Together with

Good Morning from Sunny LA!

Managed to escape the NYC cold and snag a ticket to the big game this weekend. Catch Exec Sum stickers plastered at or around SoFi stadium and the Bungalow this weekend (Karl's latest staffing). Pls advise on quality food / bar recs, thx.

The TL;DR of yesterday's news: Snoop Dogg acquired his old record label, everyone and their mom is betting on the Super Bowl, Pelosi Capital may no longer be a thing, New York is dropping its mask mandate, SEC proposes new rules for private investment funds, CVS crushed earnings, Uber (surprisingly) crushed earnings too, and a judge granted the Bitcoin hackers bail.

As always, special shoutout to today's sponsor Mizzen + Main for the most versatile dress shirts in the game. Can't go back to that non-stretch material after these.

Let's dive in.

Before The Bell

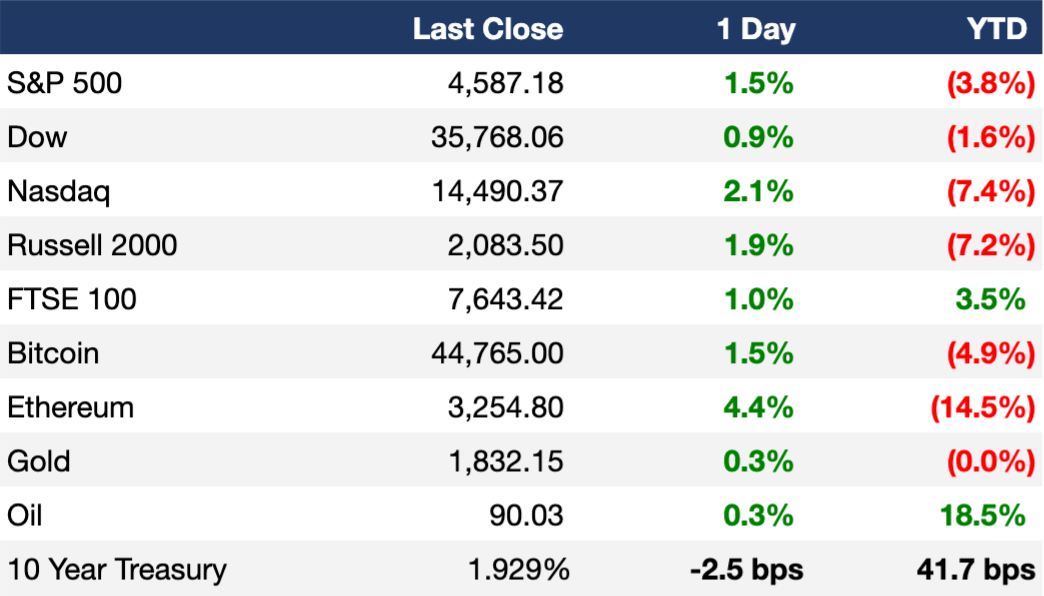

As of 2/9/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Tech stocks continued to drive US stocks up, with all three US averages finishing the day in the green again

The 10Y treasury cooled off slightly in comparison to Tuesday, down from 1.95% to 1.93%

Mortgage applications dropped 10% WoW, with the rise in interest rates possibly slowing demand among homebuyers

Investors will be keeping a close eye on the January CPI data released this morning, which could push Fed Chairman Powell closer to a 50 basis point rate hike

Earnings

CVS posted better-than-expected revenue numbers driven by strong covid-19 vaccine and at-home test demand (WSJ)

Uber posted better-than-expected earnings and revenue numbers as its core business is starting to bounce back from the omicron slump (CNBC)

Disney jumped 8% AH after Disney+ subscriptions beat estimates and Disney’s parks continued to see strong growth (CNBC)

Yum Brands beat revenue expectations but missed earnings for Q4 as higher costs weighed on profits; Taco Bell, KFC, and Pizza Hut saw margins shrink (CNBC)

What we’re watching today: Twitter, Coca-Cola, Affirm

Full calendar here

Headline Roundup

100M Americans can legally bet on the Super Bowl. Sports will never be the same (BBG)

Fed’s Bostic says more than 3 hikes possible this year, but needs to see how economy responds (CNBC)

Proposal to ban Congressional stock trades gains traction (WSJ)

Coffee prices soar to highest level in a decade as stockpiles dwindle (BBG)

Microsoft unveils new app store guidelines as it woos regulators on deal (RT)

New York State to drop indoor mask mandate (WSJ)

San Francisco drops mask mandate for indoor dining and drinking for vaccinated diners on Feb 16 (Eater)

SEC proposes broad disclosure rules for private investment funds (WSJ)

There are now 1,000 unicorn startups worth $1B or more (BBG)

Barry Diller's IAC ends print versions of 6 magazines (WSJ)

Consumer debt total $15.6T in 2021, a record-breaking increase (CNBC)

A Message From Mizzen+Main

Imagine that you have been putting in 12-hour days for the last month, and suddenly it’s February 13th.

You scramble to make dinner reservations for you and your better half, but you have a problem: You’ve been working from home for two years, and every dress shirt that you own is dirty. Good luck getting your clothes dry cleaned overnight.

