Together with

Good Morning,

Risky companies have access to cheap debt, Meta’s stock price hit an all-time high, Terraform Labs filed for bankruptcy protection, Europe is navigating a post-energy crisis world, ocean shipping rates are surging, and Ron DeSantis ended his 2024 presidential campaign.

Are you tired of waking up tired? Check out today’s sponsor, Eight Sleep, for a mattress cover that will improve your sleep quality overnight.

Let’s dive in.

Before The Bell

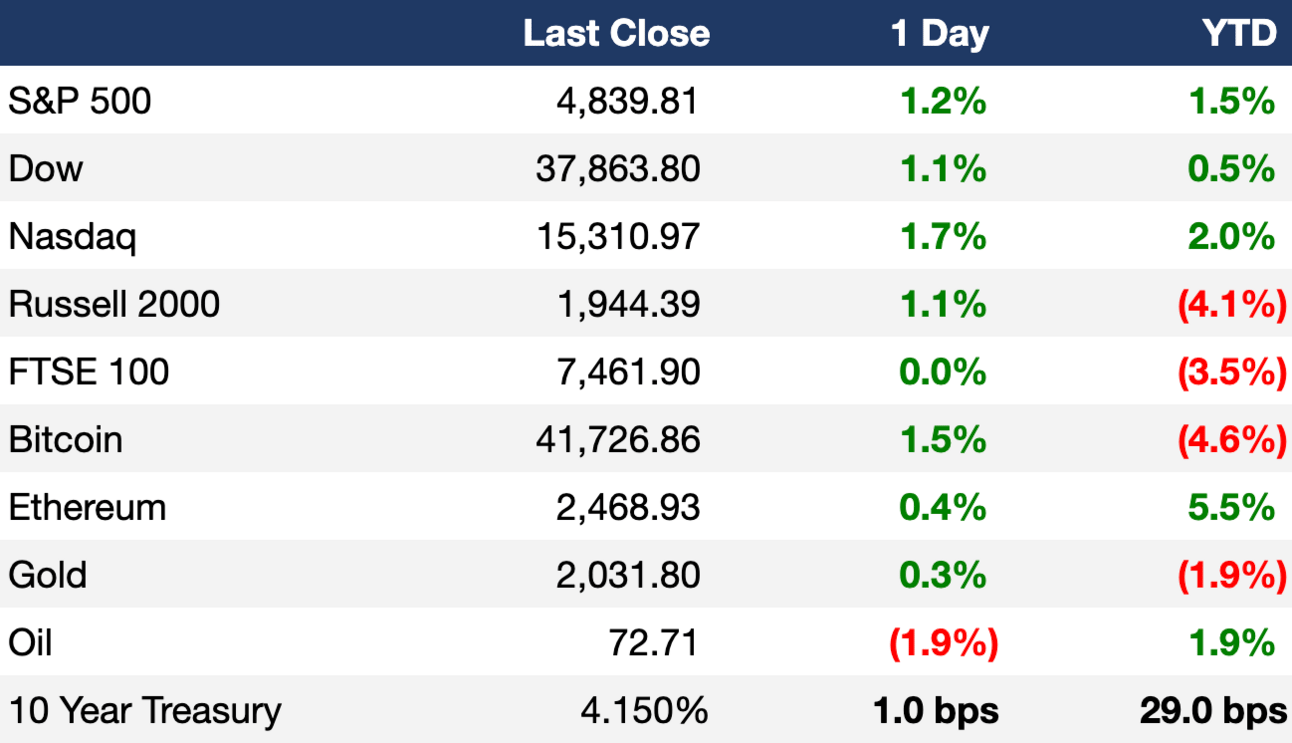

As of 1/19/2024 market close.

Markets

US stocks rallied on Friday as the S&P closed at an all-time high

The Nasdaq led indices with a 1.70% gain

Asian stocks rose, excluding Chinese stocks, as Japan reported slowing inflation

Earnings

What we're watching this week:

Tuesday: Netflix, Verizon, 3M, Johnson & Johnson, RTX, P&G, Lockheed Martin, United Airlines

Wednesday: Tesla, AT&T, IBM, ASML, Progressive

Thursday: Intel, Visa, Blackstone, American Airlines, Comcast, Next Era Energy

Friday: American Express

Full calendar here

Headline Roundup

A hot debt market is slashing borrowing costs for riskier companies (WSJ)

Meta snaps out of historic slump with first record high in years (BBG)

Musk’s AI startup secures $500M towards $1B funding goal (BBG)

Europe moves into a new world after crippling energy crisis (BBG)

US authorities say more Boeing 737 planes should get checks after MAX 9 incident (RT)

Microsoft says Russia-linked group hacked employee emails (BBG)

Euro Zone’s job market puzzle shows risk of early ECB rate cuts (BBG)

Netflix has its own tough act to follow (WSJ)

Australia halts ‘Golden Visa’ under broad migration overhaul (BBG)

Why there is a new global race to the moon (CNBC)

Ocean shipping rates surge as Red Sea attacks continue (WSJ)

AMD’s record high shows AI-fueled chip rally has another gear (BBG)

Petrobras board member resigns from Brazilian oil giant (BBG)

Ron DeSantis ends 2024 campaign, endorses Trump over Haley (RT)

A Message From Eight Sleep

A Mattress Cover Fine-Tuned to Your Sleep

Our bodies sleep best when the temperature drops 1-3 degrees as we fall asleep, cools down further during REM sleep, and warms as we wake up to leave us feeling refreshed. The problem is that most beds trap heat, resulting in uncomfortable and inefficient sleep.

Eight Sleep fixes this.

I’m sure you’ve heard of Eight Sleep, the company that has been revolutionizing sleep from Wall Street to Silicon Valley. But did you know that their buzz-worthy mattress cover, the Pod, can be added to your existing mattress to immediately improve your sleep quality?

The Pod, which fits on your bed like a fitted sheet, includes sensors that track your health while you sleep, and it cools down and warms up each side of your bed throughout the night to improve your sleep quality. Want to try it yourself? Get started by clicking below:

Deal Flow

M&A / Investments

Apollo Global is among PE firms considering making an offer for National Amusements, the Redstone family company that controls $8.9B film and TV giant Paramount Global (BBG)

Macy’s rejected a $5.8B takeover offer from Arkhouse Management and Brigade Capital Management (BBG)

Spirit Airlines and JetBlue Airways are appealing a federal judge’s decision to block JetBlue’s $3.8B acquisition of the ultra-low-cost carrier (BBG)

Blackstone Real Estate Partners agreed to acquire Canadian real-estate company Tricon Residential in a $3.5B deal (WSJ)

La Française des Jeux, France’s exclusive lottery and offline sports-betting operator, is nearing an acquisition of online gambling operator Kindred Group for ~$2.5B (WSJ)

Synchrony Financial agreed to acquire consumer lender Ally Financial's point-of-sale financing business, including $2.2B of loan receivables (RT)

Italy is considering the sale of as much as 20% in postal operator Poste Italiane, which could bring in up to $2.7B (BBG)

Brookfield Asset Management is in talks to invest ~$2B in Dubai-based GEMS Education, one of the world’s largest private school operators (BBG)

Privately-held Australian software company Canva is close to completing a share sale to raise over $1.5B at a $26B valuation (BBG)

PE firm Arcline Investment Management will take aerospace parts maker Kaman private for $1.3B (RT)

French shipping firm CMA CGM is set to buy British logistics firm Wincanton for ~$700M cash (RT)

UK caterer Compass Group is in advanced discussions to acquire rival CH&Co in a deal that could be worth over $508M (BBG)

AT&T, Google, and Vodafone made a$155M strategic investment in AST SpaceMobile, a space-based cellular broadband network (BW)

VC

Valsoft Corporation, a Canadian company focused on acquiring and developing vertical market software businesses, raised $170M in funding led by Coatue and Viking Global Investors (BW)

Tr1X, a biotech company focused on engineering cures for immune and inflammatory diseases, raised a $75M Series A led by The Column Group (FN)

Korean travel tech startup Myrealtrip raised a $56.7M Series F co-led by BlueRun Ventures Korea and IMM Investment (TC)

Flowdesk, a Paris-based full-service digital asset trading technology company, raised a $50M Series B led by Cathay Innovation (FN)

Beatdapp, a fraud detection company in the music industry, raised a $17M round (BW)

Tandem, a Chicago-based provider of an app for couples to manage their finances together, raised a $3.7M seed round led by Corazon Capital (FN)

XTM Inc., a fintech startup creator of payment innovations, raised $1.2M in funding from a strategic investor (BW)

Runnr.ai, a startup providing a conversational guest engagement platform for hotels, raised a $1.1M round led by Arches Capital (FN)

IPO / Direct Listings / Issuances / Block Trades

Fintech Kaspi.kz shares rose 4.3% on its debut day of trading for a valuation of ~$18B after raising $1B for its IPO (BBG)

Croatian tycoon Pavao Vujnovac plans to prepare Fortenova Grupa for an IPO as soon as the Balkan retail giant refinances its $1.3B rescue loan (BBG)

Senior housing and assisted living property owner American Healthcare REIT is seeking to raise ~$700M in an IPO (BBG)

Kazakh carrier Air Astana confirmed its plans for a February London listing (RT)

Debt

Synopsys plans to finance its $34B purchase of software maker Ansys through a term loan and bond issuance (BBG)

New World Development and Abu Dhabi’s sovereign wealth fund plan to refinance a $1.2B syndicated loan related to the acquisition of three Hong Kong luxury hotels (BBG)

India's Tata Consumer Products will raise $782M through the issue of commercial papers and rights issue of shares (RT)

Bankruptcy / Restructuring / Distressed

Terraform Labs, the company behind stablecoin TerraUSD, which collapsed and roiled crypto markets in 2022, filed for Chapter 11 bankruptcy (RT)

Fundraising

Middle-market PE firm Wynnchurch Capital closed its Wynnchurch Capital Partners VI fund at $3.5B (FN)

JPMorgan Chase is in talks to clinch $2.5B-$3B of third-party commitments to grow its private credit strategy (BBG)

Bain Capital closed its Bain Capital Middle Market Credit 2022 at $1B to provide flexible, junior debt to midmarket companies (WSJ)

Crypto Corner

Exec’s Picks

Trung Phan published an excellent piece on how different tech apps influence our behavior without us realizing it.

Dan Shipper discussed how AI has taken us from a knowledge economy to an allocation economy.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter