Together with

Good Morning,

UK regulators are expected to approve Microsoft’s acquisition of Activision, Tether increased its T-Bill holdings to $53B, Robinhood is facing regulatory probes, Tucker Carlson is staying on Twitter, Spotify removed thousands of AI-generated songs, and TikTok delayed fully opening a US shop.

If you’re looking to hire, manage, and pay a remote / global team, check out today’s partner: Deel.

Let’s dive in.

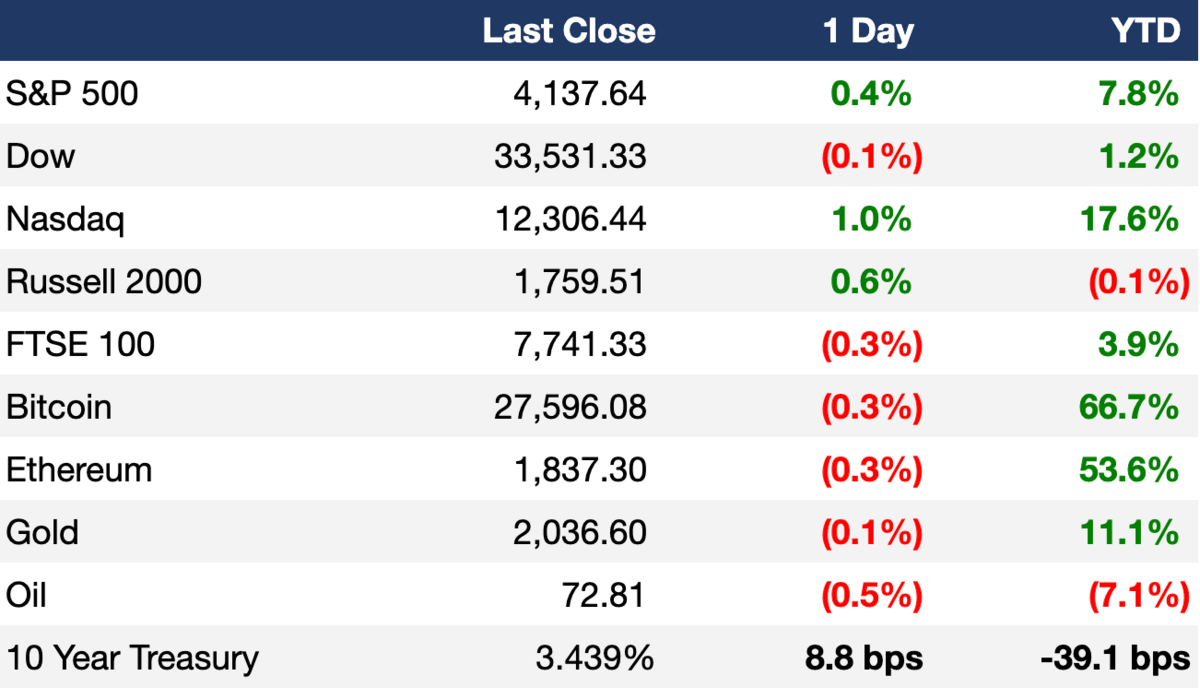

Before The Bell

As of 5/10/2023 market close

Markets

US stocks ended slightly higher after CPI report showed inflation slightly lower than expectations, signaling strides towards easing

Treasury yields tumbled following the CPI report, further supporting a stock market that was previously worried about higher rates

Markets are preparing for potential debt default as deadline looms

Earnings

Disney missed Q2 EPS estimates by a penny as losses from streaming narrowed and theme parks outperformed estimates; the company will continue to cut $5.5B in costs this year (YF)

Beyond Meat beat Q1 revenue estimates and had lower-than-expected losses as the company strives for cash-flow positive operations and sustainable long term growth (MW)

Robinhood blew past Q1 revenue estimates as the Fed’s rapid rate hikes boosted the online brokerage’s interest income (RT)

Wendy’s beat Q1 estimates as systemwide sales increased by 10% and same restaurant sales were up 8% (PR)

What we're watching this week:

Today: Krispy Kreme

Full calendar here

Headline Roundup

US CPI edged slightly lower to 4.9% YoY in April (WSJ)

US White House, Congress begin tough debt limit, budget negotiations (RT)

US prosecutors are investigating recent short selling in bank shares (RT)

Icahn blasted Hindenburg after coming under federal investigation (WSJ)

US accounting watchdog found unacceptable deficiencies in KPMG and PwC audits performed in China (RT)

