Together with

Good Morning,

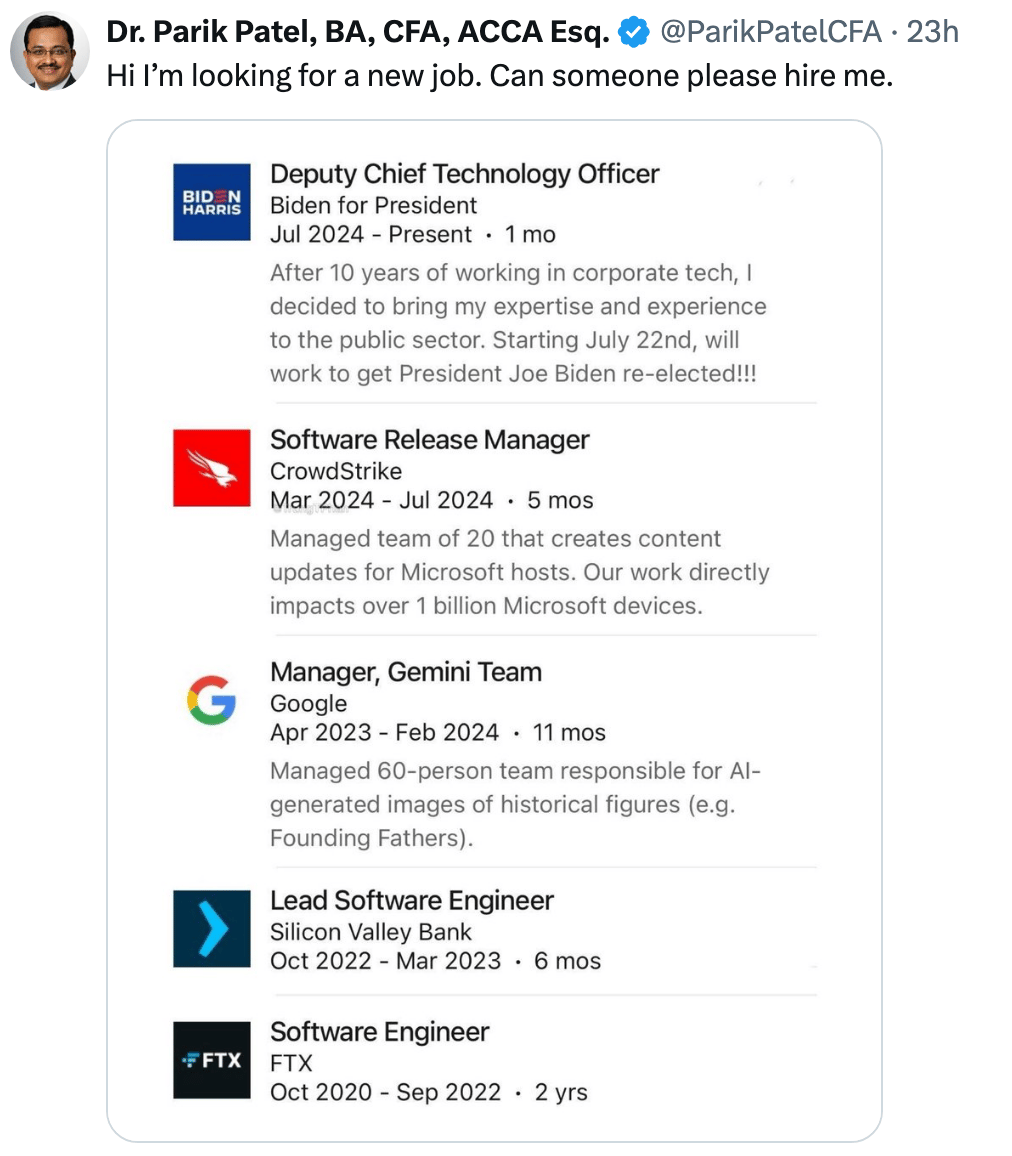

'Twas a pretty calm day in markets, with stocks regaining ground after last week's selloff and businesses continuing to reel from CrowdStrike's glitch. Meanwhile, a slew of failed M&A deals are making bankers rethink fee structures.

Barbecue with BILL—check out BILL's automated expense management platform and they’ll send you a Blackstone Omnivore Griddle.

Let’s dive in.

Before The Bell

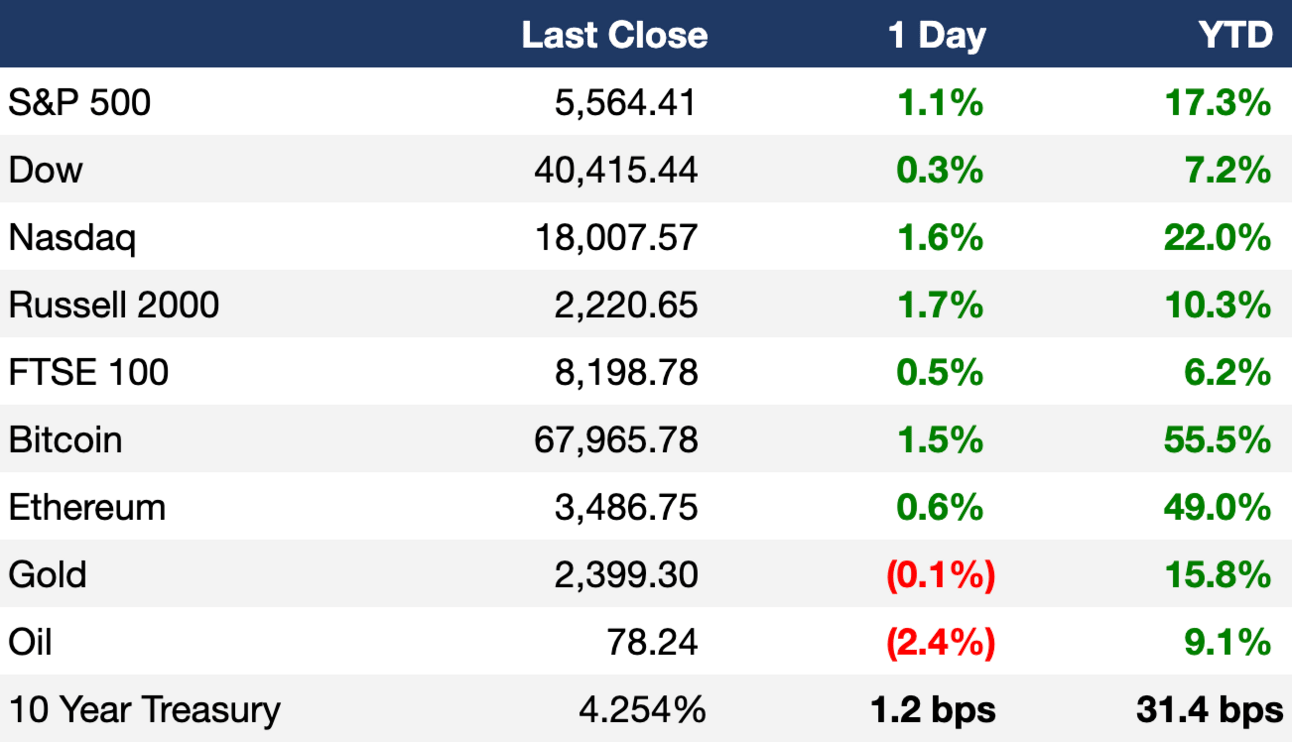

As of 07/22/2024 market close.

Markets

US stocks surged yesterday as investors bought back in after a major tech selloff

S&P had its best day since early-June

Oil fell to a five-week low

Earnings

What we're watching this week:

Today: Tesla, Alphabet, Spotify, UPS, Visa

Wednesday: Chipotle, Ford, AT&T, IBM

Thursday: American Airlines

Full calendar here

Headline Roundup

Bankers are modifying fee structures to protect against failed M&As (RT)

Wall Street banks are betting on pound to extend winning run (FT)

Pension funds are pressuring PE over labor risks (FT)

Geopolitics overtakes inflation sovereign wealth funds top worry (RT)

BlackRock forecast active ETF assets to hit $4T by 2030 (FT)

Firms quoted on London's junior exchange plunged to a 22-year low (FT)

CrowdStrike warns of hacking threats as outage persists (WSJ)

Business travel spending recovered everywhere but Asia and Europe (RT)

Summer travel boom seems insufficient to fire up airline earnings (RT)

Warner Bros. offered to match Amazon's bid for NBA TV rights (BBG)

Reddit signed content partnerships with NFL, NBA, MLB, others (BBG)

Car dealers beef up incentives as inflation hurts demand (FT)

A Message From BILL

Take a demo, get a Blackstone Griddle

Financial operations heating up? BILL Spend & Expense can help you take control.

Automate expense reports, set budgets across teams, and get real-time insights into company spend.

Take a demo to learn how and we'll give you a 28" Blackstone Omnivore Griddle—so you can take control of your next barbecue, too.

Deal Flow

M&A / Investments

PE firm L Catterton approached $6.6B-listed toy maker Mattel with an acquisition offer (RT)

Manufacturing firm Terex agreed to acquire a garbage-truck manufacturing business from peer Dover in a $2B all-cash deal (BBG)

L Catterton acquired a stake in luxury outlet operator Value Retail from UK shopping center landlord Hammerson in a $1.9B deal (FT)

Fairfax Financial will acquire retailer Sleep Country Canada in a $1.2B cash deal (RT)

Australia's Woodside Energy agreed to acquire US LNG gas developer Tellurian for $1.2B, including debt (RT)

Natural gas compression provider Archrock agreed to acquire peer Total Operations and Production Services from Apollo for $983M (WSJ)

Agilent Technologies agreed to acquire CDMO BIOVECTRA for $925M (BW)

Japan's Yokohama Rubber will acquire Goodyear's OTR tire business for $905M (BBG)

Ex-UK finance minister Nadhim Zahawi is assembling a $776M bid for The Daily Telegraph (RT)

French PE firm Ardian acquired a majority stake in Italian biotech Masco in a $762M deal (RT)

PE firm Stonepeak will buy New Zealand aged care provider Arvida Group for $746M, excluding debt (RT)

QXO, a construction-materials distribution business, raised $620M in a private placement and added Jared Kushner as an independent director (WSJ)

PE firms firms Verlinvest and Mistral Equity Partners acquired a majority stake in Insomnia Cookies for $127M (BBG)

UPS will acquire Mexican delivery firm Estafeta (WSJ)

Amazon acquired UK-based Bray Film Studios (FT)

New York Life Investment Management acquired six muni funds with $1.2B total AUM from Aquila Investment Management (BBG)

VC

GenAI startup Cohere raised a $500M round at a $5.5B valuation from Cisco, AMD, and Fujitsu (BBG)

Grover, a German tech rentals platform, startup raised a $55.6M round from Cool Japan Fund and others (FN)

Lithuanian crowdfunding platform Finbee Verslui raised a $37.8M round led by Pollen Street Capital (FN)

Linx Security, an AI-based identity management startup, raised $33M across two rounds led by Index Ventures and Cyberstarts (TC)

Egyptian fintech Dopay raised a $13.5M Series A led by Argentem Creek Partners (FN)

CarbonBlue, a startup developing water-based CO2 removal tech, raised a $10M seed round led by Ibex Investors and FreshFund (PRN)

Fragment, a digital ledger API, raised a $9M seed round from Stripe, BoxGroup, and others (TC)

Heeler Security, an application security startup, raised an $8.5M seed round led by Norwest Venture Partners (BW)

IPO / Direct Listings / Issuances / Block Trades

Vodafone sold a 10% stake in Europe's Vantage Towers for $1.4B (RT)

Latvian carrier AirBaltic's potential H2 IPO may be delayed (BBG)

French media giant Vivendi plans to list its Canal+ broadcasting business in London and its Havas advertising agency in Amsterdam (BBG)

Anglo American Platinum is exploring a second listing in London after its spinoff from miner Anglo American (BBG)

SPAC

AI computing solutions firm Velocium will merge with Maquia Capital Acquisition Corp. in a $445M deal (YH)

Debt

JPMorgan bought ~$6B in mortgage warehouse loans from NYCB (RT)

Standard Chartered-backed China Bohai Bank proposed to sell $3.5B of loans at a discount to shore up capital (BBG)

Golub Capital led a ~$1B debt facility to support TA Associates' LBO of Community Brands-unit Momentive Software (BBG)

HDB Financial Services, a unit of India’s HDFC Bank, is seeking to raise $300M through an offshore loan (BBG)

Oil pipeline operator Trans Mountain plans to sell bonds to refinance debt ahead of an eventual sale (BBG)

Bankruptcy / Restructuring / Distressed

Ukraine reached a deal with private creditors to restructure over $20B of international debt (BBG)

AMC Entertainment reached a restructuring deal with creditors to delay repayment of over $1.6B of debt (BBG)

PE firm TDR Capital risks losing control of Norwegian cruise line operator Hurtigruten if it fails to refinance a bond by August-end (BBG)

Four subsidiaries of German landlord Demire are filing for insolvency after failing to repay an $89M loan (BBG)

Bankrupt hospital operator Steward Health found buyers for two hospitals (BBG)

Fundraising

Crypto Corner

Exec’s Picks

The ARK Venture Fund is taking an asset class once reserved for the accredited, ultra-rich and making it available to all US investors. Gain exposure to a portfolio comprising names like SpaceX, OpenAI, and Anthropic with as little as $500. Learn more and invest today.

Financial Services Recruiting

NEW OPPORTUNITY

Smash Capital - Growth Equity Investor, Immediate Start, NYC or LA

VC firm with $1.5B+ in AUM is hiring growth equity investors for an immediate start in NYC and LA

The firm invests in technology companies across enterprise software, consumer internet, gaming, financial services, healthcare, and commerce

Seeking experienced growth equity investors, with at least 2 years of experience from a top management consulting firm or investment bank and at least 2 years of software-focused buy side experience in growth equity, VC, or private equity

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter