Together with

Good Morning,

Trump canceled troop deployments to SF after Jensen Huang called, KKR's Henry Kravis sees no systemic risk in private credit, investors are cutting allocations to real estate, Blackstone profits surged, CZ got a pardon, and Jamie Dimon cut the ribbon on JPMorgan's new Manhattan HQ.

Fall season means it's time for a wardrobe overhaul. Check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game.

Let's dive in.

Before The Bell

As of 10/23/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as investors digested major earnings and news of a Trump-Xi meeting ahead of crucial inflation data due today

UK's FTSE 100 hit an ATH

Europe's Stoxx 600 hit an ATH

EM Asia bond real yields rose to a six-year high while nominal yields drifted to a four-year low amid cooling inflation

Spot platinum in London surged 6.4% in its biggest jump since 2020 to become the latest precious metal to get squeezed

Oil had its largest one-day gain since June

Earnings

Intel beat Q3 earnings and revenue estimates after returning to profitability for the first time since 2023 and gave an upbeat revenue forecast on progress in its turnaround efforts and partnership with the US government (BBG)

Blackstone beat Q3 profit estimates as distributable earnings jumped 48% on a surge in PE exits and gains in infrastructure; the firm is sitting on a record deal pipeline and $1.25T AUM, but warned of end to bumper private credit returns (BBG)

Union Pacific narrowly beat earnings estimates as rail volume held up despite tariffs, though revenue missed forecasts ahead of its $72B Norfolk Southern merger (BBG)

Lazard beat Q3 profit estimates as financial advisory revenue rose 14% to a record $422M driven by stronger M&A, restructuring, and LMEs (RT)

American Airlines posted a better-than-expected Q3 loss and raised Q4 and FY guidance with summer demand shifting to later in the year (CNBC)

Ford beat Q3 earnings estimates but lowered FY guidance due to a supplier fire affecting truck and SUV production, while planning increased US pickup output to recoup lost units (CNBC)

Honeywell beat Q3 earnings estimates and raised its FY outlook on growth in aerospace sales ahead of a planned three-way spinoff (BBG)

O'Reilly beat Q3 earnings and revenue estimates and raised FY guidance as more consumers repair older vehicles than buy new ones; the firm reported exposure to bankrupt First Brands (RT)

What we're watching this week:

Today: Procter & Gamble, Booz Allen Hamilton, General Dynamics

Full calendar here

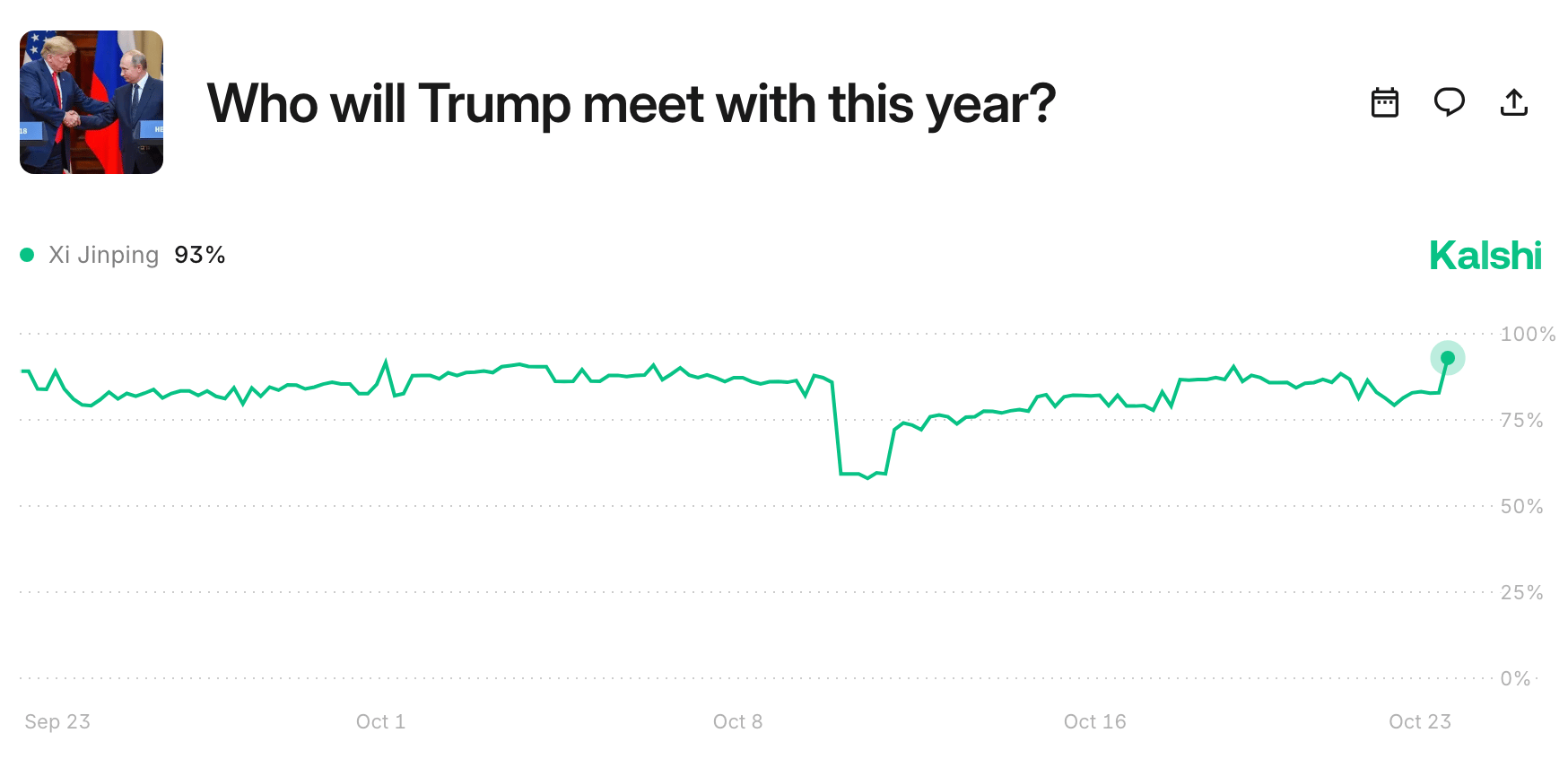

Prediction Markets

Unless the Twitter bug bites him again…

Headline Roundup

Biggest Wall Street banks' CEOs hold most power since 2008 (BBG)

Trump canceled troop deployment to SF after Jensen Huang called (CNBC)

Trump will meet China's Xi Jinping next week in South Korea (BBG)

US terminated all trade talks with Canada (BBG)

Argentina President Milei will meet with Jamie Dimon (RT)

Global hedge funds AUM hit $5T, with most number of firms since 2015 (RT)

Private credit begins sacrificing secrecy to draw in retail cash (BBG)

KKR's Henry Kravis sees no systemic risk in private credit (BBG)

Fed reserves fell for a second week, putting QT in focus (BBG)

Japan inflation rose to 2.9% YoY (CNBC)

Investors trimmed allocations to real estate for first time in thirteen years (FT)

AI adoption in healthcare is twice as fast as wider economy (FRB)

Fannie Mae's CEO exited ahead of its potential IPO (BBG)

Beyond Meat's meme-stock resurrection sparks retail trading record (BBG)

FINRA probes broker-dealers amid rise in pump-and-dumps (BBG)

Porsche hit reverse on EV push as new CEO shifts back to petrol (FT)

Rivian will pay $250M to settle IPO fraud lawsuit (RT)

Rivian will cut 600 jobs (BBG)

Target will cut 1000 roles in corporate (BBG)

FBI arrested NBA players and coaches in sports gambling probes (BBG)

CFA Level III pass rate rose to 50% (BBG)

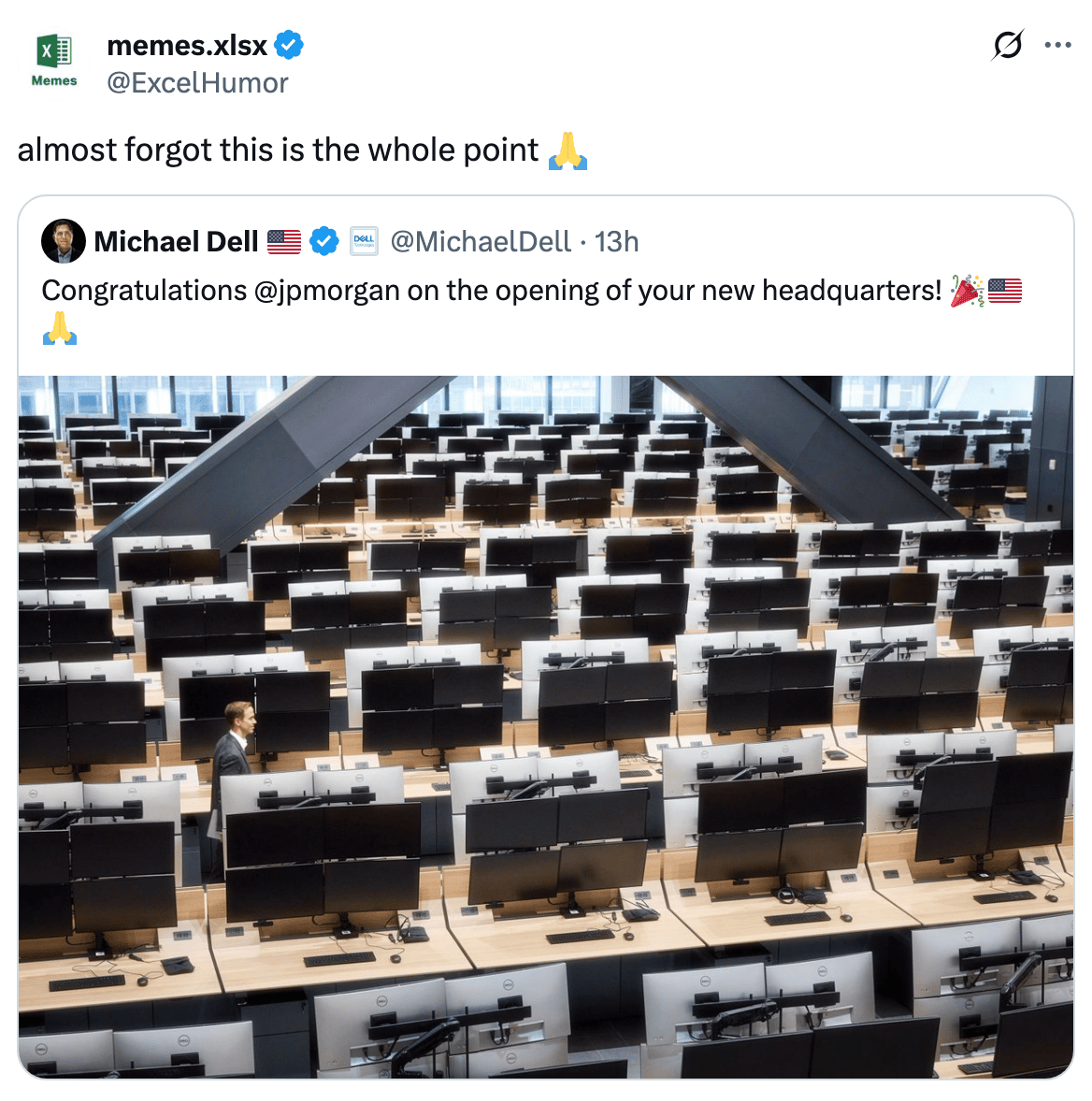

JPMorgan's new HQ is officially open (BBG)

A Message from Mizzen+Main

"I legit love my Mizzen+Main shirts!" – Hank, CEO of Litquidity

Fall szn means it's time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don't stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey T-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant – so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use code EXECSUM and take $35 off any order of $125+ today!

Deal Flow

M&A / Investments

Paramount Skydance is leading the race to acquire Warner Bros. Discovery despite numerous ~$60B offers being rejected; Apple, Netflix, and Comcast are among other suitors

PE firms Advent and TA Associates are exploring a sale of utility management and billing company Conservice at a $4.5B-$5B valuation

Japan's top power generator JERA agreed to buy US shale gas assets from pipeline operator Williams and GeoSouthern Energy and Williams JV GEP Haynesville II for $1.5B

Goldman Sachs is nearing a deal for a majority stake in talent agency Excel Sports Management at a $1B valuation

OpenAI acquired Software Applications, a startup building an AI-powered UI for Mac

Top VC picks by Fundable

AI data center startup Crusoe raised a $1.4B Series E at a ~$10B valuation led by Valor Equity Partners and Mubadala

Battery recycling startup Redwood Materials raised a $350M Series E at a $6B valuation led by Eclipse

Chainguard, a startup delivering hardened, secure, and production-ready builds of open source software, raised $280M in growth financing from General Catalyst

UnifyApps, an enterprise OS for AI, raised a $50M Series B led by WestBridge Capital

ChipAgents, a chip design and verification platform, raised a $21M Series A led by Bessemer Venture Partners

Riff, a European platform for companies to build and launch high-impact applications, raised a $16M Series A led by Northzone

CipherOwl, a startup building AI-based on-chain compliance for financial institutions, raised a $15M seed round led by General Catalyst and Flourish Ventures

Darwin AI, a startup helping governments adopt AI responsibly, raised a $15M Series A led by Insight Partners

GammaTime, a premium micro-drama streaming platform, raised a $14M seed round led by vgames and Pitango

Clerq, a startup modernizing payments for high ticket transactions, raised $21M in funding, including a $12M Series A led by 645 Ventures

WSense, an Italian ocean tech startup, raised an $11.5M pre-Series B led by Indico Capital Partners and SIMEST

Generation Lab, a startup using DNA methylation to predict biological age, raised an $11M seed round led by Accel

Cybrid, a platform providing compliant stablecoin and fiat payment infrastructure, raised a $10M Series A led by BDC Capital

Natural, a fintech startup creating the core infrastructure for AI-driven financial transactions, raised a $9.8M seed round led by Abstract and Human Capital

AI inference platform Tensormesh raised a $4.5M seed round led by Laude Ventures

Stay fully up-to-date on everything VC and startups here.

IPO / Direct Listings / Issuances / Block Trades

Canadian investment firm Onex plans to IPO Canadian airline WestJet in two years

SPAC / SPV

Power plants developer One Nuclear Energy agreed to merge with Hennessy Capital Investment Corp. VII in a $1B deal

Debt

EU leaders failed to back a $160B loan to Ukraine using frozen Russian state assets following opposition from Belgium

Mexico raised a record $41B in hard-currency sovereign bonds to become this year's top EM borrower, with much meant to prop up indebted state oil company Pemex

Banks led by JPMorgan and Japan's MUFJ are preparing to launch a $38B debt offering to help fund data centers tied to Oracle

Versant Media Group raised $2B in leveraged debt to fund a payment to parent Comcast as part of its spinoff

South Korea sold $1.7B of samurai and dollar bonds to bolster FX reserves

Malaysian conglomerate Genting Group's plan to sell hotel and non-casino assets at New York's Resorts World Catskills was put on hold until January, delaying a $560M munis sale

Bill Ackman's hedge fund Pershing Square raised $500M in its first dollar-bond sale since 2021

Norwegian shipping firm CMB Tech canceled a $300M bond sale on pricing disagreements

Soccer club Sporting Lisbon raised $260M in its biggest bond sale yet

Bankruptcy / Restructuring / Distressed

Lenders including Pemberton, Blue Owl, and Hayfin are taking over Cinven-owned telecoms supplier Netceed

Bankrupt subprime auto lender PrimaLend attributed troubles to slowing auto sales among customers with poor credit

Lenders including BlackRock and Veritas Capital hired advisors to negotiate a debt deal with Clearlake-backed cybersecurity firm RSA Security

Troubled crypto custodian Fortress Trust received a cease-and-desist order in Nevada amid an imminent insolvency

Fundraising / Secondaries

Canadian alternative investments firm Dawson Partners raised $7.7B for its sixth portfolio finance fund

US established a new $5B fund to invest in critical minerals alongside Orion Resource Partners and Abu Dhabi's ADQ

UK PE firm BC Partners raised $2.1B for its new flagship fund

UK PE and infrastructure investor Foresight Group raised $120M for its third dedicated North West regional investment fund

Goldman Sachs Asset Management partnered with MSCI on an ETF targeting returns to 'mimic' a PE portfolio

Crypto Sum Snapshot

Crypto M&A surged 30x as niche firms shift to mainstream

Trump pardoned Binance founder CZ

Trump may not need Congress' approval for a crypto legislation win

Alleged 'Trump insider whale' closed a $200M Bitcoin short

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Email was just the beginning. beehiiv is hosting their Winter Release 2025 on November 13th to unveil a bunch of new stuff for the creator ecosystem. A must-watch for anyone in social media and content creation. Reserve your spot here.

Ben Carlson uncovered the stark reality of the challenge of stock-picking: Less than 10% of S&P 500 stocks outperform the market.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.