Together with

Good Morning,

Mamdani's transition team will include some prominent Wall Street execs, Michael Burry launched a newsletter to share his market research, Ray Dalio says the 'pod shop' hedge fund model is unlikely to last, and Trump just signed an executive order to begin the “Manhattan Project of AI” (*cue epic Oppenheimer soundtrack*) .

Chairman of Greenhill Australia Richard Phillips explores the curious case of collapsing transactions in big-ticket Australia M&A. Join the conversation.

Let's dive in.

Before The Bell

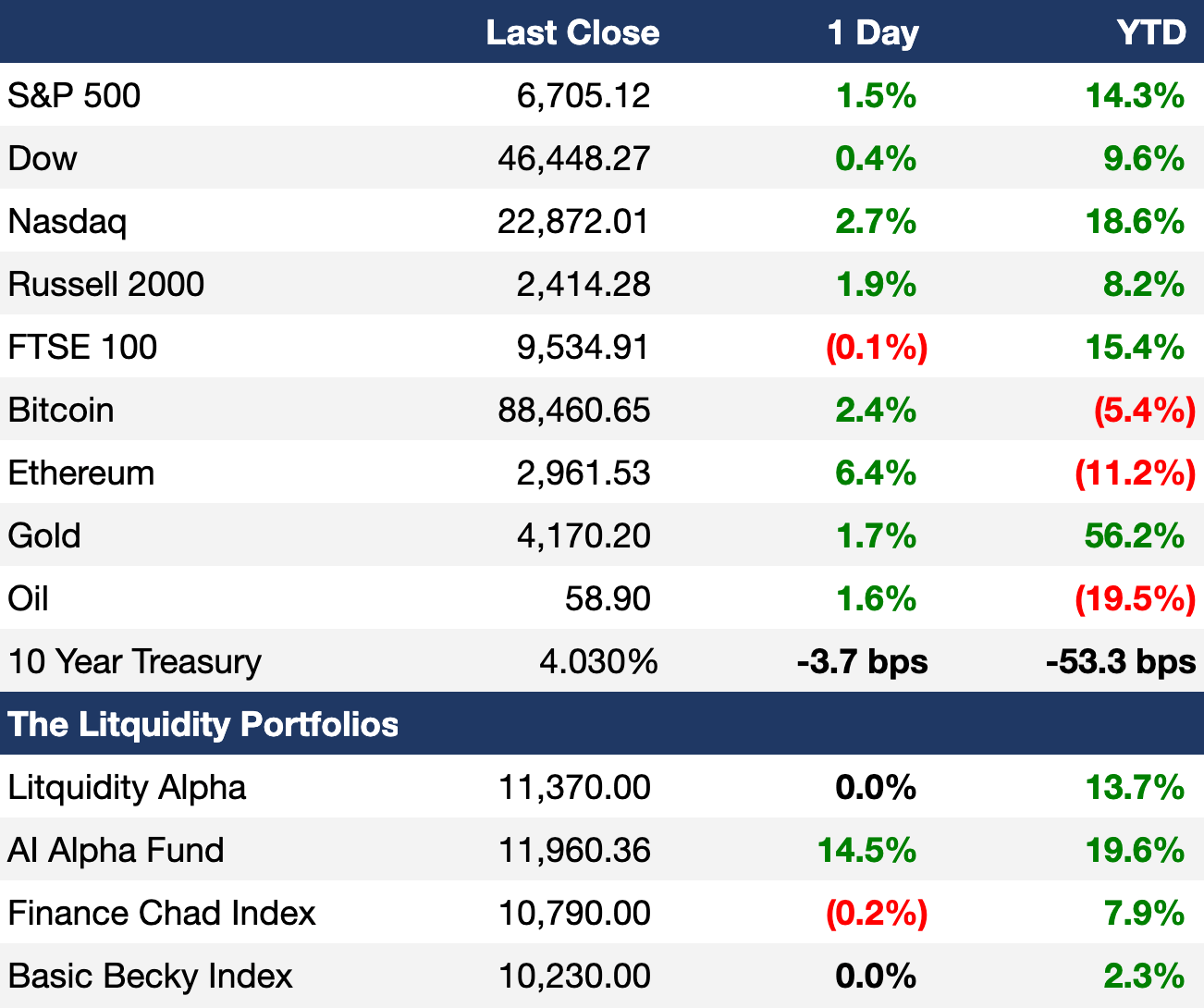

As of 11/24/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks ripped on the back of technology yesterday as traders weighed dovish Fed comments