Luckily, you can throw your Mizzen+Main shirts in the washer with the rest of your clothes. Valentine’s Day = saved.

Upgrade your wardrobe with breathable and comfortable dress shirts that leave you feeling and looking your best.

Deal Flow

M&A / Investments

Xavier Niel-backed French carrier Iliad’s offer for Vodafone’s Italian unit came in at $12.6B (BBG)

Genstar Capital is exploring a sale of drug-research services firm Advarra which could fetch $5B+ (BBG)

RE landlord First Washington and California Public Employees’ Retirement System are nearing a deal to buy grocery-anchored shopping-center landlord Donahue Schriber Realty for $3B+ (BBG)

Waste-management company Republic Services agreed to buy smaller rival US Ecology in a $2.2B deal (RT)

Shipping company Maersk agreed to buy trucking firm Pilot Freight Services for $1.7B (BBG)

UK airport ground-handling firm Menzies rejected an unsolicited offer for ~$635M from Agility Public Warehousing, saying it undervalues the company (BBG)

The UAE’s largest lender First Abu Dhabi Bank is set to make an offer to buy Egyptian bank EFG Hermes (BBG)

Firms including KKR, Bain Capital, and Baring PE Asia are among shortlisted bidders for Japanese conglomerate Hitachi’s minority stake in its transportation unit (BBG)

Newmont agreed to buy Peruvian miner Buenventura’s ~44% stake in the Yanacocha gold mine in Peru for $300M+ (BBG)

Saudi Telecom agreed to buy Pakistan-based Awal Telecom (BBG)

Hip Hop legend and entrepreneur Snoop Dogg acquired his debut label Death Row Records from MNRK Music Group, which is controlled by Blackstone (BW)

VC

Swedish payments firm Klarna is weighing plans to raise new funding at a potential $50-60B valuation (BBG)

Metaverse company Animoca is in talks to raise $500M at a $5B+ valuation in a financing round with investors including KKR (BBG)

Compute North, a sustainable and large scale computing infrastructure provider, raised $385M in funding: an $85M Series C led by Mercuria and Generate Capital and $300M in debt from Generate Capital (PRN)

Direct bank payment solutions startup GoCardless raised a $312M Series G at a $2.1B valuation led by Permira (BW)

Indian logistics startup Xpressbees raised a $300M Series F at a $1.2B valuation led by Blackstone, TPG Growth, and ChrysCapital (TC)

Starburst, a startup building a analytics platform for decentralized data, raised a $250M Series D at a $3.35B valuation led by Alkeon Capital (PRN)

Computer vision data capture startup Scandit raised a $150M Series D at a $1B+ valuation led by Warburg Pincus (TC)

Ventus Therapeutics, a biopharmaceutical company utilizing structural biology and computational tools to identify and develop small molecule therapeutics, raised a $140M Series C led by SoftBank Vision Fund 2 and RA Capital Management (BW)

Omega Venture Partners raised a $115M+ fund for AI-enabled companies (PRN)

Seismic Therapeutic, a biotech company advancing machine learning + immunology drug development, raised a $101M Series A led by Lightspeed Venture Partners (BW)

Envisioning Partners, a Seoul based VC firm, closed a $64M fund for climate tech startups (TC)

Scopio, an Israeli startup developing a scanner to assess blood cell morphology, raised a $50M Series C led by OurCrowd (TC)

Machine learning based transportation platform Leaf Logistics raised a $37M Series B led by Sozo Ventures (BW)

Neo Cybernetica, a stealth deep tech startup, raised a $30M seed round led by NEA (PRN)

German construction tech startup Cosuno raised a $30M Series B at a $150M valuation led by Avenir Growth (TC)

Battery storage systems startup ION raised a $30M Series A led by Clear Creek Investments, VoLo Earth Ventures, and Alsop Louie Partners (BW)

Canadian low cost crypto trading platform Newton raised a $25M Series B led by DV Chain (PRN)

Green hydrogen technology developer Verdagy raised a $25M round led by TDK Ventures (BW)

Perfuze, a neurovascular startup developing a new stroke treatment, raised a $25M Series A led by LSP and Seroba Life Sciences (BW)

Vicarius, a fully autonomous end-to-end vulnerability and remediation platform, raised a $24M Series A led by AllegisCyber Capital, JVP, and AlleyCorp (BW)

Large scale infrastructure monitoring platform Prisma Photonics raised a $20M Series B led by Insight Partners (PRN)

Egyptian investment app Thndr raised a $20M Series A led by Tiger Global, BECO Capitals, and Prosus Ventures (TC)

Calamu, a startup building ‘virtual data harbors’ for securely storing data, raised a $16.5M Series A led by Insight Partners (PRN)

Expressable, a virtual speech therapy platform, raised a $15M Series A led by F-Prime Capital (PRN)

BTR, a regulatory technology company for healthcare, raised a $15M Series A led by Insight Partners (BW)

hOS, a startup building AI technology, raised a $12.8M seed round led by NEA (PRN)

