Together with

Good Morning,

US markets emerged as the biggest loser from Trump's sweeping tariffs, with the S&P suffering its second-biggest market cap wipeout ever. The selloff was so deep that L/S funds erased any and all YTD gains in one day. Major players like Citadel aren't doing too good either.

Interviews can be a different ball-game even when you've mastered the knowledge and Training the Street knows that best. Check 'em out to make sure you crush those interviews when the day comes. Whether its technicals or behavioral, buy-side or sell-side, Training the Street got you covered.

Let's dive in.

Before The Bell

As of 4/3/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks plummeted yesterday in response to sweeping US tariffs

All three major indexes posted their biggest drops since Covid

S&P shed $2.5T in the second-biggest market cap wipeout ever

S&P is at its lowest since Trump's election victory and down 12% from its February ATH

Small caps Russell 2000 entered a bear market, down 22% from its 2021 ATH

'Magnificent 7' stocks lost over $1T in market cap

VIX jumped to the highest since August

Europe's Stoxx 600 fell 2.6% to its lowest since mid-January

Japan's Nikkei 225 entered a bear market, down 21% from its July ATH

South African stocks fell 3.4% in their biggest drop since April 2022

US 10Y yield fell below 4% for the first time since Trump's election victory

US corporate junk spreads widened 53 bps to 387 bps in the worst selloff since Covid

Global corporate junk spreads also spiked 45 bps in the worst selloff since Covid from historical lows to 386 bps, the highest since August

US investment grade credit risk hit the highest since November 2023

Commodities slumped by the most since 2022

Dollar fell 1.9% in its worst day since 2022

Euro and yen hit their highest versus dollar since October

Earnings

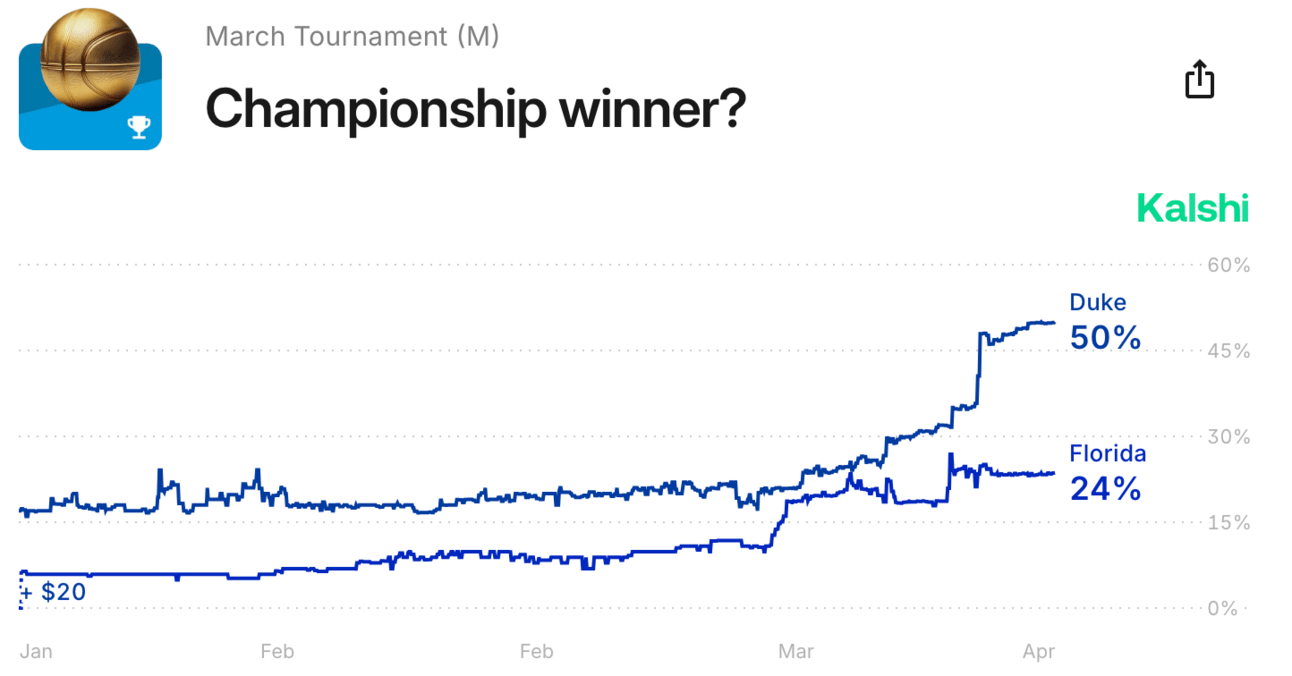

Prediction Markets

Turns out your stocks aren't tariff proof. Maybe March Madness is…

Headline Roundup

US is open to tariff negotiations (CNBC)

US economy slows heading into tariffs turbulence (RT)

Tariffs may be largest US tax hike since 1968 (RT)

Layoff announcements surged to the most since Covid (CNBC)

L/S hedge funds erased all YTD gains in one day (RT)

Major hedge funds including Millennium, Citadel, Pershing Square, and Brevan Howard are negative YTD (BBG)

Hedge funds frazzled by tariff chaos contemplate sitting it out (BBG)

Asia stocks saw the biggest outflows in 15 years in Q1 (RT)

Canada ETFs saw record inflows in March amid volatility (BBG)

Canada's AIMCo returned 12.3% last year (BBG)

Activist Elliott named nominees for Phillips 66 board amid proxy fight (WSJ)

Private credit firms are eyeing the $50T mortgage market (BBG)

Billionaires lost a combined $200B in one day (BBG)

Deloitte will lay off US consultants amid DOGE crackdown (WSJ)

US escalates university crackdown on Harvard and Brown (WSJ)

A Message from Training the Street

Finance interviews are designed to weed out the weak and unprepared.

That's where Training the Street's Interview SmartPrep Al comes in. Powered by advanced Al and machine learning, it simulates real interview scenarios, coaches you in real-time, and provides instant feedback – so when the actual interview comes, you're ready. It's like a golf-simulator for your career.

With Interview SmartPrep Al, you get

Interactive Al coaching: Get real-time feedback on your answers

Practice tailored to finance roles: From IB and PE to VC and hedge funds, practice the toughest questions

Confidence without guesswork: Master technical, behavioral Qs, and case studies

Crush those upcoming interviews with Interview SmartPrep Al.

Deal Flow

M&A / Investments

Brookfield agreed to acquire Colonial Pipeline, the largest US fuel transportation system, for $9B, including debt

French grocer Carrefour increased its offer to take-private its Brazilian unit Atacadao to ~$3.2B, up 10% from its initial bid

Blackstone is exploring a sale of two AirTrunk data centers in Sydney and Melbourne, valued at a combined $2.6B

Primary Health Properties submitted a ~$2B cash-and-stock bid for UK healthcare REIT Assura

Guatemalan conglomerate Castillo Hermanos will acquire SunnyD-maker Harvest Hill for ~$1.5B, including debt

Hailey Bieber is exploring a sale of her makeup brand Rhode, which could be valued at over $1B

Lowell Group, Europe's biggest debt collector owned by PE firm Permira and Canada's OTPP, is exploring a sale of its Nordic operations at an ~$800M valuation

Hershey's will acquire popcorn brand LesserEvil in a $700M deal

KKR withdrew from a consortium of PE firms exploring a takeover of German drug packaging giant Gerresheimer

McLaren will merge with UK luxury EV startup Forseven

Intel and TSMC tentatively agreed to form a US chipmaking JV

PwC China plans to spin off its Dark Lab cyber security arm in a private partner-led buyout

VC

Fintech Plaid raised a $575M round at a $6.1B valuation led by Franklin Templeton

Runway, a startup developing a range of GenAI models for media production, raised a $308M Series D at a $3B valuation led by General Atlantic

Flowdesk, a startup helping crypto issuers manage liquidity, raised $102M from HV Capital, Eurazeo, Cathay Innovation, BlackRock, and more

Data platform Redpanda raised a $100M Series D at a $1B valuation led by GV

Hydrolix, a data lake platform, raised an $80M Series C led by QED Investors

Solace, a digital health platform that connects patients with expert health advocates, raised a $60M Series B led by Menlo Ventures

Space solar startup Aetherflux raised a $50M Series A led by Index Ventures and Interlagos

Unframe, an all-in-one turnkey AI platform for global enterprises, raised $50M in funding from Bessemer Venture Partners, TLV Partners, and more

Adaptive Security, an AI-powered social engineering prevention solutions, raised a $43M Series A led by a16z and OpenAI

Thatch, a startup transforming the health insurance experience for employers and employees, raised a $40M Series B led by Index Ventures

Ecoat, a French greentech startup helping decarbonize the paints and coatings sector, raised $23M in funding from Yotta Capital Partners, ECBF, and Starquest Capital

Djamo, a YC-backed West Africa neobank, raised a $17M round led by Janngo Capital

Fairly Made, a startup helping fashion brands become more sustainable, raised a $16.6M round led by BNP Paribas, GET Fund, and more

Ultra, a UK-based destination for gamers, publishers, and developers, raised a $12M round led by NOIA Capital

Cancer care startup Daymark Health raised an $11.5M seed round led by Maverick Ventures and Yosemite

Vivere Partners, a specialty insurance platform, raised a $7.5M Series A led by General Catalyst, Pathlight Ventures, and Greenlight Re

Unravel, an AI-powered video commerce platform, raised a $7M Series A led by Nauta Capital

Hello Soju, a ready-to-drink sparkling soju brand, raised a $6.8M round led by Kleiner Perkins and Ballistic Ventures

Luxury-focused insurance startup GRACE raised a $6.5M seed round led by FinTech Collective and Speedinvest

HeroWear, a startup specializing in occupational exosuit solutions, raised a $5M Series A led by White Road Investments and Engage

SAT prep startup Linus raised a $5M seed round led by Owl Ventures

IPO / Direct Listings / Issuances / Block Trades

India plans to sell a 4.83% stake in Mazagon Dock Shipbuilders for $337M

Investors associated with activist Yoshiaki Murakami acquired a 5.2% stake in Fuji Media Holdings, proposing significant changes to management

Debt

Blackstone-backed data center firm AirTrunk is seeking a $1.7B green loan to fund its data center campus in Singapore

Tencent-backed streaming media firm China Ruyi is aiming to raise $300M-$500M in convertible bonds next week

Fertility financing company Future Family raised $400M in private credit from Clear Haven Capital Management

India's largest crude O&G company ONGC raised a $200 million loan from state-owned Bank of India

Bankruptcy / Restructuring / Distressed

CMX Cinemas is weighing selling assets or closing theaters as box offices struggle

Fundraising

Investindustrial raised $4.3B for its eighth flagship MM PE fund

Morgan Stanley is raising $680M for a Japan real estate fund

Moneta Ventures raised $250M for its third fund to invest in West Coast and Texas startups

VC Lux Capital is seeking to raise $200M for a debut defense-tech fund

Ballistic Ventures is seeking to raise $100M for a third fund

Crypto Sum Snapshot

Crypto stays resilient as US tariffs rattle global markets

Crypto exchange Gemini is expanding to Miami

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

We're for the visionaries. The value creators who make global markets

thrive. SS&C Intralinks pioneered the first virtual data room (VDR). Today, we

power the world's most advanced financial technology ecosystem with bank-

grade security to fuel funds, M&A and banking.AXIOS gave a breakdown of the oversimple formula that US used to calculate its historical sweeping global tariffs.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.