Together with

Good Morning,

US CPI growth slowed to 6.5% YoY in December, London IPOs dropped 90% in 2022, Sweden found the Earth's biggest deposit of rare earth metals, Microsoft is granting US employees unlimited time off, Starbucks wants corporate workers back in the office, and Tim Cook's pay will be more directly tied to Apple's stock performance.

Want to invest *directly* into energy companies, without worrying about the ebbs and flows of public markets? Check out today's sponsor, EnergyFunders.

Let's dive in.

Before The Bell

Markets

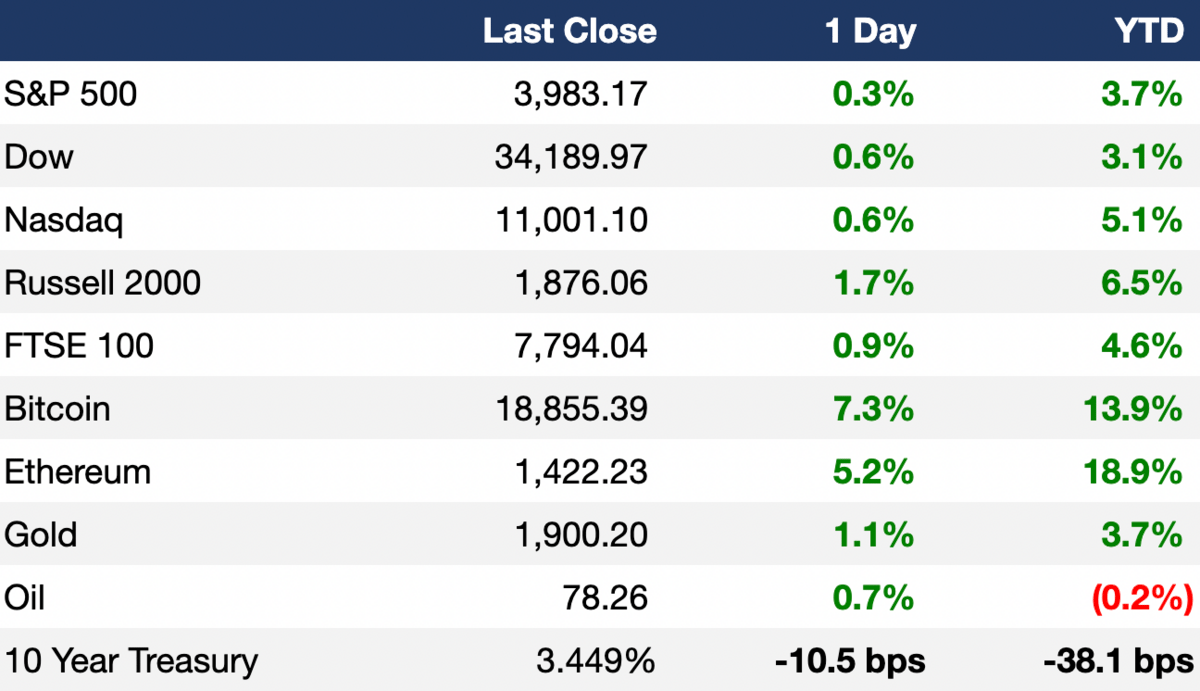

US stocks gained yesterday after consumer prices declined month over month for the first time in over 2.5 years in December (core CPI rose slightly as expected though)

The pan-European Stoxx 600 rose 0.7% to near 9-month highs

Bitcoin rose 6% yesterday, up 14% YTD

The dollar slid to a near 9-month low vs the euro

Earnings

TSMC beat Q4 earnings and revenue estimates on record net profit due to favorable exchange rates and cost-cutting, but the company trimmed 2023 CAPEX on softer demand expectations from Apple; their stock rose 6.4% (RT)

What we're watching this week:

Today: JPMorgan, BofA, Citi, Wells Fargo, BlackRock

Full calendar here

Headline Roundup

US CPI growth slowed to 6.5% YoY in December, with core CPI also down to 5.7% (AX)

HSBC expects a 50 bps final rate hike on Feb 1 (RT)

London IPOs dropped 90% in 2022 (IW)

Sweden's state-owned miner found Europe's biggest deposit of rare earth metals (RT)

India and US established a new trade group to improve trade/supply chains (RT)

53% of German companies report labor shortages (RT)

Exxon's own climate research accurately projected global warming (AX)

Porsche is considering fully integrating Google software into car cockpits (RT)

Microsoft is giving its US employees unlimited time off (TV)

Morgan Stanley named 184 new MD's to a record 38% women class (BBG)

Starbucks ordered corporate workers back to office (CNBC)

Tim Cook's 2023 pay will depend more on stock performance (RT)

LendingClub to cut 225 workers, take charges of $5.7M (BBG)

Brazil's Americanas' CEO and CFO resigned after discovery of $3.88B accounting inconsistencies (RT)

Ex-Goldman bankers tap LinkedIn, headhunters in frail financial jobs market (RT)

A Message From EnergyFunders

A Smarter Energy Investment

2022 was a bloodbath. Inflation ravaged asset classes across the board, including stocks, bonds, real estate, and crypto.

