Together with

Good Morning,

Instacart is targeting an IPO and its valuation is low, Meta is developing a more powerful AI system, earnings estimates are rising, Biden doubts China’s ability to invade Taiwan, Daniel Zhang stepped down from Alibaba’s cloud business, and hedge funds hurt by oil’s last dip have piled back into crude.

Want to stay on top of the biggest stories in tech as they develop? Check out and subscribe to The Information.

Let’s dive in.

Before The Bell

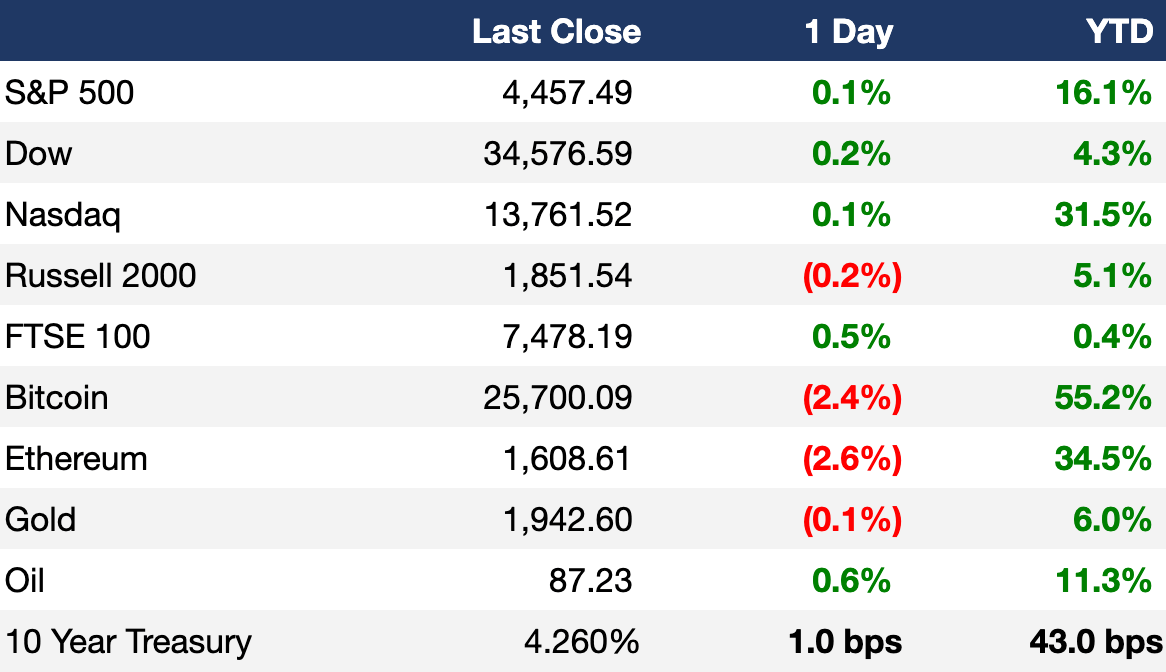

As of 9/8/2023 market close.

Markets

US stocks edged higher Friday, but they logged a losing week due to concerns over Fed rate hikes

The Dow led indices with a 0.22% gain

Asian stocks fell after Japan released lower-than-expected Q2 GDP numbers

Earnings

Headline Roundup

Meta is developing a new, more powerful AI system as technology race escalates (WSJ)

Earnings estimates are rising, a welcome sign for a 2023 market rally (WSJ)

Yellen ‘feeling very good’ about soft landing US economy (BBG)

Biden doubts China able to invade Taiwan amid economic woes (BBG)

The mighty American consumer is about to hit a wall, investors say (BBG)

Private jets and pop-up workspaces: Boeing eases return to office for top brass (WSJ)

Extreme heat is fast becoming a threat to global fuel security (BBG)

Franklin Templeton CEO says China pessimism is overhyped (RT)

Blinken says Musk’s Starlink should keep giving Ukraine full use (BBG)

Taylor Swift could change the movie theater industry with her Eras Tour concert film (CNBC)

California emissions-disclosure mandate awaits final passage, among other bills (WSJ)

Daniel Zhang steps down from Alibaba’s cloud business (CNBC)

Hedge funds hurt by oil’s dip in first half pile back into crude (BBG)

US, Vietnam upgrade ties as Biden visits in hedge against China (CNBC)

VinFast’s 504% rally burns traders playing greater fool theory (BBG)

A Message From The Information

It seems like there’s a new blockbuster story in tech every single day, from chip maker Arm’s IPO, to Nvidia’s rocketing stock performance, to Twitter’s tanking ad revenue.

To stay on top of the news each day, I read The Information. Not only do they track the biggest stories in tech and finance, they also break exclusive stories on everything from Gemini’s recent layoffs, to Thoma Bravo’s latest buyouts, to Google’s AI power struggle with Microsoft.

Deal Flow

M&A / Investments

$14B building materials firm Kingspan Group made an informal approach to combine with $12.5B construction materials manufacturer Carlisle Companies, which rebuffed the tie-up offer (BBG)

German chemical company Covestro began ‘open-ended discussions’ with Abu Dhabi National Oil Company after the state-owned energy company raised its bid to ~$15B (FT)

Walmart is exploring buying a majority stake in closely-held senior clinic operator ChenMed at a ‘several billion dollar’ valuation (BBG)

J.M. Smucker is closing in on a deal to purchase Twinkies owner Hostess Brands for ~$4B (WSJ)

Kroger will sell over 400 grocery stores to C&S Wholesale Grocers for $1.9B cash in an effort to get regulatory approval for its $25B takeover of rival Albertsons (RT)

US auto dealer Asbury Automotive Group is buying privately-owned Jim Koons Automotive for ~$1.2B (RT)

Pertamina Geothermal Energy, a unit of Indonesian state energy firm Pertamina, is in advanced talks to purchase a geothermal unit owned by KS Orka Renewables for up to $1B (RT)

Indonesian telecom Indosat Ooredoo Hutchison is considering options for its $1B fiber assets, including a stake sale (BBG)

CB Insights, a provider of market intelligence on VC and startups, is exploring a potential $800M sale (BBG)

Los Angeles-based Alchemy Copyrights will acquire UK-listed Round Hill Music Royalty Fund, which owns the rights to Bruno Mars and Bonnie Taylor, for $469M (FT)

A group including a unit of Abu Dhabi’s Mubadala Investment and Alpha Wave Ventures invested $360M in luxury hotel operator Aman (BBG)

The Big Table Group, the owner of Cafe Rogue, is in advanced talks to acquire the Frankie and Benny’s and Chiquito’s restaurant chains from The Restaurant Group (FT)

VC

Cruise brand Virgin Voyages raised a $550M round led by Ares Management (FN)

Apollo Therapeutics, a portfolio biopharmaceutical company, raised a $226.5M Series C led by Patient Square Capital (FN)

EIT InnoEnergy, a sustainable energy investor, raised over $150M in funding led by Societe Generale, Santander CIB, PULSE CMA CGM Energy Fund, and Renault Group (FN)

UK neobank Zopa raised $93M led by IAG SilverStripe (TC)

Grit Biotechnology, a cell therapy company, raised a $60M Series B led by CICC (FN)

BlueWhale Bio, a startup striving to overcome bottlenecks in cell and gene therapy manufacturing, raised $18M in funding led by Danaher Ventures (FN)

Decentralized exchange Brine Fi raised a $16.5M Series A at a $100M valuation led by Pantera Capital (TC)

Treyd, a Stockholm-based fintech payment company, raised a $12M Series A extension led by Nineyards Equity (FN)

Green energy company Ostrom raised an additional $8M in funding led by SE Ventures (FN)

Industrial waste management startup Advantek Waste Management Services raised an $8M seed round led by Lowercarbon Capital (FN)

AI-native travel planning startup Mindtrip raised a $7M seed round led by Costanoa Ventures (FN)

Delft Circuits, a Dutch quantum computing startup, raised $6.7M in funding led by DTXL (FN)

inari, a Barcelona-based core technology infrastructure provider for the insurance and reinsurance industry, raised a $5.2M seed round led by Caixa Capital Risc (FN)

OpenCover, a blockchain insurance and cover data startup, raised $4.6M in funding from Base Ecosystem Fund, NFX, and others (FN)

inContAlert, a startup developing a sensor to measure the bladder filling level for incontinence patients, raised a $1.6M pre-seed round led by High-Tech Gründerfonds and Carma Fund (FN)

Sports experience app Takes raised a $1.6M seed round led by Riccardo Silva (FN)

IPO / Direct Listings / Issuances / Block Trades

Grocery delivery business Instacart is targeting an IPO valuation of $8.6B to $9.3B, down significantly from its $39B 2021 valuation (WSJ)

China's Alibaba Group Holding put its Hong Kong Freshippo grocery chain IPO on hold after concluding that it would achieve a $4B valuation, lower than the $6B-$10B it was seeking (RT)

ADES Holding, a PIF-backed oil and gas driller, is seeking to raise as much as $1.2B in Saudi Arabia’s largest IPO this year (BBG)

Indian wires and cables maker RR Kabel, which is backed by PE firm TPG, is looking to raise $236M in its IPO (RT)

Soya Supreme, a large cooking oil manufacturer in Pakistan, is planning an IPO (RT)

Car-sharing business Turo restarted plans for an IPO as early as this fall (BBG)

SPAC

Brand Engagement Network, a provider of personalized customer engagement AI tech, is merging with DHC Acquisition Corp. in a $358M deal (BW)

Debt

Thoma Bravo is in discussions with private credit lenders over ~$1B of debt financing for its acquisition of NextGen Healthcare (BBG)

German development bank KFW offered a $214M loan to South African power utility Eskom Holdings to boost its transmission grid in the Northern and Western Cape provinces (BBG)

Bankruptcy / Restructuring

Off Lease Only, a used-car retailer owned by alternative investment firm Cerberus Capital Management, filed for bankruptcy after its lender Ally Bank tightened financing (WSJ)

Fundraising

Crypto Corner

Exec’s Picks

This Business Breakdowns episode featuring EEP Capital President Alan Flatt covers everything you need to know about Padel and its scorching hot growth.

Hunter Walk explained why VC-backed “creator economy” startups have largely disappointed.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter