Together with

Good Morning,

Meta is launching smart glasses, ChatGPT now has internet access, Delta’s CEO walked back recent SkyMiles changes, Costco’s CEO said more young people are getting memberships, the dollar surge is impacting forex, and Peloton has a new partnership with Lululemon.

AI is changing everything, and tech companies are racing for dominance. Today’s sponsor, Axios Pro, covered forthcoming United States AI laws in this free report so you can be prepared.

Let’s dive in.

Before The Bell

As of 9/27/2023 market close.

Markets

US stocks closed mixed as an uptick in treasury yields and oil prices hurt investor sentiment

The Dow fell 0.2%, while the Nasdaq gained 0.22%

Emerging market stocks fell to their lowest levels since March thanks to a surging dollar and weakening investor appetite for riskier assets

Earnings

Micron Technology shares fell 4% after reporting weak Q4 results of $4.01B revenue, down 40% YoY, and an adjusted loss of $1.07 per share; its revenue guidance for next quarter beat estimates (BRRN)

Jefferies shares fell after it missed Q3 revenue expectations, driven by a 30% drop in advisory revenue, due to the challenging dealmaking environment (BBG)

What we're watching this week:

Today: Nike, Accenture, BlackBerry

Friday: Carnival Corporation

Full calendar here

Headline Roundup

Meta CEO Mark Zuckerberg looks to digital assistants, smart glasses and AI to help metaverse push (CNBC)

US crude oil hits highs of year (WSJ)

ChatGPT users can now browse internet, OpenAI says (RT)

Delta CEO promises SkyMiles update after plan changes irk frequent flyers (BBG)

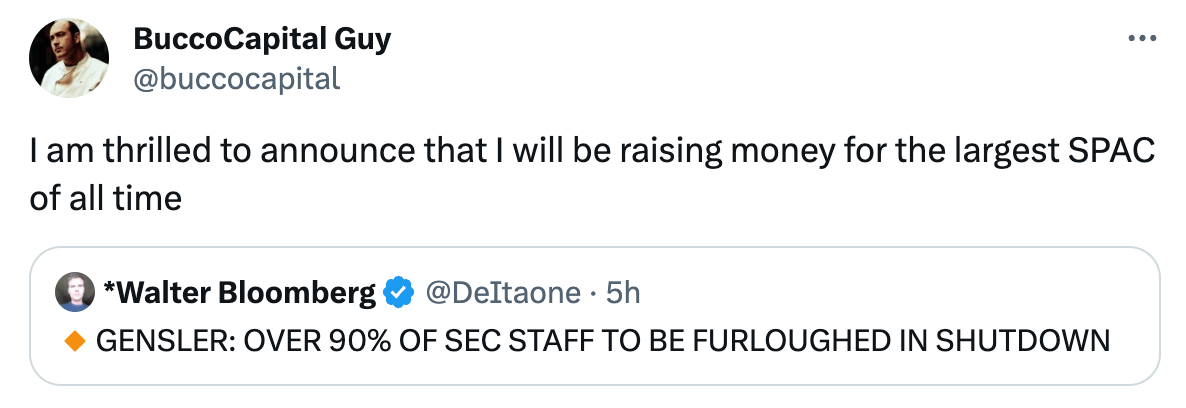

A last-minute deal averting government shutdown is unlikely (BBG)

Oil rally gets fresh impetus from shrinking stockpiles at US hub (BBG)

Costco CEO says more younger people are signing up for memberships (CNBC)

Dollar surge is bringing ‘pseudo tightening’ to southeast Asia (BBG)

UK risks power supply crunch in January as nuclear plants halt (BBG)

American soldier in US custody after release from North Korea (WSJ)

Chinese hackers stole emails from US State Dept in Microsoft breach, Senate staffer says (RT)

Peloton shares soar on digital content, apparel partnership with Lululemon (CNBC)

London price cuts boost UK home discounts to highest since 2019 (BBG)

A Message From Axios Pro

AI is changing everything. Now, policymakers are racing to protect the public from artificial intelligence's threats without impeding innovation. We're taking a deeper look at that process.

Why it matters: Policy outcomes will affect companies big and small across all sectors that have widely adopted the technology. In this report, the Axios Pro newsroom analyzes key legislation to watch, big tech's lobbying efforts, and what it might mean for your business.

Deal Flow

M&A / Investments

FTC revived its challenge to Microsoft’s $69B acquisition of Activision Blizzard (BBG)

Chinese regional lender Shengjing Bank agreed to sell a portfolio of assets, including loans and investments, for $24.1B to Liaoning Asset Management (RT)

Cloud computing provider CoreWeave is nearing a stake sale to Fidelity Investments, JPMorgan Asset Management and others that values the cloud computing provider at $7B (BBG)

Pipestone Energy's shareholders approved of its proposed all-stock sale to privately-held larger rival Strathcona Resources to create a $6.4B combined entity (RT)

Singapore's sovereign wealth fund GIC is among investors competing to buy a 20% stake in Vietnamese grocer Bach Hoa Xanh from Vietnam's retail giant Mobile World Investment in a deal that could value the grocery chain at up to $1.7B (RT)

Pros Holdings, a provider of revenue management software for airlines, is exploring options including a potential sale; Pros has a market cap of $1.6B (RT)

Australian investment firm QIC is exploring a sale of CampusParc, the long-term owner of Ohio State University’s parking lease, which could be valued at over $850M (BBG)

South Korea's LG Chem will sell its polariser businesses to Chinese firms Hefei Xinmei Materials Technology and Shanjin Optoelectronic for $816M (RT)

Cybersecurity company Palo Alto Networks is in advanced negotiations to buy enterprise browser developer Talon Cyber Security for $600M-$700M (TC)

PE firm Wind Point Partners is exploring a sale of Gehl Foods that could value the US dairy product manufacturer at over $600M, including debt (RT)

Wells Fargo will buy the former Neiman Marcus space at Manhattan’s Hudson Yards for ~$550M to convert into office space (BBG)

Cybersecurity company Palo Alto Networks is in advanced negotiations to buy data security specialist Dig Security for $300M-$400M (TC)

Lenders Peoples Financial Services and FNCB Bancorp will combine in an all-stock strategic merger valued at $129M (PRNW)

Haitong Securities is considering taking its Hong Kong-listed investment banking unit private (BBG)

Soy sauce maker Jonjee Hi-Tech Industrial and Commercial Holding is considering bringing in strategic investors (BBG)

British insurer Hiscox will sell its motor insurance business in Singapore and Thailand, DirectAsia, to Ignite Thailand Holdings (RT)

PGA Tour is considering bringing in high-profile US investors to help finance its merger with Saudi-backed LIV Golf to alleviate concerns (BBG)

VC

Biopharma startup Avalyn Pharma raised a $175M Series C led by Perceptive Xontogeny Venture Funds, SR One, and Eventide Asset Management (FN)

Evozyne, a generative AI drug discovery platform, raised an $81M Series B led by Fidelity (FN)

Electric boat startup Arc raised a $70M Series B from Eclipse, a16z, Lowercarbon Capital, and Menlo Ventures (TC)

Kneron, a startup developing full-stack hardware and software products for AI applications, raised a $49M Series B led by Horizons Ventures (FN)

H55, a Swiss startup providing electric propulsion technologies for the aviation industry, raised a $45M Series C led by ND Capital, Tippet Venture Partners, RTX Ventures and private investors (FN)

Doceree, a physician-only messaging platform, raised a $35M Series B led by Creaegis (PRN)

Cybersecurity startup Lumu raised a $30M Series B led by Forgepoint Capital (TC)

Gringo, a Brazilian driving app, raised a $30M Series C led by Valor Capital (TC)

