Together with

Good Morning,

HSBC bankers are battling each other to stay employed, VC profits are at a historic low, Chinese tech giants are building AI teams in Silicon Valley, major hedge funds piled into Bitcoin ETFs, and activist Glenview secured four CVS board seats, including a spot for Glenview's CEO.

Master your valuation techniques and stand out as a top valuation expert with the FMVA® Certification from CFI, the #1 rated finance training provider.

Let's dive in.

Before The Bell

As of 11/18/2024 market close.

Markets

US stocks rose yesterday as investors prepared for Nvidia's earnings ahead

Oil surged 3% on Russia-Ukraine war escalation

Dollar is trading near a one-year high

Earnings

What we're watching this week:

Today: Walmart, Lowe's

Wednesday: Nvidia, Palo Alto Networks, Target, TJX

Thursday: John Deere, Baidu, Gap

Full calendar here

Headline Roundup

HSBC bankers are reapplying and interviewing for own jobs in fight to stay employed (BBG)

ECB split over report showing EU bank capital requirements lower than US (FT)

BOJ will bid farewell to QE and embrace rate hikes in policy review (RT)

Big banks teamed with BlackRock to improve bond market pricing data (BBG)

Chinese tech giants are building AI teams in Silicon Valley (FT)

VC profits are at historic low despite booming AI investments (WSJ)

Race for Treasury Secretary role has gotten messy (WSJ)

Global employers boost hiring towards year end, but finance sector lags (RT)

UK could force pensions to invest more in UK assets (FT)

Greece will repay $5.3B of bailout debt ahead of time (BBG)

Millennium, Capula, and Tudor piled into Bitcoin ETFs in Q3 (RT)

Manulife CEO welcomes more scrutiny of PE de-risking deals (FT)

Activist Glenview secured four CVS board seats (CNBC)

Supermicro named BDO as auditor, plans to maintain Nasdaq listing (CNBC)

Perplexity added shopping features to compete with Google (RT)

Sam Altman becomes latest tech exec to get involved in SF government (RT)

Kering named new CEOs of YSL and Balenciaga (WSJ)

NYC's MTA approved a $9 congestion toll (BBG)

82 y/o oil trader sentenced to 17 years for 'cheating' HSBC over $112M (FT)

A Message from CFI

Thinking About Getting Certified? Keep Reading

If you're already thinking about your next promotion, and the one after that, and the one after that…you're in the right headspace.

You know what you want, but here's how to achieve it: CFI's Financial Modeling & Valuation Analyst (FMVA®) Certification. When you earn the highly sought FMVA® Certification, you will not only learn advanced financial modeling techniques, you'll also accelerate your career growth faster than you could ever imagine.

Here's why so many are turning to CFI for their financial learning provider:

CFI is the #1 rated finance training provider with courses taught by finance industry veterans.

Rated 4.9/5 stars by nearly 41,000 reviews – and counting

Certifications that are recognized by the financial industry to set you apart from the competition

So, ready to take your financial modeling skills to the next level? Check out CFI today.

Deal Flow

M&A / Investments

Blackstone is nearing a deal to acquire Jersey Mike's Subs for $8B, including debt

Building products distributor QXO offered to acquire $6.7B-listed Beacon Roofing Supply

Orla Mining agreed to acquire an Ontario gold mine from Newmont for $850M

State-backed China Mobile, the world's largest wireless carrier, is exploring a potential $835M deal for Hong Kong broadband provider HKBN

Trump Media is in talks to buy $400M-listed crypto marketplace Bakkt

PE firm Charlesbank Capital Partners acquired a controlling stake in economic analysis software maker Implan for over $100M

Abu Dhabi's International Resources Holding is in talks to buy an indirect stake in tin mining giant Alphamin Resources via a vehicle of PE firm Denham Capital

LeBron James' media company SpringHill will merge with UK film company Fulwell 73

PE firm Investcorp and Canada's PSP Investments will buy US accounting firm PKF O'Connor Davies

Centerbridge Partners and Bessemer Venture Partners will acquire a majority stake in accounting firm Carr, Riggs & Ingram

VC

Indian nutrition startup HealthKart raised a $153M round at a $500M valuation led by ChrysCapital and Motilal Oswal

Moonvalley, a startup building 'ethical' video models, raised a $70M seed round led by General Catalyst and Khosla Ventures

Text marketing firm Take Blip raised a $60M Series C led by SoftBank

Investment management software QPLIX raised $28.5M from Partech

Medical research platform Medeloop raised a $15.5M Series A led by Inovia Capital

Orderful, a cloud-based EDI solutions, raised a $15M growth round led by NewRoad Capital Partners

GridBeyond, a battery storage system for energy grids, raised $12.3M from Triodos Investment Management

Juna.ai, a German AI startup making factories more energy efficient, raised a $7.5M seed round from Kleiner Perkins and Norrsken VC

Revisto, an AI startup streamlining medical, legal, and regulatory review for pharma marketing, raised a $4M seed round led by LiveOak Ventures

IPO / Direct Listings / Issuances / Block Trades

MicroStrategy raised $4.6B in a share sale as part of plans to buy Bitcoin

Home service software firm ServiceTitan, last valued at $7.6B in 2022, publicly filed for a US IPO

Chinese foods giant WH Group plans to list 20% of Smithfield Foods in a New York IPO at a $5.4B valuation

Delivery Hero is seeking to raise $1.5B at a $10B valuation in an IPO of its Mideast unit Talabat

Oman's state energy company OQ is seeking to raise $490M at a $1B valuation in an IPO of its methanol and LPG unit OQ Base Industries

Debt

MicroStrategy is set to raise $1.75B via 0% senior convertible notes as part of plans to buy Bitcoin

Thoma Bravo-backed Quorum Software raised $865M in private credit led by Apollo

Bankruptcy / Restructuring / Distressed

Spirit Airlines filed for Chapter 11 to restructure $1.6B of debt and hand control to bondholders

Struggling Chinese property developer Country Garden submitted an offshore debt restructuring plan to creditors as it fights to avoid liquidation

Fundraising

EQT raised its hard cap for its latest Asia PE fund to $14.5B

Silver Point Capital closed its latest private credit fund at $8.5B

Bain Capital raised $5.7B for its second global special situations fund

Credit investor Redwood Capital Management is seeking to raise $2.5B for its next drawdown fund

PE firm Rubicon Technology Partners raised a $500M continuation fund for inventory software firm Cin7 from CVC, Ares, BlackRock, Goldman Sachs Asset Management, and Schroders Capital

Crypto Corner

Trump will meet privately with Coinbase CEO Brian Armstrong (WSJ)

Ex-Millennium and PIMCO execs launched a crypto advisory x2B (BBG)

Goldman Sachs is looking to spin out its digital assets tech platform (RT)

Nasdaq plans to list options on BlackRock's Bitcoin ETF by today (BBG)

SEC charged Bit Mining for bribing foreign officials (RT)

Exec’s Picks

A good night's sleep sets the tone for the rest of your day, and Eight Sleep's Pod will have you sleeping like a baby. The Pod, which fits on any bed, uses machine learning to analyze your health while you sleep and automatically optimizes your body temperature and breathing throughout the night to have you waking up sharper, energetic, and fully rested from day one. Use code LIT to get $600 off your Eight Sleep Pod.

Mario Gabriele and Michael Dempsey published an incredible piece on whether AI companies can really just scale their way to AGI…this time employing the analogy of religious institutions.

Jon Sindreu at WSJ explained why higher Bitcoin prices isn't necessarily a boon for miners.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

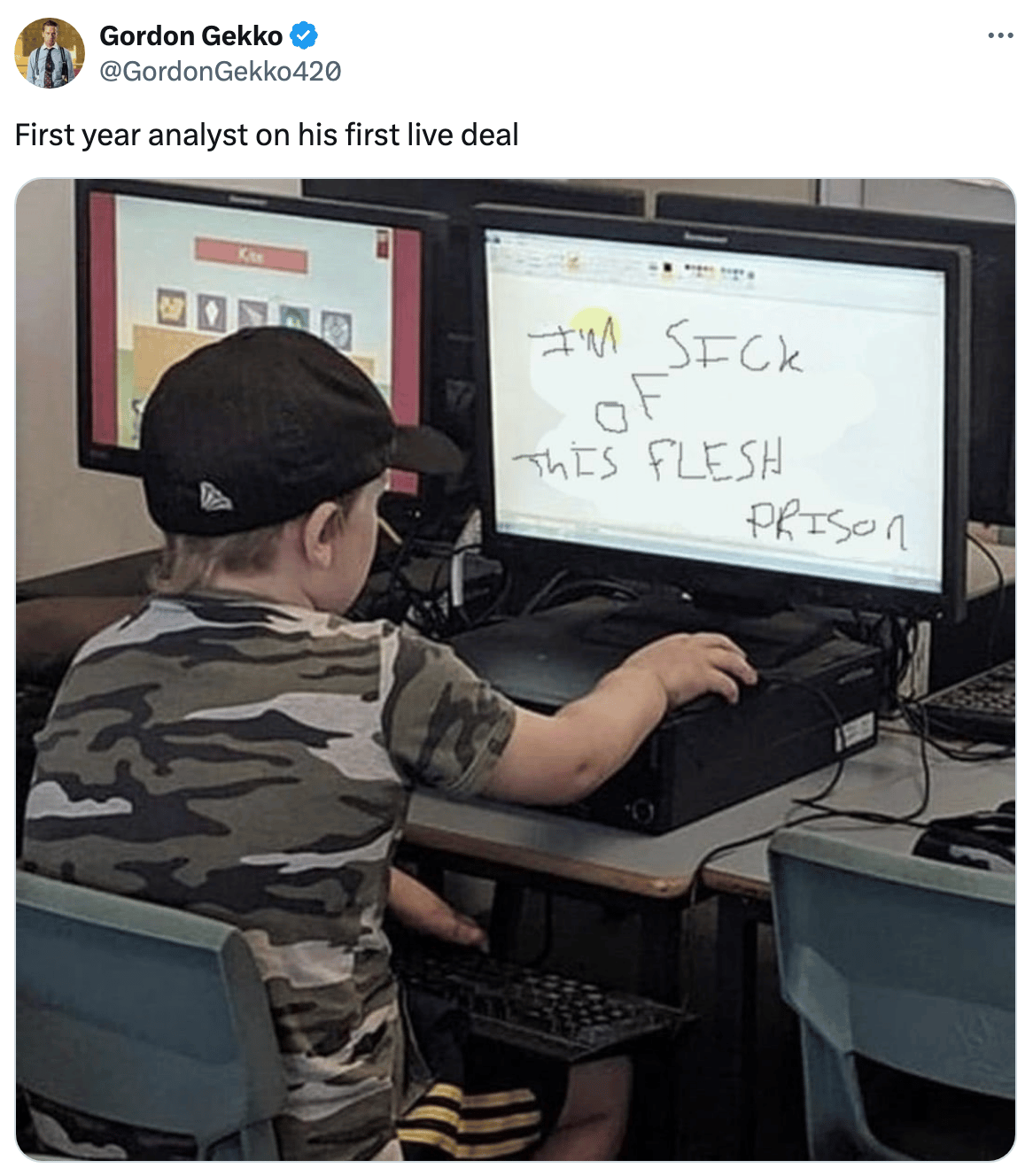

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.