Together with

Good Morning,

Goldman is facing a new wave of leadership unrest, markets are rallying to new highs, energy traders are sitting on massive cash piles, investors are fleeing non-Tesla EV stocks, some retailers are fearing deflation, and Litquidity continues to bring pay transparency to the street.

Looking to up your finance skillset but not sure where you stand? Finance|able offers approachable, intuitive, and personalized training that meets the learner where they are. Check ‘em out!

Let’s dive in.

Before The Bell

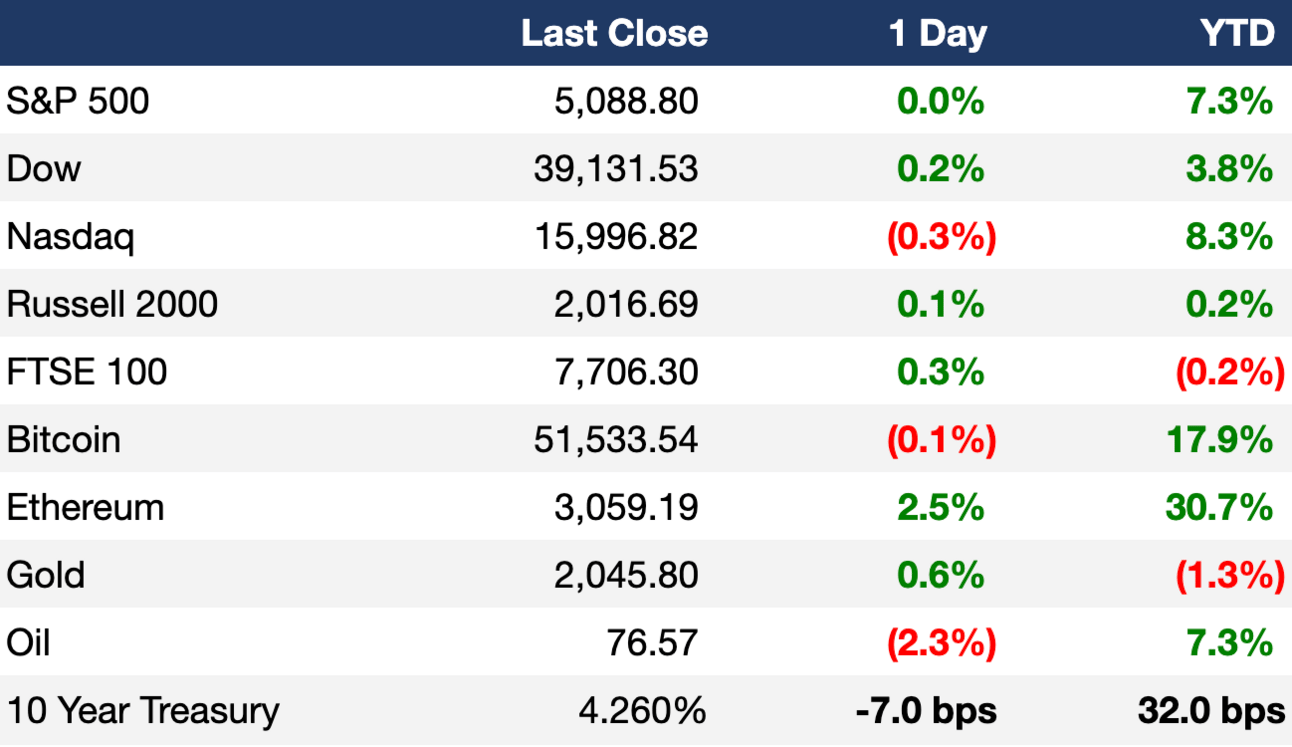

As of 02/23/2024 market close.

Markets

US stocks closed mixed on Friday as the S&P and Dow notched new all-time highs

All three major indexes registered winning weeks

Natural-gas futures hit their cheapest inflation-adjusted prices since trading began on NYMEX in 1990

The dollar index saw its first weekly fall in 2024

Earnings

Berkshire Hathaway reported a 28% rise in Q4 operating earnings and a record $167.6B cash pile; it also posted a record $97B YoY profit (CNBC)

Warner Bros. Discovery shares fell 10% after reporting a higher-than-expected Q4 loss, missing revenue estimates, and warning about 2024 FCF headwinds (CNBC)

What we're watching this week:

Today: Zoom, Domino’s Pizza, Workday, Unity

Tuesday: Macy’s, Lowe’s, AutoZone

Wednesday: Salesforce, AMC

Thursday: Birkenstock, Best Buy, Dell

Full calendar here

Headline Roundup

Risk models behind world’s best HF strategy are getting a lot harder to crack (BBG)

New rules will force PE firms to flag suspicious investments (WSJ)

Litquidity salary reports help bankers measure up annual raises (BBG)

PE fundraising plunged to a six-year low in 2023 (S&P)

Global equity funds see outflows amid inflation concerns (RT)

Goldman Sachs and Mubadala ink $1B private credit India-focused partnership deal (RT)

Blackstone CEO Schwarzman received $897M in pay last year (RT)

Energy traders are sitting on record cash piles (RT)

Goldman Sachs no longer expects a Fed rate cut in May (RT)

SPY ETF becomes first ETF to top $500B in assets (RT)

Nvidia hit a $2T valuation (RT)

US investment-grade bond sales topped $60B for the first time since 2022 (BBG)

As consumers contented with inflation, retailers fear deflation (CNBC)

Investors flee tumbling EV upstarts once hailed as ‘Next Tesla’ (BBG)

Microsoft offered to sell Bing to Apple in 2018 (CNBC)

NFL salary cap increased to $255M (WSJ)

Goldman Sachs' CEO is dealing with a new wave of insider unrest (FT)

A Message From Finance|able

Ever notice that finance training is unpleasant, barely applies to the job, and is somehow more 2004…than 2024?

We’ve been hard at work for several years re-building training from the ground up.

First stop…no more slide voiceovers! We offer interactive, animated modules that use empirically backed learning best practices to provide the absolute best learning experience from start to finish.

And we've built proprietary, bleeding-edge software to deliver personalized learning that meets the learner where they are. No more one-size fits all.

Our Investment Banking, Private Equity, Credit & Growth Equity clients have seen amazing results with our unique approach.

Learn more about Finance|able.

Want to explore our software platform or live training services for your team?

Deal Flow

M&A / Investments

Nord Anglia’s owners EQT and Canada Pension Plan Investment Board hired Goldman Sachs, JPMorgan and Morgan Stanley to explore strategic options including a potential $15B sale or listing of the international school operator (BBG)

KKR is nearing a ~$4B deal to buy a software business from Broadcom (BBG)

US aluminum producer Alcoa made a $2.2B offer to acquire its Australian JV partner Alumina (BBG)

Japanese power generation company JERA will acquire a 15.1% stake in Australian gas producer Woodside Energy’s Scarborough project for ~$1.4B (RT)

France's Bouygues Telecom will acquire La Poste Telecom for $1.03B (RT)

ExxonMobil is mulling bids for its $1B Argentina shale assets after receiving several offers this month (BBG)

Zurich Insurance Group will purchase a 70% stake in Kotak Mahindra Bank's general insurance arm for ~$671M upfront (RT)

US PE firm Pacific Avenue Capital Partners will acquire Italian engine filtration manufacturer Sogefi’s filtration business unit in a $405M deal (RT)

Walt Disney and Reliance Industries signed a pact to merge their Indian media operations; Reliance’s media unit expects to own at least 61% of the combined entity (BBG)

Fintech giant Ant Group outbid billionaire Ken Griffin's Citadel Securities for Credit Suisse's China investment bank (RT)

VC

Abridge, a startup using AI to help doctors write patient notes, raised a $150M Series C led by Lightspeed (BW)

Frontier Medicines, a precision medicine company focused on the proteome, raised an $80M Series C led by Deerfield Management Company and Droia Ventures (VC)

InsightRX, a startup using applied patient-specific data to tailor dosing, received $7.5M in growth financing from CIBC Innovation Banking (BW)

Bitcoin Dogs, a token sale on the Bitcoin blockchain, raised $800k in two days, bringing its total raise to $3.9M in less than ten days (FN)

Xergy, a project management startup, raised a $3.9M Series A (FN)

Tuned, a digital hearing health company providing preventive and comprehensive hearing health for employers, raised a $3.2M seed extension led by Unum Group (BW)

Samphire Neuroscience, a startup building a neurostimulation wearable for menstrual health, raised a $2.3M pre-seed round led by SOSV, FIRSTPICK, Afterwork, and more (EU)

Sparqle, a sustainable delivery platform, received a $1.3M investment from a group of angels including the ex-MD of Deliveroo EU and the former CTO of Just Eat Takeaway (EU)

Cybersecurity startup ExactTrak raised $1.3M in funding from UKI2S and others (FN)

IPO / Direct Listings / Issuances / Block Trades

US cruise operator Viking Holdings confidentially filed for an IPO as it seeks to raise $500M+ (BBG)

Debt

Philippines raised a record $10.5B from the sale of small-denominated treasury bonds (BBG)

3M's healthcare unit Solventum raised $6.9B via investment-grade bonds (BBG)

KKR-owned French insurance broker April Group is seeking a $1.3B syndicated loan to help refinance debt, with KKR Capital Markets, HSBC and Nomura serving as bookrunners (BBG)

UK payments firm SumUp held talks to raise ~$1.1B from private credit lenders to refinance existing debt (BBG)

Bankruptcy / Restructuring

Struggling Swedish real estate group SBB agreed to enter a JV with investment manager Castlelake to help pay off debt; Castlelake will lend the JV $504M (RT)

India's Go First received two financial bids as part of its bankruptcy process, including a joint $193M bid from Ajay Singh, and Busy Bee Airways (RT)

Canadian budget airline Lynx Air filed for bankruptcy protection and will cease operations today (RT)

Canadian real estate services firm Avison Young is close to a restructuring to clean up its balance sheet after defaulting on a senior term loan (BBG)

Fundraising

Growth investment firm Verdane raised $1.2B for a new fund to invest in European decarbonization companies (BBG)

Activist investor Elliott is establishing a new venture Hyperion to hunt for global mining assets worth at least $1B (FT)

German-based VC Earlybird Health raised a $185M fund to invest in European healthcare companies (BS)

Crypto Corner

Exec’s Picks

With bonus season upon us, we’re recirculating our comp survey to gather as much data as possible so we can provide y'all with the latest Wall Street compensation numbers. Please fill it out here. We'll be releasing the report soon!

Read Warren Buffett’s much anticipated 2024 annual letter to shareholders.

Bloomberg explained why private credit is booming and how banks are fighting back.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter