Together with

Good Morning,

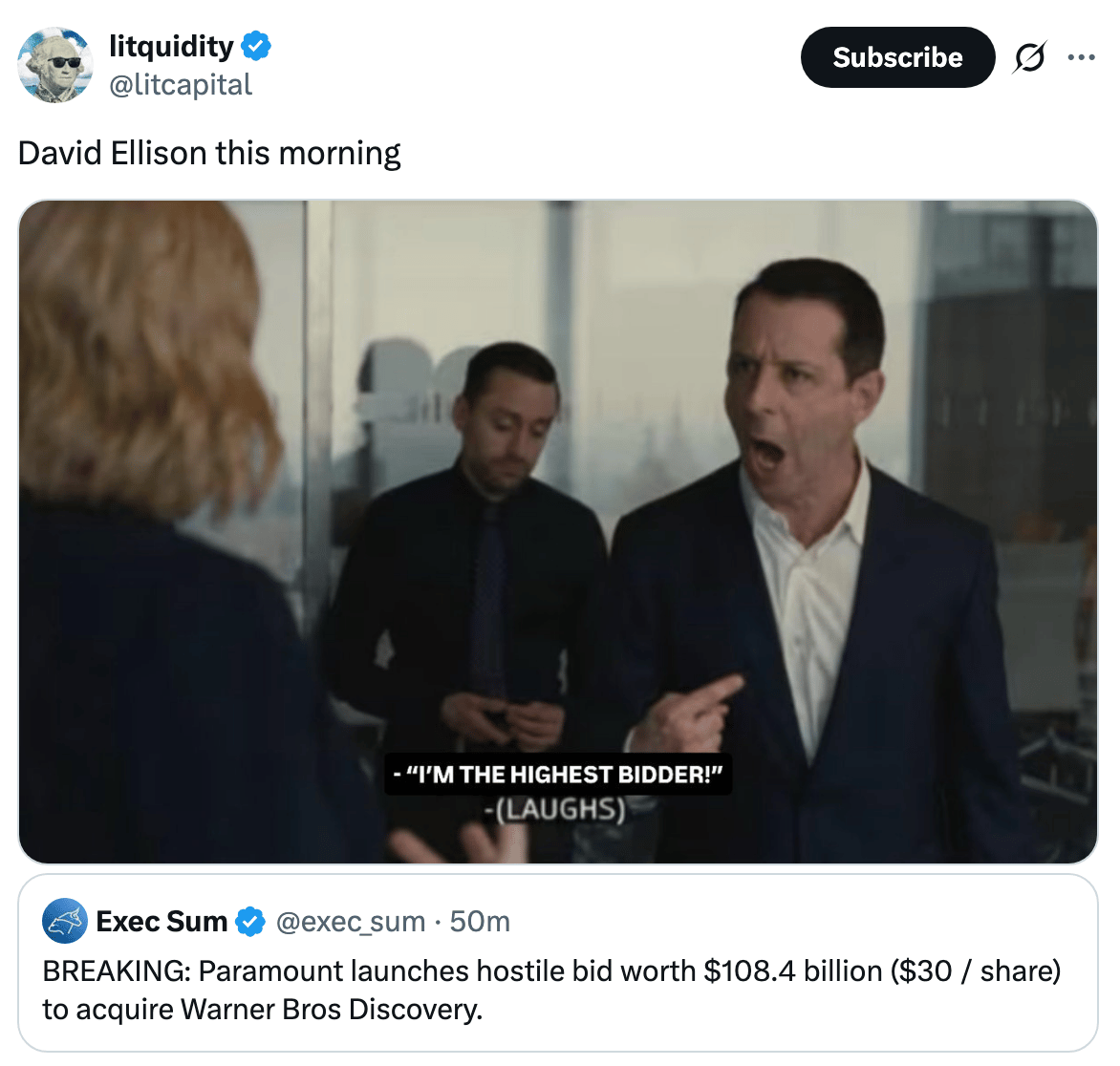

Paramount launched a $108B hostile takeover bid for Warner Bros. to challenge Netflix's deal. Our best wishes to all the TMT bankers staffed on this deal whose calendars are also victim of a hostile takeover.

Plaid released their 2025 Fintech Effect report to explore what 2,000+ consumers want next – and how listening to their expectations can be your 2026 advantage. Read it here.

Let's dive in.

Before The Bell

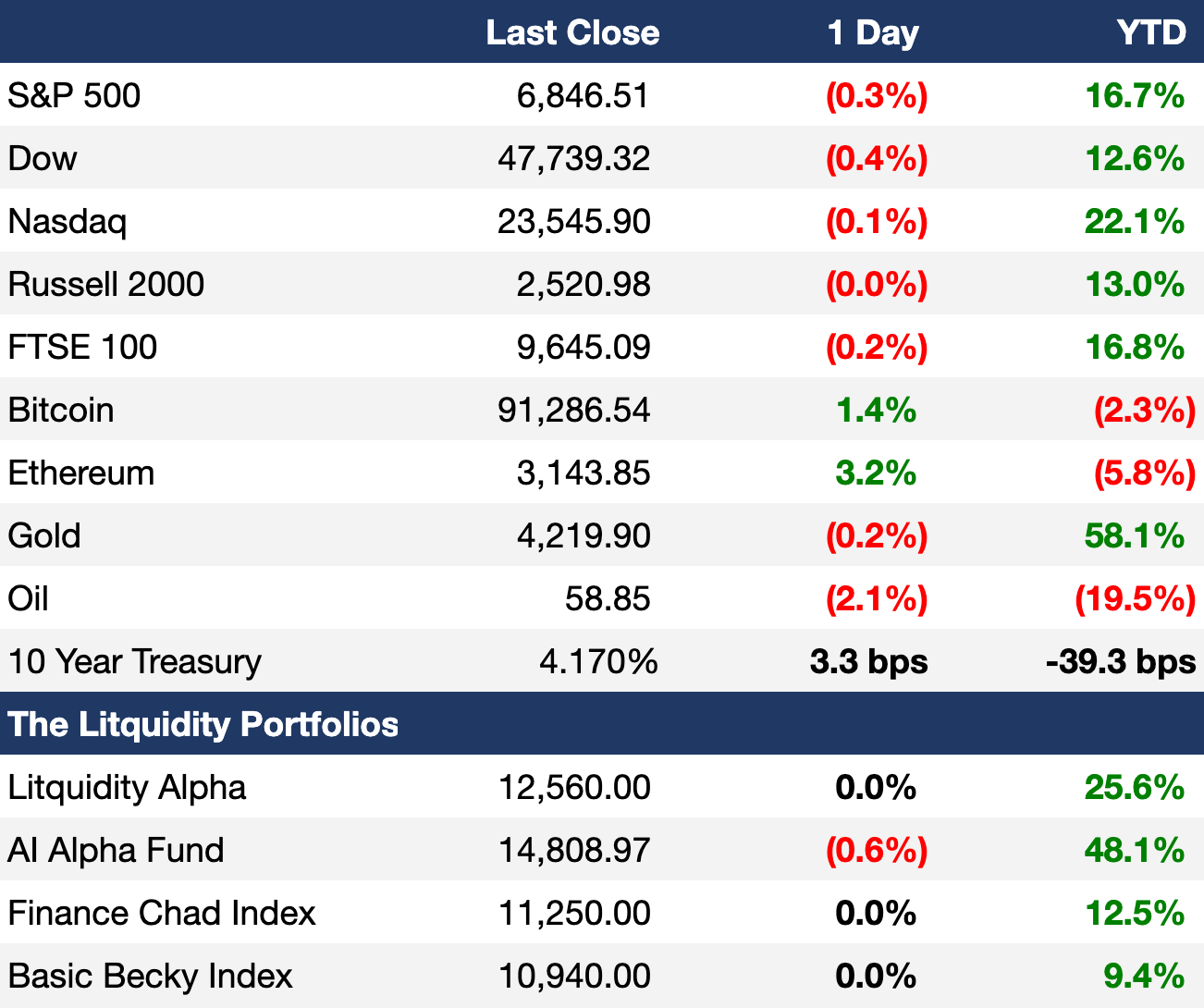

As of 12/8/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks pulled back yesterday as traders braced for the Fed's rate decision

S&P snapped a four-day win streak

Canada's TSX index is up 25% YTD

US Treasury yields rose to two-month highs

Traders are pricing in 30% chance of an ECB rate hike next year

Germany 10Y yield rose to 2.86% to a nine-month high

Germany 5Y yield surged 10 bps

Congo franc is up 30% YTD as Africa's best FX amid a reserve surge

Earnings

Toll Brothers reported higher Q4 revenue but posted a drop in profits and gave a cautious FY outlook on house deliveries due to slow demand amid high mortgage rates and broad economic concerns (WSJ)