B2B payments startup Slope raised a $30M round led by Union Square Ventures (TC)

Virtual clinic provider for women's midlife healthcare Midi Health raised a $25M Series A led by GV (PRN)

Cloud security platform Gem Security raised a $23M Series A led by GGV Capital (TC)

Drone-enabled power line upgrade startup Infravision raised a $23M Series A led by Energy Impact Partners (BW)

CellFE, a life sciences tools company developing a microfluidics-based cell engineering platform, raised a $22M Series A led by M Ventures (PRN)

PortX, a financial integration startup, raised a $16.5M Series B led by FUSE and Curql (BW)

Automera, a startup developing autophagy-targeted small molecules, raised a $16M Series A led by ALSP and ClavystBio (BW)

Canvs AI, a startup providing an insights platform to unlock consumer and employee feedback, raised a $15M round led by Fulcrum Equity Partners (FN)

Mundi, a provider of a platform for importers and exporters, raised a $15M Series A-2 led by Haymaker Ventures (FN)

Resourcify, a waste management and recycling platform, raised a $14.7M Series A led by Vorwerk Ventures (TC)

Evvy, a female-founded startup focused on the microbiome, raised a $14M Series A led by Left Lane Capital (BW)

Collective Liquidity, a startup providing financial tools for employees, extended its Series A to $12M led by Aliya Capital Partners (FN)

Revefi, a platform to monitor and manage data quality, raised a $10.5M seed round led by Mayfield (BW)

Yaysay, a shopping app combining AI-driven personalization with gamification, raised a $10.3M seed round led by Lightspeed Ventures (BW)

EchoMark, a SaaS information protection company, raised a $10M seed round led by Craft Ventures (FN)

AI-enhanced observability platform Senser raised a $9.5M seed round led by Eclipse (TC)

Vega, a UK-based wealthtech platform provider, raised $8M in funding led by Motive Ventures (FN)

AI-powered machine translation startup XL8 raised a $7.5M Series A led by KB Investment (FN)

Lucid Scientific, a life science instruments company, raised a $7M Series A led by IAG Capital Partners (BW)

Zerobroker, a logistics software startup, raised a $6.5M seed round led by Flexport, FundersClub, Streamlined Ventures, and more (FN)

Machine Discovery, a software company using ML to accelerate compute-intensive tasks, raised $6M in funding led by BGF and East Innovate (PRN)

Revio, an African payment orchestration platform, raised a $5.2M seed round led by QED and Partech (TC)

IPO / Direct Listings / Issuances / Block Trades

German payments provider DKV Mobility, which is backed by CVC Capital Partners, plans to move forward with plans to list in Frankfurt as soon as next week; it could be valued at over $4.2B and plans to raise $525M-$1.1B for shareholders (RT)

German medical vials manufacturer Schott Pharma priced its IPO at $28.4 per share, giving it a potential valuation of up to $4.3B (RT)

Oman’s OQ Gas Networks’ $771M IPO sold out within a day after books opened for what is potentially set to be the country’s largest listing on record (BBG)

Indian commercial port operator JSW Infrastructure’s ~$195M IPO was oversubscribed by 37.37 times (RT)

Debt

Bankruptcy / Restructuring

Thrasio, a startup that previously raised $3.4B to buy consumer brands sold on Amazon, is exploring restructuring options (WSJ)

Fundraising

San Francisco secondaries specialist Industry Ventures raised ~$1.7B, $1.45B for Industry Ventures Secondary X and $260M for Industry Ventures Tech Buyout II, to acquire secondhand stakes in venture funds and private startups (WSJ)

Crypto Corner

Exec’s Picks

Jack Raines covered the FTC’s recent war path against Big Tech in his latest piece.

Linkedin released a list of its top 50 startups to watch for 2023.

Cory Weinberg wrote about how startups are navigating the current IPO window for The Information.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter