Together with

Good Morning,

BOJ hinted at a rate hike, top consulting firms froze starting salaries for a third-straight year, Trump pardoned PE fraudster David Gentile, bond investors are seeking shelter in mortgage securities, and Blackstone, Apollo and KKR agreed to a private credit stress test in UK.

Vanta is hosting a session for startup founders looking to kick-start first-time compliance. An important element if you've just begun winning customers. Register below.

Let's dive in.

Before The Bell

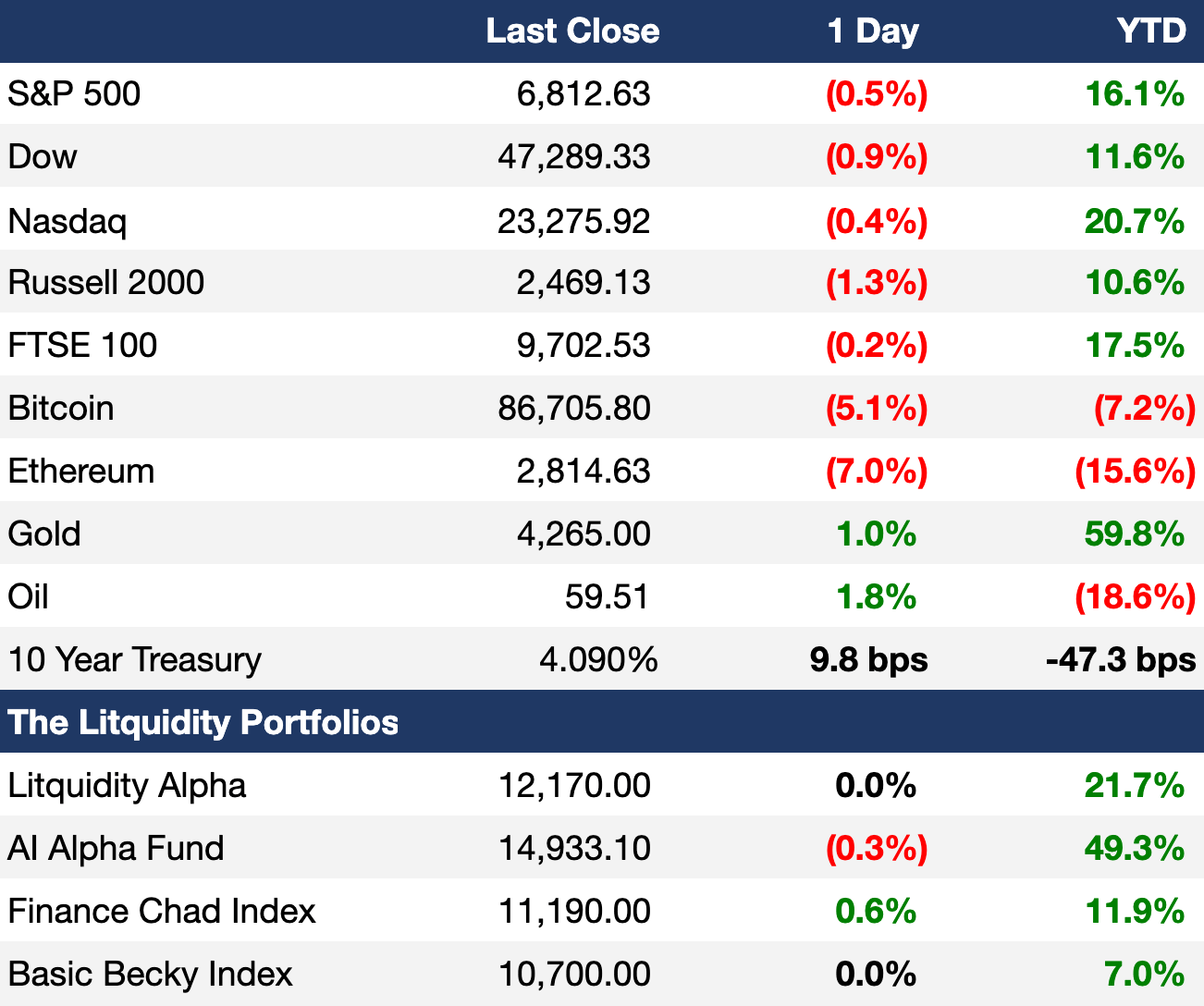

As of 12/1/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks resumed their slide yesterday as the AI and crypto selloff weighed

All three major indexes snapped five-day win streaks

India's Nifty 50 index hit an ATH with YTD gains at 11%

Global bonds slid on hawkish BOJ commentary

Japan 10Y yield rose to 1.88% to its highest since June 2008

Japan 2Y yield topped 1% for the first time since 2008

US 10Y yield rose 10 bps in its largest increase in a month

Germany 10Y yield climbed 6 bps to 2.75%

Silver hit a new high

Gasoline prices fell to a four-year low

Indian rupee slid to a new low versus dollar

Bitcoin had its worst day since March

Earnings

What we're watching this week:

Today: CrowdStrike, American Eagle

Wednesday: Salesforce, Macy's, Dollar Tree

Thursday: TD Bank Group, Dollar General, Docusign

Friday: Victoria's Secret

Full calendar here

Prediction Markets

Trump has made his choice for J Pow's successor and it's 100% someone on the more dovish side.

Trade your prediction on the next Fed chair on Polymarket.

Headline Roundup

BOJ hinted at a rate hike (BBG)

US manufacturing contracted for a ninth month amid tariff headwinds (RT)

Fed raised concerns over CRE risks (BBG)

Blackstone, Apollo, and KKR agreed to BoE's private credit stress test (FT)

Big 3 consultancies freeze starting salaries as AI threatens 'pyramid' model (FT)

Junk borrowers spur $27B year-end funding spree (BBG)

AI bond deluge pushes some investors to seek shelter in MBS (BBG)

Secondaries fundraising broke 2024 records in three quarters (PB)

LPs are expanding into more diverse secondaries strategies (PEI)

Quant traders are on track for record trading revenue this year (BBG)

Citadel's flagship fund is up 8.3% YTD (RT)

Costco joined companies suing for refunds if US tariffs are struck down (BBG)

Switzerland filed criminal charges against UBS and Credit Suisse (WSJ)

JPMorgan doubled Swiss business by targeting wealthy clients (RT)

Evercore poached JPMorgan's global co-head of healthcare IB (BBG)

Ex-Macquarie banker was charged in a Cum-Ex tax scandal (BBG)

Apple's head of AI John Giannandrea will step down (BBG)

Seven states asked BNPL firms to share lending practices (WSJ)

India GDP grew 8.2% YoY in Q3 (FT)

NYC emerges as epicenter of office-to-residential conversions (WSJ)

Point72 founder Steve Cohen won approval to operate a casino in NYC (BBG)

Trump pardoned PE fraudster David Gentile (BBG)

A Message from Vanta

AI has unlocked new velocity for startups – and new visibility, too. The faster you grow, the sooner you'll need to prove you're secure enough to play with enterprise customers.

The TL;DR? You need compliance to sign deals.

Join Vanta for a session on how to make compliance work at your pace, without slowing momentum, stalling deals, or putting revenue at risk.

We'll cover essential steps you can take now to prepare for your first audit in 2026 – and enter the new year ready to earn customer trust (and deals).

You'll walk away with:

Tips on identifying the right framework(s) for your startup

Advice on how to work security into your budget

Security best practices to implement now so you’re audit-ready next year

Deal Flow

M&A / Investments

$60B-listed Warner Bros. Discovery is fielding second-round bids, including a mostly cash offer from Netflix and an Apollo-financed offer from Paramount Skydance and Mideast SWFs

Mining giant BHP offered $53B in its now-aborted stock-and-cash takeover offer for rival Anglo American

Global commodity trading house Gunvor's CEO Torbjorn Tornqvist will step down and sell his shareholding to management; the firm was valued at $6.5B in June

European PE firms EQT and CVC scrapped their $3.4B bid for Australian insurance broker AUB

Blackstone is considering abandoning its $2.9B bid for UK self-storage company Big Yellow Group

Goldman Sachs agreed to acquire ETF issuer Innovator Capital Management for $2B

Mattress giant Somnigroup offered to buy mattress product supplier Leggett & Platt for $1.63B in an all-stock deal

European PE firm CVC agreed to acquire a majority stake in UK green-power developer Low Carbon for $1.3B

Natural gas pipeline operator Targa Resources agreed to acquire smaller rival Stakeholder Midstream for $1.25B in cash

Commercial REIT Realty Income agreed to acquire a preferred equity stake in the CityCenter Las Vegas complex from Blackstone for $800M

OpenAI acquired a stake in Thrive Capital-backed investment vehicle Thrive Holdings to speed up enterprise AI adoption

Swiss food giant Nestlé is weighing options including the sale of its Blue Bottle Coffee chain

European consumer foods holding company Katjes agreed to acquire UK snack brand Graze from UK consumer goods giant Unilever

German industrial firm Thyssenkrupp's troubled steel unit agreed to a corporate restructuring, paving the way for a potential sale

Professional services giant WTW acquired PE secondaries firm FlowStone Partners

VC

German visual AI model startup Black Forest Labs raised a $300M Series B at a $3.25B valuation co-led by Salesforce Ventures and a16z's Anjney Midha

AI wealth-management startup Range raised a $60M Series C led by Scale Venture Partners

Regulatory AI startup Norm Ai raised a $50M investment from Blackstone Innovations Investments and Blackstone Growth

Regenerative-medicine startup Morphocell Technologies raised a $50M Series A extension led by Investissement Québec and CDPQ

Korean enterprise AI startup Sionic AI raised an $18M Series A led by Atinum Investment and LB Investment

AI-enabled procurement security startup Coverbase raised a $16.5M Series A led by Canapi Ventures

Joy Bank, a loyalty rewards startup, raised a $14M Series A from undisclosed investors

Onton, a product search and discovery startup, raised a $7.5M seed round led by Footwork

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Canada's Barrick Mining is exploring an IPO of its North American gold assets, which may fetch a $60B valuation; the firm is under activist pressure from Elliott

Nvidia took a 2.6% stake in chip-design software maker Synopsys for $2B

Strategy raised $1.44B in a stock sale for a 'dollar reserve' to insulate its balance sheet from the crypto selloff

Temasek-backed Indian consumer electronics firm Atomberg is considering raising $200M in an India IPO

India is seeking to sell a 6% stake in $5B-listed state-owned Bank of Maharashtra

SPAC / SPV

Hong Kong-based crypto firm First Digital plans to merge with CSLM Digital Asset Acquisition Corp III

Debt

Pharma giant Merck is seeking to sell $8B in bonds to fund its $9.2B acquisition of Cidara Therapeutics

Australian data center firm Iren is seeking to sell $2B of convertible bonds

KKR-backed Swedish lender Avida Finans sold its first SRT linked to a $300M consumer loan portfolio to UK credit investor Sona Asset Management

Bankruptcy / Restructuring / Distressed

Distressed Chinese developer Vanke asked bondholders to wait one year to be made whole under a new extension plan

Ukraine launched an exchange of GDP-linked warrants for bonds as it seeks to restructure $3.2B of debt after additional talks with some private creditors

Carlyle sold a troubled $190M loan it provided to Roomba-maker iRobot less than three years ago as bankruptcy risks loom

Fundraising / Secondaries

Edizione, the family office behind Italy's billionaire Benetton family, launched private markets investment firm 21 Next alongside 21 Invest and Tages with $3.5B AUM

Australian VC secondaries/liquidity solutions firm SecondQuarter Ventures is seeking to raise $2.6B for its third fund

European MM investment firm Unigestion raised $2B for its sixth flagship secondaries fund

Nordic PE firm Axcel raised $533M for its first dedicated lower MM fund

Indian healthcare-focused PE firm Somerset Indus Capital Partners is seeking to raise $250M for its third fund

Iberian VC Indico Capital Partners is seeking to raise $145M for its sixth fund

Crypto Sum Snapshot

Naver and Dunamu's $13B deal gives rise to two new Korean billionaires

Crypto selloff wiped out $1B in levered bets

Crypto retail traders get hit hard as Strategy ETFs plunge 80%

Fed and other regulators are working on stablecoin rules

Vanguard will allow crypto ETFs on its platform

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Michal Katz, Head of Investment & Corporate Banking at Mizuho Americas, participated in the FII Institute in Riyadh, where the theme 'Key to Prosperity' took center stage. The main takeaway: globalization isn't collapsing – it's being deliberately reshaped across trade, capital and supply chains. In this environment, resilience and growth will belong to those who navigate change with focus, foresight and flexibility. Read more.

CNBC published some updated thresholds on what it takes to be in the top 10% of Americans.

FT published a deep dive exploring how banks are fueling the private credit boom.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.