What we're watching this week:

Today: Campbell's, GameStop, Cracker Barrel

Wednesday: Oracle, Adobe

Thursday: Broadcom, Costco, lululemon

Full calendar here

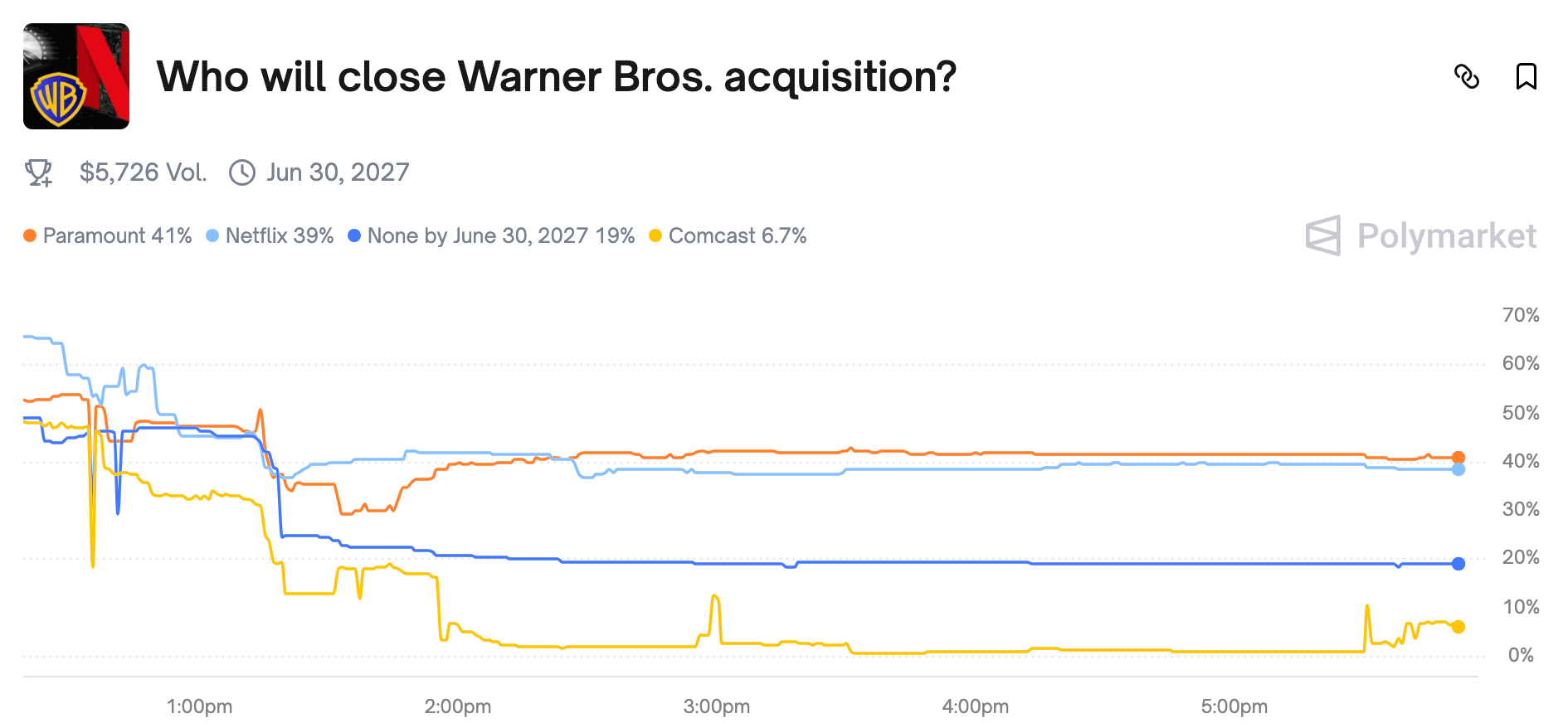

Prediction Markets

Merger arbitrage has never been so easy. Trade the Warner Bros. takeover saga on Polymarket

Headline Roundup

Berkshire's top stock picker Todd Combs will leave for JPMorgan (CNBC)

Berkshire shakes up leadership as Buffett steps down (RT)

Jamie Dimon named advisors for $1.5T US investment pledge (WSJ)

PIMCO CIO warned of 'dangerous' assumptions in credit ratings (BBG)

J Pow's vote-gathering challenge shows test for next Fed chair (BBG)

Bond investors bet on mild rate cut cycle with middle-of-curve positions (RT)

Retail investors help drive gold and US stocks to bubble territory (FT)

Hedge funds tap US leveraged-swap bets as basis trade stagnates (BBG)

Companies rush to bond markets for cut-price M&A funding (BBG)

US tariff shock drove global FX trading to record (BBG)

US will allow Nvidia H200 chips sale to China with 25% tax (CNBC)

Trump says Netflix, Paramount not his friends as WBD fight heats up (RT)

Trump will issue order creating national AI rule (RT)

Foreign investors are dominating Japan's bond market (BBG)

Ares will join the S&P 500 (BRN)

Number of listed Canadian firms shrank for a fourth-straight year (BBG)

Nine EU nations urge extreme caution on 'Buy European' policies (RT)

German corporate bankruptcies surged to a decade high this year (RT)

China trade surplus topped $1T for the first time (FT)

Evolution was ordered to compensate trader who made 97% of revenues (FT)

Simulated trading firm accused of fraud clears hurdle to restart (BBG)

PepsiCo reached a deal with activist Elliott (WSJ)

Ben & Jerry's chair will not resign despite pressure from Unilever unit (RT)

US unveiled a $12B bailout for farmers (WSJ)

A Message from Plaid

WTFintech?

Then you need to check out the 2025 Fintech Effect by Plaid.

Plaid partnered with The Harris Poll to survey 2,000+ US fintech consumers and get a pulse on what’s working, what's not, and where the biggest opportunities lie.

From the next wave of users to emerging usage trends to the future of AI, this report covers everything you need to truly understand the fintech space.

But what makes this year's edition worth the download? Good question. Here's a glimpse:

47% of consumers say the loan application process is too confusing → real-time transaction data can simplify it

77% expect their bank to connect to the apps they use → no more app-jumping to make payments

57% want their fintech apps to use AI → signaling the next phase of financial experiences

If you're looking to grow your business through fintech – or just understand what consumers expect next – this report is a must-read.

Deal Flow

M&A / Investments

Paramount Skydance launched a $108.4B hostile bid for all of Warner Bros. Discovery with equity support from Mideast SWFs PIF, L'imad, and QIA, Trump-linked Affinity Partners, and RedBird Capital in a last-ditch effort to outbid Netflix's $83B deal for WBD's studio and streaming assets

IBM will acquire data streaming platform Confluent at an 11% valuation for a 34% premium

Antero Resources and its pipeline affiliate Antero Midstream agreed to buy natural gas upstream assets from HG Energy II for $3.9B cash

US metals processor Worthington Steel held takeover talks with $915M-listed German steel producer Kloeckner

E-commerce firm ContextLogic acquired evaporated salt products provider US Salt from Emerald Lake Capital Management for $900M, with BC Partners contributing $150M in preferred equity

PE firm Carlyle emerged as the frontrunner to acquire $825M-listed Japanese medical supplies company Hogy Medical

Mirum Pharmaceuticals agreed to acquire Bluejay Therapeutics in an $820M cash-and-stock deal

US energy giant NextEra Energy's infrastructure arm agreed to acquire gas retail platform Symmetry Energy Solutions for $800M

Nordic PE firm Altor Equity Partners will acquire Finnish clean tech firm Evac from UK PE firm Bridgepoint for $700M

UK's Hayfin Capital Management and UK real estate investor Capreon agreed to buy London's Can of Ham tower for $453M

Apollo will take a <10% stake in Ryan Reynolds-owned Welsh soccer club Wrexham AFC

Jefferies agreed to buy a 50% stake in $18B AUM credit-focused asset manager Hildene for $340M cash as Hildene acquires annuities firm Silac

UK PE firm Cinven will acquire a majority stake in UK advisory firm Flint Global at a $255M valuation

Indonesian O&G firm Prime agreed to acquire UK's Harbour Energy's operating interests in two Indonesia offshore projects for $215M

Ares acquired Redback Boots at a $66M valuation in its first PE deal in Australia

Bain Capital is considering bringing in fresh backers for Singapore-based Bridge Data Centres to help raise cash and expand

Boeing and Airbus completed their complex acquisition of struggling US aerospace supplier Spirit AeroSystems

Germany is closing in on a deal to buy a 25% stake in the German unit of Dutch state-owned grid operator TenneT

VC

AI robotics startup Skild is in talks to raise an over $1B round at a $14B valuation from investors including SoftBank and Nvidia

Crypto firm Ripple's $500M share sale at a $40B valuation to Citadel Securities, Fortress, and others came with strong protections including the right to sell shares back to Ripple at a guaranteed return

Brazilian stablecoin startup Crown raised a $13.5M Series A at a $90M valuation led by Paradigm

COGNNA, an AI-led SecOps platform, raised a $9.2M Series A led by Impact46

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Blackstone, Carlyle, and Hellman & Friedman-backed medical supplies provider Medline is seeking to raise $5.4B at a $55B valuation in what would be the biggest US IPO of 2025

French cosmetics giant L'Oreal acquired another 10% stake in $48B-listed skincare firm Galderma from PE firm EQT to raise its stake to 20%

Unilever's spinoff The Magnum Ice Cream debuted lower than expected at a $9.1B market cap

French lender BNP Paribas' insurance unit BNP Paribas Cardif will raise its stake in Belgian insurance group Ageas from 15% to 22.5% for $1.3B and sell its 25% stake in Belgian insurance provider AG Insurance to Ageas for $2.2B to give Ageas full control of AG Insurance

Andersen Group, the tax firm founded by Arthur Andersen alumni, is pursuing a $176M IPO at a $1.75B valuation

Vietnam's biggest fund manager Dragon Capital plans to list all its shares on the Unlisted Public Company Market at a $150M market cap

The China IPOs of Chinese chipmakers MetaX Integrated Circuits and Onmicro Electronics are ~3000x oversubscribed after peer Moore Threads' stellar debut

SPAC / SPV

Cancer detection biotech Freenome will merge with Perceptive Capital Solutions Corp in a $330M deal that includes a $240M investment from Perceptive Advisors, RA Capital, and ADAR1 Capital Management

Debt

Paramount lined up $54B of secured bridge financing from Bank of America, Citigroup, and Apollo to support its $108B hostile takeover bid for Warner Bros. Discovery

AI cloud computing firm CoreWeave plans to raise $2B in a convertible bond sale

Casino operator Bally's secured amended commitments from Ares, King Street, and TPG to lift its term loan to $1.1B

Carlyle is providing $340M in private credit to French aerospace and defense high-precision components supplier Mecachrome

Ukraine's Universal Bank hired Morgan Stanley to explore a debut international bond sale

Bankruptcy / Restructuring / Distressed

Senior lenders including CVC, KKR, Blackstone, and HIG Capital will take control of French nursing home operator Colisée from owner EQT in exchange for writing off $1.4B of debt

Troubled Chinese developer Vanke's local bondholders are discussing Vanke's payment delay with China officials

The struggling CRE unit of Chinese conglomerate Dalian Wanda is seeking to delay payment on a $400M bond

Spirit Airlines will transfer two airport gates to American Airlines for $30M

Fundraising / Secondaries

Ares raised $3.2B for its debut credit secondaries fund

Tiger Global is raising $2.2B for its seventeenth VC fund which will employ a more disciplined approach

Jay-Z's investment firm MarcyPen Capital Partners is working with Korea's Hanwha Asset Management to raise a $500M PE fund to back Korean firms in entertainment, beauty, food, and lifestyle pursuing international growth

German VC FoodLabs raised $122M for its third fund to invest in early-stage food tech startups in Europe

Crypto Sum Snapshot

BlackRock's Bitcoin ETF is up 40% YoY from its January 2024 debut but average investor returns are just 11% YoY

Bank CEOs are set to meet senators on crypto market structure

Criminal's 'cash to crypto swaps' use stablecoins to bypass bank security

Binance gains major regulatory wins in Abu Dhabi

StableChain launch shows how far crypto has strayed from Bitcoin's original promise

Strategy's 60% slide leaves Bitcoin's biggest booster with dwindling options

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Has AI reduced the workload in M&A – or just moved it around? Read UpSlide's The AI Paradox in M&A report to discover the truth from M&A professionals across the US and UK.

Michael Batnick shared the most simple yet profound advice for leaders anywhere.

Also, ethics matters when it comes to M&A. Especially among investment firms…

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.