Good Morning,

Markets are open for another shortened trading week before we head out for New Years. Whether you're taking the week slow, are back in the office, or never left the office, we've brought you all crucial market updates (and memes) from the long weekend to get you up to speed.

Happy holidays! 🎉

Let's dive in.

Before The Bell

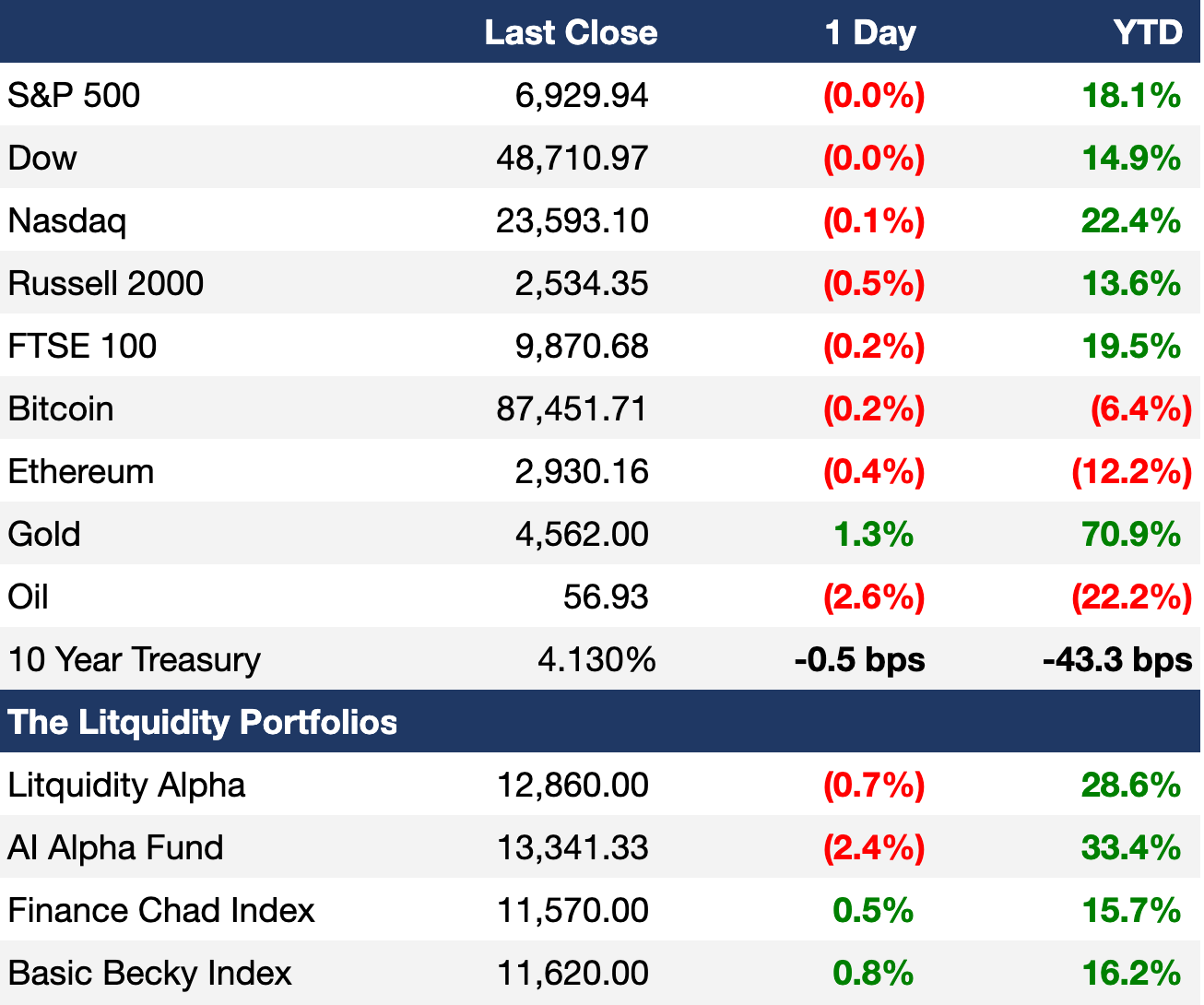

As of 12/26/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks notched fresh ATHs last week as a 'Santa rally' came to fruition

S&P notched its best week in a month

Europe's Stoxx 600 hit a fresh ATH

US high-yield spreads are trading at 275 bps near 25-year lows

Italy-Germany and Spain-Germany 10Y yield spreads narrowed to 70 bps and 50 bps respectively to a sixteen-year low as 'periphery' EU markets rise

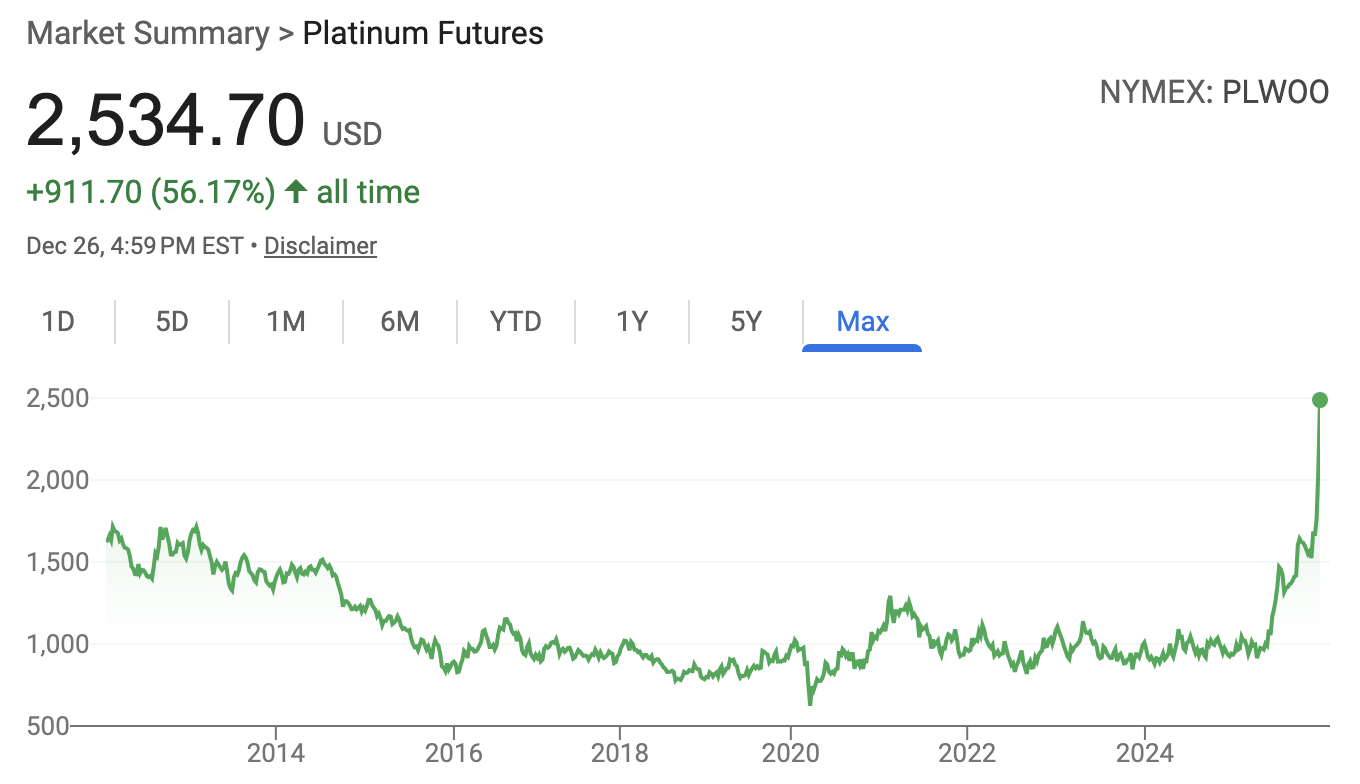

Gold, silver, and platinum rocketed to new ATHs as geopolitical concerns spurred safe-haven (and speculative??) buying

The metals are up 71%, 167%, and 169% YTD respectively

Palladium climbed to a three-year high

Dollar posted its worst week since June

The metals surge: visualized

Earnings

Full calendar here

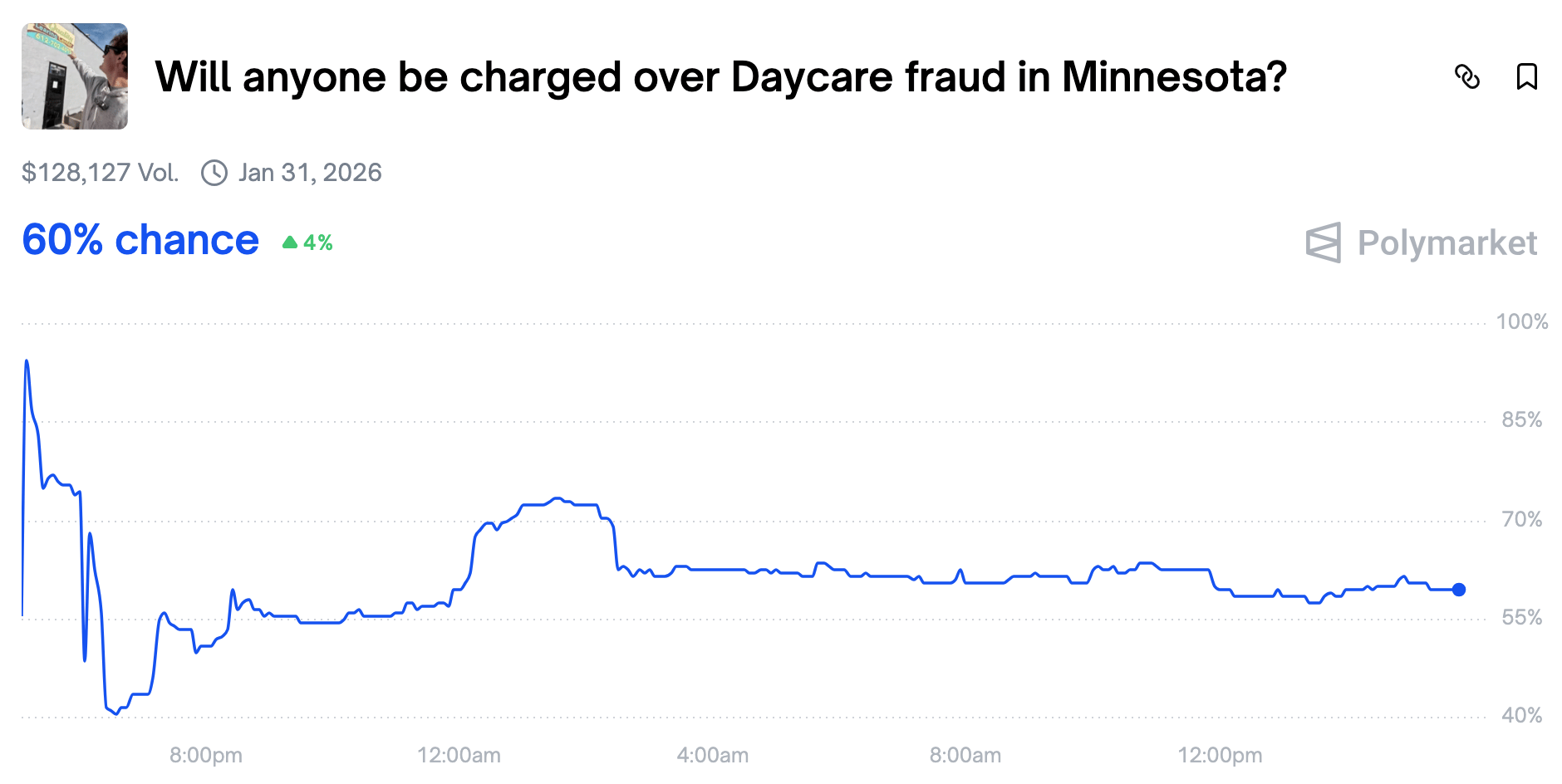

Prediction Markets

A complete embarrassment and even more embarrassing that the odds are not already 100%

Trade the fate of alleged fraud schemes on Polymarket.

Headline Roundup

Trump met with Zelensky after 'productive' call with Putin (BBG)

Japan will slow pace of QT (BBG)

Investors warn of 'rot in PE' as funds strike circular deals (NYT)

PE has more housecleaning to do in 2026 (WSJ)

PE GP stake sales are set to climb after record year (WSJ)

LPs bet on smaller MM PE funds as industry slows (FT)

Tech firms moved $120B of AI debt off balance sheets via SPVs (FT)

Global dealmaking hit $4.5T in second-best year ever (FT)

US tech billionaire's net worth surged by $550B this year on AI boom (FT)

AI startups amassed a record $150B in funding this year (FT)

Family offices are the new power players on Wall Street (WSJ)

Investor risk could rise as crypto and private credit go mainstream (RT)

Mutual funds shed $1T in eleventh-straight annual outflow (BBG)

Retail inflows are set to break records this year (RT)

Banks and traders race to capitalize on gold's historic rally (FT)

Japan small IPOs fell to a twelve-year low amid market reforms (BBG)

Apollo separated its lending unit from its buyout unit (FT)

Goldman Sachs BDC is struggling to clean up soured bets (WSJ)

15% of FTSE 100 firms replaced their CEO (FT)

Goldman Sachs client data was exposed in law firm data breach (BBG)

North Sea suffers worst year since 1970s as drillers freeze investment (FT)

Luxury brands push into mass-market sports despite shift to exclusivity (FT)

US and EU are officially beefing on free speech and tech regulations (BBG)

Tech billionaires and Congressman Khanna are beefing on a wealth tax (FRT)

A Message from Litquidity

We officially got a Santa rally this Christmas with markets (except crypto) notching fresh record highs last week 📈🛷🎅. Hopefully, the momentum continues into the new year.

But while we're still in cruise control mode for the holidays, I wanted to remind you guys of what the Litquidity community is up to so we can continue building together in 2026.

We're here to deliver memes, news, jobs, and deals and we're excited to head into the new year with you all.

Advertising & Partnerships

Exec Sum would not be possible without the continued support from our sponsors. As such, we're always looking to partner with exciting brands looking to reach a highly-engaged and lucrative professional audience. We have the strongest engagement and conversion through our premium offerings and trusted brands.

We're also expanding our offerings by working directly with select startups on end-to-end launch and GTM campaigns.

Interested in advertising with Litquidity to reach over 2M unique individuals? Fill out our partnership form here.

Litquidity Ventures

We've been on an absolute tear securing primary allocations into high-profile funding rounds led by Tier 1 VCs, as well as allocations into late stage opportunities with incredible demand. Some of our representative investments include Perplexity, Bezel, Autopilot, SpaceX, Beehiiv, Forterra, and Harbinger Motors (among many others).

If you're an accredited investor or qualified purchaser and want to gain access to the deal flow, pls fill out this quick form.

If you are a startup currently raising capital and are interested in an investment from Litquidity, pls send an email to [email protected]

Litney Partners – Financial Services Recruiting

If your firm is currently seeking experienced investment bankers & institutional investors (private equity, hedge funds, credit, etc), shoot me an email at [email protected] so we can find a way to work together!

If you are a candidate looking for a job across IB, PE, VC, hedge funds, credit, family offices, and Corp Dev, drop your resume at our portal and we'll be in touch with relevant opportunities!

Palm & Park – Events

If you're looking to organize exclusive happy hours, private dinners, padel, and wellness events to build community and network with founders, investors, and dealmakers, check out Palm & Park, a new events business I co-founded earlier this year to connect with our vast network IRL. Learn more here.

Work for Litquidity

I am looking for a handful of interns and contributors who are interested in creating content and writing for Litquidity Media. If you're interested in learning more about working for me, feel free to reach out at [email protected]. Stay tuned for more info on openings and applications!

Deal Flow

M&A / Investments

Nvidia will acqui-hire AI chip startup Groq's assets and exec team in a $20B deal

A consortium led by KKR and PAG will acquire Japanese brewery Sapporo Holdings' real estate unit Sapporo Real Estate for $3B, including debt

Honda agreed to buy out Korea's LG Energy Solution's facilities and other assets from their JV battery plant in Ohio for $2.9B

Indian IT services firm Coforge agreed to buy data analytics provider Encora in a $2.35B all-stock deal

French pharma giant Sanofi will acquire biotech Dynavax Technologies for $2.2B at a 40% premium

China's Jiangxi Copper agreed to buy Australian copper miner SolGold at a $1.17B values, representing a 43% premium

Blackstone will acquire Hamilton Island in Australia's Great Barrier Reef from the Oatley family for $810M

UK investment firm LCM Partners agreed to acquire UK's Secure Trust Bank's consumer vehicle operations for $620M

Saudi's Prince Alwaleed bin Talal is close acquiring a 75% stake in Saudi soccer team Al Hilal from SWF PIF at a $530M valuation

Indian conglomerate Bharti Enterprises and PE firm Warburg Pincus will acquire a 49% stake in home appliance maker Haier Smart Home's India unit

VC

Advance, a fintech platform for insurance premium banking and payments, raised a $7.3M seed round

Indian merchant SaaS platform Mintoak Innovations raised a $6M Series A2 from PayPal Ventures and Pravega Ventures

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Activist hedge fund TOMS Capital built a stake in $40B-listed retailer Target

Infrastructure investor Stonepeak and Canada's CPPIB will launch an offer to acquire a 26% stake in lubricant giant Castrol's $2B-listed India unit, following their deal to acquire Castrol from UK oil giant BP at an $8B valuation

AI-powered fleet management firm Motive Technologies is planning to IPO

Debt

Nigeria secured a $1.2B loan from UAE

Senegal raised $1B in a regional bond sale

Bankruptcy / Restructuring / Distressed

Creditors to distressed Chinese developer Vanke agreed to extend the grace period of another note to help avert a default

Fundraising / Secondaries

China launched a national fund to channel state-backed money into early-stage tech startups

Crypto Sum Snapshot

Crypto M&A is running at record pace with more expected in 2026

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec's Pics

FWIW: We curated a gift guide of the perfect gifts you can buy for loved ones this holiday season or beyond. The curation is thoughtfully appropriate with choices for everyone and we've even secured discounts for Exec Sum readers where possible. Check it out here.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.