Together with

Good Morning,

PE made a splash into NFL, hedge fund launches are at a 24-year low, commodity traders are set for the worst year since 2019, a court struck down a DEI rule for Nasdaq firms, and Albertsons sued Kroger for billions after terminating their blockbuster merger.

See how to stream your financial operations with BILL and they'll send you a free pair of Ray-Ban Smart Glasses.

Let's dive in.

Before The Bell

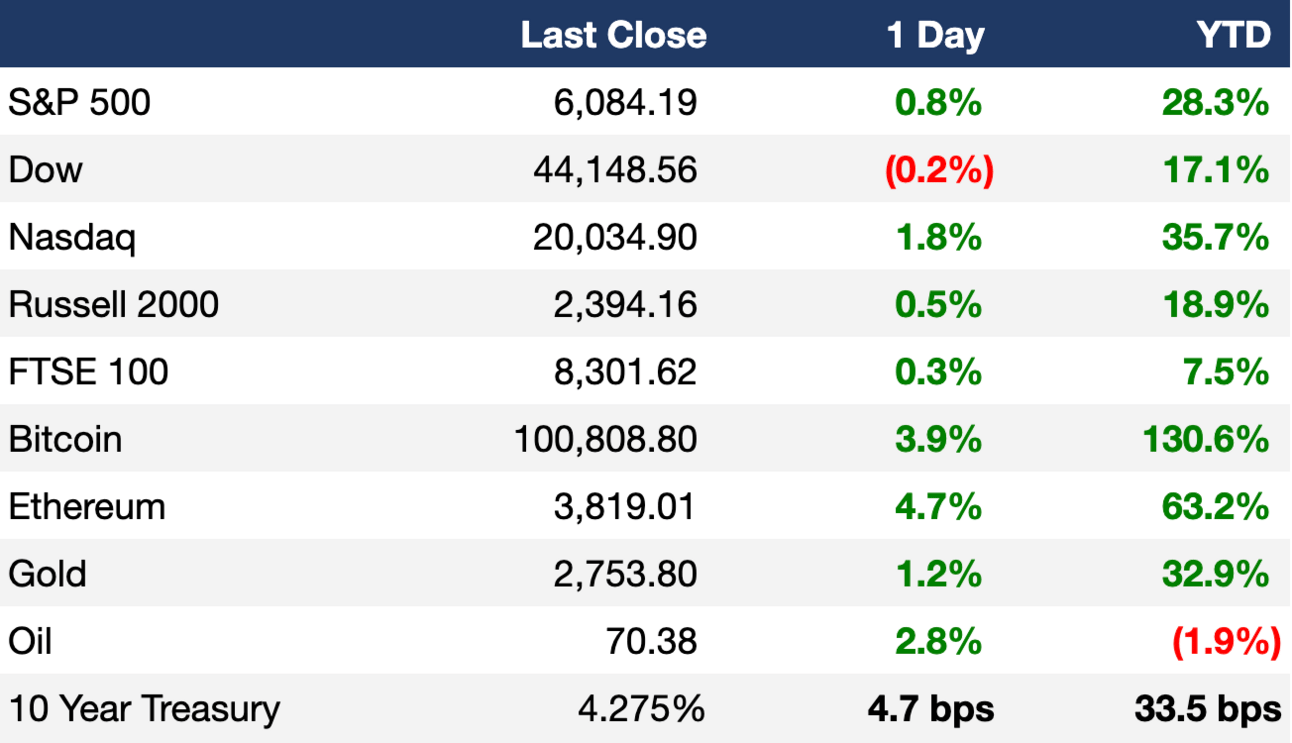

As of 12/11/2024 market close.

Markets

US stocks jumped yesterday as inflation data solidified expectations for a Fed rate cut

Nasdaq closed above 20,000 for the first time in a new ATH

Traders fully priced in a 25 bps rate cut next week

Japan's Nikkei 225 hit a two-month high

Gold rose for a fourth-straight day

Gold is on pace for its biggest annual gain in 45 years

Earnings

Adobe fell 9% despite beating Q4 earnings estimates as disappointing FY revenue guidance stoked fears of emerging AI competition (BBG)

Macy's met Q3 EPS and revenue estimates but lowered Q4 profit guidance after concluding its investigation into an employee hiding $151M of expenses; the firm remains under pressure from activist investors (WSJ)

What we're watching this week:

Today: Costco, Broadcom

Full calendar here

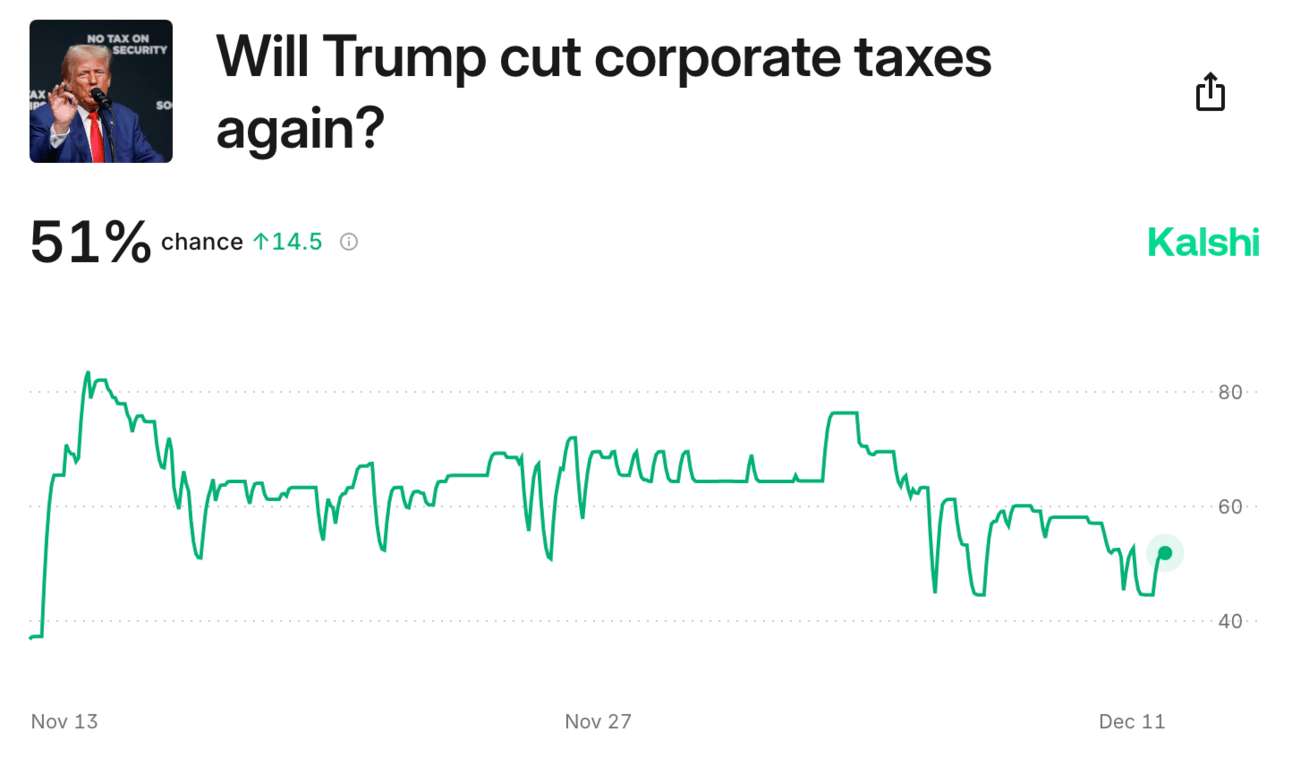

Prediction Markets

Headline Roundup

US CPI rose 2.7% by the most in seven months (CNBC)

BoC cut rates by 50 bps again to 3.25% (RT)

Australia unemployment dropped to a surprise 8-month low (RT)

Argentina inflation hit a four-year low (RT)

Appeals court tossed out DEI rules for Nasdaq-listed firms (WSJ)

New hedge fund launches are set to hit a 24-year low (BBG)

Commodity traders are set for the worst year since 2019 (BBG)

Lazard expects dealmaking surge to be boosted by PE (RT)

Dealmakers see return of more and bigger megadeals in 2025 (RT)

80% of US junk bond sales were for refinancing (BBG)

Citigroup urges investors to look past S&P 500 for 2025 gains (BBG)

Hong Kong M&A hit a seven-year high at $38B (BBG)

BoE plans tougher liquidity rules for insurers (FT)

BlackRock's private markets push not over despite 2024 buyout spree (RT)

BlackRock opened up private assets to rich Europeans and beyond (FT)

Congress plans to force health insurers to sell off pharmacies (WSJ)

HSBC and IFC launched a $1B EM trade finance program (RT)

OPEC made its biggest cut to oil demand forecasts yet (BBG)

BofA named 387 to MD, a 16% increase (RT)

Albertsons sued Kroger for billions amid failed $25B merger (CNBC)

Nvidia stepped up China hiring to focus on AI-driven cars (BBG)

Coca-Cola named a new COO after a two-year vacancy (BBG)

EU raided Adidas HQ for a second-straight day (FT)

Musk's net worth topped $400B in a historic first (BBG)

TPG founder and PE pioneer David Bonderman passed away (BBG)

Apple added ChatGPT to iPhones (CNBC)

Exxon plans to power data centers (NYT)

Auction house Sotheby’s will lay off 6% of staff (WSJ)

Health execs reckon with patient outrage after CEO killing (RT)

Two star luxury real estate brokers were charged with sex trafficking (FT)

Meta donated $1M to Trump's inaugural fund (WSJ)

Bill Belichick will join UNC has head coach (WSJ)

Hamas conceded to two key Israel demands (WSJ)

Saudi Arabia will host the 2024 World Cup (BBG)

A Message from BILL

Demo BILL. Get Ray-Ban Smart Glasses.

As we close out the year, it's the perfect time to look back and gear up for a bigger, better 2025. In our 2024 survey of 354 finance leaders, we found that 42% are eyeing full automation of their financial operations in the next three years.

Ready to join them and finish the year strong?

With BILL Spend & Expense, you get a knockout combo of the BILL Divvy Card and software that helps you never have to do an expense report again.

You'll also get:

Virtual cards that help protect you from fraud and overspending1

Customizable budget and spending controls

1The BILL Divvy Card is issued by Cross River Bank, Member FDIC, and is not a deposit product. 2Terms & Conditions Apply. See offer page for more details.

Deal Flow

M&A / Investments

$36B-listed chocolate maker Hershey rejected a preliminary takeover offer from snacks maker Mondelez

Amkor chairman Susan Kim and Ed Peskowitz's children Zack Peskowitz and Olivia Suter will acquire an 8% stake in NFL's Philadelphia Eagles at an $8.3B valuation

Ares will acquire a 10% stake in the NFL's Miami Dolphins

Arctos Partners will acquire a 10% stake in the NFL's Buffalo Bills

Malaysian wireless carrier Axiata and Indonesian conglomerate Sinar Mas agreed to merge their Indonesian telecom operations in a $6.5B cash and stock deal

Bain Capital increased its offer for Japanese software maker Fuji Soft to $4.3B, extending a bidding war with KKR

PE firm Patient Square Capital agreed to take private dental and veterinary company Patterson Companies for $4.1B, including debt

Saudi conglomerate Zahid Group offered to acquire South African equipment maker Barloworld at a $1.3B valuation

PE firm Triton Partners is nearing a deal to acquire some of German engineering firm Bosch's security systems operations at a $735M valuation

$423M-listed supply chain software firm Logility is exploring a sale

South Korean conglomerate SK Group is considering a sale of its 65% stake in $300M-listed Vietnamese pharma firm Imexpharm

Bain Capital invested $157M in Indonesia's Mayapada Healthcare Group

Indian conglomerate Jubilant Bhartia Group will acquire a 40% stake in Coca-Cola's Indian bottling unit Hindustan Coca-Cola Holdings

VC

Ayar Labs, an optical interconnects for large scale AI workloads, raised a $155M Series D led by Advent Global Opportunities and Light Street Capital

Players Health, an athlete safety and sports insurance solutions, raised a $60M Series C led by Bluestone Equity Partners

Flare, a threat exposure management startup, raised a $30M Series B led by Base10 Partners

IT site reliability startup NueBird raised a $22.5M seed extension led by M12

Albert Invent, an AI platform for the chemicals sector, raised a $22.5M Series A led by Coatue

Electrified Thermal Solutions, a startup helping industrial firms replace natural gas with bricks, raised a $19M pre-Series A from Clean Energy Ventures, EDP Ventures, and more

Stigg, a startup helping companies model pricing data, raised a $17.5M Series A led by Red Dot Capital Partners

RapidCanvas, an AI agents company, raised $16M in funding led by Peak XV

Reveal Technology, a 'decision dominance' tools for DOD, raised an $11.2M Series A led by Next Frontier Capital

KAST, a stablecoin-powered neobank, raised a $10M seed round led by Peak XV and HongShan

Wafeq, a UAE accounting platform, raised a $7.5M Series A led by 9900 Capital

Omni HR, an Asia-focused employee management platform, raised a $7.4M round led by Picus Capital

SkySQL, a startup bringing conversational AI to databases, raised a $6.6M seed round from Eniac Ventures, Good Capital, and WTI

IPO / Direct Listings / Issuances / Block Trades

Cinven and Bain-backed drugmaker Stada Arzneimittel is seeking to raise over $1.6B in a German IPO

Home services software firm ServiceTitan raised its IPO price again to raise $625M at a $6.3B valuation

Debt

Kroger will buy back $4.7B of debt issued to help fund its terminated $24.6B acquisition of Albertsons

Spanish drugmaker Grifols raised $1.4B in a private debt placement

Deutsche Bank plans to sell a SRT linked to a $2.1B portfolio of German mid-cap loans

Utah's Deer Valley Resort is looking to raise $300M in high-yield munis

Bankruptcy / Restructuring / Distressed

A US bankruptcy court rejected satire website The Onion's deal to buy Alex Jones' conspiracy website Infowars

UK fintech Stenn collapsed into administration amid Russia money laundering case

Hong Kong gym chain Physical Health Centre received a liquidation petition

Crypto Corner

Exec’s Picks

Enron has an update! After a week of mystery, Enron introduced their new CEO and their plans ahead. Check out the second video on their website to hear from Connor Gaydos and his plans to unveil world-changing technology next month.

The world's oldest bond is officially 400 years old.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.