Good Morning,

Two Sigma staff hid assets for its founder's divorce, Ken Griffin said GenAI doesn't help produce alpha, CME is launching sports contracts, Jefferies' stock tanked, 777 Partners' co-founder was charged with fraud, and anti-DEI crusader Robby Starbuck was invited to speak at the biggest HR lobby event.

Let's dive in.

Before The Bell

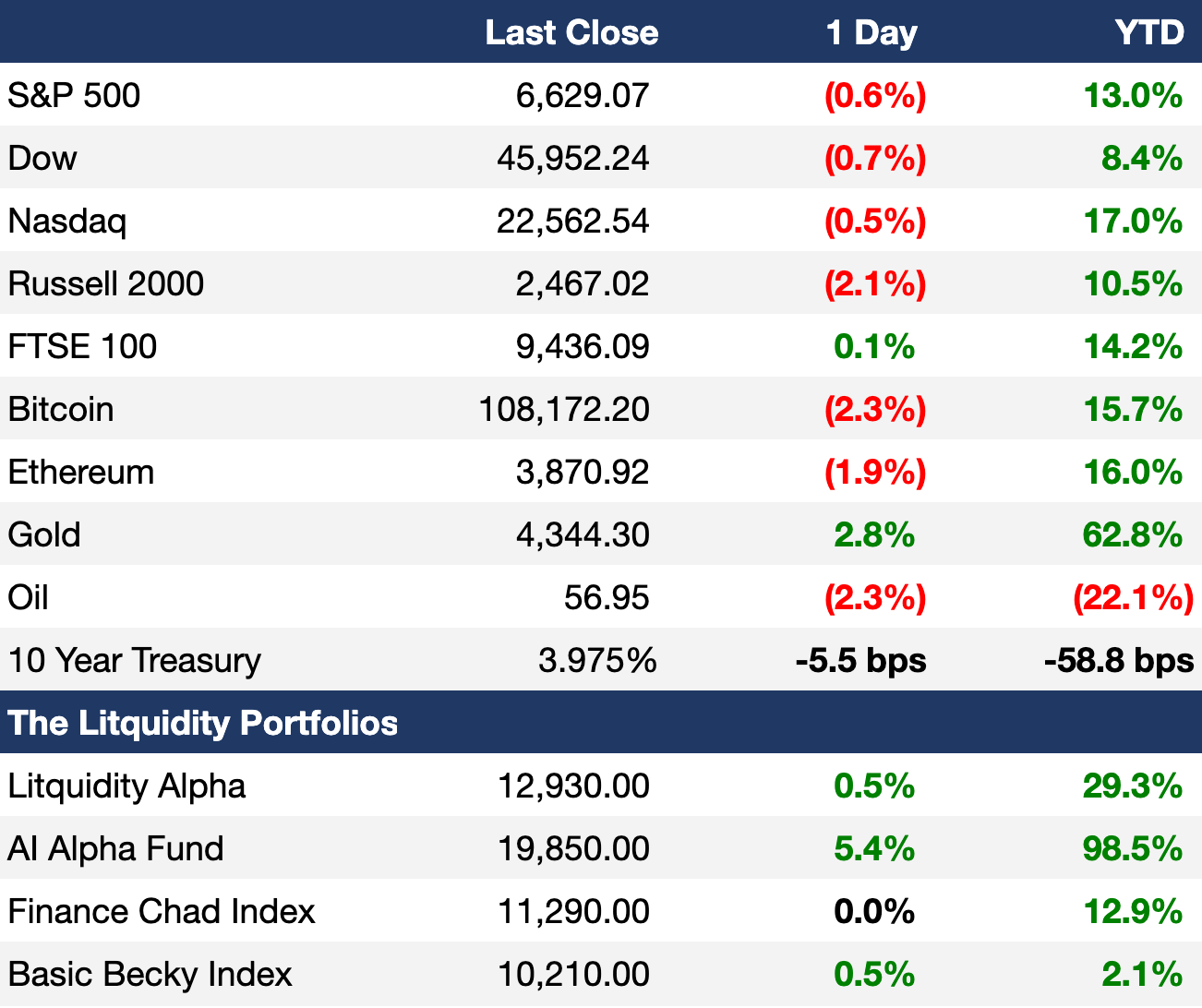

As of 10/16/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed lower yesterday on worries of worsening credit at regional banks

Nasdaq Banks index plunged 5.6%

South Korea's KOSPI index hit a new ATH high on trade deal optimism

US 10Y yield fell below 4% to a YTD low

US 2Y yield slid to 3.4% to the lowest since September 2022

Gold and silver surged to new ATHs

Gold is up 63% YTD

Earnings

Charles Schwab beat Q3 earnings and revenue estimates as total net new assets surged 48% to $134B on strong retail investor demand; daily average revenue trades also jumped 30% to $7.4T, fueling record revenue (BBG)

What we're watching this week:

Today: State Street, American Express, Truist, Fifth Third Bank

Full calendar here

Prediction Markets

There's always next year.

Headline Roundup

Ken Griffin says GenAI doesn't help hedge funds produce alpha (BBG)

Ten loss-making AI startups have gained $1T in value this year (FT)

Trump will meet with Putin again (BBG)

Jefferies stock tanked as credit concerns grow on Wall Street (CNBC)

Fed reserves fell below $3T putting QT in focus (BBG)

US will offer auto tariff relief after lobbying push (BBG)

Australia unemployment hit a four-year high (RT)

Traders at top hedge funds take home 25% of profits (FT)

US IPO candidates have only four viable weeks to list this year (BBG)

Private credit is on defensive again over 'mark-to-myth' study (BBG)

Big investors scale back risky bond exposure after storming rally (FT)

Europe's biggest firms soar on earnings, setting tone for season (BBG)

Europe's IPO wave puts discount math at top of buyer checklists (BBG)

Over 200 firms are planning Hong Kong listings (BBG)

JPMorgan is shopping for banks in Europe and Latin America (RT)

Citadel Securities is seeking to expand in India (BBG)

Goldman's global co-head/CIO of public investing will retire (RT)

'Google backstop' adds new twist to data center financing frenzy (BBG)

777 Partners' co-founder Josh Wander was charged with $500M fraud (BBG)

CME will launch sports contracts to compete with Kalshi (BBG)

Webull is offering corporate bond trading to US clients (BBG)

Credit card data shows slowdown in consumer retail spending (BBG)

Rare earth firms boost lobbying as US expands investments (RT)

Major US business group sued over $100k H-1B visa fee (RT)

UBS and HSBC hire aggressively in $8T Taiwan wealth market (BBG)

US canceled a $500M tender for cobalt (BBG)

Wife of Two Sigma's founder said firm hid husband's assets in divorce (BBG)

Anti-DEI crusader Robby Starbuck will speak at biggest HR lobby event (WSJ)

A Message from Vero3

How Wyoming Will Become A Lithium Powerhouse

America needs 5X more Lithium by 2035, yet no new mines have opened since 1967. Validated by $25M in funding, Vero3’s Wyoming site can cleanly produce Lithium, create water, and store carbon, tackling $400B+ in combined markets at once. And with a Nasdaq IPO planned for 2028, you can invest today.

This is a paid advertisement for Vero3 Limited’s Regulation CF offering. Please read the offering circular at https://invest.vero3.com/. Timelines are subject to change. Listing on the NASDAQ is contingent upon necessary approvals, and reserving a ticker symbol does not guarantee a company’s public listing.

Deal Flow

M&A / Investments

Spanish lender BBVA failed in its $19B hostile takeover bid for peer Sabadell, ending an 18-month takeover battle

UK investment firm Baillie Gifford is seeking co-investors to acquire a stake in European app investor Bending Spoons at a $12B valuation

PE groups Carlyle and Boyu Capital are the lead bidders for a majority stake in Starbucks' China business, which could fetch a $4B valuation

Private markets investment firm StepStone Group and European real estate investor Greykite acquired an 80% stake of Spanish care-home provider Vitalia from European PE firms CVC and Portobello Capital for $1.75B

Electronic components maker Molex Electronic agreed to acquire UK engineering company Smiths Group's interconnect unit for $1.75B

Austria's Vienna Insurance Group agreed to acquire German rival Nuernberger Beteiligungs for $1.6B cash

PE firms CVC and Advent are in talks for Canadian financial services group Canaccord Genuity's UK wealth arm, which could sell for $1.4B

Consumer goods company Mammoth Brands agreed to acquire premium baby care brand Coterie for over $1B

Franchisee Yadav Enterprises acquired Mexican fast-food chain Del Taco from burger chain Jack in the Box for $115M cash

Crypto exchange Kraken acquired a US-licensed futures exchange Small Exchange from IG Group in a $100M cash-and-stock deal

Top VC picks by Fundable

Yogurt maker Chobani raised a $650M round at a $20B valuation

Indian quick commerce startup Zepto raised a $400M round at a $7B valuation led by CalPERS

Upgrade, a fintech startup offering credit and banking products, raised a $165M Series G led by Neuberger

Video game clip sharing platform Medal spun out a new AI lab General Intuition, which raised a $134M seed round led by Khosla Ventures and General Catalyst

Kuku, an Indian storytelling platform backed by Google, raised an $85M Series C at a $500M+ valuation led by Granite Asia

Wild Bioscience, a startup developing climate resilient crops, raised a $60M Series A led by the Ellison Institute of Technology

Autonomous delivery company Starship Technologies raised a $50M Series C led by Plural, Karma.vc, Latitude, and more

Stand Insurance, a startup reimagining insurance for catastrophe-exposed properties, raised a $35M Series B led by Eclipse

ExaCare AI, a company building an AI platform for post-acute care facilities, raised a $30M Series A led by Insight Partners

OneLayer, a private 5G management and security startup, raised a $28M Series A led by Maor Investments

Conceal, a startup building a browser-native security service edge platform, raised a $26M Series B led by Two Bear Capital

Hardware development startup Encube raised a $23M round from Inventure, Promus Ventures, and Kinnevik

Second Nature, a sales and service AI roleplay platform, raised a $22M Series B led by Sienna VC

UPCITI, an OS for cities, raised a $20M Series A led by Notion Capital

Strella, a customer research platform, raised a $14M Series A led by Bessemer Venture Partners

Autonomous delivery logistics platform Airbound raised an $8.7M seed round led by, of Physical Intelligence co-founder Lachy Groom

Temple Digital Group, a startup building a privacy-focused trading platform for digital assets, raised a $5M seed round led by Paper Ventures

AI business creation platform Appy.AI raised a $5M seed round led by Four Rivers and Founder Collective

Space Quarters, a space construction startup, raised a $5M seed round led by Frontier Innovations

Stay up-to-date with your industry, competition, or trend of choice. Access the complete startup ecosystem here.

IPO / Direct Listings / Issuances / Block Trades

Insurance tech firm Exzeo is looking to raise $175M at a $2B valuation in an IPO

Chemicals giant DuPont approved the spinoff of its electronic business Qnity Electronics

SPAC / SPV

Ripple Labs is leading an effort to raise $1B to accumulate XRP in a new digital-asset treasury

Newsmax is launching a $5M cryptocurrency reserve to buy Bitcoin and a Trump meme coin

Debt

Meta and Blue Owl sealed a $30B private credit and equity deal for the Louisiana Hyperion data center; Meta and Blue Owl will split ownership 20%-80%

Silver Lake, Affinity Partners, and PIF are adding over a dozen banks to its underwriting group to finance their $55B LBO of video game giant Electronic Arts after JPMorgan committed $20B in leverage loans

JPMorgan, Bank of America, Goldman Sachs, and Citigroup are in talks with US to provide $20B in bailout loans to Argentina

Deutsche Bank and Goldman Sachs are among banks looking to sell $1.2B of debt to finance PE firm Apax's $2B buyout of a unit of UK financial software company Finastra

Spanish lender Santander is seeking a SRT tied to $1.2B of LBO debt and corporate loans

Varde Partners-backed Spanish online lender WiZink Bank is planning a SRT tied to $640M in credit card loans

Energy company ChemOne is seeking $600M in private credit to fund CapEx

Japanese e-commerce giant Rakuten sold a $550M local perpetual callable bond at a 4.69% YTM, the highest in Japan this year

Peruvian electricity company Luz del Sur raised $400M in its first-ever international bond sale

Tokyo plans to raise $330M in its first-ever climate resilience bond sale

Bankruptcy / Restructuring / Distressed

US is seeking an independent bankruptcy probe of the collapse of auto parts supplier First Brands

Fundraising / Secondaries

French PE firm Ardian raised $20B for its flagship infrastructure platform targeting energy, transport, and digital infrastructure

Bain Capital raised $14B for its fourteenth flagship PE fund

Activist hedge fund Elliott is raising $7B for its latest drawdown fund

European real estate investor Greykite raised $1.4B for its debut fund

Hedge fund D1 Capital Partners plans to raise over $1B for a new PE fund in a private markets push

AI-focused VC Radical Ventures raised $650M for its sixth fund to invest in early-stage AI

Small cap software-focused PE firm K1 Investment Management raised $160M for a continuation vehicle for enterprise software firm TeamDynamix led by SQ Capital

Crypto Sum Snapshot

YouTuber MrBeast is launching MrBeast Financial to foray into fintech, crypto, and banking

Trump's second term fuels a $1B crypto fortune for his family

Chinese firm Bitmain is giving a Trump crypto firm preferential access to tech

Strategy resumed Bitcoin buying at record highs

Crypto Sum summarizes the most important news on everything crypto. Read it here.

Exec’s Picks

LinkedIn release their list of the Top Startups of 2025. Some familiar and not-so familiar names. See the list here.

Nick Maggiulli wrote a deeply introspective piece on the purpose of wealth.

Upcoming Events 🌴

UpSlide × Litquidity Happy Hour – Monday, October 20, NYC

Come hang out for some drinks and conversation Monday after work! We'll be at Loreley Beer Garden in the LES. RSVP here🍻

Powered by Palm & Park

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.