Together with

Good Morning,

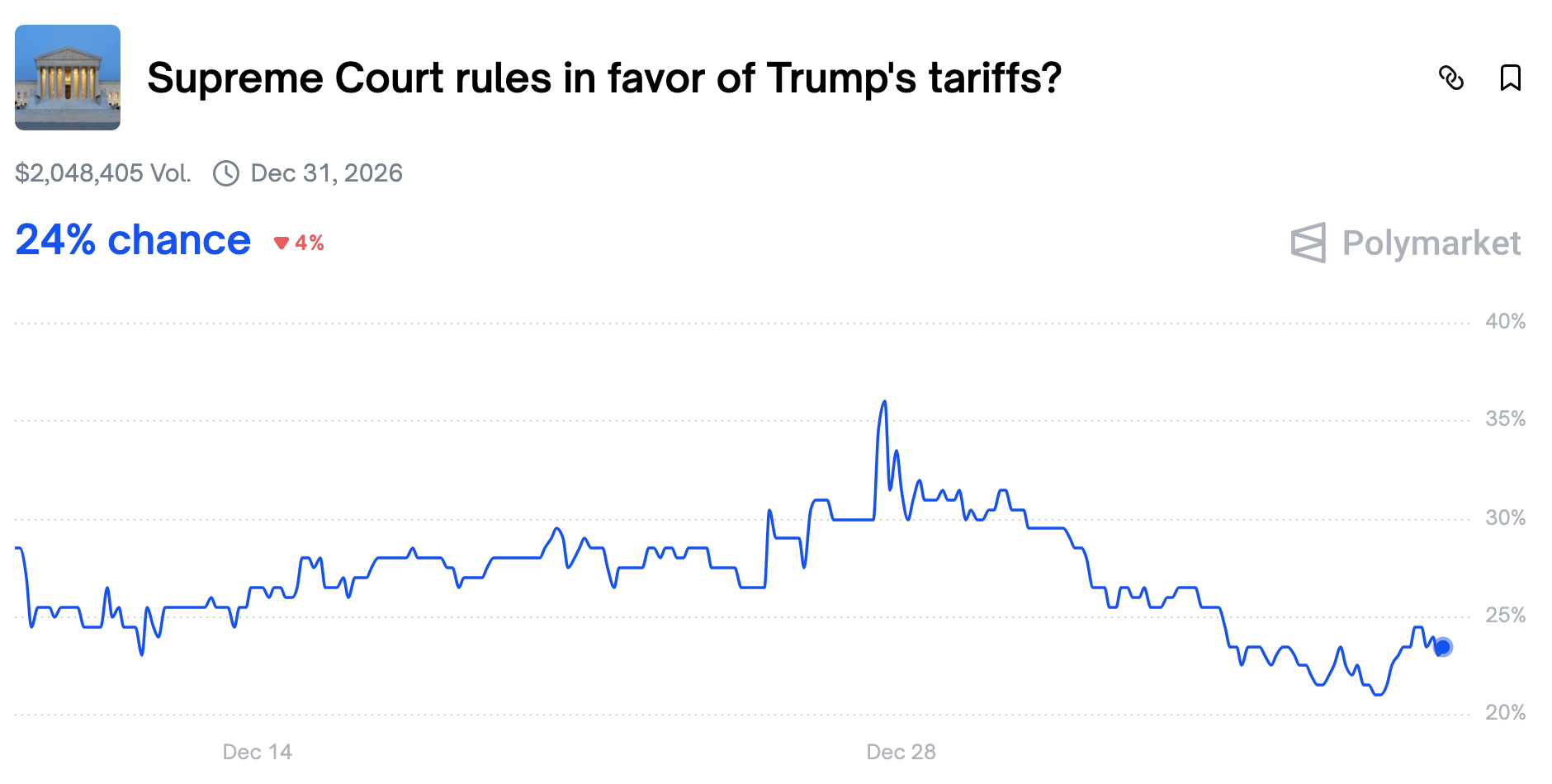

US is considering paying Greenlanders to secede from Denmark, PE megafunds captured their largest fundraising share in a decade, Musk and Sam Altman are headed to trial, the hedge fund industry is having a moment, and SCOTUS is set to rule on the legality of Trump's tariffs.

Stavtar created a new class of software for the Office of the CFO, revolutionizing business spend and expense allocation for complex businesses, as well as compensation and organizational management. Check it out.

Let's dive in.

Before The Bell

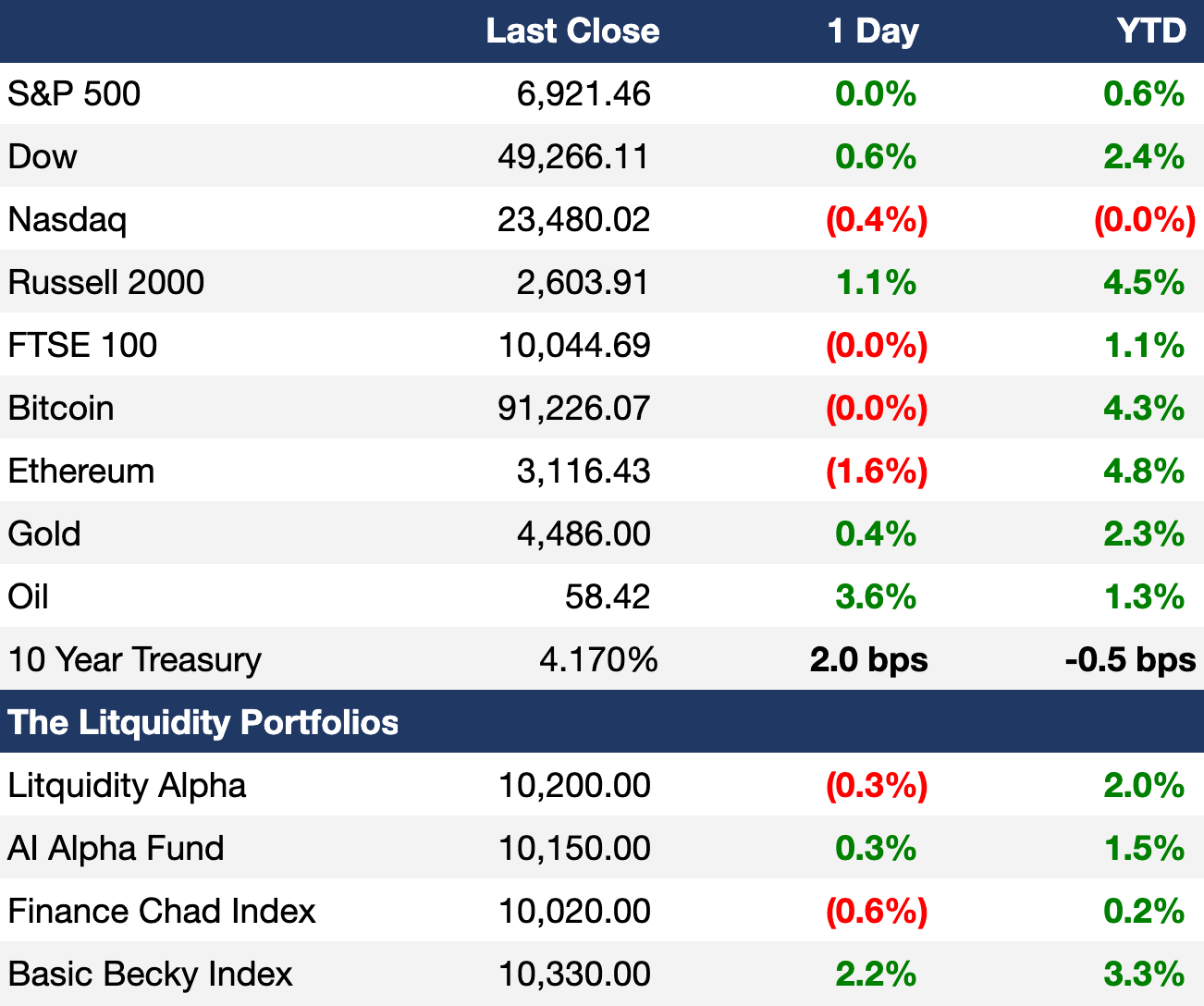

As of 1/8/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mixed yesterday as investors rotated out of tech and braced for a crucial jobs report and SCOTUS tariff ruling

Russell 2000 is rallying as investors embrace small caps

Venezuela stocks are up over 125% YTD

Earnings

Prediction Markets

This is probably going to be the most confusing AND nothing burger ruling despite all the market hype

Track your prediction on SCOTUS rulings on Polymarket

Headline Roundup

US weighs $100k payments to Greenlanders to secede from Denmark (RT)

Trump will announce Fed chair after interviewing BlackRock's Rieder (RT)

US trade deficit narrowed to the lowest since 2009 (BBG)

US Q3 productivity rose 4.9% at fastest pace in two years (RT)

US oil firms want 'serious guarantees' to invest in Venezuela (FT)

Investors are the most bearish on oil in ten years (BBG)

Bessent said PE firms won't be forced to sell homes (BBG)

Ten biggest PE funds took their largest fundraising share in a decade (FT)

Hedge funds boom as investor enthusiasm for PE falters (FT)

Italy and Portugal added to record week of global bond sales (BBG)

Foreigners flocked to Japan stocks by most since 2013 last year (BBG)

Investors urged China to let yuan strengthen (FT)

US airports sold a record $24B in munis in 2025 (BBG)

Memory stocks record rally of 2025 shows no signs of slowing (BBG)

Morgan Stanley promoted 184 to MD amid dealmaking revival (RT)

UBS capital compromise plan got backing of largest Swiss party (BBG)

Defense firms spent twice as much on stock than CapEx since Covid (BBG)

OpenAI earmarked $50B for employee stock compensation (RT)

Index Ventures is preparing for a succession (BBG)

Musk's lawsuit over OpenAI for-profit conversion will head to trial (CNBC)

US firms are dropping layoff plans for more hiring (BBG)

Jensen Huang doesn't care about proposed California billionaire tax (WSJ)

Luxury watch prices hit a two-year high in the secondary market (BBG)

A Message from Stavtar

Stavtar has built the universe of software for complex businesses to live in, bringing together StavPay, StavComp, StavOrg and StavMarket in one platform.

More than 120 managers with over $2.4T of AUM collectively rely on Stavtar to manage their vendors, contracts, invoices, expense allocations, payments, legal entities, compensation, and connect to vendors in the Stavtar community.

Get more details at stavtar.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

Mining giants Glencore and Rio Tinto are in preliminary talks on a potential $260B all-share merger to create the world's largest mining company

Warner Bros. Discovery shareholders are divided on Paramount Skydance's improved $108B hostile bid, which management urged to reject

Pharma giant Merck is in talk to buy cancer drug developer Revolution Medicines in a $28B-$32B deal

Hong Kong lender Hang Seng Bank's minority shareholders backed a $14B buyout offer from parent HSBC, valuing the bank at $37B at a 30% premium

PE firm Advent is in talks to partner with Polish logistics company InPost's founder Rafal Brzoska and Czech investment firm PPF on a potential $8.2B+ buyout

UK PE firm Hg's $6.4B acquisition of software solutions firm Onestream netted KKR a 4.5x return in seven years

Chinese sportswear giant Anta Sports offered to acquire a 29% stake in $3.7B-listed struggling German peer Puma from France's Pinault family

Indian conglomerate Bajaj acquired a 23% stake in its insurance subsidiaries Bajaj General Insurance and Bajaj Life Insurance from Allianz for $2.4B to take full control

Hotel owner MCR's $2.7B take-private deal for members club Soho House hit a snag as MCR is unable to make a $200M funding commitment in time

Tech-focused PE firm Haveli agreed to acquire a 90% stake in AI contract software firm Sirion at a $1B valuation

LVMH-linked PE firm L Catterton agreed to acquire a majority stake in cottage cheese brand Good Culture at an over $500M valuation

German investment firm AEQUITA agreed to acquire Saudi petrochemical firm SABIC's European Petrochemicals for $500M

German investment firm Mutares agreed to acquire SABIC's Engineering Thermoplastics business for $450M

Cybersecurity giant CrowdStrike will acquire identity security startup SGNL for $740M

Paramount Skydance is in talks with several major companies and music industry leaders about acquiring a stake in the MTV cable network

Mubaldala-backed refiner Moeve and peer Galp Energia are in early talks to form a JV combining their Iberian gas stations and refining plants

Research firm Vanda agreed to acquire data analytics firm Exante Data

VC

Nvidia-backed European data center startup Nscale is in talks to raise a $2B Series C; the firm was valued at $3.1B in September

AI data-security firm Cyera raised a $400M Series F at a $9B valuation led by Blackstone

Women- and child-focused virtual care startup Pomelo Care raised a $92M Series C at a $1.7B valuation led by Stripes

Valinor Enterprises, a defense technology holding company, raised a $54M Series A round led by Friends & Family Capital

Spatial multi-omics startup Vizgen raised a $48M round led by ARCH Venture Partners, M Ventures, and Northpond Ventures

Luxury Presence, a real-estate agent growth platform, raised a $22M Series C led by Bessemer Venture Partners

AI data platform Protege raised a $30M Series A extension led by a16z

Spanish clinical voice-AI startup Tucuvi raised a $20M Series A round led by Cathay Innovation and Kfund

AI-commerce startup Spangle raised a $15M Series A led by NewRoad Capital Partners

Voice-AI restaurant startup Presto raised a $10M round led by Metropolitan Partners Group

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

US will decide on Fannie Mae and Freddie Mac IPOs by February-end

Czech defense firm CSG will launch its $4.7B Amsterdam IPO next week

Hong Kong infrastructure conglomerate CK Hutchison picked Goldman and UBS for a planned $2B IPO of global health and beauty retailer A.S. Watson

UI Boustead REIT, the REIT unit of engineering services group Boustead Singapore, is seeking to raise over $700M in a Singapore IPO

Chinese AI firm MiniMax surged 54% after raising $620M in an upsized Hong Kong IPO that was 70x oversubscribed

Philippine fast food group Jollibee Foods plans to spin off its international business and list it in US by late-2027

Debt

US ordered Fannie Mae and Freddie Mac to buy $200B in mortgage bonds

Italy drew a record $220B in bids for a $17B bond sale, its biggest-ever publicly syndicated transaction

Belgium raised $9.4B in its biggest-ever publicly syndicated transaction

Portugal raised $4.6B in a bond sale

Poland raised $3.7B in a bond sale

Austrian bank Erste sold an SRT linked to over $11.7B of loans tied to insurance companies to allow for its ~$8B acquisition of a 49% stake in Santander's Polish unit Santander Bank Polska

Banks are competing to provide a $5.3B debt package to back an Advent-led consortium's potential $7B buyout of InPost

A group of banks led by Barclays is shopping a $2.6B debt deal to support Blackstone's effort to merge power grid equipment suppliers MacLean Power Systems and Power Grid Components

Chinese e-commerce giant JD.com is considering a $1.4B dim sum bond sale

Mercuria Energy agreed to lend $1.2B to fund the buyout of major Kazakh copper producer Kazakhmys

Bankruptcy / Restructuring / Distressed

LNG operator New Fortress Energy is seeking another extension from creditors as a forbearance period nears expiration and restructuring talks continue

Administrators recovered only ~10% of the $1B owed to Stenn Technologies as they probe the UK invoice-finance firm's December 2024 collapse

Yu Liang, the ex-chairman of distressed Chinese developer Vanke, retired from all roles

Ghana and bondholders agreed in principle on restructuring a defaulted 2026 dollar bond in a key step in Ghana's debt resolution

US lawmakers are raising national security concerns over Roomba-maker iRobot's bankruptcy plan to transfer control to its main Chinese supplier

BGC Partners Advisory, a boutique munis restructuring firm founded by ex-Citigroup execs in in 2024, is dissolving

Fundraising / Secondaries

Benefit Street Partners, the credit unit of asset manager Franklin Templeton, raised $10B for its second real estate credit fund

PE firm Warburg Pincus raised $3B for a third fund targeting financial services

KKR raised $2.5B for its second Asia-focused private credit fund

Sports-focused investment firm Bruin Capital raised a $1B from Apollo co-founder Josh Harris' 26North and PE firm TJC

General Catalyst partner Niko Bonatsos will depart to launch his own early-stage VC as General Catalyst shifts away from traditional VC

Crypto Sum Snapshot

Morgan Stanley will launch a crypto wallet this year

Bipartisan crypto talks hit a new hurdle in Senate

Stablecoin treasuries rose to a record $33T

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Over 1000 companies are suing US for tariff refunds on expectations that SCOTUS will overrule some of Trump's tariffs. Read Bloomberg's deep dive into the situation here.

Bloomberg also published a brief trader's guide to potential SCOTUS tariff refunds.

FT is covering the Business of Formula 1 in their latest Special Report. There's some interesting reads.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.