Together with

Good Morning,

Wall Street wants in on new 'Trump Accounts' for babies, Binance launched a crypto app for kids, Citadel debuted a new AI tool for equities research, hedge fund leverage is near record highs, bond investors warned the Treasury against Hassett for Fed chair, and Trump called the affordability crisis a hoax.

Mercor is seeking folks with 2+ years of IB or PE experience to train AI models for a leading AI startup. The work pays $150/hr and is part-time, remote, and async. There's also a bonus if you refer qualified folks. Learn more.

Let's dive in.

Before The Bell

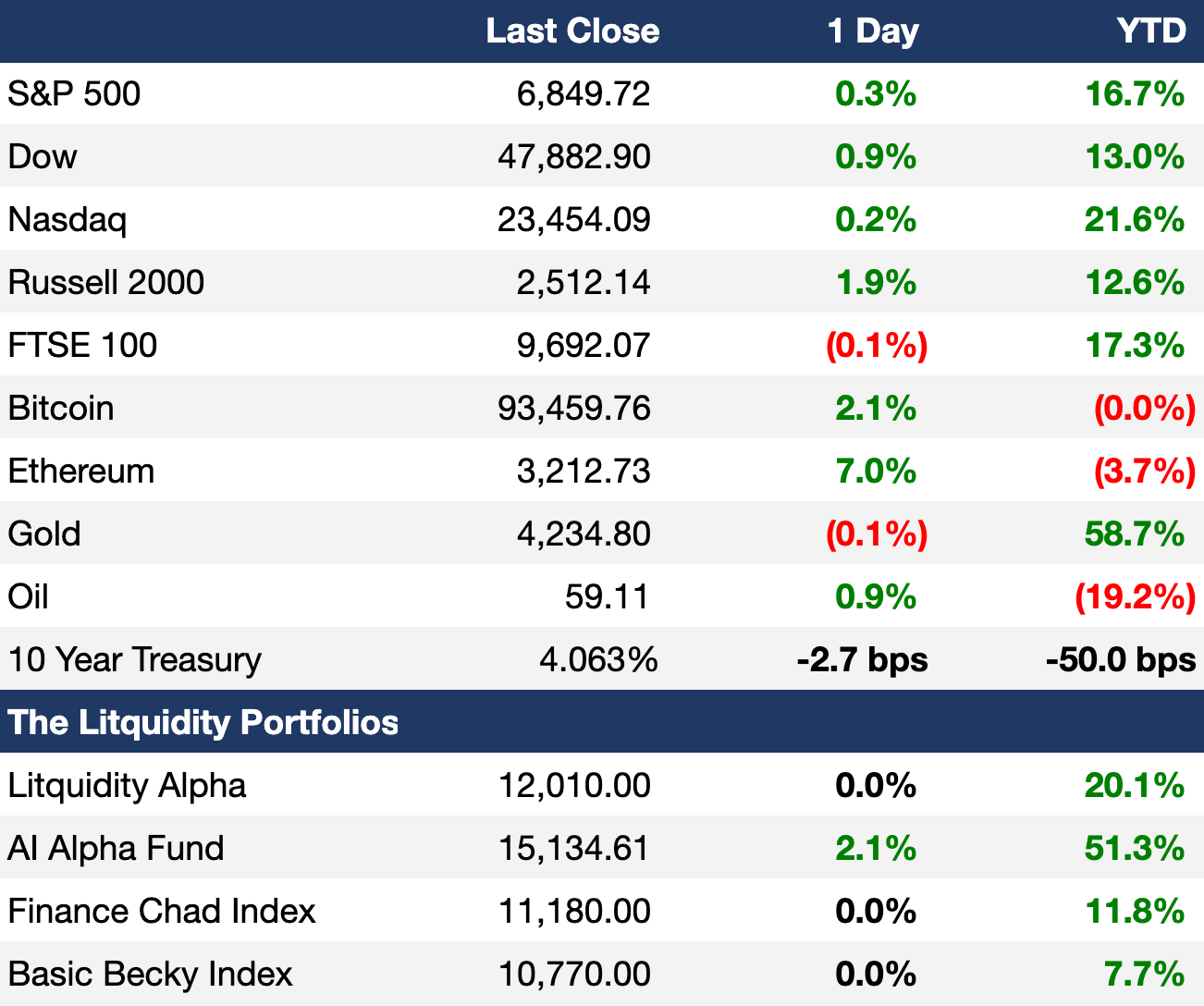

As of 12/3/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks edged up yesterday as weak jobs data reinforced December rate cut bets

Indian stocks are underperforming EM peers by the widest margin since 1993 as investors pivot towards China and AI stocks

MSCI India index is up 2.5% YTD in dollar terms

MSCI EM index is up 28% YTD

Japan's 30Y bond auction drew the strongest demand since 2019

Japan 30Y yield rose to 3.445% to the highest since 1999

Japan 10Y yield hit 1.91%, its the highest since 2007

Australia 10Y yield rose to 4.68% to a YTD high amid rate hike bets

China 30Y bond futures fell 1.1% to a one-year low ahead of key policy meetings

EM debt gap is at a 50-year high

EM-US sovereign spreads are at the lowest since early 2018

Dollar fell to a five-week low on rate cut bets

Euro and yen rose to seven-week highs

Indian rupee slid for an eighth month to a new low to become Asia's worst currency YTD

Rupee is down 5% YTD versus dollar as trade talks drag

Earnings

Salesforce missed Q4 revenue estimates but beat on earnings and issued an optimistic Q1 outlook on strong adoption of its Agentforce AI software (CNBC)

Macy's beat Q3 earnings and revenue estimates on its strongest sales growth in three years as wealthier shoppers traded down and its turnaround efforts gained traction (CNBC)

Dollar Tree issued a Q3 beat-and-raise as strained consumers trade down and pull back further on discretionary spending (BBG)

What we're watching this week:

Today: TD Bank Group, Kroger, Ulta Beauty, Dollar General, Docusign

Friday: Victoria's Secret

Full calendar here

Prediction Markets

If you can trade this market, they probably* will. Trade the fate of Polymarket, only on Polymarket.

*Probability = 99%

Headline Roundup

Trump called US affordability crisis a 'hoax' (FT)

Wall Street wants in on the 'Trump Accounts' for babies (WSJ)

Sam Altman explored a deal to build a rival to Musk's SpaceX (WSJ)

US private-sector payrolls fell by the most in three years (CNBC)

Bond investors warned US Treasury over picking Hassett as Fed chair (FT)

Bessent is a top contender for top White House economic adviser (BBG)

Upward earnings guidance is outpacing cuts for first time in 1.5 years (BBG)

Tech is getting left behind in latest market rebound (BBG)

China will likely chase 5% GDP growth in bid to end deflation (RT)

Banks have underwritten $65B of debt tied to LBOs for 2026 (BBG)

AI investment and M&A will increase bond sales next year (RT)

Hedge fund leverage is near record highs (RT)

M&A boom fuels record decline in Japan's listed companies (BBG)

Race for talent begins as Vietnam bankers brace for IPO boom (BBG)

SEC halted review of leveraged ETF filings (RT)

Citadel debuted a new AI tool for equities investors (RT)

S&P is scrutinizing AI debt deals and questioning crypto giants (TI)

Korea raised foreign bond cap to prepare for $350B US investment (FT)

Foreign banks chase rupee deals as India offshore debt sales slow (BBG)

Hedge fund Marshall Wace's average North America salary is $1.5M (EFC)

HSBC named interim chair Nelson as permanent in surprise move (WSJ)

Trump praised Jensen Huang after talks on export controls (RT)

Glencore cut 1k jobs in a cost-cutting drive (FT)

A Message from Mercor

Earn up to $150 / hr to train AI models

Mercor is recruiting US, UK, Canada, Europe, Singapore, Dubai, and Australia-based IB or PE talent for a research project with a leading foundational model AI lab.

The work is completely asynchronous, part-time, remote, and on your own terms. They're also offering $500 in referral fees for intros to qualified folks.

Learn more here.

Deal Flow

M&A / Investments

$200B-listed Intel shelved plans to spinoff or sell a stake in its networking and communications unit NEX following a strategic review

Paramount Skydance doubled its breakup fee to $5B in its offer for $60B-listed Warner Bros. Discovery

Ex-Pornhub owner Bernd Bergmair is interested in acquiring some of sanctioned Russian oil giant Lukoil's $22B international assets

European PE firm CVC agreed to acquire UK engineering company Smiths Group's security scanning unit for $2.7B

Japan's JFE Steel will invest $1.7B in an equal JV with India's JSW Steel

Gold miner Perseus offered to acquire the remaining shares it does not already own in BlackRock-backed rival Predictive Discovery in a $1.3B stock deal, implying a 22% premium

Italian energy giant Eni's renewable unit agreed to buy an energy customer portfolio from Italian utility ACEA for $685M

US insurer Prudential is considering selling its ~33% stake in $630M-listed South African financial-services firm Alexforbes

Canadian lender EQB will acquire President's Choice Bank, the banking unit of Canada's largest supermarket chain Loblaw, in a $575M stock deal

TPG and Acadia Realty Trust agreed to acquire NYC shopping center The Shops at Skyview from Blackstone for $425M

Japanese broker Daiwa Securities agreed to acquire a minority stake in Indian wealth manager Ambit Wealth for $32M

UK asset manager Schroders is exploring a sale of its $42B AUM financial planning unit Benchmark Capital

OpenAI will acquire AI model training tracking startup Neptune in an all-stock deal

German energy firms Uniper and Sefe are drawing investor interest after their government bailout

Defense lender European Rearmament Bank proposed merging with JPMorgan and Deutsche Bank-backed peer Defense, Security and Resilience Bank

Chilean telecommunications giant Entel is considering a solo bid for Spanish telecom Telefonica's Chile unit after ending its joint bid with Mexico's America Movil

Abu Dhabi state-owned oil giant ADNOC is among suitors in talks to buy SEFE's trading unit from Germany

VC

Deterministic simulation testing startup Antithesis raised a $105M Series A led by Jane Street

Security technology startup Verkada raised a $100M round at a $5.8B valuation led by CapitalG

AI-powered chemistry startup Excelsior Sciences raised a $70M Series A co-led by Deerfield Management, Khosla Ventures, and Sofinnova Partners

Construction-tech startup PermitFlow raised a $54M Series B led by Accel

Enterprise marketing-automation startup Gradial raised a $35M Series B led by VMG Partners

UK AI energy analytics startup Modo Energy raised a $33K Series B led by Molten Ventures

AI-driven protein designer Aether Biomachines raised a $15M round led by Tribe Capital

AI-native data platform Supper raised an $11M seed round led by Union Square Ventures

Autolane, an AV coordination platform, raised a $7.4M funding round from Draper Associates and Hyperplane

BuiltAI, an AI-enabled real-estate financial-modeling startup, raised a $6M seed round led by Work-Bench

Orq.ai, an enterprise AI agent lifecycle platform, secured a $5.8M seed round led by seed + speed Ventures

Access the complete VC deal flow on Fundable.

IPOs / Direct Listings / Issuances / Block Trades

Anthropic is in early talk for one of the largest IPOs ever; the AI startup is valued at $350B

Indian asset management JV ICICI Prudential Asset Management is seeking to raise $1.2B in an India IPO next week

Indian hospital operator Manipal Health Enterprises is seeking to raise $1B at a $13B valuation in an India IPO

China National Uranium raised $570M in a China IPO

Execs and employees of Blue Owl Capital bought $115M of shares of the firm's publicly traded BDC

SPAC / SPV

Israeli EV battery charger developer StoreDot agreed to go public through a merger with Andretti Acquisition Corp. II in an $800M deal

Modular medical check-up firm OnMed is eyeing a SPAC deal for next year

Debt

TenneT Germany, the German unit of Dutch state-owned grid operator TenneT is seeking to raise ~$40B in debt to fund infrastructure upgrades

Volkswagen's financial arm Volkswagen Bank raised $2.9B in green bond sale

University of California is preparing a $2B munis sale

Russia raised $2.8B in its first-ever Chinese yuan bond sale

Goldman Sachs-owned Canadian benefits provider People Corp. is seeking $500M from private credit lenders to fund a dividend recap

Japanese personal care business FineToday raised $350M in private credit from Goldman Sachs Asset Management to fund a dividend recap

Morgan Stanley is considering a SRT tied to a portfolio of data center loans

Argentina is preparing to sell international bonds next year for the first time since defaulting in Covid

Vietnam's largest real estate firm Novaland Investment Group is in talks to raise fresh capital to repay 20% of its $2.4B outstanding bonds to retail investors as it plots a return to profitability

Bankruptcy / Restructuring / Distressed

Struggling UK utility Thames Water reported ballooning debt of $23.3B as restructuring talks drag

The struggling CRE unit of Chinese conglomerate Dalian Wanda is sounding out investor interest for options to deal with $700M in dollar debt

The $400M debt backing Brookfield-owned Bank of America Plaza skyscraper in Los Angeles is on sale after defaulting

Several bondholders of troubled Chinese developer Vanke signaled opposition to a plan to delay repayment

Cinven-backed Spanish renewable energy firm Amara tapped Houlihan Lokey ahead of potential talks with creditors

Fundraising / Secondaries

Latino-led tech PE firm OceanSound is seeking to raise $2B for its third fund

Future Energy Ventures, a VC investing digital and asset-light tech, raised $270M for its second fund targeting energy tech startups

European secondaries investor Jera Capital raised $140M for its latest secondaries fund

India's DMI Alternatives raised $120M for a debut private credit fund

Quant hedge fund Two Sigma debuted a 'tax-aware' L/S fund with $54M amid growing craze

Crypto Sum Snapshot

M&A among major crypto firms hit a record $8.6B YTD

Binance launched Binance Junior, a supervised crypto app for kids

Binance named co-founder Yi He as new co-CEO

Bank of America is recommending wealth clients to put 1%-4% of portfolio in crypto

BlackRock CEO Larry Fink softened his stance on crypto

UK passed a law legally recognizing crypto as property

Trump family-backed World Liberty Financial plans to debut a portfolio of RWA products in January

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Apollo CEO Marc Rowan took to Bloomberg to defend against private credit fears and criticisms. Read his piece here.

Also, an FT analysis found that activist campaigns are more likely to target female CEOs.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.