Intel and BCG are teaming up to sell AI to corporate customers (RT)

Panasonic delays production of new Tesla battery to improve performance (RT)

Robinhood faces regulatory probes over communications compliance (BBG)

Repeat bankruptcies are piling up at fastest rate since 2009 (BBG)

Tucker Carlson's Twitter move wipes $235M from Rumble (BBG)

Uber launches flight bookings in UK travel ‘super app’ push (FT)

Spotify ejected thousands of AI-made songs in purge of fake streams (FT)

NYC-area rents surge by most in nearly two decades (BBG)

TikTok delays full opening of US shop (WSJ)

Toyota accelerates its EV changes with extra $7B investment (WSJ)

US airlines thrown a curveball as consumer habits change post-pandemic (RT)

A Message From Deel

Compliantly hire anyone, anywhere, in 5 minutes with Deel

Deel is your one-stop shop for hiring, paying, and managing your remote team.

With their tech-enabled self serve process, you can now hire independent contractors or full-time employees in over 150 countries, compliantly and in minutes.

They stay on top of local labor laws across the world to ensure compliance and mitigate risk so that you don't have to.

Today, Deel serves over 8,000 customers from SMBs to publicly traded companies.

Deal Flow

M&A / Investments

EU Antitrust regulators are expected to clear Microsoft’s $69B acquisition of Activision next week (RT)

Germany’s Software AG snubbed Bain Capital’s $2.7B offer, choosing to maintain support for a lower takeover offer from existing backer Silver Lake Management (BBG)

A consortium comprising Franchise Group’s CEO and PE firm Irradiant Partners will take Vitamin Shoppe-owner Franchise Group private in a $2.6B cash deal (RT)

Singapore’s sovereign wealth fund GIC emerged as the frontrunner to buy a $2.2B stake in Messer in deal that could value the German industrial gas maker at over $10B (BBG)

Biopharmaceutical company Swedish Orphan Biovitrum agreed to buy US biotech CTI BioPharma, a developer of blood-related cancer therapies, for $1.7B in cash (BBG)

Arctos Sports Partners are among a group of investors interested in buying a 5-15% stake in French football club PSG, currently valued at $4.6B (BBG)

African investment firm Axian is in advanced talks with Africa’s largest mobile operator MTN to acquire some of its West African assets (BBG)

UK housing provider Home REIT will not extend the deadline for investment firm Bluestar to make a firm offer for the company (RT)

VC

“MRI for Cars” manufacturer UVeye raised a $100M Series D led by Hanaco VC (TC)

Petal, a startup offering credit cards for underserved consumers, raised a $35M equity round led by Valar Ventures (TC)

DiogenX, a biotech company focused on regenerating insulin-producing beta cells for the treatment of diabetes, raised a $27.5M Series A from Roche Venture Fund, Eli Lilly, Omnes, and others (FN)

Triumph, a startup building an SDK to add real-money tournaments into games, raised $14M in funding: a $3.9M seed round led by Flux and a $10.2M Series A led by General Catalyst (TC)

Datanomix, a production intelligence platform, raised $12M in growth capital led by MK Capital and Joint Effects (PRN)

ChrysaLabs, a leading innovator at the forefront of soil science, announced an $11M financing round led by Leaps by Bayer, TELUS Ventures, and BDC Capital (PR)

Salsa, a startup providing APIs for developers to add revenue-generating payroll solutions to their products, raised a $10M round led by Greycroft, Better Tomorrow Ventures, and Definition (TC)

Pudgy Penguins, a Web3 IP company and NFT collection, raised a $9M seed round led by 1kx (FN)

SquareX, a startup developing a browser-based cybersecurity product, raised a $6M seed round led by Sequoia Capital Southeast Asia (FN)

Generative AI platform Orby AI raised a $4.5M seed round led by Pear VC and New Enterprise Associates (PRN)

Blocktorch, an observability platform for web3 engineers, raised a $4.2M seed round led by Ideo CoLab Ventures (FN)

Obeo Biogas, a biogas developer for dairy farms, raised a $3M seed round led by Diagram Ventures (BW)

IPO / Direct Listings / Issuances / Block Trades

Digital infrastructure provider ST Telemedia Global Data Centres, backed by Singapore state-owned investment firm Temasek, is considering raising up to $1B through a funding round before its potential IPO (BBG)

Indian commercial port operator JSW Infrastructure filed for an IPO worth up to $342M (RT)

Japanese oil refiner Eneos Holdings is considering a spinoff and IPO of its metals unit, JX Nippon Mining & Materials, to increase its focus on renewable energy (BBG)

Egypt plans to sell an additional 10% stake in state-run Telecom Egypt through share sale to raise cash and reassure investors (BBG)

Italian Yacht Maker Ferretti is working on a potential dual listing in Milan after going public in Hong Kong last year (RT)

SPAC

SPAC Pioneer Martin E. Franklin, who warned about excess blank check companies last year, launched a new SPAC Admiral Acquisitions on the London Stock Exchange (BBG)

Bankruptcy / Restructuring

Fundraising

BlackRock is seeking $1B for a new Middle East infrastructure and PE fund with possible sovereign wealth fund contributors including Saudi Arabia’s PIF and Abu Dhabi’s Mubadala (BBG)

One Equity Partners closed a $1B continuation fund to help fund acquisitions and continued growth for portfolio companies USCO and DWK Life Sciences (BBG)

Crypto Corner

Tether, the operator of the largest stablecoin USDT, increased its holdings of US Treasury Bills to $53B and cut its exposure to cash in Q1 (BBG)

US IRS filed claims worth $44B against the estate of bankrupt crypto exchange FTX and its affiliates (CD)

Binance slammed US crypto crackdown as ‘confusing’ and hopes to be regulated in the UK (FT)

Bitcoin is facing volatility threats amid declining participation from institutional market makers (BBG)

Exec’s Picks

The Atlantic’s Ariel Sabar shared a wild story about how a solar “start-up” pulled the scam of the century, hooking everyone from Warren Buffett to the US Treasury.

This New York Times piece discussed steps that NYC could take to deal with its office vacancy problem.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

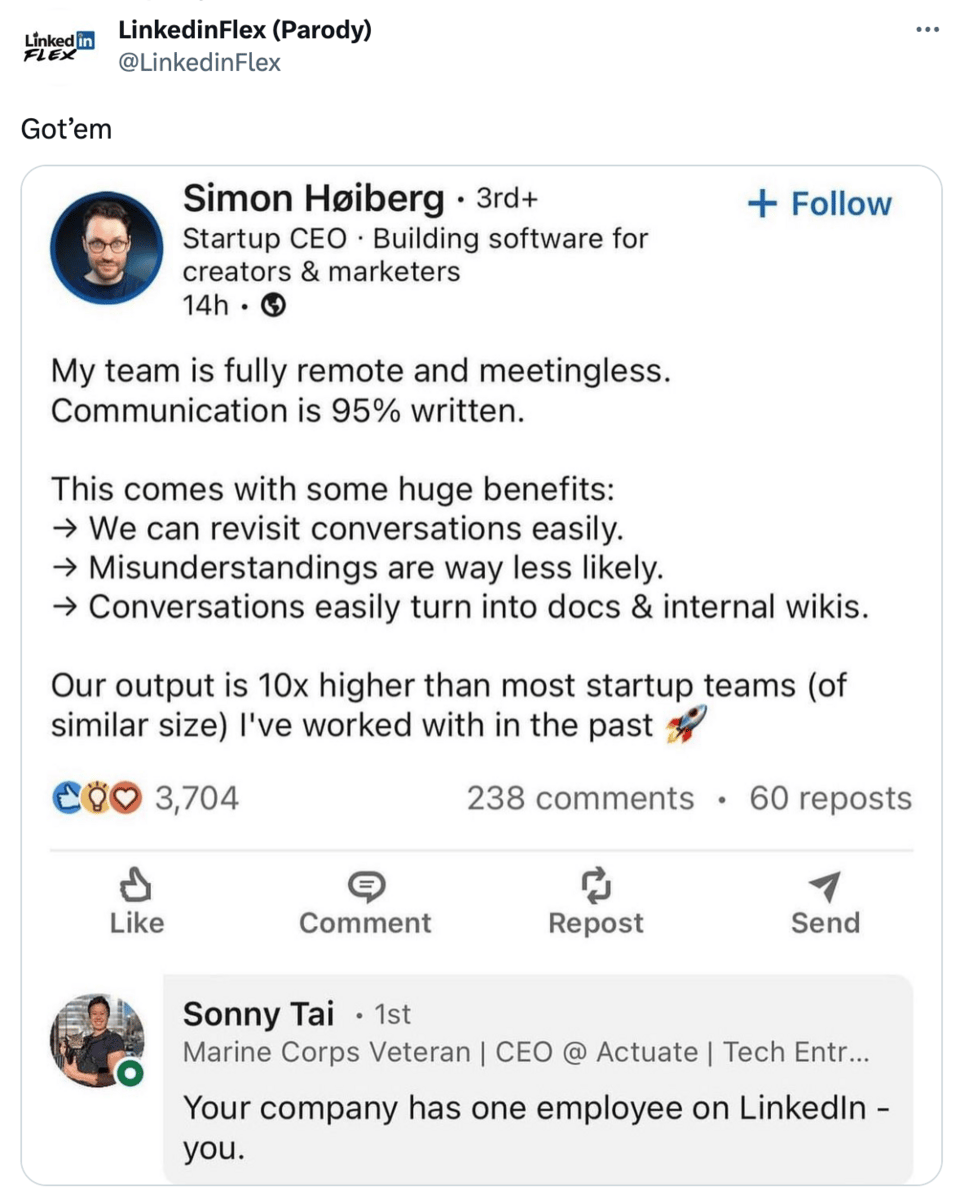

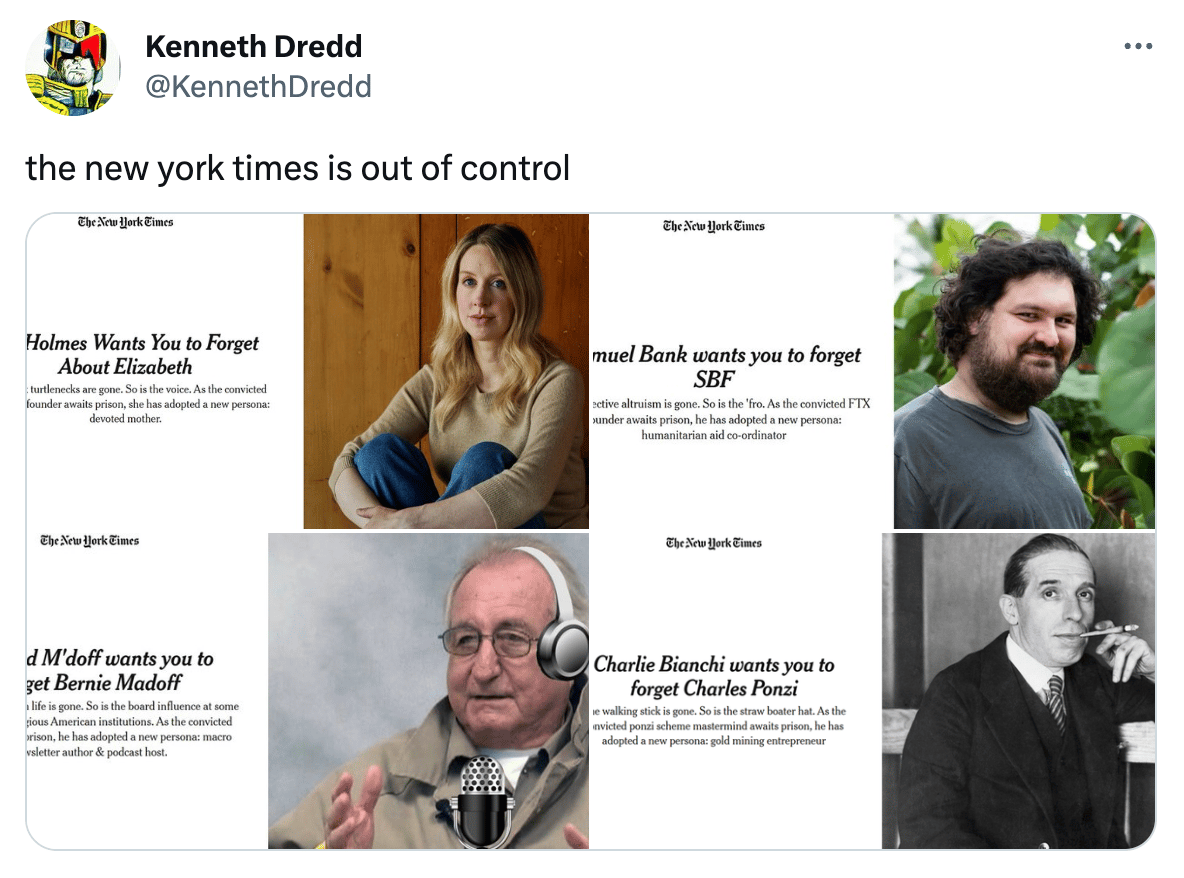

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.