Together with

Good Morning,

Intel's CEO resigned, Pershing Square will delist from Amsterdam, JPMorgan's chair of IB is retiring, Jane Street accused an ex-trader of calling Millennium trades 'dumb,' and Enron seemingly revived itself in the most mysterious come back ever.

Invest in institutional-caliber private markets with 10 East, a membership-based investment platform offering targeted exposure to PE, VC, and more.

Let's dive in.

Before The Bell

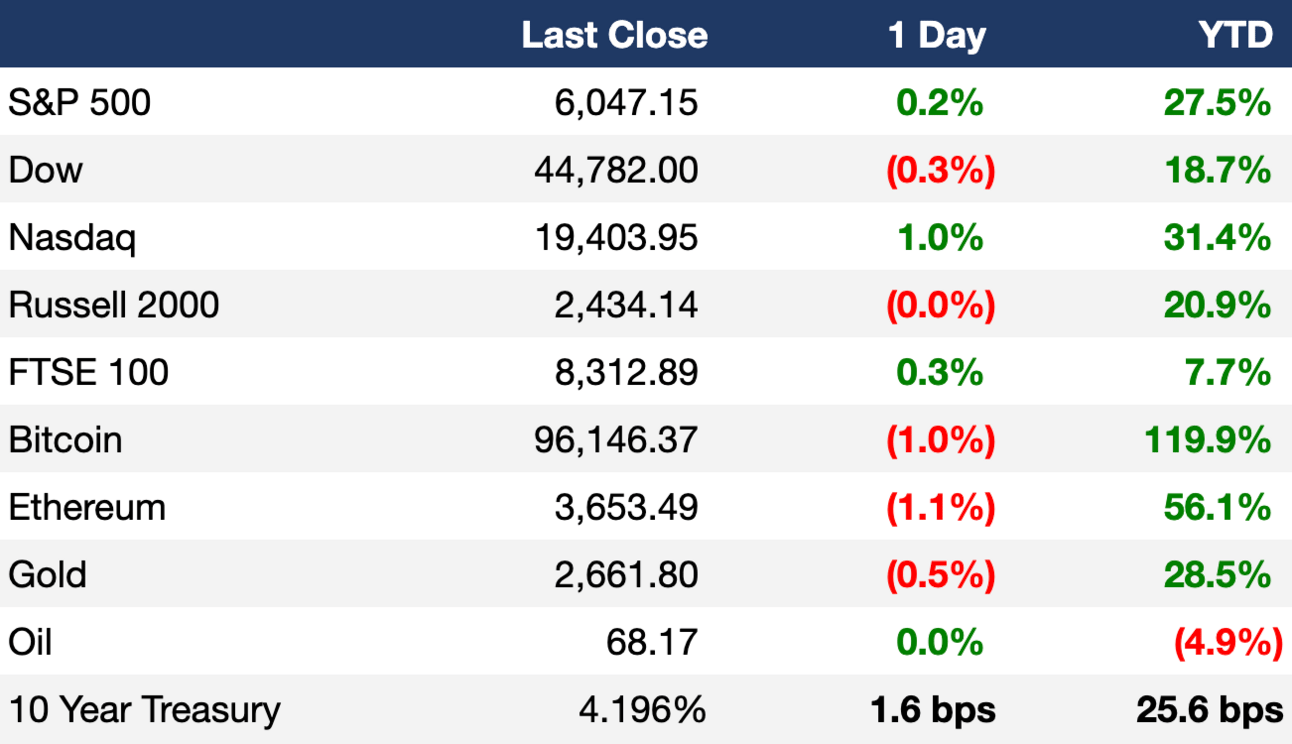

As of 12/2/2024 market close.

Markets

US stocks rose on the back of tech as investors await this week's economic data

S&P and Nasdaq closed at new ATHs

China 10Y yields slipped below 2% to the lowest in 22 years

Yuan fell to a one-year low versus the dollar amid Trump tariffs threat

Yen rose to a six-week high on growing bets for BOJ rate hikes

Earnings

What we're watching this week:

Today: Salesforce

Wednesday: Dollar Tree, RBC

Thursday: lululemon, TD Bank Group, Dollar General, Kroger

Full calendar here

Headline Roundup

Fed officials keep options open for December rate decision (BBG)

US manufacturing orders grew for the first time in eight months (RT)

JPMorgan's global chair of IB will retire after forty years (BBG)

Corporates launched $56B in leveraged loans to smash daily record (BBG)

Hedge funds are up 10.6% YTD on heels of Trump rally (RT)

Hedge fund all-or-nothing trades gain traction in options market (BBG)

Bill Ackman's Pershing Square will delist from Amsterdam (RT)

Hedge fund Paloma is offering IOUs to fleeing investors (WSJ)

Indian insurers requested zero-coupon bonds to manage long-term risks (BBG)

Musk sued to block OpenAI from becoming for-profit (CNBC)

Intel CEO Pat Gelsinger was ousted by the board (CNBC)

Jane Street says ex-trader mocked Millennium before joining (BBG)

UK's regulator opened the door to Shein London listing (FT)

Canada's HOOPP named OMERS' Annesley Wallace as CEO (BBG)

Commodities giant Cargill plans to cut 8k jobs (RT)

Musk lost his bid to get $56B pay package reinstated (CNBC)

A whistleblower accused Apple of spying on employee's personal devices (RT)

Singapore gets tough on commodity trading after series of scandals (FT)

Fuel oil smuggling network raked in $1B for Iran and its proxies (RT)

Chinese EV giant BYD has been building Apple products (WSJ)

EU births fell to a new record low (FT)

A Message from 10 East

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

EQT and Singapore SWF GIC will acquire a majority stake in UK energy metering firm Calisen from a consortium of BlackRock's GIP, Goldman Sachs Alternatives, and Mubadala at a ~$5.1B valuation

Denmark will acquire an additional ~59% stake in Copenhagen Airports from Danish pension fund ATP for $4.5B to boast a to 98.6% stake

$2.4B-listed French payments group Worldline attracted takeover interest from Bain Capital and others

ExxonMobil is weighing a sale of its Singapore gas stations for $1B

China Mobile made a takeover bid for Hong Kong broadband provider HKBN at an $882M valuation

Australia-based Pacific Equity Partners will acquire Singapore Post’s Australian business Freight Management in a $651M deal, including debt

Middle East's largest poultry producer Alwatania is exploring a sale at $532M valuation

KKR and hedge fund Baupost acquired a portfolio of 33 UK Marriott-brand hotels from Abu Dhabi SWF ADIA

Qatar SWF QIA will acquire a significant minority stake in Audi F1

VC

SpaceX is in talks to sell secondary shares at a $350B valuation

European AI infrastructure firm Nebius raised a $700M funding round from Nvidia, Accel, and Orbis

AI computing startup Tenstorrent raised a $693M Series D at a $2B valuation led by Samsung Securities and AFW Partners

Digital banking provider Lumin Digital raised $160M led by Light Street Capital, NewView Capital, and Partners Group

Public, a multi-asset investing company, raised a $135M Series D-2 led by Accel

Cloud security startup Upwind raised a $100M Series A at a $900M valuation led by Craft Ventures

9fin, an AI-powered analytics platform for credit and DCM, raised a $50M Series B led by Highland Europe

Stablecoin infrastructure platform usdx.money raised a $45M round at a $275M valuation from NGC, BAI Capital, and more

Oxygen-powered wound care startup Inotec raised a $33M Series C led by Amadeus Capital Partners

French medtech Raidium raised a $13M seed round led by Newfund

Polish edtech Coding Giants raised an $8.5M round led by True Global Ventures

HUB2, an Ivory Coast fintech aiming to become the 'Stripe for Francophone Africa', raised an $8.5M Series A led by TLcom Capital

Jotelulu, a Spanish platform supporting IT firms' transition to cloud, raised a $7.5M round led by Kibo Ventures

Teachy, a Brazilian AI-powered workspace for teachers, raised a $7M Series A led by Goodwater Capital

IPO / Direct Listings / Issuances / Block Trades

MicroStrategy raised $1.5B last week via a share sale, as part of plans to buy more Bitcoin

Japanese memory chip-maker Kioxia priced its IPO at a range expected to raise $842M at a $5.4B valuation

Chinese beauty brand Mao Geping Cosmetics is seeking to raise $270M in a Hong Kong IPO

CVC-backed Japanese personal-care business FineToday postponed its IPO, citing market conditions

Debt

Netherlands' public pension Stichting Pensioenfonds acquired a $2.8B portfolio of Dutch mortgages

Nigeria launched a $2.2B Eurobond sale

Jane Street launched a $1B leveraged loan offering

Bankruptcy / Restructuring / Distressed

Castle Water will offer to inject $5.1B equity into troubled UK water utility Thames Water to save it from administration

Canadian real estate developer Groupe Mach's investment arm is in talks to help rescue troubled EV bus manufacturer Lion Electric

UK FMCG distributor Supreme bought tea brand Typhoo Tea from administration in a $13M deal

Fundraising

UK asset manager Schroders raised over $2B for its semi-liquid PE fund

Crypto Corner

Ripple's XRP token surpassed a $150B market cap to become the third-largest crypto (BBG)

South Korea retail crypto trading is outperforming the country's entire stock market (CT)

Coinbase will allow crypto purchases with Apple Pay in third-party apps (TC)

Coinbase policy chief expects speedy approval of crypto laws following Trump victory (CNBC)

Japanese crypto exchange DMM Bitcoin will shut down after $300M hack (DC)

Exec’s Picks

Exactly 23 years after its bankruptcy, Enron has revived teasing a bold vision for everything from renewable energy and infrastructure investments to merch. I honestly can't tell what the 7-day countdown leads to but maybe one of ya'll might get the hint…

In 2024, there's no reason for your portfolio companies to be wasting time on financial busywork. Ramp's all-in-one platform allows firms to fully automate all financial operations to improve efficiency and profitability across the board. Automate your financial operations with Ramp, the FinOps platform trusted by hundreds of PE and VC firms.

In case you missed it, we recently published our 2024 holiday gift guide. We’ve got a broad selection of items for the gents, ladies, and even pets! Ignore the generic, mass-market gift guides out there because this one has been carefully curated for our subscribers who enjoy the finer things in life 🤝.

FT published their Big Read on why America's economy is soaring ahead of its rivals.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.