionLink raised a $5.3M seed round led by White Star Capital (EU)

Game of Silks, a Boca Raton-based blockchain gaming platform, raised a $5M Series Seed 2 led by Taylor Made, FunFair Ventures, and others (FN)

Goodwrx, a startup providing tech-enabled platform pairs employees and employers, raised a $4M Series A led by Advantage Capital (BW)

Restaurant operation management platform Yooga raised a $2.3M seed round led by SaaSholic (TC)

KINO Studios, a tech startup aiming to reshape entertainment economics, raised a $2M pre-seed round from Sequoia, Blockchain Founders Fund, and others (PRN)

Sotai, a startup providing ML models, raised a $2M seed round led by Four Rivers (FN)

KIT Plugins, a music software development startup, raised a $1M Series A led by Copycat Holdings (TC)

IPO / Direct Listings / Issuances / Block Trades

Birkenstock Holding sank 12.6% in the worst first-day showing for a US listing of at least $1B in over two years; Birkenstock closed at an $8.3B valuation (BBG)

Shares in ADES Holding jumped 30% after the oil driller raised $1.2B in Saudi Arabia’s biggest IPO this year (BBG)

Polestar Automotive Holding is seeking to raise as much as $1B through a mixed shelf offering of stock and warrants (BZ)

French software company Planisware priced its IPO shares at $16.97/share for a ~$1.2B valuation, making it the largest IPO on Euronext Paris in the last 2 years (RT)

SPAC

Chinese personal care products company Big Tree Cloud International Group will merge with Plutonian Acquisition Corp at a ~$500M EV (RT)

Debt

American food manufacturing giant J.M. Smucker raised $3.5B through a four-part bond sale to fund its acquisition of Hostess Brands (BBG)

Bankruptcy / Restructuring

KKR-backed Envision Healthcare, which provides outsourced emergency department services to hospitals, received US bankruptcy court approval to split into two companies and cut over $7B in debt (RT)

A lender-appointed receiver, Kroll, took steps to assume control of Byju’s Great Learning Education unit after months of failed restructuring negotiations and a loan default (BBG)

Fundraising

Beyond Next Ventures, a Japanese VC focused on early-stage Asian startups, completed a first close of $68M for BNV Fund 3 to invest in deep tech startups in fields like robotics and biotech (TC)

Crypto Corner

Exec’s Picks

Kyle Chayka explained why the internet isn’t fun anymore.

Social media is no longer a reliable source for real-time news, according to Bloomberg.

Alameda Research and FTX tried a lawyer, Thai prostitutes, and a $150M bribe to a Chinese government official to unlock $1B of frozen funds connected to money laundering.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter