Together with

Happy Friday,

The Trump / FBI situation continues to unfold, SoftBank's Masa Son is personally down $4B (oooof), NYC median asking rents hit an all-time high, and Melvin Capital is now under SEC investigation after getting rekt by reddit degens last year.

Every Friday we publish our Eight Ball newsletter, where we provide real insights about the economy based on real money prediction markets. You can sign up here to read about what we're tracking across Fed rate hikes, NYC rent growth, jobs, and even Hurricanes hitting Florida (good for hedging).

Lastly, we have another investment opportunity that we're circulating to the syndicate! If you are an accredited investor or qualified purchaser and want access to VC deal flow, please fill out this form.

Let's dive in.

Before The Bell

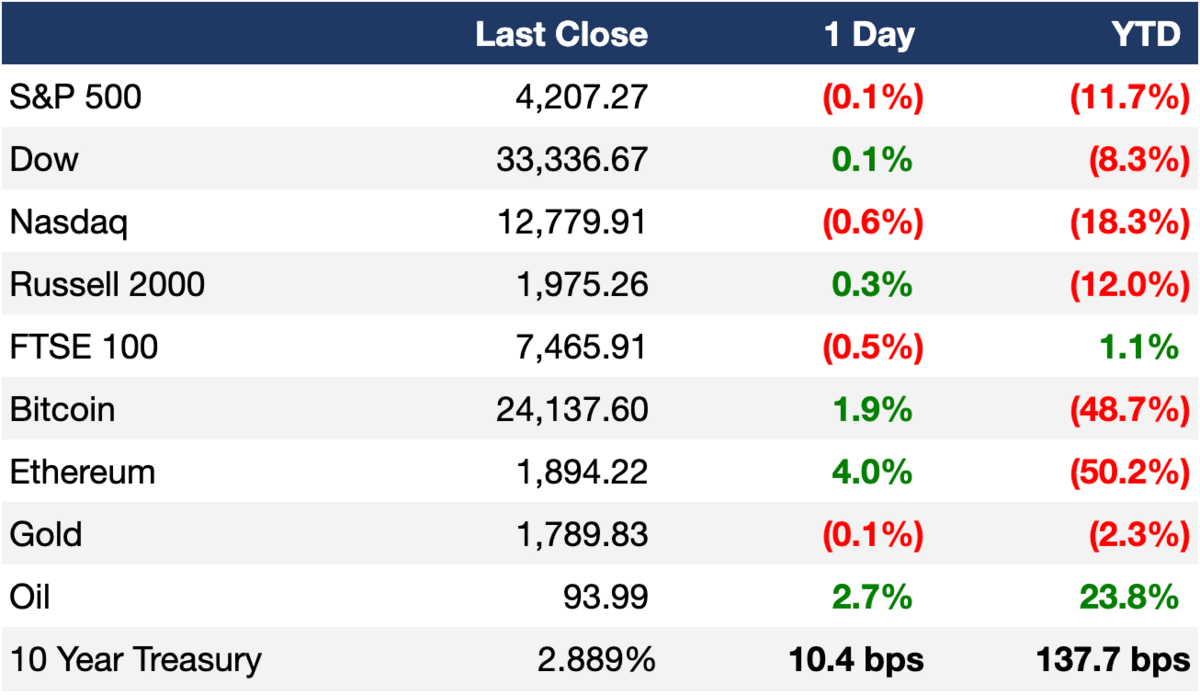

As of 8/11/2022 market close.

Markets

Stocks rose to begin the day but faded later on and closed in the red

The PPI decreased to 9.8% YoY, lower than 11.2% YoY in June and the first MoM decrease since April 2020

The energy sector of the S&P 500 rose more than 3%

30-year fixed mortgage rates increased back up to above 5%

Earnings

Rivian Automotive reported Q2 revenue that was higher than expected but the company expects a wider loss for the full-year than previously forecasted; the company’s net loss for the quarter was ~$1.7B. Its stock rose 4.1% on the day (CNBC)

Cardinal Health reported a mixed quarter, coming up short of profit expectations but exceeding in revenue while announcing its CEO's departure; its stock fell pre-market but ended the day up 5.1% (WSJ)

Full calendar here

Headline Roundup

National average gas prices dropped to under $4 per gallon (AX)

OPEC cut forecasts for global oil demand this year to 100.03M barrels per day (WSJ)

Q2 2022 was the weakest quarter for biotech IPOs in over 5 years (FBT)

Nearly half of SPACs may be forced to liquidate if SEC brings them under the Investment Company Act (II)

262k Americans applied for unemployment benefits last week, a 2022 record (WSJ)

Median home prices rose by double digits YoY in 80% of 185 metro areas during Q2 (WSJ)

The median asking rent in NYC hit an all-time high of $3.5k in June (WSJ)

USPS will temporarily hike prices for the holiday season (CNBC)

The DOJ asked a Florida judge to unseal the warrant FBI agents used to search Trump’s Mar-a-Lago residence, citing ‘substantial public interest’ (WSJ)

The SEC is investigating Melvin Capital over their 2021 meme-stock tumble (WSJ)

Masayoshi Son is now down $4B on his SoftBank side deals (BBG)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our new newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

PE firm Investindustrial will acquire a significant portion of TreeHouse Foods' meal-prep business for $950M (RT)

A unit of Abu Dhabi’s International Holding Co. acquired a 50% stake in Turkish renewable energy firm Kalyon Enerji for $490M (BBG)

Real estate investment trust Park Hotels & Resorts is exploring a sale of Puerto Rican hotel Caribe Hilton for over $200M (BBG)

Philippine media company ABS-CBN will acquire 35% of free-to-air television company TV5 Network for $38.9M (BBG)

Vistria Group, a PE firm with ~$8B AUM, is exploring a minority stake sale (BBG)

Activist investor ValueAct Capital acquired a 7% stake in the New York Times and is pressuring them to expand on subscriber-only bundles (FT)

Investindustrial will also acquire specialty ingredient maker Parker Food for undisclosed terms (BBG)

VC

Chinese synthesis blocks and enzymes maker Hongene Biotech is looking to raise ~$400M at a potential ~$6B valuation (BBG)

Superblocks, a platform for companies to create custom internal apps, raised a $37M funding round from Kleiner Perkins, Greenoaks and others (TC)

Insilico Medicine, an AI-based drug discovery startup, raised a $35M Series D led by Saudi Aramco's Prosperity7 (TC)

FundamentalVR, a VR-based surgeon training platform, raises $20M in funding from EQT Life Sciences (TC)

Jiminny, a UK-based conversational intelligence platform for businesses, raised a $16.5M Series A from Kennet Partners (TC)

Farther, a wealth tech startup, raised a $15M Series A led by Bessemer Venture Partners (TC)

Abridge, an AI platform that records and summarizes medical conversations, raised a $12.5M Series A-1 led by Wittington Ventures (BW)

Invisible Universe, an internet-first animation studio, raised a $12M Series A led by Seven Seven Six (FSM)

Satellite IM, a decentralized peer-to-peer communications platform, raised a $10.5M seed round led by Multicoin Venture Fund and Framework Ventures (FSMS)

Interaxon (Muse), a consumer neurotechnology company, raised a $9.5M Series C led by BDC Capital, Alabaster, and Export Development Canada (BW)

Craniometrix, an early-stage Alzheimer’s detection platform, raised a $6M seed round from Y Combinator, Quiet Capital and others (TC)

Diri Care, an Indonesian healthtech platform, raised a $4.3M seed round co-led by East Ventures and Sequoia Capital India (TIA)

Datawisp, a no-code data exploration platform focused on web3 and gaming, raised a $3.6M seed round led by CoinFund (BW)

Bakkal, a B2B ethnic grocery marketplace, raised a $3M seed round from new and existing investors (PRN)

EtherMail, a web3 wallet-to-wallet communication platform, raised a $3M seed round led by Fabric Ventures and Greenfield One (PRN)

Stimulus, a SaaS startup in the supply chain space, raised a $2.5M seed round led by Black Ops VC (PRN)

ReadON, a startup reshaping digital reading behaviors in Web3 and crypto by using GameFi, raised a $2M seed round led by SevenX Ventures (BTCOM)

Dropbase, a collaborative data import management platform, raised a $1.75M pre-seed round led by Google's Gradient Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

Flutterwave, Africa’s biggest fintech startup valued at ~$3B, is facing financial impropriety allegations ahead of its planned 2023 IPO (BBG)

World’s largest duty-free retailer China Tourism Group is looking to raise up to $2.2B in a Hong Kong share offering (BBG)

Computer component maker Hygon Information Technology soared 105% and raised $1.6B in China's third-biggest IPO this year (BBG)

Johor Corp, a Malaysian state-owned investment firm, is looking to IPO its ~$1B palm oil unit Kulim by next year (BBG)

Hong Kong-based British conglomerate Swire Pacific will buy back up to $510M of its shares (BBG)

Chinese energy drink maker Eastroc Beverage picked Goldman Sachs and China International Capital Corp to advise on a potential ~$500M Swiss GDR sale this year (BBG)

Beverage giant ThaiBev deferred its brewery unit BeerCo's Singapore ~$1B IPO again (BBG)

Tokyo-based luxury real estate developer Lead Real Estate Co filed for a US IPO (MW)

Fundraising

Crypto Corner

Ethereum blockchain’s most significant software update (“the merge”) is scheduled for mid-September (BBG)

BlackRock launched a private trust to hold bitcoin, with crypto exchange Coinbase as the trust's custodian (YHOO)

Mark Cuban is facing a class action lawsuit for promoting Voyager crypto products (CT)

A mysterious investor moved over $3B worth of Bitcoin on Wednesday to create a new wallet amongst the three largest individual Bitcoin holders (CS)

Email marketing platform Mailchimp has been suspending accounts of crypto-related content creators (DC)

Exec's Picks

Exponential is a new platform that allows users to discover new DeFi yield pools, get a custom risk analysis on your wallet, and invest in one click. Want to know if some yield play that's going viral is overhyped or legit? Check out Exponential. They're in early beta, which can be accessed here.

Want access to the same financial modeling courses that Goldman Sachs, JPM, Barclays, and other major banks use to train their junior investment bankers? Check out Wall Street Prep's self study courses and get 15% off w/ code "LITQUIDITY". Check them out here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started and building your own audience.