Together with

Good Morning,

Labor Day air travel passed pre-Covid levels, Europe energy companies are getting margin called, Russia blames the US on European gas woes, Citi wants to lend to people without credit scores, junk bond defaults hit $6B last month, Elizabeth Holmes wants a new trial, Thoma Bravo is opening a UK office, and Juul is paying a fat fine for underage vaping.

Still feeling off your game after a big Labor Day Weekend? Check out today's sponsor, LMNT, for the boost you need to get back to 100%.

Let's dive in.

Before The Bell

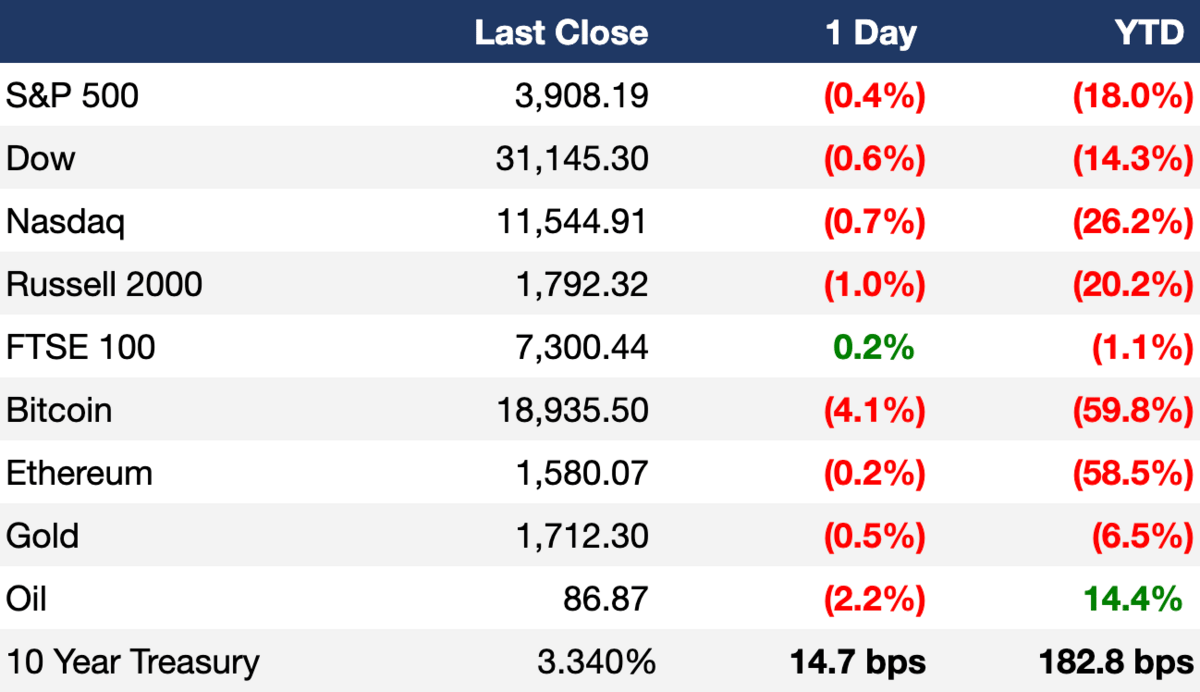

Markets

Adding to their three-week slump, all three major averages fell slightly yesterday in their first day of trading after Labor Day

The US 10Y Treasury jumped to ~3.35%, its highest level since June, and the US 30Y Treasury closed at its highest level since 2014

Today we’ll hear the Fed’s summary on economic conditions, aka its 'Beige Book,' while the Fed Vice Chair and Fed presidents of Cleveland and Richmond are scheduled to speak at various events

Earnings

Headline Roundup

Consumers feel worse now than they did during Covid lockdowns (WSJ)

Labor Day weekend air travel surpassed pre-Covid 2019 levels (CNBC)

Europe energy companies need $1.5T+ in margin calls to cover exposure to soaring gas prices (RT)

Instagram is planning to drastically scale back its shopping features to focus its e-comm efforts to those that directly drive advertising (TI)

Russia blames US for provoking Europe's gas supply crisis (RT)

Japanese yen hits 24-year low against the US dollar (FT)

Citigroup joins industry effort to lend to people without credit scores (WSJ)

Defaults on leveraged loans hit $6B in August, the highest monthly total since Oct 2020 (WSJ)

EU blocked Illumina’s $7.1B acquisition of Grail, days after FTC approval (WSJ)

Theranos founder Elizabeth Holmes is seeking a new trial, citing fresh evidence (WSJ)

US buyout firm Thoma Bravo to open UK office (BBG)

Bed Bath & Beyond shares fell 18% and named an interim CFO (RT)

Juul to pay $438.5M to settle probe over underage vaping (WSJ)

Brazil ordered Apple to stop selling iPhones without a charger (RT)

Electronic Arts is resisting shareholder calls to shrink executive severance payouts (AX)

Jerry Jones (owner of the Dallas Cowboys) has earned more than 300% on oil & gas assets in the past 4 years compared to a 58% gain in the value of the team (YH)

Russia is buying millions of rockets and artillery shells from North Korea (AX)

Covid vaccines will likely become annual (AX)

A Message From LMNT

You had a big Labor Day Weekend, but you’re still feeling the hangover two days later. Coffee and water aren’t getting the job done this time, and you need a hangover cure that actually works.

LMNT is an electrolyte drink mix, but not like any electrolytes you’ve had before. It contains 1,000mg of sodium, 200mg of potassium, and 60mg of magnesium. But most importantly, 0mg of sugar, 0mg of coloring, and no artificial ingredients or gluten. Basically, it’s the perfect recipe to rehydrate and prevent headaches and cramps.

Yeah, you can use LMNT after workouts. But it’s also the secret sauce to recover after a late night of drinking. If you’re the work hard, play hard type (who am I kidding, we all are) try LMNT here, and get your free LMNT sample pack!

Deal Flow

M&A / Investments

US natural gas producer EQT agreed to buy privately held competitors THQ Appalachia I and XcL Midstream in a $5.2B deal (BBG)

Oil and gas rights company Sitio Royalties agreed to buy US rival Brigham Minerals in a $4.8B deal (RT)

Truist Financial agreed to buy Texas Capital Bancshares’ insurance premium unit for $3.4B (RT)

Abu Dhabi's Mubadala Investment Co. is nearing a deal to buy Fortress Investment Group at a potential $2B valuation (BBG)

State Farm agreed to buy a 15% stake in security-services provider ADT for $1.2B (BBG)

Shell and Exxon have placed their Dutch-based JV NAM for sale, which could raise over $1B (RT)

Teine Energy agreed to buy 95k acres of oil and gas producing land in Alberta, Canada from Spanish oil company Repsol for ~$304M (RT)

Chinese tech giant Tencent agreed to buy 49.9% of video game publisher Ubisoft for $198M (BBG)

Web services provider Yahoo acquired 'unbiased' political news platform The Factual (AX)

VC

Programmable cell therapy startup Arsenal Biosciences raised a $220M Series B led by SoftBank Vision Fund 2, Bristol-Myers Squibb, Byers Capital, and more (BW)

Battle Motors, a startup building electric trucks, raised a $150M Series B led by an unnamed global institutional investor (BW)

VTS, a commercial real estate technology platform, raised a $125M+ Series E led by CBRE and an unnamed existing customer (BW)

Open source password manager Bitwarden raised a $100M round led by PSG (TC)

Dutch solar powered vehicle startup Lightyear raised $81M in funding led by Invest-NL, SHV, Dela, and more (TC)

Cymulate, a cybersecurity startup helping companies stress test their networks, raised a $70M Series D led by One Peak (TC)

Skyroot Aerospace, a small satellite launch startup, raised a $51M Series B led by GIC (BW)

Instant delivery startup Jokr is in talks to raise up to $50M in a Series C at a $1.3B valuation (TI)

Elephas, a startup developing an oncology diagnostic platform, raised a $41.5M Series B led by ARCH Venture Partners (PRN)

Varjo, a startup building XR headsets and software for enterprises, raised a $40M Series D led by EQT Ventures, Atomico, Lifeline Ventures, and more (TC)

In session marketing platform ZineOne raised a $28M Series C led by SignalFire (BW)

Product-led growth platform Userpilot raised a $4.6M seed round led by Silicon Badia (TC)

JusticeText, a platform improving transparency in criminal evidence gathering, raised a $2.2M seed round led by Bloomberg Beta, True Ventures, and more (TC)

Metaverse architecture startup Smobler Studios raised a $1.2M seed round from The Sandbox, Brinc, and Enjinstarter (PRN)

IPO / Direct Listings / Issuances / Block Trades

AIG plans to raise up to $1.9B in an IPO of its life and retirement unit, Corebridge Financial (BBG)

SPAC

Materials science technology company Footprint took a near 38% cut to its valuation, from $1.6B to $1B, as part of an amended merger deal with Gores Holdings VII (RT)

Digital World Acquisition Corp., the SPAC planning to merge with Donald Trump’s social media company, fell 11% after uncertainty over deal closure (BBG)

Debt

US home improvement chain Lowe's will raise ~$4.75B in four-part notes offering (RT)

McDonald's is offering ~$1.5B in two-part bonds due 2052 and 2032 (RT)

US retailer Target is offering $1B in notes due 2032 (RT)

Deutsche Bank agreed to buy $608M worth of auto-parts supplier Marelli’s debt from MUFG (BBG)

Fundraising

Heavybit, an investor in developer-first startups, raised an $80M Fund IV (BW)

Crypto Corner

Exec's Picks

Are you looking to invest in an early stage fintech startup? Staax is a seed-stage fintech company enabling peer-to-peer payments via fractional shares of stock and are raising a community round on Wefunder. Existing investors include Techstars, Western Union, Harlem Capital, Plug & Play, Lightspeed Venture Partners, and Litquidity (aka ya boiii). You can invest as little as $100 and do not have to be an accredited investor. Check out the investment opportunity here!

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.