Together with

Good Morning,

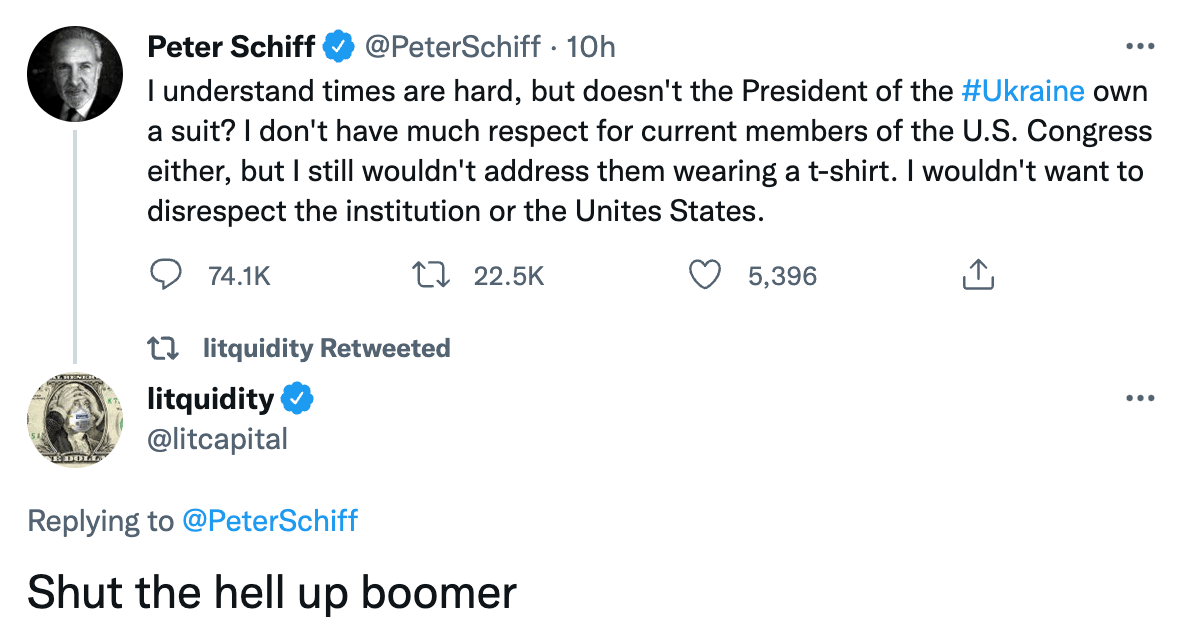

The Fed is raising rates by 25 bps, US and Chinese stocks rallied (for different reasons), Howard Schultz returns to Starbucks as interim CEO, the US is sending dive-bombing drones to Ukraine, Republicans are mad about Citi's new abortion policy, and Robinhood will let users lend their stocks.

If you missed it yesterday, we just dropped a new BSD podcast episode. Lit & Mark answer questions from the audience, covering topics such as the value of an MBA, private market valuations, advice to incoming summer analysts, non-target vs. target cheeks, and more. Listen on spotify and apple.

📅 Tomorrow at 8PM ET: Co-hosting a twitter spaces with the BSD podcast sponsor -CoinFLEX. Be sure to tune in to learn more and hang with the litquidity team.

Let's dive in.

Before The Bell

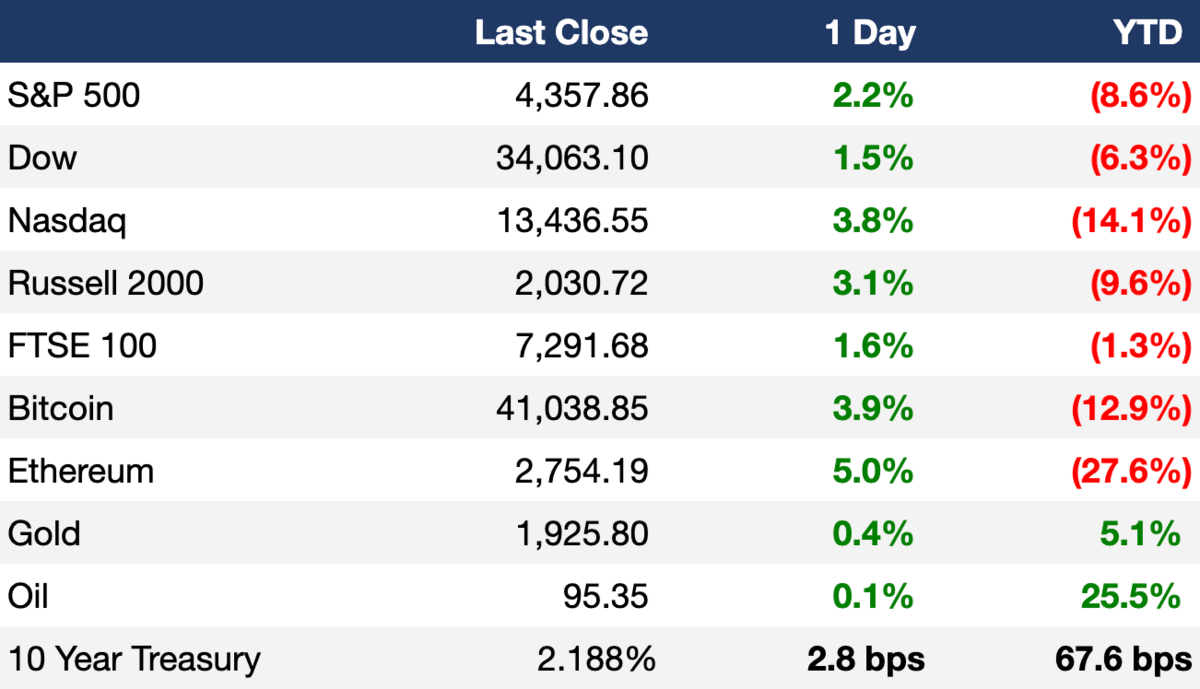

As of 3/16/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US markets moved higher yesterday, with all three major US averages closing in the green, after the Fed announced an interest rate hike (25 bps) for the first time since 2018

The Fed expects to hike rates ~6x this year, bringing its benchmark interest rate to 1.9% according to their new projections

Over in China, stocks climbed as Beijing promised to ease up on its regulatory crackdown, support property and tech companies, and stimulate the economy

This morning we’ll get last week’s initial jobless claims numbers, housing starts, manufacturing data, and industrial production numbers, which will help build a better economic picture

Earnings

Headline Roundup

Magnitude 7.3 earthquake hits near Japan’s Fukushima (BBG)

Russia stokes fear of first foreign currency default in more than a century as it attempts payment (CNBC)

Starbucks CEO to retire; Founder Howard Schultz returns as interim CEO (BBG)

Pentagon cuts request for Lockheed’s F-35s by 35% (BBG)

Walmart to hire more than 50K workers in push into newer businesses (CNBC)

Robinhood readies feature that lets users lend out their stocks (BBG)

Citi draws ire of Texas Republicans over its new abortion policy (BBG)

Biden to name new Fed nominee after Raskin withdrawal (BBG)

Sweetgreen rebuilds office delivery program as cubicles fill again (WSJ)

Abramovich investment vehicle shifted control shortly after Russia invaded Ukraine (WSJ)

Berkshire Hathaway stock closes at a record above $500K for first time (CNBC)

New Federal Reserve projections show six more rate hikes this year (CNBC)

Ex-New York Gov. Andrew Cuomo considers running against Kathy Hochul despite opposition from his own party (CNBC)

Netflix makes Volodymyr Zelenskyy’s show ‘Servant of the People’ available to US streamers (CNBC)

Joe Buck and Troy Aikman leave Fox to host ESPN’s Monday Night Football (CNBC)

A Message From LEX

Do Bears Drink Green Beer?

Is the world just trying to ruin our St. Paddys day? As if the past few years haven’t been hard enough, now we’re running at double digit inflation rates and a looming bear market. Luckily, one building is still one building even if it’s hard to tell after a long night of green beer.

Commercial real estate is your answer to hedging inflation and diversifying your portfolio. That’s why we're excited about LEX.

Truth is, the best deals in real estate are hard to find, unless you own Guinness and are accredited and all that. Even then, you’ve got scarce deals, crowdfunding, or REITs to pick from…until LEX.

LEX IPOs buildings so you can get in the game.

By taking buildings public, LEX has created a way for you to invest in marquee commercial real estate. Build a portfolio by picking the buildings you want to invest in. Each building gets a ticker and trades like your other stocks.

The best part?

As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.

Check out LEX’s live assets in New York City and upcoming IPO in Seattle.

Deal Flow

M&A / Investments

PE firms Sycamore Partners and Hudson’s Bay plan to submit takeover bids for department-store chain Kohl’s which could value it at $9B+ (WSJ)

Telecom company Etisalat proposed to boost its shareholding in Saudi Arabia phone operator Mobily in a potential $2.12B deal, sending shares up 9%+ (BBG)

Norway’s DNB, the country’s largest bank, will be allowed to buy online rival Sbanken in a $1.24B deal, overturning an earlier ban (RT)

Canadian heavy oil producer Serafina Energy is looking at a possible sale of the company in a potential $782M+ deal, figuring that high crude prices will boost its value (RT)

Ken Griffin (the billionaire founder of Citadel) teamed up with the Ricketts family (the owners of the Chicago Cubs) for a takeover bid of English soccer’s Chelsea Football Club, which is being sold by Roman Abramovich in the wake of Russian oligarch sanctions (BBG)

VC

Cloud-based parking software startup FLASH announced a $250M+ strategic investment at a $1B+ valuation led by Vista Equity Partners (BW)

RISC-V chip design startup SiFive raised a $175M Series F at a $2.5B valuation led by Coatue (BW)

Sokowatch, a Kenyan asset-light B2B & B2C retail platform, raised a $125M Series B led by Tiger Global and Avenir (TC)

Talent.com, a portal aggregating job ads posted directly by recruiters and ads from 3rd party sites, raised a $120M Series B led by Inovia Capital (TC)

Amagi, a startup developing cloud-based tech for broadcast and connected tv, raised $95M at a $1B+ valuation led by Accel (PRN)

Precirix, a clinical-stage biotech company developing precision radiopharmaceuticals, raised an $88M Series B led by INKEF Capital, Jeito Capital, and Forbionas (PRN)

Remote work platform Multiplier raised a $60M Series B at a $400M valuation led by Tiger Global and Sequoia Capital India (TC)

Telecom-as-a-service platform OXIO raised a $40M Series B led by ParaFi Capital (BW)

Nautilus Labs, a startup working to decarbonize ocean shipping, raised a $34M Series B led by M12 and the Microsoft Climate Innovation Fund (BW)

Bambee, a startup automating HR for SMEs, raised a $30M Series C led by QED (BW)

AI analytics and monitoring platform TruEra raised a $25M Series B led by Menlo Ventures (TC)

Quadric, a developer of edge AI chips, raised a $21M Series B led by NSITEXE and MegaChips (VB)

Clockwork.io, a startup aiming to improve server clock sync, raised a $21M Series A led by NEA (TC)

AI-powered IDV solutions provider Shufti Pro raised a $20M Series A led by Updata Partners (PRN)

4G Capital, a Kenyan fintech startup providing unsecured credit to micro enterprises, raised an $18.5M Series C led by Lightrock (TC)

doxo, a bill payment platform, raised an $18.5M Series C led by Jackson Square Ventures (BW)

Stämm, a startup developing an industrial biomanufacturing platform, raised a $17M Series A led by Varana Capital (PRN)

PingPod, a 24/7 autonomous table tennis on-demand concept, raised a $10M Series A led by Sequoia Heritage (BW)

Indonesian earned wage access platform Wagely raised an $8.3M pre-Series A led by East Ventures (TC)

Solo, a vehicle hardware company focused on freight transportation, raised a $7M seed round led by Trucks VC (BW)

Loveseat, an online marketplace for home goods, raised a $7M Series A led by Bessemer Venture Partners (BW)

Onuu, a startup helping Americans without financial security, raised a $6M seed round led by Leap Global Partners (BW)

Archeon, a French startup working on CPR AI, raised a $6M Series A led by Karot Capital, Majycc eSanté Invest, and Daphni (BW)

Wombat Exchange, a BNB native multichain stableswap protocol, raised a $5.25M Series A led by Animoca Brands and Hailstone Ventures (PRN)

Maritime surveillance startup Modern Intelligence raised a $5M seed round led by Geoff Lewis (PRN)

Twelve Labs, a startup making a “CTRL-F for video”, raised a $5M seed round led by Index Ventures (TC)

Liveblocks, a startup that lets you turn a regular web app into a multiplayer product, raised a $5M seed round led by Boldstart (TC)

Job board startup Rolebot raised a $4.5M seed round from Data Point Capital, Uncorrelated Ventures, Jason Calacanis, and the LAUNCH fund (PRN)

IPO / Direct Listings / Issuances / Block Trades

Italian tech firm Deda Group is seeking to IPO at a $1.1B valuation (BBG)

Luxury furniture, bedding, and home accessory maker Serena & Lily is planning an IPO at a potential $1B+ valuation (BBG)

Auto retailer Ali Alghanim & Sons filed to list on Boursa Kuwait in the first share sale by a family-owned business in 7 years (BBG)

Debt

Fundraising

Asana Partners, a vertically integrated real estate investment company, raised $1.5B for its 5th fund (PRN)

Frazier Life Sciences raised a $987M+ venture fund focused on biopharmaceutical companies (BW)

MedTex Ventures closed a $46.5M fund aimed at seed to Series A companies developing early-stage medical devices (BW)

Crypto Corner

Ukraine president signs law legalizing and regulating crypto assets (DC)

ApeCoin launches for Bored Ape Ethereum NFT holders with Reddit, FTX, Animoca Execs on board (DC)

Congress members demand answers from SEC on crypto company probes (TBC)

Check out our latest deep dive breaking down FTX's business model (ES)

Exec's Picks

We are officially in correction territory, with all indexes down more than 10% from their highs. Nick Maggiulli wrote a piece explaining how the market has historically performed after large declines. Check out his latest here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, Corp Dev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