Together with

Good Morning,

The Fed is holding rates steady, JPMorgan is seeking out a private credit partner, The US and European economies are diverging, China agreed to an arms-control talk with the US, top MBA programs are enrolling more women than men, and Toyota gave US auto-factory workers a pay bump.

Want to stay on top of the biggest stories in tech as they develop? Check out and subscribe to The Information.

Let’s dive in.

Before The Bell

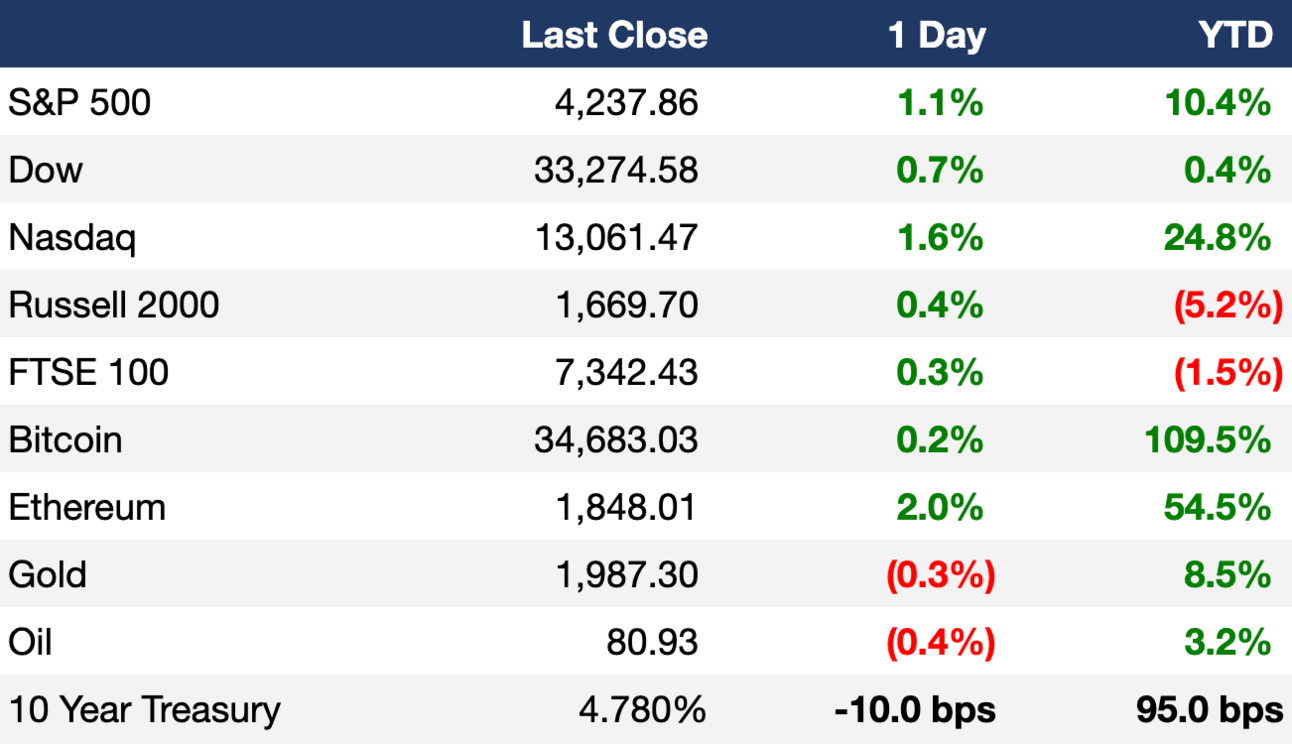

As of 11/1/2023 market close.

Markets

US stocks rallied after the Fed announced that it would keep interest rates unchanged for a second consecutive time

The Nasdaq led indices with a 1.64% gain

Earnings

Apollo Global Management shares rose 8% despite missing adjusted earnings expectations thanks to its credit business’ growth (BBG)

PayPal shares rose 4% after beating Q3 earnings and revenue expectations and raising its full-year adjusted profit forecast above analyst estimates (RT)

Qualcomm shares rose 4% after beating Q3 earnings and revenue expectations and providing a strong forecast for the current quarter (CNBC)

CVS beat Q3 earnings and revenue estimates, partially thanks to strong sales from its health services business (CNBC)

Airbnb reported stronger-than-expected Q3 revenue but missed on revenue guidance for the upcoming quarter (CNBC)

What we're watching this week:

Today: Apple, Starbucks, Novo Nordisk, Shopify, Coinbase, Block, Eli Lilly, Moderna, Palantir, ConocoPhillips

Friday: Enbridge, Cinemark, Cboe

Full calendar here

Headline Roundup

Fed holds rates steady, upgrades assessment of economic growth (CNBC)

JPMorgan is seeking out a partner to accelerate its private credit push (BBG)

Legal scrutiny signals shift in how US homes are bought and sold (BBG)

Apple loses bid to shutdown UK iPhone class action suit (BBG)

The US and European economics are diverging (WSJ)

Toyota gives 9% pay bump to most US auto-factory workers, following UAW gains in Detroit (WSJ)

Jamie Dimon warns Texas to stop pushing anti-business bond laws (BBG)

China agrees to arms-control talks with US (WSJ)

Zillow rebounds after NAR’s guilty verdict rattled investors (BBG)

Space Force awards $2.5B in rocket contracts to SpaceX and ULA for 21 launches (CNBC)

Actors, Hollywood studios still at odds on AI and other issues, union says (RT)

Top business schools are enrolling more women than men (WSJ)

Costco, Resideo queried over products tied to China suppliers (BBG)

Four ex-Sculptor executives sued to stop merger over wiped-out pay (BBG)

A Message From The Information

It seems like there’s a new blockbuster story in tech every single day, from chip maker Arm’s IPO, to Nvidia’s rocketing stock performance, to Twitter’s tanking ad revenue.

To stay on top of the news each day, I read The Information. Not only do they track the biggest stories in tech and finance, they also break exclusive stories on everything from Gemini’s recent layoffs, to Thoma Bravo’s latest buyouts, to Google’s AI power struggle with Microsoft.

Deal Flow

M&A / Investments

PE firm Silver Lake Management is in talks to team up with Abu Dhabi wealth fund Mubadala Investment for a potential takeover bid for UFC-owner Endeavor Group Holdings, which has a market cap of $11.2B (BBG)

Nasdaq completed its $10.5B acquisition of software provider Adenza, which will help the company transform into a full-fledged financial services firm (BBG)

Australia's Origin Energy received a sweetened best and final takeover bid from a Brookfield consortium that valued the power producer at $10.5B after Origin’s top shareholder rejected the previous offer (RT)

Walt Disney formally began the process of buying Comcast's 33% stake in Hulu that will give Disney full ownership of the streaming platform; Disney expects to pay Comcast ~$8.6B by December 1 (RT)

Brookfield Infrastructure Partners will acquire most of bankrupt data center firm Cyxtera Technologies for $775M (BBG)

Zillow Group will acquire real estate CRM system Follow Up Boss for $400M with an additional $100M potential cash earnout (PRNW)

Blackstone’s IQ Student Accommodation business acquired London and Edinburgh student properties for $449M from Downing Students (BBG)

Medical device company Inari Medical will acquire artery disease treatment developer LimFlow for up to $415M cash (BW)

Velo3D, a metal 3D printing technology company with a $250M market cap, is exploring strategic options including a potential sale (BBG)

Singapore’s Health Management International is purchasing a majority stake in Harley Street Heart & Vascular Centre (RT)

Theme park operators Six Flags Entertainment and Cedar Fair Entertainment are possibly in talks for a potential merger (BBG)

VC

BNPL platform Tabby raised a $200M Series D at a $1.5B valuation led by Sequoia Capital India and STV (TC)

Infinitum, a startup creating sustainable air core motors, raised a $185M Series E led by Just Climate (BW)

Atom, a UK-based app-based bank, raised $122M in funding from BBVA, Toscafund, and Infinity Investment Partners (FN)

Authentication startup FusionAuth raised a $65M round led by Updata Partners (TC)

Software supply chain security startup Chainguard raised a $61M Series B led by Spark Capital (PRN)

Gate Bioscience, a biotech company creating medicines based on molecular gates, raised a $60M Series A led by Versant Ventures and a16z Bio + Health (PRN)

Covera Health, an AI-enabled diagnostic technology company, raised a $50M Series C led by Insight Partners (FN)

Procurement management software startup Oro Labs raised a $34M Series B led by Felicis (TC)

Vespa.ai, the big data serving engine that recently spun out from Yahoo, raised a $31M round led by Blossom Capital (TC)

Adaptive cyber insurance company Cowbell raised $25M in funding from Prosperity7 Ventures (FN)

Genome Insight, a precision healthcare solutions company, raised a $23M Series B-2 led by Samsung Venture Investment Corporation, Asan Foundation, SCL Group, and Ignite Innovation (BW)

Brickeye, a construction IoT and data analytics startup, raised a $10M round led by BDC Capital’s IP-backed Financing Fund and Graphite Ventures (FN)

Toposware, a startup building zero-knowledge infrastructure, raised a $5M strategic seed extension round led by Evolution Equity Partners (PRN)

P0 Security, a startup building a solution to secure cloud access and developer entitlements, raised a $5M seed round led by Lightspeed Ventures, SV Angel, and more (BW)

Agentio, an AI-powered ad platform for sponsored creator content, raised a $4.3M seed round led by Craft Ventures and AlleyCorp (PRN)

Freeplay, a startup that lets companies build and experiment with apps powered by generative AI, raised a $3.3M seed round led by Conviction Ventures (TC)

Orlando, FL-based game development studio Third Time Entertainment raised a $2M seed plus round led by Sfermion (FN)

Inspired Beauty Brands, a developer and marketer of personal care products, received a $2M investment from LO3 Capital (FN)

Stockpress, a platform for teams to manage file management, raised a $1.8M seed round led by Argon Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

SoftBank raised $800M through Japan’s first listing of bond-type shares (RT)

Cargo firm SAL Saudi Logistics Services rose as much as 30% in its trading debut after raising $678M in Saudi Arabia’s second-largest IPO this year (BBG)

Hamilton Insurance Group is seeking to raise $270M at a valuation of up to $2B in an IPO (BBG)

European PE giant CVC Capital Partners will postpone its planned Amsterdam IPO due to increased market turmoil (BBG)

Spinneys Dubai, a supermarket and grocery chain in the UAE and Oman, is close to hiring banks for a potential IPO (BBG)

SPAC

Budget airline AirAsia parent Capital A plans to list its brand management business Capital A International on the Nasdaq through a $1B merger with Aetherium Acquisition Corp. (RT)

Debt

Chicken fast-food chain Raising Cane’s Restaurants raised $500M through a sale of junk bonds after receiving strong demand from investors (BBG)

Bankruptcy / Restructuring

Property developer China Evergrande Group has proposed a new debt restructuring plan for offshore bondholders that would swap debt into ~30% equity stakes in Evergrande’s two Hong Kong-listed subsidiaries (BBG)

Fundraising

Turnaround specialist and NY-based PE firm KPS Capital Partners raised $9.7B for its KPS Special Situations Fund VI, which will invest in corporate carve-outs, restructurings and special situations (WSJ)

Charlesbank Capital Partners is seeking to raise $1.25B for its third opportunistic credit fund, Credit Opportunities Fund III, which will invest in corporate loans (BBG)

PE investment firm Saothair Capital Partners, which invests in lower middle market industrial businesses facing challenges, closed its inaugural Saothair Fund I at $125M (FN)

Crypto Corner

Exec’s Picks

Elizabeth Lopatto wrote a 10/10, hysterical piece on Sam Bankman-Fried’s behavior in court.

Morgan Housel joined Tim Ferriss for a detailed conversation about contrarian money and writing advice, finding the right career and right spouse, and more.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

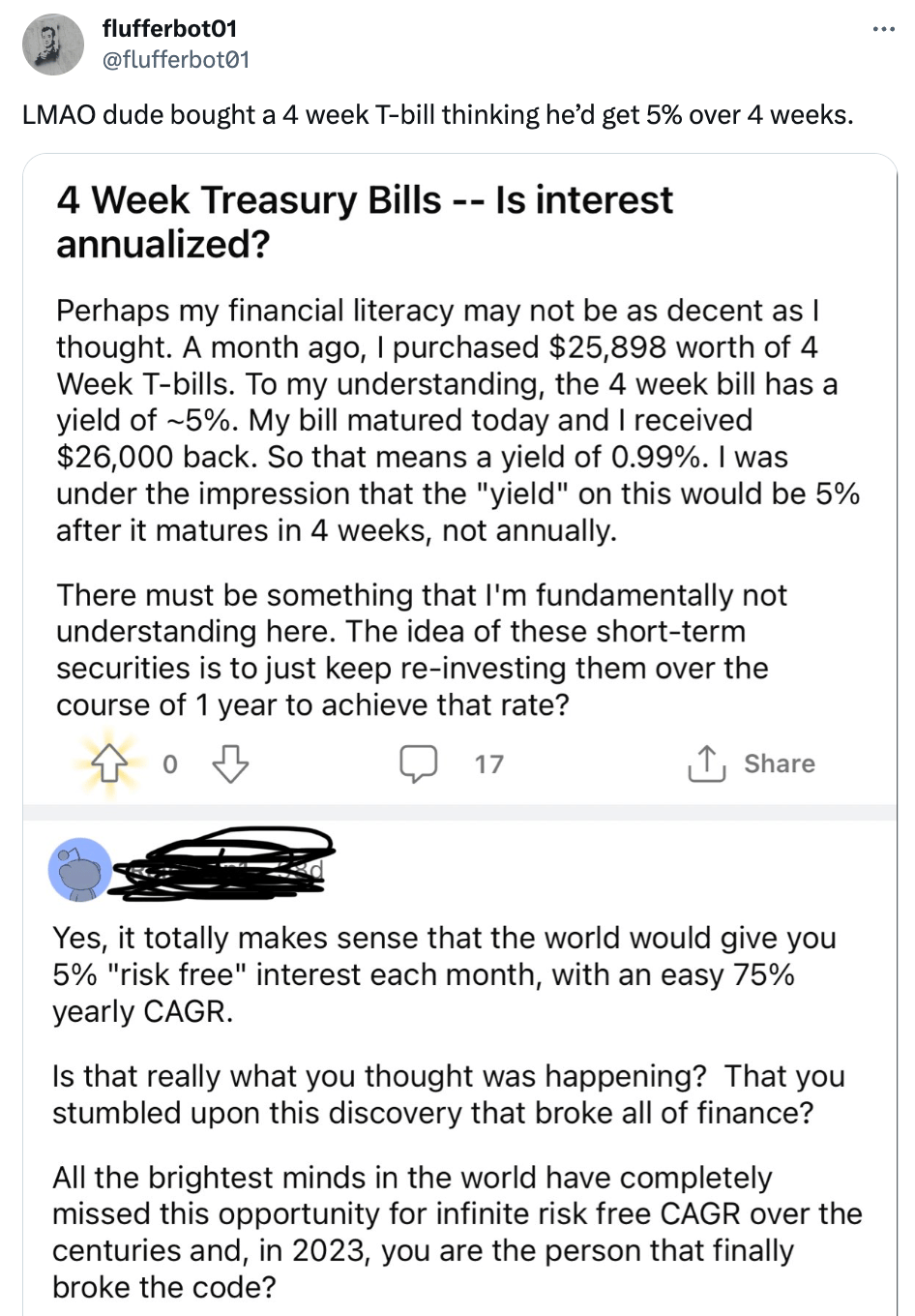

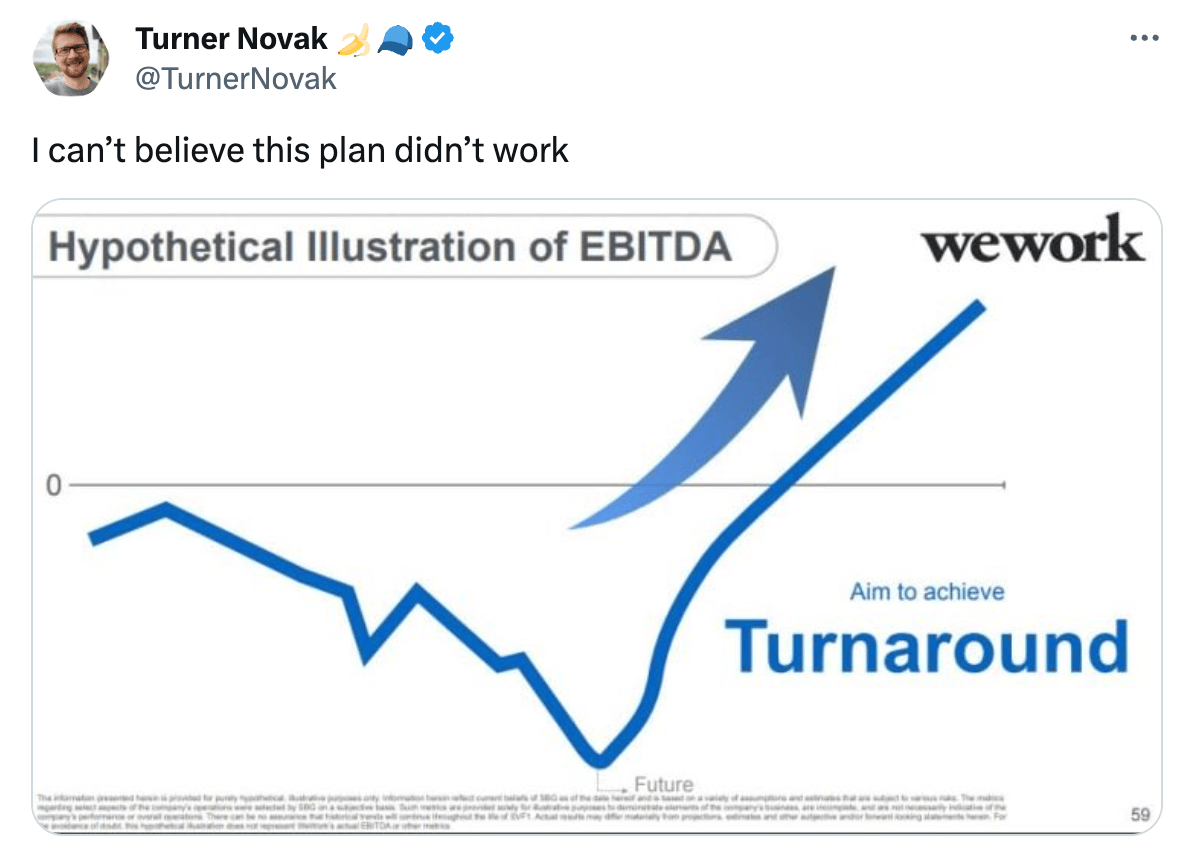

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter