Together with

Good Morning,

Meta fell 20% after hours on poor earnings, mortgage rates are over 7%, US auto sales are on track to rise in October, Rishi Sunak is committed to banning fracking, banks are starting to fund their debt commitments for the Twitter deal, and the DOJ is probing Tesla over self-driving claims.

Let's dive in.

Before The Bell

Markets

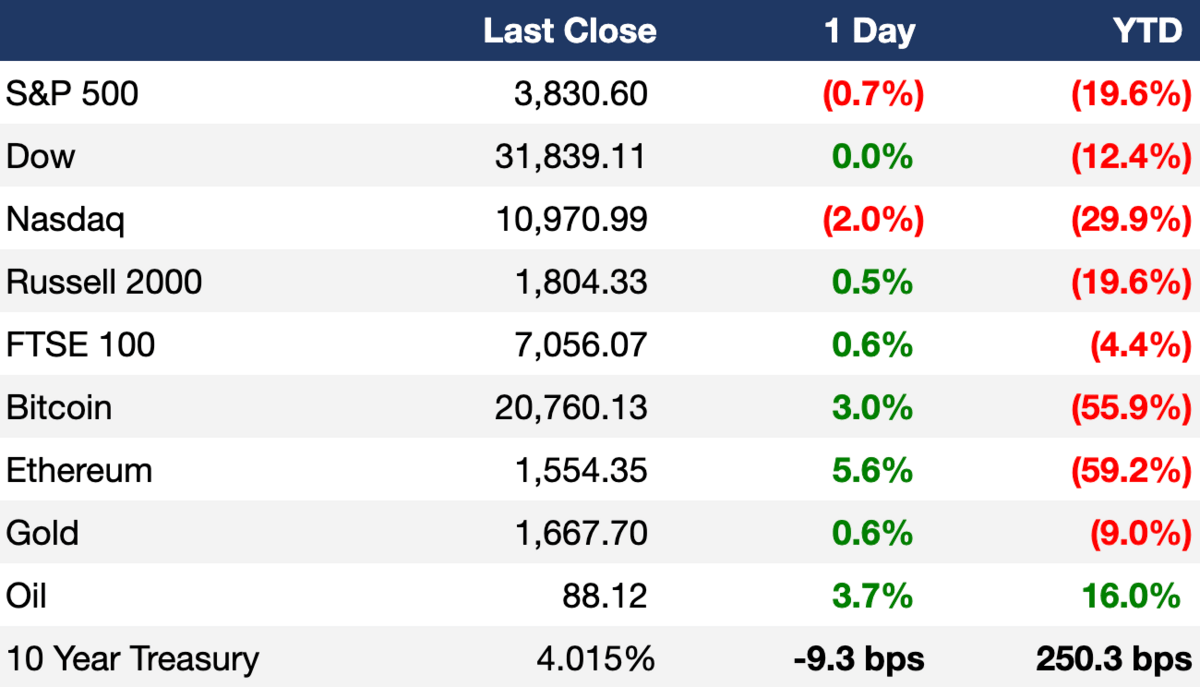

The Dow was the only winner yesterday after disappointing tech earnings dragged the Nasdaq and S&P 500 down, snapping their three-day winning streaks

The dollar index fell to a five-week low while the pound hit its highest since Sept. 13

Earnings

Meta missed on EPS estimates, posted a second straight revenue decline on slowdown in online ad spending and increased competition from TikTok, and issued a weak Q4 forecast; their stock fell 20% in AH trading (CNBC)

Hilton beat Q3 EPS and revenue estimates on strong recovery within leisure and corporate travel and lifted their FY guidance above expectations; their stock closed <1% higher yesterday (INV)

Boeing posted an unexpected $3.3B Q3 loss, poor revenue, and cut its 737 Max delivery outlook again as problems in its defense unit countered strides in its commercial aircraft business; their stock fell ~6.8% yesterday (CNBC)

What we're watching this week:

Today: Credit Suisse, Apple, Amazon, Shopify, McDonald's

Friday: ExxonMobil

Full calendar here

Headline Roundup

US 30-year fixed-rate mortgage rose to 7.16% last week to highest level since 2001 (RT)

US goods trade deficit rose sharply by 5.7% in September (RT)

US auto sales are on track to rise in October as supply chains improve (RT)

Euro zone banks expect lower loan demand and tighter access to credit in Q4 (RT)

Bank of Canada raised rates by a smaller-than-expected 0.5% (RT)

New UK PM Rishi Sunak committed to ban fracking (RT)

Pfizer is under a probe in Italy for allegedly hiding $1.2B in profit and skirting taxes (BBG)

Australia inflation rose 7.3% YoY in Q3 to 32-year high (RT)

Russia banned dealing in capital of 45 foreign-owned banks (RT)

People with disabilities in the US workforce has increased by ~900k since 2020 (AX)

World on track to increase emissions 10.6% by 2030 (RT)

US awarded $1B to electrify school bus fleets (RT)

SEC will require firms that restate financials to claw back excess compensation from executives (RT)

Deutsche Bank reported big jump in Q3 profits despite dealmaking slump (RT)

DOJ is criminally probing Tesla over EV self-driving claims (RT)

Refiner Phillips 66 is eliminating jobs across all business segments (RT)

Augusta National Golf Club under investigation in DOJ antitrust probe (WSJ)

A Message From The BAD Investment Company

Tired of ESG Bullsh*t?

Fortunately, there's a money manager that decided that B-A-D might be the better acronym for investors.The BAD ETF (NYSE: BAD) launched last December and is taking a different stance in this green washed world focusing on 3 industries for which the ticker represents – B-A-D.

Betting – Casinos, gaming, and online gaming operations – 33%

Alcohol – Alcoholic beverage manufacturing and distribution – 23%

Drugs – Pharmaceutical and biotechnology product development and manufacturing – 33%

Cannabis cultivators & distributors - 10%

The case for these BAD industries remains strong for a simple yet important reason – they have historically offered attractive risk-adjusted returns. In addition to these industries overcoming government scrutiny, these industries have shown resilience during economic downturns because people tend to indulge in their vices, or what some call hobbies.

As a result, we believe these asset classes are typically underappreciated and therefore under-valued but the reality is that people will continue to consume alcohol, gamble, and need medicine in good times, and in BAD.

In regards to the betting and cannabis aspects, as these industries become more widely accepted socially and legally, they may offer investors additional growth as more states look to legalize those industries for additional tax revenues.

Learn more about the BAD ETF fund details and sign up for our mailing list to get the latest fund insights and information.

Deal Flow

M&A / Investments

French oil and gas company TotalEnergies agreed to pay up to $580M to buy a stake in wind and solar power projects powered by Brazil’s Casa dos Ventos (BBG)

Apollo and Pimco are in talks to buy Credit Suisse’s securitized-products group (WSJ)

Growth equity firm General Atlantic agreed to buy investment manager Iron Park Capital as it seeks to build out a credit arm (RT)

Spanish wind turbine maker Siemens Gamesa is considering selling two manufacturing subsidiaries, Gearbox and Gamesa Electric, as it seeks to turn business around (BBG)

Bonaccord Capital and RidgeLake Partners agreed to buy a minority stake in media and entertainment focused investment firm Shamrock Capital Advisors (BBG)

Consumer goods company Dabur India agreed to buy a 51% stake in spice maker Badshah Masala for $71M (BBG)

Thai media tycoon and celeb Jakkaphong "Anne" Jakrajutatip acquired the Miss Universe Organization for $20M (RT)

MSP Sports Capital agreed to buy a majority stake in ESPN’s X Games business (BBG)

Ford will sell its 49% stake in Russia-based Sollers Ford JV at an undisclosed price and exit the country (RT)

Mercedes-Benz will sell shares in its Russian industrial and financial services subsidiaries to a local investor and exit the country (RT)

