Together with

Good Morning,

Yesterday was another slow day in markets but headlines came in hot nonetheless with US in talks to become Intel's largest shareholder, Citi's raid on JPMorgan hitting double digits, Dana White confirming a White House cage fight, and Trump brokering a meeting between Putin and Zelenskyy.

Procrastinating on taxes after filing your extension? Check out OLarry, a personalized tax service for professionals with emerging wealth.

Let's dive in.

Before The Bell

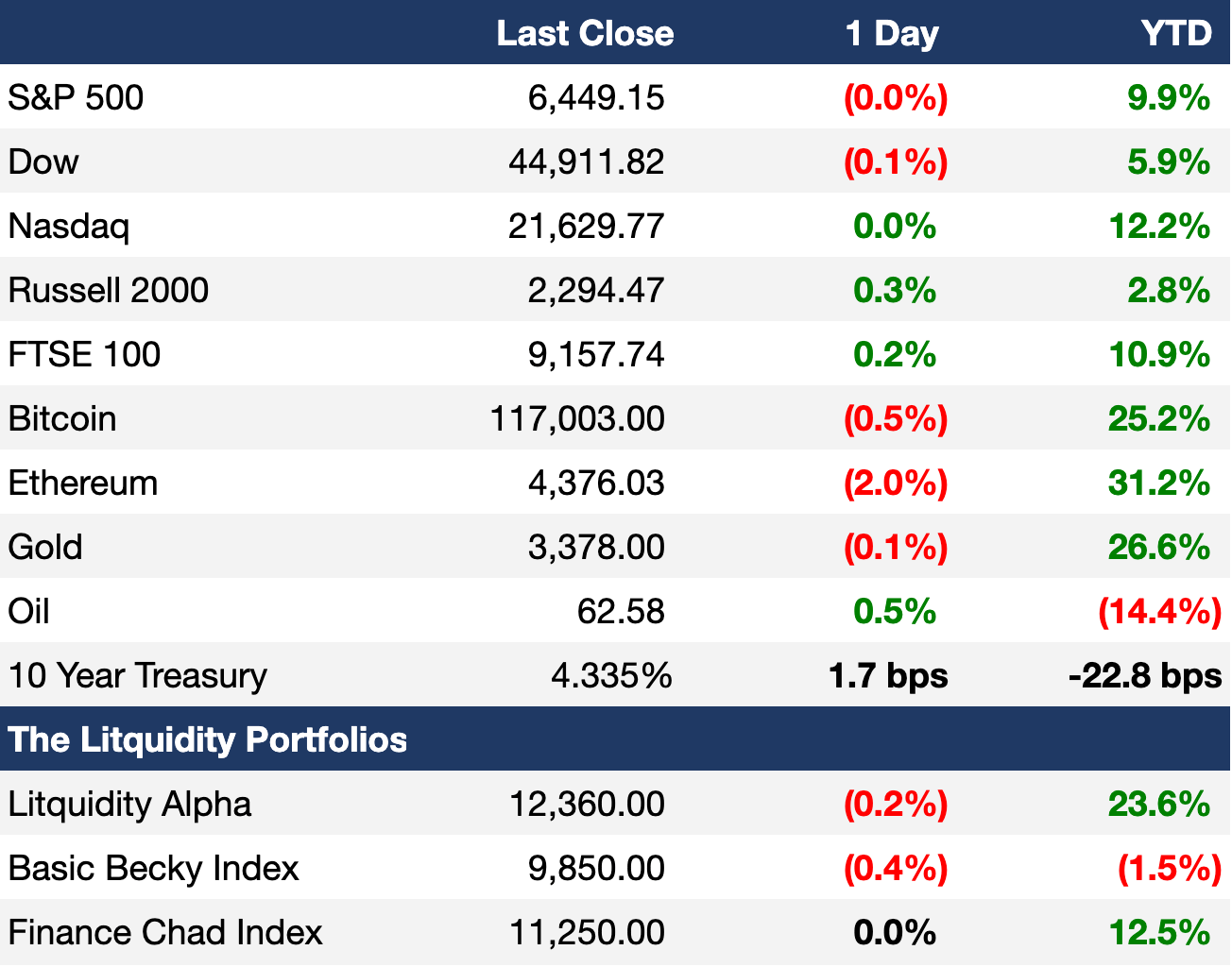

As of 8/18/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed flat yesterday as investors looked ahead to J Pow's speech on Friday

Japan's Nikkei 225 hit a fresh ATH

Bolivia dollar bonds rallied to their highest in over two years after an election marked the end of socialist rule

Earnings

Palo Alto Networks beat on Q4 earnings, revenue and Q1 and FY guidance estimates on strong results from its 'platformization' push, growth optimism, and its recent $25B deal for Israeli cybersecurity firm CyberArk; Founder/CTO Nir Zuk will retire (CNBC)

What we're watching this week:

Today: Home Depot, Carlyle

Wednesday: Target, Estée Lauder, TJX, Baidu, Lowe's, Macy's

Thursday: Walmart, Zoom, Workday, Costco, Best Buy

Full calendar here

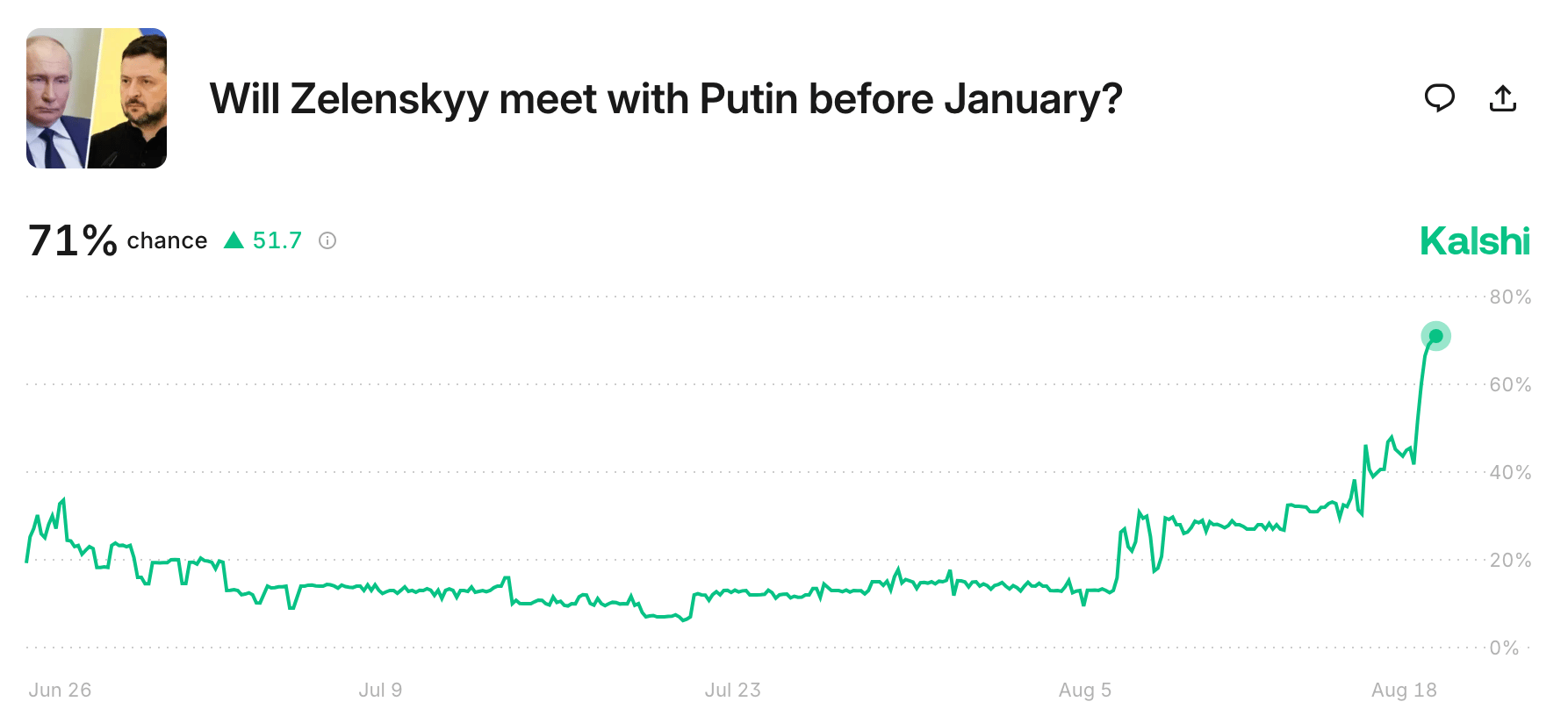

Prediction Markets

Trump is brokering a meeting between Putin and Zelenskyy.

Headline Roundup

Trump hosted Ukraine and other European leaders at White House (CNBC)

Ukraine and Europe offered a $100B weapons deal to US (FT)

US national debt hit $37T (AP)

Hedge funds bought US stocks at fastest pace in seven weeks (RT)

PE's big fish see deals machinery gearing up (WSJ)

US IPO debut surges are being riven by 'superfan' scramble (BBG)

Investors lose billions on meme stocks as pump and dumps multiply (FT)

Switzerland's M&A surge leaves rest of Europe behind (BBG)

Global investors cut back dollar hedging (BBG)

EM firms rush to global debt markets as premiums fall to 20-year low (FT)

China stock rally has makings of a durable bull run (BBG)

China capital outflows hit record amid liberalization push (BBG)

Norway's $2T SWF will sell off more Israeli companies (BBG)

Apollo's insurer points finger at rivals over potential conflicts (FT)

Citigroup raid on JPMorgan investment bankers reaches double digits (FT)

Hong Kong property sector clouded by rising debt repayment risks (RT)

Google will build an advanced nuclear plant (CNBC)

Novo Nordisk will slash Ozempic prices in US by half (CNBC)

JPMorgan must face claims over son's fleecing of elderly mom (BBG)

Jay Clayton will remain as Wall Street's top prosecutor (FT)

Dana White said White House cage fight is 'going to happen' (WSJ)

Foreigners are buying US homes again while Americans get sidelined (BBG)

'Job hugging' has replaced job-hopping (CNBC)

A Message from OLarry

OLarry was built for operators, fund managers, and investors whose tax needs go way beyond basic.

Strategic tax planning for carry, equity, and liquidity events.

Built for complexity: multi-entity, K-1s, QSBS, international exposure.

All-inclusive access to your U.S. only team, at a flat annual rate.

Supported by CPA with experience supporting the Ultra-High-Net-Worth.

Meet with our Co-Founder – Schedule a meeting now.

"Easily the best and most strategic tax convos I have had." Raj, CEO

Deal Flow

M&A / Investments

US is in talks to take a 10% stake in struggling $100B-listed Intel by converting CHIPS Act grants into equity to become their largest shareholder

Tech-focused PE firm Thoma Bravo is in talks to acquire Israeli cybersecurity company Armis from Insight Partners at a $5B valuation

TV station owner Sinclair proposed separating its Ventures business, which houses non-traditional broadcast and investments, and offered to merge its remaining broadcast TV business with Tegna at a $3.5B-$4B valuation amid Tegna's advanced talks to sell itself to Nexstar Media Group

A group of investors led by MCR Hotels agreed to take-private private members club Soho House at a $2.7B valuation

Electronic equipment maker Amphenol agreed to acquire cable assembly firm Trexon for $1B cash

State-owned Chinese automaker Dongfeng Motor is selling its 50% stake in a JV with Honda valued at $752M

UK asset manager Legal & General's Managed Property Fund will merge with peer Federated Hermes Property Unit Trust forming a combined $6.4B AUM fund

BlackRock-owned Global Infrastructure Partners agreed to acquire a 49.99% stake in Italian energy giant Eni's carbon capture and storage business

UK's Starling Bank acquired UK accounting-software startup Ember to offer tax tools to SMEs

VC

IVIX, a startup using AI to detect financial fraud, raised a $60M Series B led by O.G. Venture Partners

Medallion, a startup using AI to enhance healthcare back-office operations, raised a $43M round led by Acrew Capital

Polestar Analytics, an AI-driven data analytics and planning startup, raised $12.5M in funding from family offices and institutional investors

Swiss edtech startup Evulpo raised a $10.8M Series A led by Serpentine Ventures, Swiss family offices, and notable entrepreneurs

AI-driven food service support tools startup Goals raised a $9M pre-Series B from WiL, Serverworks Capital, Mizuho Capital, and more

Sports management software company TeamLinkt raised a $6M Series A led by Growth Street Partners

Paradigm, an AI-powered spreadsheet, raised a $5M seed round led by General Catalyst

UK cybersecurity startup Innerworks raised a $4.3M seed round led by AlbionVC

IPO / Direct Listings / Issuances / Block Trades

$11B-listed Chinese electronics manufacturer Anker Innovations Technology is weighing a Hong Kong listing

KKR-backed South Korean e-commerce company Musina is weighing an IPO at a potential $7.2B valuation

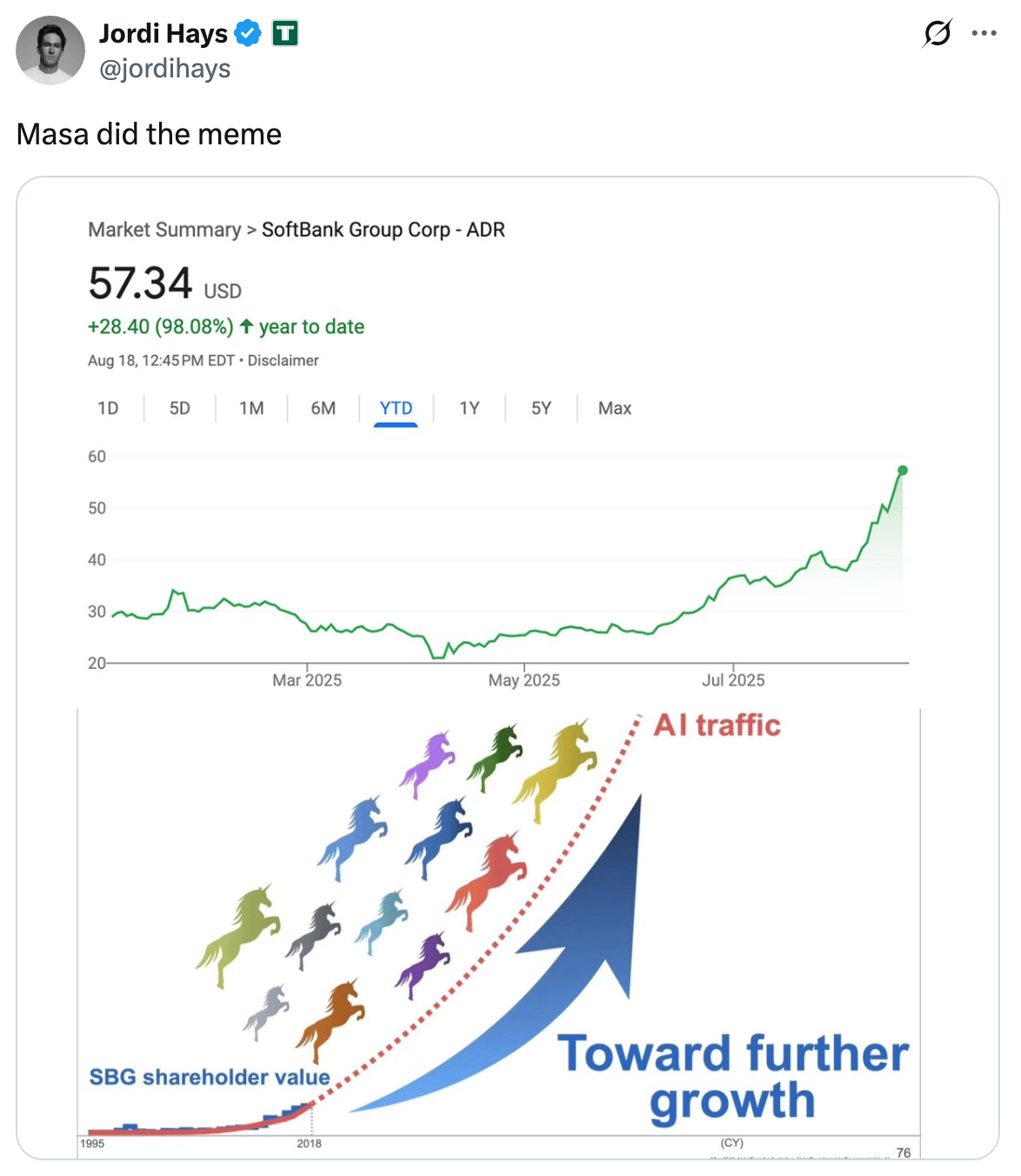

SoftBank will invest $2B for a ~2% stake in Intel

Google will raise its stake in Bitcoin miner and AI-computing company TeraWulf from 8% to 14% via a $1.4B backstop and share warrants

SPAC

Chamath launched a new SPAC American Exceptionalism Acquisition Corp with plans to raise $250M to invest in AI, DeFi, defense, or energy

Debt

Philippines sold $8.9B worth of retail treasury bonds

Pharma giant Eli Lilly is raising $6.75B of debt in its biggest-ever US investment-grade bond sale

Goldman Sachs Asset Management-backed modular building firm Adapteo raised $2.3B of green bank debt

German specialist CRE bank PBB is seeking a $2B SRT on US CRE loans

Kenya is seeking to raise $250M-$500M in a diaspora bond sale from Kenyans living abroad

Bankruptcy / Restructuring / Distressed

A $7B deal for Jacobs Capital-owned UK private school operator Cognita is on the brink of collapse after a new 20% tax, with a stake sale to final bidders Blackstone and CVC now unlikely to proceed

Fundraising / Secondaries

Polish PE firm Spire Capital Partners raised $105M for its debut fund

BlackRock is readying a VC secondaries fund

Crypto Sum Snapshot

Crypto market cap fell below $4T after Bitcoin hit ATHs

SEC delayed decision to approve Truth Social's Bitcoin & Ethereum ETF among others

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Palm & Park is partnering with Farsight for another chill happy hour on Tuesday, September 16 near Bryant Park, NYC to bring together an exclusive group of experienced investment banking and private equity professionals. Take some time off this unusually busy summer and join us for some laid-back conversations. RSVP here.

Zuckerberg may be forgetting that too many cooks spoil the broth. Read Jo Constantz's take on why Meta's Superintelligence dream team will be management challenge of the century.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech.

We're able to move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract top caliber candidates.

Head over to our website to drop your resume / create your profile and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They've grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.