But one asset class hit the ball out of the park, returning more than 50%…

Yes, I’m talking about energy stocks.

The problem is, past performance is no guarantee of future returns. Following a period of monster gains, energy stocks now trade at elevated valuations across the board, and buy-and-hold investors face lower potential returns and higher risks from today’s prices.

Thankfully, there is another way: EnergyFunders offers a solution with the world’s first digital platform for connecting individual investors directly to the wellhead.

This private market approach to energy investing means that you get paid directly from successful investments into individual oil and gas wells. It means bypassing the buy low/sell high guessing game of public stock investing. And the best part? Eligible investors can unlock the opportunity to reduce your current year's tax bill by directly funding oil and gas wells.

So what are you waiting for? Invest with the EnergyFunders team today!

Deal Flow

M&A / Investments

Smart mobility company Apollo Future Mobility Group agreed to buy Chinese EV maker WM Motor for $2.02B (BBG)

Thai energy firm Bangchak agreed to buy 66% of ExxonMobil’s stake in oil refiner Esso Thailand in a $603M deal (RT)

Fuel trader and refiner Varo Energy agreed to buy an 80% stake in Dutch biogas maker Bio Energy Coevorden (RT)

The parent company of French label Lacoste is looking to expand its portfolio of brands through acquisitions after reporting record annual sales (WSJ)

Morning Brew acquired digital media startup Our Future (MB)

VC

South Korean entertainment company Kakao Entertainment raised $930M in financing from PIF and GIC (TC)

Consumer Edge, a data analytics and insights company focused on global consumer spending, raised $60M in financing from CoVenture (PRN)

No Meat Factory, a plant-based protein manufacturer, raised a $42M Series B led by Tengelmann Growth Partners (BW)

Proptech startup Welcome Homes raised a $29M Series A led by Era Ventures (TC)

Maternity care center Oula raised a $19.1M Series A led by 8VC (PRN)

Insurtech startup Joyn Insurance raised a $17.7M Series A led by OMERS Ventures (PRN)

SpiderOak, a cybersecurity solutions company for space systems, raised a $16.4M Series C led by Empyrean Technology Solutions (PRN)

LinusBio, a precision exposome sequencing startup, raised a $16M Series A led by GreatPoint Ventures and Bow Capital (BW)

FPGA startup Rapid Silicon raised a $15M Series A led by Cambium Capital (TC)

HVR Cardio, a medtech startup developing structural heart products, raised an $11.1M Series B led by the Innovestor Life Science Fund and Tesi (PRN)

Athulya, a provider of senior care services in India, raised $9.3M in funding from North Haven India Infrastructure Partners (PRN)

PneumoWave, a respiratory disease detection and monitoring platform, raised a $9.16M Series A led by the Scottish National Investment Bank (PRN)

Coho AI, a startup using AI to help B2B SaaS companies boost revenue, raised an $8.5M seed round led by Eight Roads, Tech Aviv, and angel investors (TC)

BIOHM, a startup using microbiome data to create new products, raised $7.5M in funding led by VTC Ventures (PRN)

Ferrum Health, a healthcare AI platform developer, raised a $6M round led by the Urban Innovation Fund, Cercano Management, and Singtel Innov8 (PRN)

enrichAg, a platform providing real-time soil composition data, raised a $6M seed round led by At One Ventures (PRN)

Twitter rival T2 raised a $1.1M seed round led by Bradley Horowitz, Rich Miner, Katherine Maher, and other angels (TC)

IPO / Direct Listings / Issuances / Block Trades

Infrastructure income trust AT85 Global Mid-Market Infrastructure Income is set to launch its IPO with a $366M target (IW)

United Internet’s web-hosting unit Ionos Group is planning to begin its Frankfurt IPO as soon as next week (BBG)

Saudi developer Umm Al Qura picked banks including Lazard for its planned Riyadh IPO (BBG)

Bankruptcy

Bed Bath & Beyond is speaking with potential lenders that would finance the company during bankruptcy proceedings (i.e. stalking horse bidders) (BBG)

Fundraising

Chamath's VC firm Social Capital reduced the size of its early stage-focused Fund V to ~$1B (AX)

Menlo Ventures is raising three new funds: $500M for its sixteenth fund, $100M for a life sciences fund, and $100M for an incubation fund (AX)

Dublin-based VC firm Tamarind Hill raised $50M for its Fund II (BJ)

Monique Woodard launched Cake Ventures, a new $17M fund focused on ‘demographic change’ (FRB)

Crypto Corner

Gemini and Genesis were sued by the SEC over crypto 'earn' program (BBG)

SBF said he 'didn't steal funds' and blamed Binance's CZ for FTX's crash (RT)

Crypto-related crime hit a record $20B in 2022 (RT)

Crypto broker Genesis owes creditors over $3B (RT)

Crypto lender Nexo was raided by Bulgarian authorities over alleged money laundering and tax violations (CD)

Crypto firms collectively slashed over 1.6k jobs YTD (BBG)

Exec's Picks

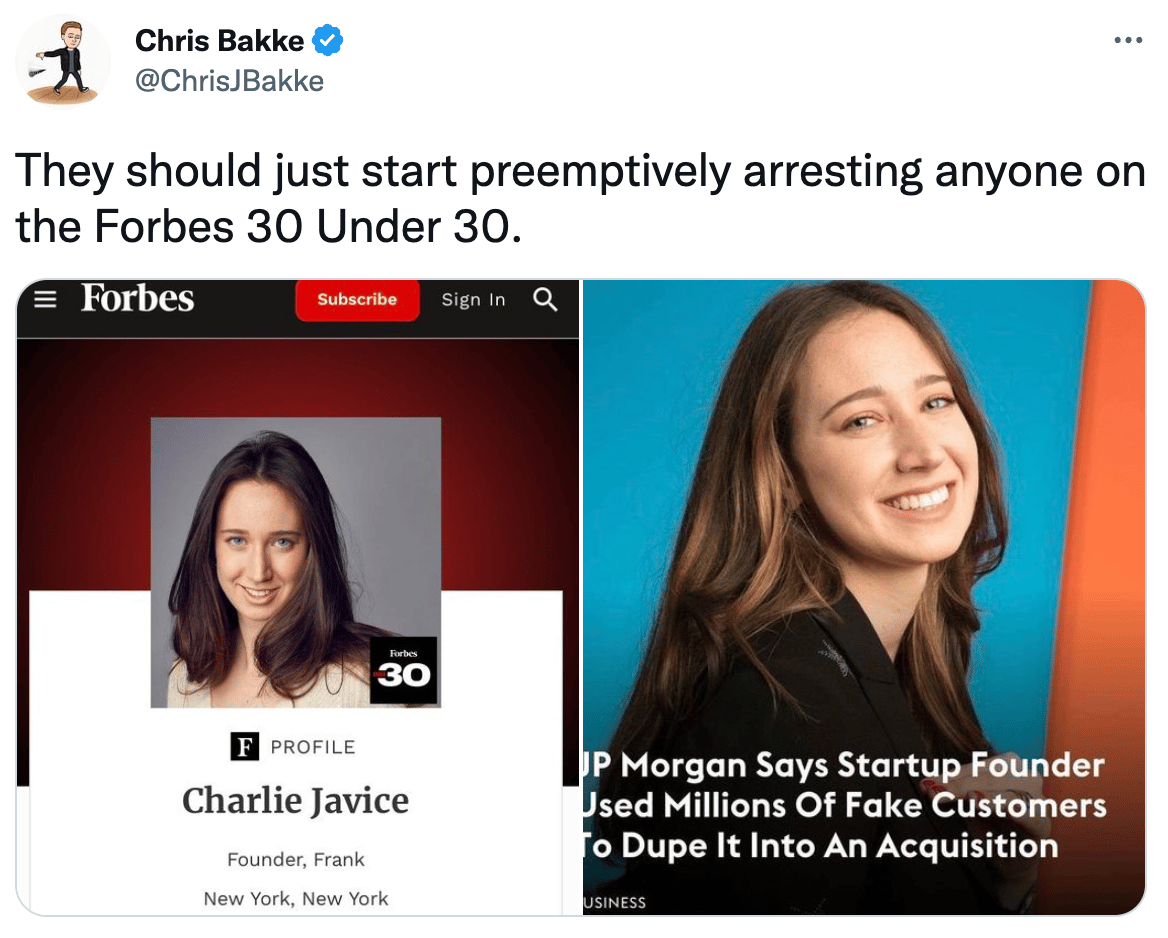

JPMorgan acquired fintech startup "Frank" for $175M, and they are now suing the startup's founder, Charlie Javice, for tricking the bank with 4M fake users. Check out the Forbes piece on this wild story.

Bear markets are tough on everyone, especially corporate executives, and 2022 set a record on explicatives used in earnings calls.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.