S&P had its best day in six weeks

Nasdaq had its best day in six months

Futures traders priced in a 75% chance of a December Fed rate cut

Europe's Stoxx 600 is virtually flat since recovering from the tariff-selloff in May

Euro Stoxx Banks index is flat since August after climbing over 60% in the year to August

Europe defense stocks are down 25% from peak to their lowest since April

Earnings

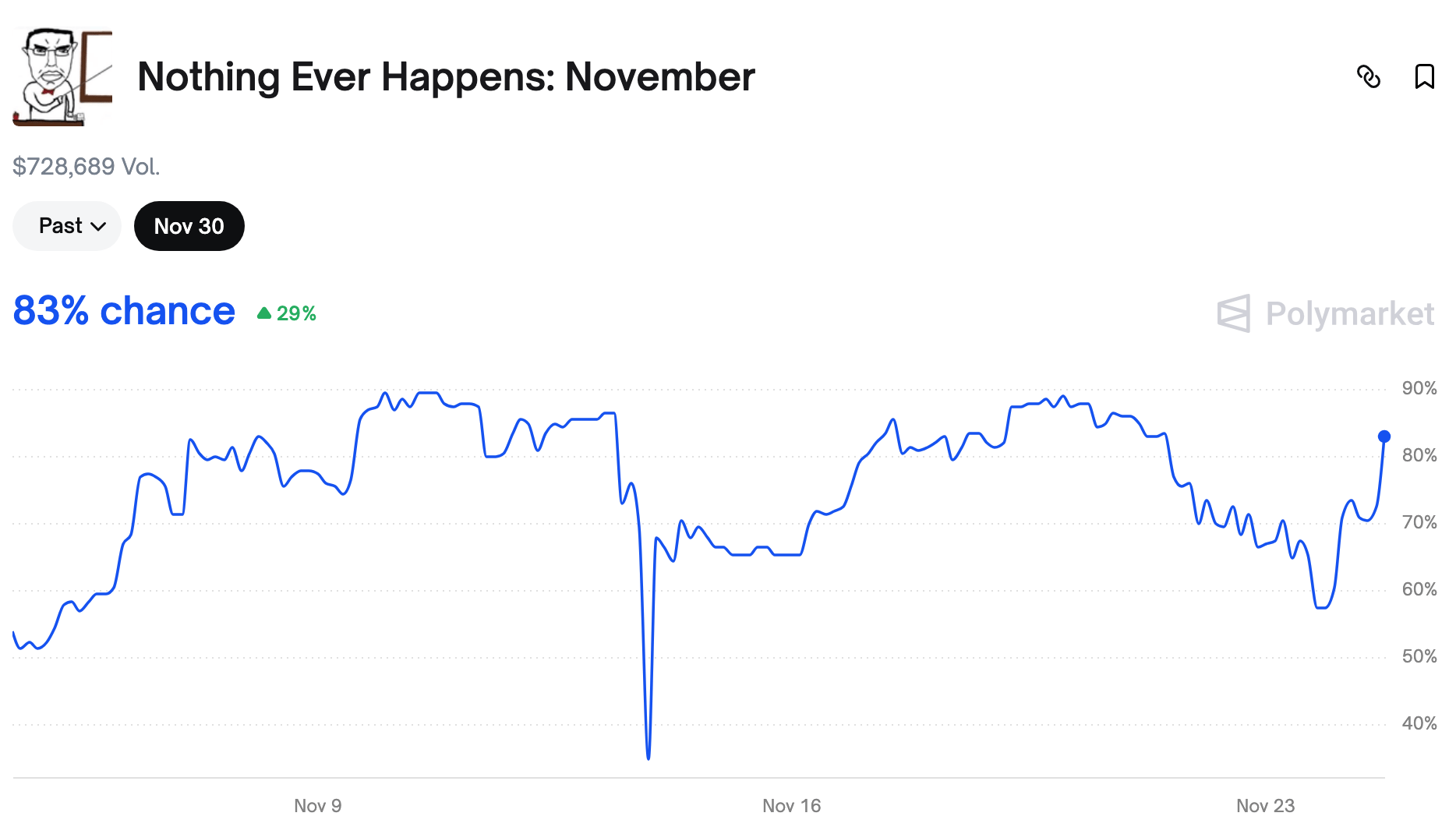

Prediction Markets

Kindly refer to the chart above.

Track and trade live odds on Polymarket.

Headline Roundup

Trump spoke with Xi and will visit China in April (BBG)

Fed's Daly and Waller support December rate cut (WSJ)

US will delay initial Q3 GDP release (WSJ)

US bank profits jumped 13.5% in Q3 (RT)

US leveraged loans come under strain as buyers yank cash from funds (BBG)

Tech companies tap debt markets to fund AI and cloud expansion (RT)

Apollo's CEO thinks people have 'lost their minds' over private credit fears (BBG)

KKR warned of froth in AI investment stampede (BBG)

DoubleLine is cautious about adding AI-related debt exposure (RT)

Private assets will be half of investing industry revenues by 2030 (BBG)

Selling private markets data is becoming a big Wall Street business (WSJ)

Banned Chinese bond tactic that doubled yields is roaring back (BBG)

Trafigura staff raised nickel concerns years before $600M fraud (RT)

Mamdani transition team includes ex-Goldman partner and a developer (BBG)

Law firms compete for small supply of top lawyers in sports dealmaking (SBJ)

Meta is in talks to use Google AI chips (BBG)

US is weighing allowing sale of advanced Nvidia chips to China (BBG)

Wave of US layoffs flash early warning sign for job market (BBG)

Trump signed order establishing 'Genesis Mission' to boost AI — it is being referred to as the “Manhattan Project of AI” (BRN)

A Message from Mizuho

Australia continues to stand out as an attractive destination for foreign investment, driven by its low sovereign risk, stable regulatory environment and currently favorable exchange rate. On average, approximately A$60 billion in transactions are completed each year, supported by a robust private treaty mergers & acquisitions market of similar scale.

Richard Phillips, Chairman of Greenhill Australia, explores how despite this national strength, transaction completion risk remains a key consideration. Most transactions are all-cash or cash-equivalent offers, and premiums have risen sharply.

With its stable economy, low sovereign risk and growing cross-border participation, Australia remains a destination for capital investment and companies looking to diversify portfolios amid global uncertainty.

Deal Flow

M&A / Strategic

Food distribution firms Performance Food Group and US Foods scrapped talks for a ~$30B merger

Amex's $3.8B-listed business-travel spinout Global Business Travel Group is weighing a sale

Dating app Grindr ended talks for a $3.5B take-private by its two largest shareholders Ray Zage and James Lu over financing uncertainty

Singapore's largest bank DBS revised its proposal to acquire Alliance Bank Malaysia, reducing the targeted stake from 49% to 30% in a $2.3B deal

Spanish renewable energy giant Iberdrola offered to acquire the remaining 16.2% stake it doesn't already own in Brazilian utility Neoenergia for $1.2B at an 8% premium, with a delisting in view

US broadcaster Sinclair submitted an offer to acquire rival E.W. Scripps in a $538M cash-and-stock deal, representing a 70% premium

Cohen & Gresser, the law firm that represented SBF and Ghislaine Maxwell, is in talks to sell a stake to PE in a $40M convertible note sale

VC

X-Energy, an advanced nuclear tech startup, raised a $700M Series D led by Jane Street

Quantum Systems, a German defense drone maker, is set to raise a $230M round at a $3B valuation led by Balderton Capital

Model ML, an AI workflow automation platform for financial services, raised a $75M Series A round led by FT Partners

Opti, an AI-native identity security startup, raised a $20M seed round led by YL Ventures, Mayfield Fund, and Hetz Ventures

AI manufacturing platform Cerrion raised an $18M Series A led by Creandum

AlixLabs, a Swedish semiconductor manufacturing solutions company, raised a $16M Series A led by Navigare Ventures, Industrifonden, and FORWARD.one

AI software-testing startup Momentic raised a $15M Series A led by Standard Capital

Blast Security, an Israeli cloud-native cybersecurity startup, raised a $10M seed round co-led by 10D and MizMaa Ventures

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

China's Sinochem-owned agrochemicals giant Syngenta is considering a Hong Kong IPO one year after it withdrew plan for a $9B China listing

Bain Capital offered a block of optical materials maker Coherent shares for $1.1B at a 5% discount

Chinese aluminum maker Chuangxin Industries surged 38% in its trading debut after raising $707M in a Hong Kong IPO backed by Glencore, Hillhouse Investment, and Millennium

JD.com's supply-chain technology unit Jingdong Industrials is gauging interest for a Hong Kong IPO that could raise $500M

Thai crypto exchange Bitkub is considering a $200M Hong Kong IPO

Saudi O&G engineering firm AlKhorayef began preparations for a listing of its O&G services subsidiary

SPAC / SPV

Financial services firm SWB will merge with Soulpower Acquisition Corp in an $8.1B deal

Debt

Dutch lender ING completed two SRTs linked to $12B of corporate loans

Junk-rated pharma company Bausch Health launched an exchange offer to retire two senior secured notes totaling $3.4B as part of efforts to reduce its $20B+ debt load

Deutsche Bank raised $1.15B in an AT1 bond sale

US green hydrogen technology firm Plug Power raised $400M in a convertible notes sale to pay off high-interest debts

Morocco's biggest private healthcare provider Akdital is seeking to raise equity from Gulf wealth managers and sell bonds to fund a $1.6B expansion in the Mideast

Bankruptcy / Restructuring / Distressed

Auto parts supplier First Brands' potential restructuring is being challenged after UMB Bank accused new managers of favoring select lenders to funnel part of its $1.1B rescue financing to a German unit in a cash crunch

French supermarket chain Casino is targeting a 43% debt write-down and seeking a fresh capital from its majority shareholder as part of restructuring efforts

Hong Kong real estate PE firm Gaw Capital Partners is rushing to extend a $110M loan backed by a life science park project in Shanghai

Fundraising / Secondaries

UK PE firm Permira raised $1.7B for a multi-asset CV for fund administrator Alter Domus and cybersecurity and cloud computing firm Exclusive Group led by Ardian, Hamilton Lane, HarbourVest, and LGT Capital Partners

Sterling Investment Partners raised $1.6B for its fifth PE fund

Investment firm H.I.G. Capital plans to raise $1.5B for a debut GP-led secondaries fund

JPMorgan Asset Management raised $1B for its second PE co-investment fund

Alba Infra Partners, the infrastructure spinout of UK PE firm 3i, raised $290M for its debut blind-pool fund

J2 Ventures, a VC firm led mostly by US military veterans, raised $250M for its third fund

Ex-Benchmark partner Victor Lazarte debuted his VC firm VL Fund with a $215M fund

Weinberg Capital Partners raised $132M for its debut CV for French hygiene and environmental specialist Sapian

UK-based Firgun Ventures raised $70M for a targeted $250M fund focused on Series A and B quantum tech startups, with SWF QIA anchoring the fund

Crypto Sum Snapshot

ECB warned stablecoins could siphon off euro zone bank deposits

Binance and founder CZ were accused of facilitating payments to Hamas (wtf???)

Bitcoin ETFs are set for their worst month of outflows on record

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

'Big Short' investor Michael Burry is moving on from his hedge fund life to something bigger: a newsletter. He describes his Cassandra Unchained newsletter as his sole focus meant to offer a front row seat to his stock, market, and bubble projections. You can subscribe here.

Bloomberg Odd Lots sat down with Ray Dalio to hear his perspective on the five forces that make this a historical market. It's worth the listen.

Bloomberg also published an interesting report on Morgan Stanley and its envious client roster of hot startups. Not a surprise that they signed on OpenAI before ChatGPT even launched. Read about it here.

One last callout… we also dropped some new merch designs ahead of Black Friday. Cop them here.

Recruiting 💼

Want to earn $130/hr of easy side income?

Mercor is hiring hedge fund professionals to train AI models for the world’s largest research labs. The work is async, part-time, and remote and will require at least 10 hours per week.

The ideal candidates will have:

At least 2 years of experience working at top hedge funds

Experience in financial modeling, TAM analysis, market sizing, investment research / summaries / memos

Plus, they’re even offering $500 if you refer any candidates who ultimately get hired for the project.

Upcoming Events ⛳️

The Litquidity × NEXUS Capital Cup: December in NYC

Days 1 & 2 of the inaugural Litquidity × NEXUS Capital Cup were absolute blasts and we’re looking forward to more incredible action on Days 3 and 4 of the qualification rounds.

We are full for Day 3 (December 2nd) but our lovely sponsors are inviting one more duo to take the last slot on Day 4 (December 9th) of this epic competition!

Grab your favorite golf buddy and sign up now before it fills up. Each team that enters will automatically receive $250 each in DraftKings bet credit and a three-month membership to NEXUS Club in Tribeca. And that’s certainly not all… you will also be competing against NYC's best for over $100K of aggregate value across some sick prizes 👀 and a shot at Wall Street glory.

Not a competitive golfer? No worries. You can simply show up for the vibes and indulge in free booze, $200 in drinks credits to NYC's finest bars, and a night to remember among a highly-curated crowd.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.