Splendid Spoon, a plant based meal delivery service, raised a $12M round led by Nicoya (PRN)

Virtual care platform VisuWell raised a $10M Series B led by Fulcrum Equity Partners (PRN)

Farming based carbon credits platform eAgronom raised a $7.4M Series A led by Yolo Investments and ZGI Capital (TC)

Logistics solutions platform GoComet raised a $7M Series A led by Rider Global and Atlas Ventures (PRN)

Amplication, a developer of an open source project that automates backend development, raised a $6.6M seed round led by Norwest Venture Partners and Vertex Ventures Israel (PRN)

Cybersecurity startup protecting SaaS applications Canonic Security raised a $6M seed round from First Round Capital, Elron Ventures, and more (PRN)

Rino, a 10-minute grocery delivery startup for Vietnamese cities, raised a $3M pre-seed round from Global Founders Capital, Sequoia Capital India, Venturra Discovery, and Saison Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Telecom services firm Syniverse and M3-Brigade Acquisition II Corp have mutually terminated their $2.85B merger (RT)

Debt

Triple Five Group, the owner of NJ super-mall American Dream, is seeking a four-year payment extension on a $1.7B construction loan (BBG)

Crypto Corner

Exec's Picks

BallStreet is a real-time prediction market allowing traders to compete on any live event. This weekend, they are partnering with us to give away $50,000 for the Super Bowl. If you want to YOLO into trades while you watch the game, click here to download the app and enter for a chance to win the big prize. There's also a bonus $1,000 pool you'd be entered into if you use referral code "lit" or "litquidity" at signing.

ICYMI - over the weekend, we dropped a deep dive into the current retail zeitgeist and how Titan, a hedge-fund like fintech platform, is filling a need in the market for active portfolio management. Check it out here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

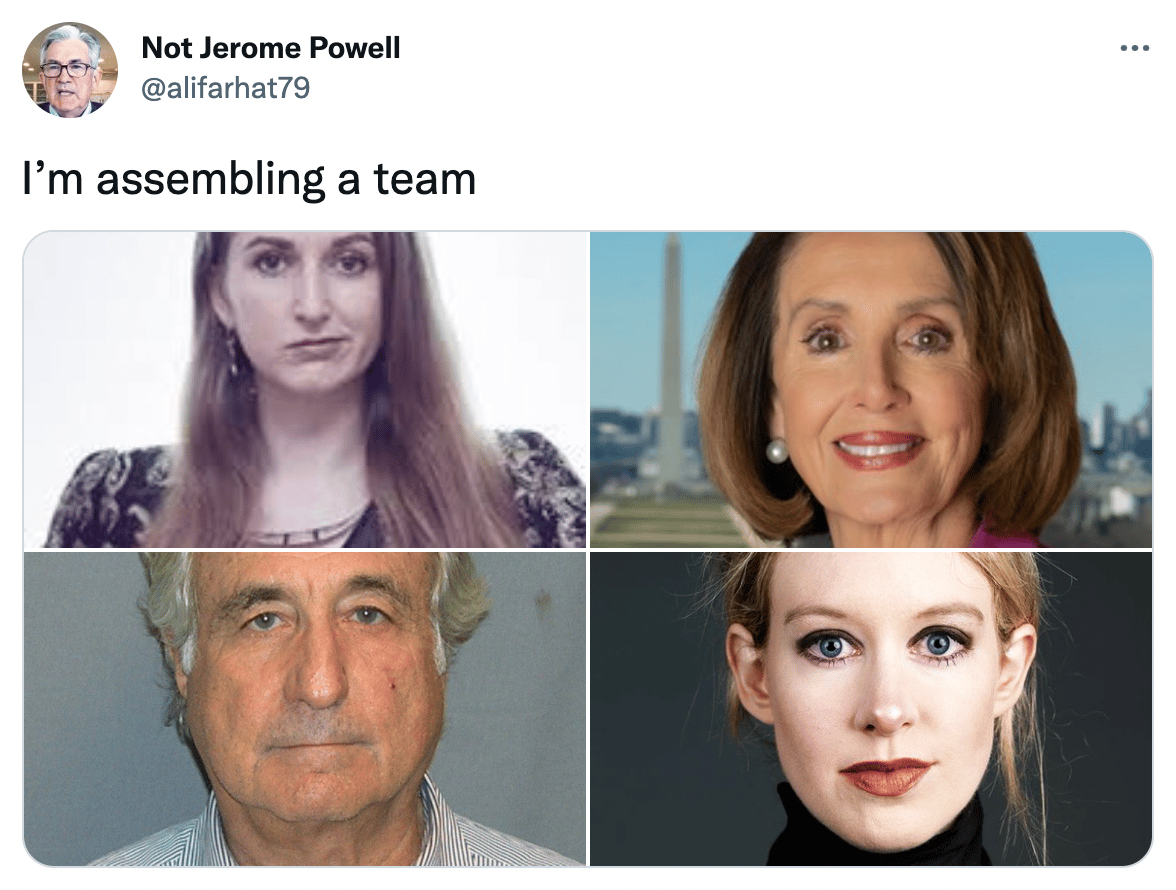

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