Together with

Good morning,

Just set up the workstation for the next two weeks for the Holidays.

Omicron continues to dominate headlines. Jake Paul delivered the knockout blow all over the world (and meme'd all over social media). Senator Manchin effectively delivered a similar blow to Biden's "Build Back Better" act.

Stay tuned for an upcoming giveaway ahead of year end.

Lastly, shoutout Masterworks for the wildest ad photo we've seen in a while (see below). Y'all wylin.

Let's dive in.

Before The Bell

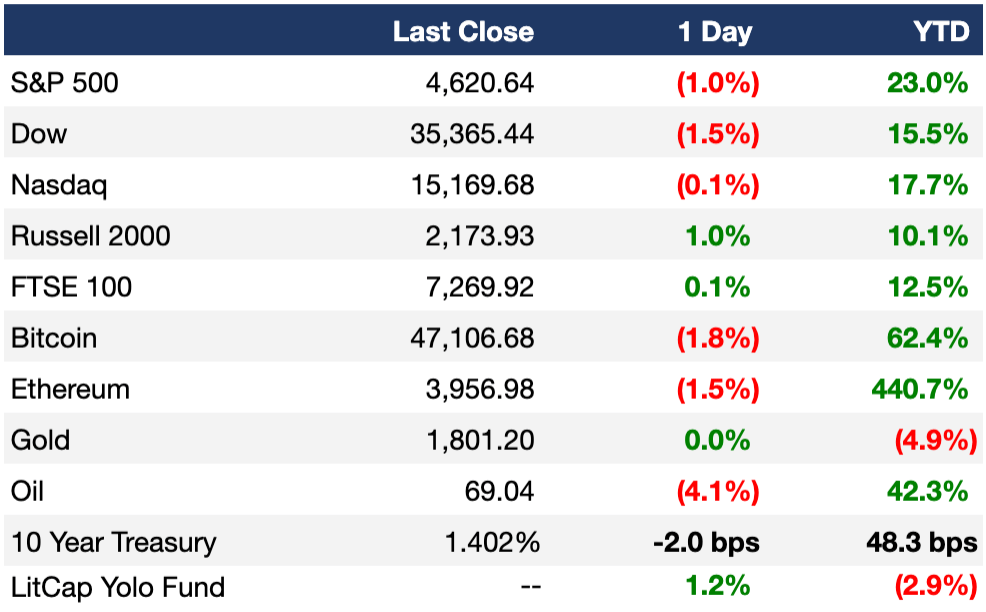

As of 12/17/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

All three major US averages closed in the red for the day and for the week Friday after worries about tight monetary policy and omicron had the markets shook af

High-growth tech stocks led the plunge with expectations of rising rates causing investors to limit their exposure

Earnings

What we’re watching this week:

Mon: Carnival, Blade, Micron, Nike

Tues: AAR Corp, General Mills, Rite Aid, BlackBerry

Wed: Carmax, Cintas

Full calendar here

Headline Roundup

Democrat Sen. Joe Manchin says he won’t vote for Biden’s Build Back Better Act, likely killing the $1.75T bill (CNBC)

Elon Musk tweeted that he'll pay over $11B in taxes this year (TWTR)

‘Spider-Man: No Way Home’ scores third-best opening in cinematic history with $250M+ debut (CNBC)

Telecom Italia’s former CEO steps down from company board (RT)

Equifax to add more ‘buy now, pay later’ plans to credit reports (WSJ)

Biden to deliver Tuesday speech on omicron variant as Covid cases rise (CNBC)

Chinese electric car start-up Nio reveals a new sedan, augmented reality glasses (CNBC)

Senators Warren, Booker have covid with "mild" symptoms (BBG)

Pfizer say Covid could become endemic by 2024 (CNBC)

Sears plans to sell or develop its massive corporate-office park in Chicago suburbs (CNBC)

Disney reaches distribution deal with Google's YouTube TV (BBG)

Indian stocks head for correction as Omicron drives Asia rout (BBG)

JPMorgan bosses hooked on WhatsApp fuel $200M penalty (BBG)

Sky-high lumber prices are back (WSJ)

A Message From Masterworks

$69 BILLION !!!!!!! (Nice)

That’s how much stock Thicc Zucc, Elon, and Bezos have sold this month alone. But who can blame’em?

J Pow is hiking rates. Inflation is at 6.8%. And thanks to Omicron, lockdown 2.0 might be coming soon. We even had to cancel our Holiday party over here at Lit Cap HQ.

With 2022 looking sketchy, YOLO’ing your hard-earned guap on overvalued stocks and shit coins might not be the best idea.

As for Karl and I, we’ve got our eyes on possibly the most dependable investment of all time: blue-chip art.

Art has the lowest correlation to developed equities of any major asset class according to Citi. Plus, blue-chip art outpaced the S&P 500 since ‘95. There’s a reason why top hedge fund bros like Steve Cohen allocate 10–30% of their overall portfolios (literally billions of $$$) to art.

But I didn’t have to shell out $50,000,000 to invest in a Picasso. I just used Masterworks, the investing app that lets you diversify your portfolio with works by Warhol, Banksy, and other legends without spending millions.

In fact, their investors saw a net IRR of 30%+ in 2020 and 2021, which is pretty impressive if you ask me.

*See important disclosures

Deal Flow

M&A

BMO is in advanced talks to buy BNP Paribas’s US unit, Bank of the West, in a potential ~$13.7B deal (WSJ)

Medical-records company Cerner's shares rose 16% for their best day in a decade on news that Oracle is in talks to buy them in a ~$30B deal (BBG)

Thoma Bravo agreed to buy payments firm Bottomline in a $2.6B deal (BBG)

Carlyle and Primavera Capital are among shortlisted bidders for Baring PE Asia’s Chinese packaging business HCP that could be worth $1.5B (BBG)

KKR agreed to buy a 49% stake in Spain’s electricity grid operator REE’s telecom infrastructure unit Reintel (RT)

Blackstone is in talks to buy a residential tower at 8 Spruce St. in New York City from Brookfield and Nuveen for $930M (BBG)

TA Associates is considering strategic options for bubble-tea chain Gong Cha including a potential sale or an IPO that could fetch $600M+ (BBG)

Blackstone agreed to buy a stake in PE firm Nautic Partners (PEI)

Venture Capital

Indian fintech startup Razorpay raised a $375M Series F at a $7.5B valuation led by Lone Pine Capital (TC)

Chinese AI firm SenseTime raised $500M in a fundraising round led by Mixed-Ownership Reform Fund ahead of its IPO (BBG)

Open source data integration platform Airbyte raised a $150M Series B led by Altimeter Capital and Coatue (BW)

Influencer marketing software startup Mavrck raised $120M in growth capital from Summit Partners (BBG)

Well Dot, a consumer-focused health improvement platform, raised a $70M Series B led by Valeas Capital Partners (PRN)

Airspace security startup Dedrone raised a $30.5M Series C led by Axon (BW)

Cloud-based data intelligence platform for FDA-regulated industries Redica Systems raised a $30M Series B led by Savant Growth (PRN)

Sustainable building startup cove.tool raised a $30M Series B led by Coatue (TC)

No-code data platform Hevo raised a $30M Series B led by Sequoia Capital India (TC)

Pakistani fintech startup CreditBook raised an $11M pre-Series A led by Tiger Global (TC)

Scheduling infrastructure company Cal.com raised a $7.4M seed round led by OSS Capital (Cal)

Fuzey, a London-based startup providing a ‘digital one-stop shop’ for SMBs and independent contractors, raised a $4.5M seed round led by byFounders (TC)

IPO / Direct Listings / Issuances / Block Trades

Data-management software company Cohesity is working with JPMorgan and Morgan Stanley on an IPO that could be worth $5-10B (BBG)

Rivian shares fell to the lowest level since their trading debut after their earnings report revealed a slower-than-expected increase in production (BBG)

Delivery startup Gopuff is in talks with banks about a 2022 IPO that could give them a valuation of up to $40B (BBG)

Communications company GoTo has hired banks to help raise ~$1B in an Indonesian IPO (BBG)

RNA therapeutics biopharmaceutical company Sirnaomics plans to raise up to $70.3M in a Hong Kong IPO (BBG)

SPAC

Italian luxury group Ermenegildo Zegna completed their SPAC merger and will begin trading today under ticker symbol “ZGN”, expecting to have a market cap of $2.4B (RT)

Mobile commerce platform Rezolve agreed to merge with Armada Acquisition Corp I in a $2B deal (RT)

Belgian telecoms firm Proximus’s subsidiary Telesign agreed to merge with North Atlantic Acquisition Corp in a $487M (RT)

Debt

Blackstone and Ares Management have provided a $2B loan to help fund the acquisition of Mimecast by Permira (BBG)

Alpha Dhabi, one of the UAE’s biggest public companies by value, is looking for opportunities to deploy capital in private and public assets in sectors ranging from hospitality to petrochemicals (BBG)

Exec's Picks

If you've had ambitions of learning a new language for years, odds are you want to start speaking it confidently sooner than later. Turn to Babbel, the top language-learning app that helps users start speaking a new tongue in just three weeks. Start learning a new language.

Commonstock built a platform to showcase the portfolios, real-time trades, and analysis of the smartest retail investors. Join their community of engaged investors to access exclusive financial data, follow and chat with fellow investors, get alerts when friends buy or sell, and make trades directly through the platform. Access verified investment insights now.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 50+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board. If you want the role to be featured on Exec Sum, check out our "Featured" and "Premium" tiers.

Meme Cleanser

Cop our new sticker pack here