Together with

Good morning,

Fresh off a renomination, J Pow has now decided to acknowledge inflation is NOT transitory. If only a certain finance meme contingent had been saying this for months *cough cough* (note: the cough is not Omicron). US markets got clapped again following his statements.

We'll keep this intro short because Karl is itching to get lit at Art Basel events early today.

Let's dive in.

Before The Bell

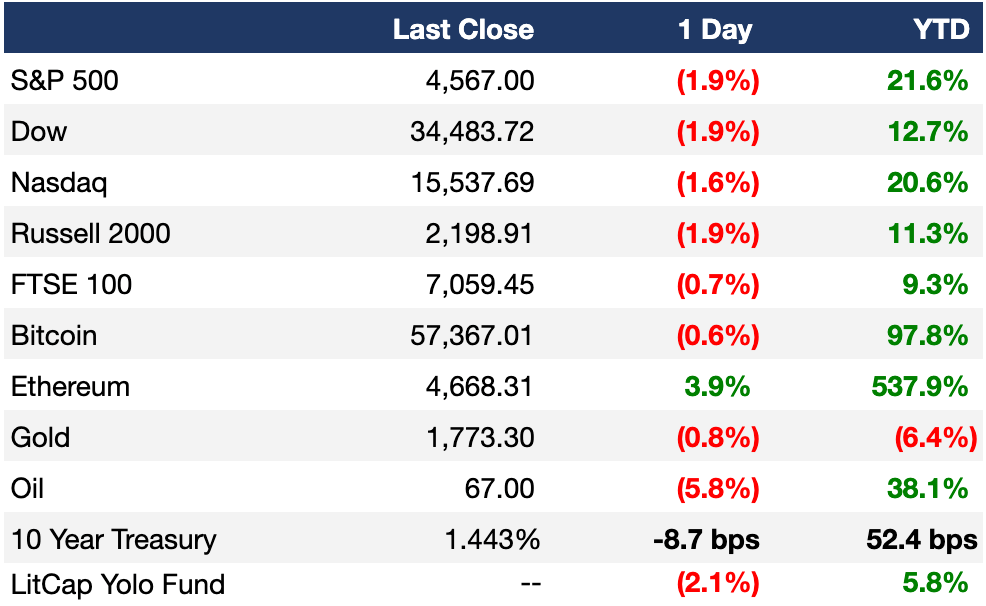

As of 11/30/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Sounds like we spoke too soon on Monday; the markets took a hit yesterday after all three major US averages were dragged down by cyclical stocks due to Covid-19 worries sparked by Omicron

Despite the impending risks, J Pow announced the central bank will discuss speeding up the bond-buying taper in their December meeting (beyond the initial $15B/month schedule announced earlier this month)

Powell’s statements helped drag stocks to their session low yesterday and the Fed’s potential policy move shows investors they’re focusing on inflation troubles instead of new pandemic-driven threats

Powell also retired the word “transitory” to describe the current inflationary environment, even though the Fed put out some dank Ugly Christmas Sweaters saying the opposite (who could’ve seen this coming?)

November’s PMI, ISM Manufacturing print, and October’s construction spending will be released this morning

ADP’s private payroll data drops at 8:15am ET today. Economists are expecting 506K private jobs added in November (down from October’s 571K)

Earnings

Salesforce posted better-than-expected Q3 earnings and revenue numbers in their first full quarter with Slack, but shares fell amid disappointing FY projections influenced by increased Q4 investment in “workforce and growth opportunities” and travel and expense expectations (MW)

What we’re watching today: Snowflake, RBC

Full calendar here

Headline Roundup

Facebook owner Meta must sell Giphy on competition concerns, UK says (BBG)

Auto execs expect EVs will make up half of US, China markets by 2030 (RT)

Elon Musk tells SpaceX employees that Starship engine crisis is creating a ‘risk of bankruptcy’ (CNBC)

EU medical agency says vaccine revisions for omicron could be approved in 3-4 months (CNBC)

Cyber Monday online sales drop 1.4% from last year to $10.7B, falling for the first time ever (CNBC)

US may tighten travel rules to fight Omicron, CDC says (BBG)

Dr. Oz announces Republican bid for US Senate in Pennsylvania (BBG)

China’s developers face $12B in trust payments this month (BBG)

Omicron risks infecting vaccinated people buy may not cause them severe illness (WSJ)

Nasdaq to move markets to Amazon’s cloud (WSJ)

CNN suspends Chris Cuomo indefinitely after role in advising brother governor Andrew Cuomo during crisis (CNBC)

A Message From Capital Allocators

Under-the-Radar Company Receives Rare "All In" Buy Signal

The “All In” buy signal has happened 95 times over the entire history of Motley Fool Stock Advisor.

And there’s a tiny internet company showing this buy signal that sits in the middle of the advertising market - a market that's 10X bigger than the online streaming industry (think Netflix, Amazon Prime, Hulu).

The average return of stocks selected with the “All In” buy signal is 641% as of 11/15/21… crushing the S&P 500 by more than 5x.

Deal Flow

M&A

Blackstone agreed to buy a portfolio of 124 logistics properties from Cabot Properties for $2.8B (BBG)

Chatham Asset Management agreed to raise its offer for printing company RR Donnelley to ~$2.5B; this comes after RR Donnelley’s previous agreement with Atlas Holdings for ~$2.1B (RT)

Activist investment firm Jana Partners urged Zendesk to abandon the deal to buy SurveyMonkey owner Momentive Global that was valued at ~$4B (RT)

Hackman Capital Partners and Square Mile Capital Management agreed to buy the LA movie lot CBS Studio Center Property, aka CBS Radford, from ViacomCBS for $1.85B (BBG)

KKR is considering a sale of market research provider GfK (BBG)

Self-storage provider MiniStorage is exploring a sale that could fetch $400M (BBG)

Assicurazioni Generali and Liberty Mutual have been selected to advance as potential buyers in a majority stake sale in Thai insurer Syn Mun Kong that could be worth ~$200M (BBG)

Hochschild Mining agreed to buy Amarillo Gold and its Posse gold project in Brazil for ~$106M (BBG)

Activist hedge fund Bluebell Capital Partners asked commodities giant Glencore to separate its thermal coal business because it has “become a barrier to investment” (BBG)

Apax Partners renewed its interest in buying a stake in the Serie A Italian soccer league (BBG)

VC

Bessemer Venture Partners closed a $220M fund dedicated to backing Indian founders (FINSMES)

Real estate marketplace platform Lessen raised a $170M Series B led by Fifth Wall (BW)

South Korean metaverse platform Zepeto raised $150M in funding at a ~$1B valuation from SoftBank (WSJ)

On demand shuttle and software company Via raised $130M in financing at a $3.3B valuation led by Janus Henderson (TC)

CloudTrucks, a startup helping trucking entrepreneurs manage their business, raised a $115M Series B led by Tiger Global (TC)

Fundbox, a startup providing loans and financial products to small businesses, raised a $100M Series D at a $1.1B valuation led by the Healthcare of Ontario Pension Plan (TC)

Reibus, an independent metals marketplace, raised a $75M Series B led by SoftBank (PRN)

DevOps security startup Cycode raised a $56M Series B led by Insight Partners (TC)

2TM Participacoes, owner of Brazil’s biggest crypto brokerage, raised $50M in funding from 10T Holdings (BBG)

ThreeFlow, a startup providing software for insurance brokers selling employee benefits, raised a $45M Series B led by Accel (TC)

Multi currency neobank YouTrip raised a $30M Series A (TC)

Q-CTRL, a startup providing software that optimizes quantum computing, raised a $25M Series B led by Airbus Ventures (TC)

SaaS startup for financial planning teams Abacum raised a $25M Series A led by Atomico (TC)

Pepper, a startup streamlining the food ordering process for restaurants, raised a $16M Series A led by Index Ventures (TC)

Developer productivity tools startup Raycast raised a $15M Series A led by Accel and Coatue (TC)

Stratio, a startup that provides predictive maintenance software, raised a $12M Series A led by Forestay (TC)

Workspace on demand marketplace startup BeerOrCoffee raised a $10M Series A led by Kaszek (TC)

Islands, a Web3 startup helping creators build their own NFT communities, raised a $3.5M seed round led by Seven Seven Six (Forbes)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Debt

Travel booking startup Hopper is in talks with banks to arranging a ~$200M credit facility ahead of a potential IPO (BBG)

Exec's Picks

How To Keep Your 2021 Gains (Deadline)

If you are facing hefty U.S. taxes on cap gains from the sale of a business, stock, BTC, real estate, or other investments…

Unlock tax incentives and put your gains to work making an impact in up-and-coming areas.

Other Picks

Been writing about Capital Allocators for a few weeks now, and if you haven’t checked out the pod, I’m telling you – it slaps. The guest library is seriously deeper than the 2018 Gold State Warriors with some of the biggest name in institutional investing. Subscribe on Apple, Spotify, or wherever you listen to podcasts.

In case you missed it last week, we're launching a Student Athlete program in partnership with OfficeHours. Litquidity Student Athletes will have access to exclusive merch, career coaching, interview prep, and access to the Litquidity team. Applications close Dec 10th. Apply here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Featured job of the day:

BitGo, a provider of capital markets infrastructure for cryptocurrencies, is looking to hire an Institutional Sales Associate in New York City. They're backed by the most prominent investment banks, prop trading firms, Silicon Valley VCs, and digital asset investors. Apply here

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board.

To Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