Together with

Good Morning,

A rare slow weekend in the finance world as markets digested the heated Trump-Musk breakup…

Some interesting reports nonetheless, with Korean retail traders taking an activist stance, Europe markets gaining steam, and Texas suing BlackRock and Vanguard for colluding.

Accelerate and streamline your M&A workflows like never before with SS&C Intralinks. Learn more below!

Let's dive in.

Before The Bell

As of 6/6/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied on Friday as traders digested strong labor market data

S&P closed at its highest since February

Hedge funds hiked bullish oil bets to the most in five months amid Canada wildfire risk

Silver hit a thirteen-year high

Platinum hit a three-year high

Earnings

What we're watching this week:

Tuesday: GameStop

Wednesday: Oracle, Chewy, Victoria's Secret

Thursday: Adobe

Full calendar here

Prediction Markets

< 2% is still ambitious

Headline Roundup

Trump has no plans to speak to Musk as feud persists (RT)

US added 139k jobs in May (BBG)

China saw deflation for a fourth-straight month (CNBC)

Europe small-caps outshine US as investors bet on growth revival (FT)

Germany corporate earnings are set to outpace US on defense boom (BBG)

US-Eurozone credit spreads hit the widest since pre-Covid (FT)

Apollo eyes Germany as Europe private credit heats up (BBG)

Corporate cash levels are starting to fall (BBG)

PE firms overhaul exit strategies as IPO market slams shut (FT)

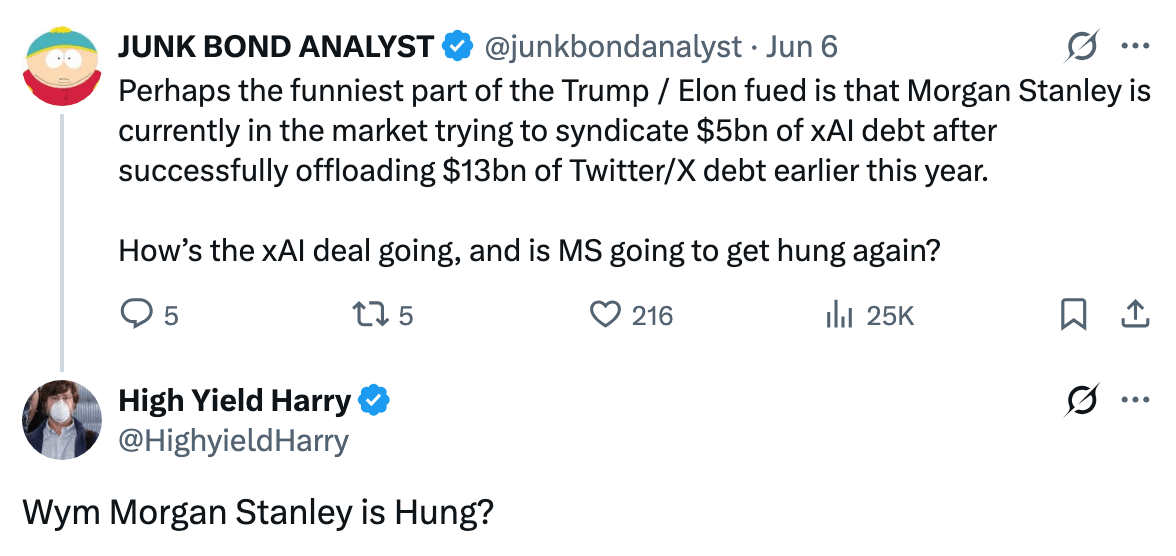

Junk bond sales surged to the highest since October (FT)

EM bond sales this year hit the fastest pace in four years (BBG)

US money market funds saw the largest inflows YTD (RT)

Asian equities saw the largest monthly foreign inflow in 15 months (RT)

Stock funds soared 6% in May (WSJ)

UK finance leads in foreign investment yet deals fall across Europe (BBG)

China approved some exports of rare earths ahead of talks with US (BBG)

Elliott called for Sumitomo Realty improvements in rare public letter (BBG)

Activist retail investors take on Korea's corporate laggards (BBG)

Global funds bet on Korean stocks' big break on reform tailwinds (BBG)

Asset managers jump back into Brazil's battered stock market (BBG)

B. Riley Financial wins Nasdaq extension to head off delisting (BBG)

xAI anticipates a $13B ARR by 2029 (BBG)

Texas sued BlackRock and Vanguard for alleged collusion (BBG)

Hedge funds face scrutiny for buying LA wildfire subrogation claims from insurers (BBG)

US household debt and credit card delinquencies hit an ATH (BBG)

Star PE lawyer Richard Beattie passed away at 86 (WSJ)

A Message from SS&C Intralinks

Experience the only AI-powered platform built to help you outpace the competition.

SS&C Intralinks DealCentre AITM brings speed and precision to every stage of your M&A deal. More than a data room, it accelerates prep and diligence, delivering real-time insights when timing matters most.

No silos, no friction, just one intelligent technology suite designed to elevate your deal team’s performance. Because it’s not just about managing transactions. It's about building momentum and trust — from first pitch to signing.

Don't wait on the market — set the pace with DealCentre AI.

Deal Flow

M&A / Investments

French banking group BPCE and Spanish bank CaixaBank submitted bids for PE firm Lone Star’s 75% stake in Portuguese lender Novo Banco, which could be valued at $6.3B-$8B

Spain's Telefonica and Masorange held informal talks on a potential deal for Vodafone Spain, who was acquired last year by PE firm Zegona for $5.7B

Infrastructure investor Stonepeak is in exclusive talks to buy Malaysian energy infrastructure firm Yinson for up to $2.1B, teaming up with the founding Lim family who owns 26.6%

Goldman Sachs Asset Management will invest $600M equity in Indian conglomerate Jubilant Bhartia Group's $1.5B purchase of a 40% stake in Coca-Cola's India bottling unit

UK retail group Frasers is exploring a bid for UK makeup and skincare retailer Revolution Beauty

VC

Enterprise AI data startup Scale AI is in talks to raise over $10B in funding from Meta

Blockchain platform IOST raised a $21M round led by DWF Labs, Presto, and Rollman

Infisical, an open-source secrets, identity and access management solution, raised a $16M Series A led by Elad Gil

AI security platform Impart Security raised a $12M Series A led by Madrona Ventures

Latent Technology, a startup using AI to create physical animation for video games, raised an $8M seed round led by AlbionVC and Spark Capital

Solidroad, a Irish platform for CX teams to improve customer experience, raised a $6.5M seed round led by First Round Capital

Stride Green, an India climate tech startup providing an asset financing and management platform, raised a $3.5M seed round led by Micelio Technology Fund and Incubate Fund Asia

IPO / Direct Listings / Issuances / Block Trades

Crypto exchange Gemini confidentially filed for an IPO

Hong Kong-based Link REIT is considering a Singapore IPO for its non-China and non-Hong Kong assets

Debt

UK PE firm Rosebank Industries plans to raise $1.55B to finance its $1.9B acquisition of US-based Electrical Components International

Barclays, Citigroup, RBC, and Deutsche Bank launched a $1.5B loan to support PE firm Silver Lake's ~$8.75B acquisition of a majority stake in Intel's programmable chips unit Altera

Bankruptcy / Restructuring / Distressed

Hedge funds Silver Point and Elliott are working on a $13.5B rescue plan for struggling UK utility Thames Water after KKR walked away

Brazilian airline Gol exited chapter 11 with plans to expand internationally

Mining giant Rio Tinto is seeking a multibillion-dollar government bailout for its Tomago aluminum smelter, Australia's largest electricity user, due to rising energy costs

Warburg Pincus-backed Solar Mosaic filed for Chapter 11 bankruptcy and secured $45M in DIP financing to fund operations during restructuring

Bankrupt banking fintech Synapse requested to convert its Chapter 11 case to liquidation or dismiss it after failing to find a buyer for its assets

Telecommunications services firm EchoStar is considering filing for Chapter 11 filing amid FCC review

Fundraising / Secondaries

VC Amplify Partners raised $900M across three new funds, including its first dedicated digital bio fund

PE firm Banner Capital raised a $400M continuation fund for eight PortCos led by Hamilton Lane

Banner Capital launched its second MM buyout fund at $200M

European VC firm Lakestar is targeting $250M-$300M for its first European defense tech fund

European private markets impact investor Swen Capital Partners raised $182M for its impact VC fund focused on regenerating ocean biodiversity

Crypto Sum Snapshot

Deutsche Bank is exploring stablecoins and tokenized deposits

UK lifted ban on some crypto-linked securities for retail investors

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

It's time to stop debating Economy vs First class and step up to private. FlyJets is making flying private easier (and less expensive) than ever. FlyJets' charter marketplace and peer-to-peer exchange offers the most seamless way to reserve or sell charter plane flights from any route and destination in the world. Whether you want to bundle up with friends to save on one flight, sell spaces on a flight, or sell your reservation and make another, FlyJets' exchange is the place to go.

Gain the charter flight access you've always deserved! Get two months free with code FLYJETSLIT.

Private equity may just be fully cooked.

@BoringBiz_ shared a short clip of Bill Ackman's recent conversation at the Forbes Summit, where Ackman gives a fantastic breakdown on his 10+ years bullish case on Fannie Mae and Freddie Mac.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.