VC

Ascend Elements, an engineered materials and lithium ion battery recycling company, raised a $300M debt / equity Series C led by Fifth Wall Climate (PRN)

Trigo, an Israeli computer vision startup building infrastructure for autonomous grocery stores, raised a $100M round led by Temasek and 83North (BW)

SiMa.ai, a startup building a MLSoC (“machine learning system on a chip”) platform, raised a $67M Series B-1 led by MSD Partners (BW)

CharterUP, a charter bus marketplace, raised a $60M Series A led by Tritium Partners (BW)

OTI Lumionics, a startup creating display materials for devices, raised $55M in funding led by LG Technology Ventures, Samsung Venture Investment Corporation, UDC Ventures, and more (TC)

SaaS security remediation startup Valence Security raised a $25M Series A led by M12 (BW)

High-energy lithium ion cell developer Ionblox raised a $24M Series B led by Applied Ventures, Catalus Capital, and Lilium (BW)

WATI, a CRM tool for WhatsApp, raised a $23M Series B led by Tiger Global (TC)

Workflow management platform Unito raised a $20M round led by CDPQ (PRN)

SwiftConnect, a startup allowingemployees to access the office with their phones, raised a $17M Series A JLL Spark Global Ventures and Navitas Capital (TC)

Expense management software startup Center completed its Series B with an additional $15M from existing investors (PRN)

Arf, a global settlement banking platform using Web3 tech, raised $13M in debt / equity from Circle Ventures, Hard Yaka, Signum Capital, and more (PRN)

Software value stream intelligence startup Allstacks raised a $12.3M Series A led by Companyon Ventures (PRN)

Devtron, a startup creating a DevOps toolkit, raised a $12M round led by Insight Partners (TC)

LatticeFlow, a startup helping ML teams improve AI vision models, raised a $12M Series A led by Atlantic Bridge and OpenOcean (TC)

Xyte, a startup building a connected device management platform, raised $10M in debt from Kreos Capital (PRN)

Impact Analytics, a provider of SaaS solutions for the retail, consumer packaged goods, and supply chain industries, raised a $10M round led by Argentum Capital Partners (PRN)

EV leasing startup Zevvy raised a $5.4M seed round led by MaC Venture Capital (BW)

Forsea Foods, a startup using organoid technology to cultivate seafood, raised a $5.2M seed round led by Target Global (PRN)

Odyssey, a platform helping states connect families to public funding, raised a $4.75M seed round led by a16z (PRN)

IPO / Direct Listings / Issuances / Block Trades

SPAC

China-based automaker Chijet Motor agreed to merge with Jupiter Wellness Acquisition Corp in a $1.6B deal, with a possible downward revision of up to $674M based on certain metrics related to post-closing financial performance and stock price (MW)

Debt

Investment banks have started to send $13B in cash backing Elon Musk's takeover of Twitter after Musk sent a borrowing notice late Tuesday ahead of this Friday's deadline to close (WSJ)

UnitedHealth issued $9B of debt for ‘general corporate purposes’, including refinancing the commercial paper used in the $8B acquisition of Change Healthcare (BBG)

Fundraising

Square Peg Capital, an Australian VC firm, raised a $550M fund to invest in Australian, Southeast Asian, and Israeli startups (TC)

Investcorp, the Middle East's largest alternative asset manager, and the PE arm of the Fung Brothers' family office, are setting up a $500M fund to invest in mid-caps across China's Greater Bay Area (PEI)

Climate tech VC firm Satgana raised a $30M fund aimed at backing startups focused on food, agriculture, energy, mobility, and buildings (TC)

Crypto Corner

Exec's Picks

Stop betting, start trading. Sporttrade is America’s first dynamic sports betting and trading exchange where you can trade in and out of your sports bets at any time. Just like trading stocks. Download on iOS today. Gambling problem? Call 1-800-GAMBLER (NJ). 21+. Present in NJ only.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.