Together with

Good Morning,

Investments banks are back in business, Apollo extended Marc Rowan's CEO tenure, Israel and Hamas agreed to a ceasefire, TikTok will go dark on Sunday, and Hindenburg Research is bowing out after a historic seven-year short selling campaign.

Want to build winning pitchbooks? Join UpSlide's webinar on January 30th at 10:30 am ET with CIB experts from Stifel and Leverest as they share how to overcome the biggest obstacles faced by deal teams. Sign up here.

Let's dive in.

Before The Bell

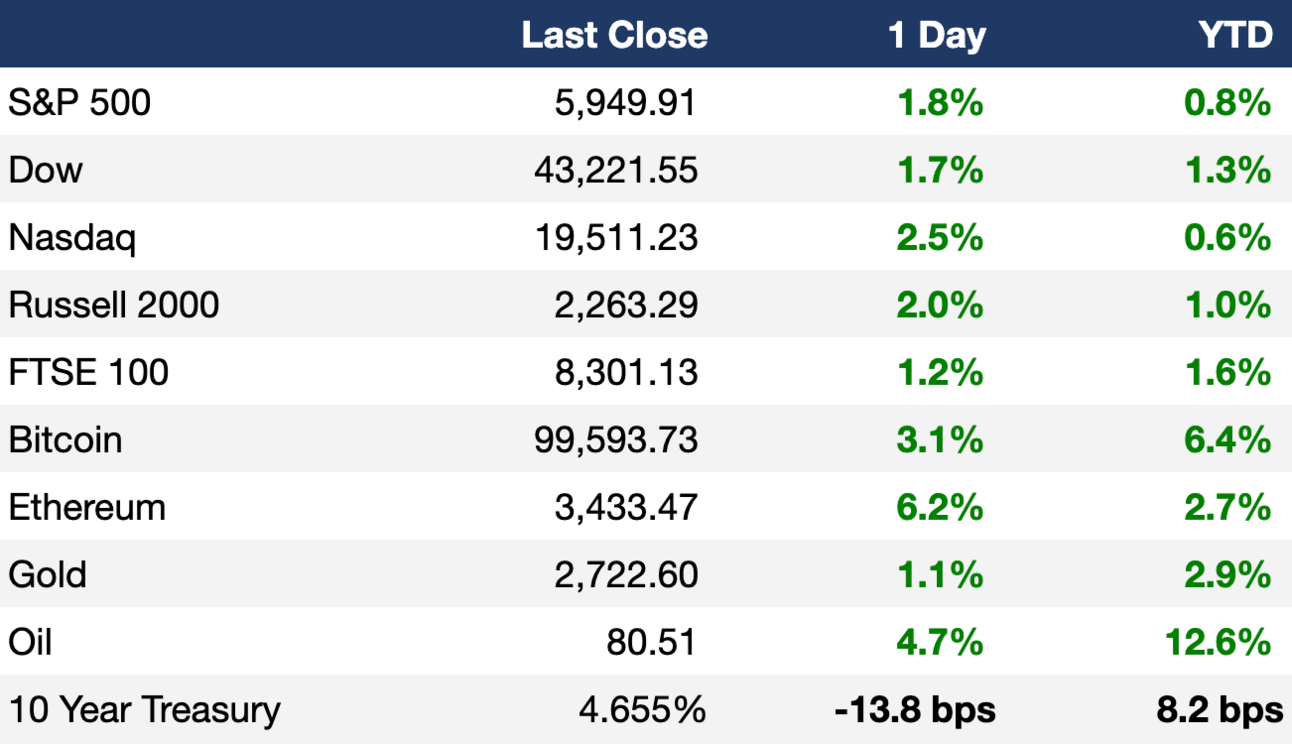

As of 1/15/2025 market close.

Markets

US stocks ripped yesterday as investors reacted to optimistic inflation data and strong bank earnings

All three major indexes posted their best day since the election

Europe's Stoxx 600 rose 1.3% to snap a three-day losing streak

The index posted its best day since August

US 5Y to 10Y yields all fell over 15 bps in their best day since August

UK 10Y gilt yield fell 16 bps to 4.73% in its best day since 2023 on positive inflation data

Earnings

JPMorgan smashed Q4 earnings estimates as profit spiked 50% to a record $14B on a 49% jump in IB fees and 21% rise in trading revenue and also raised its interest income forecast (CNBC)

Goldman Sachs also smashed Q4 earnings estimates as profit rose to a three-year high on a 24% rise in IB fees and a bumper trading quarter (CNBC)

Citigroup announced a $20B stock buyback and beat Q4 earnings estimates thanks to strong IB results and its operational restructuring (CNBC)

Wells Fargo beat Q4 earnings estimates thanks to a 59% jump in IB fees and also raised its interest income forecast (RT)

BlackRock beat Q4 earnings estimates on record revenue and a record $11.6B AUM on record client inflows (RT)

What we're watching this week:

Today: UnitedHealth, Bank of America, Morgan Stanley, TSMC

Full calendar here

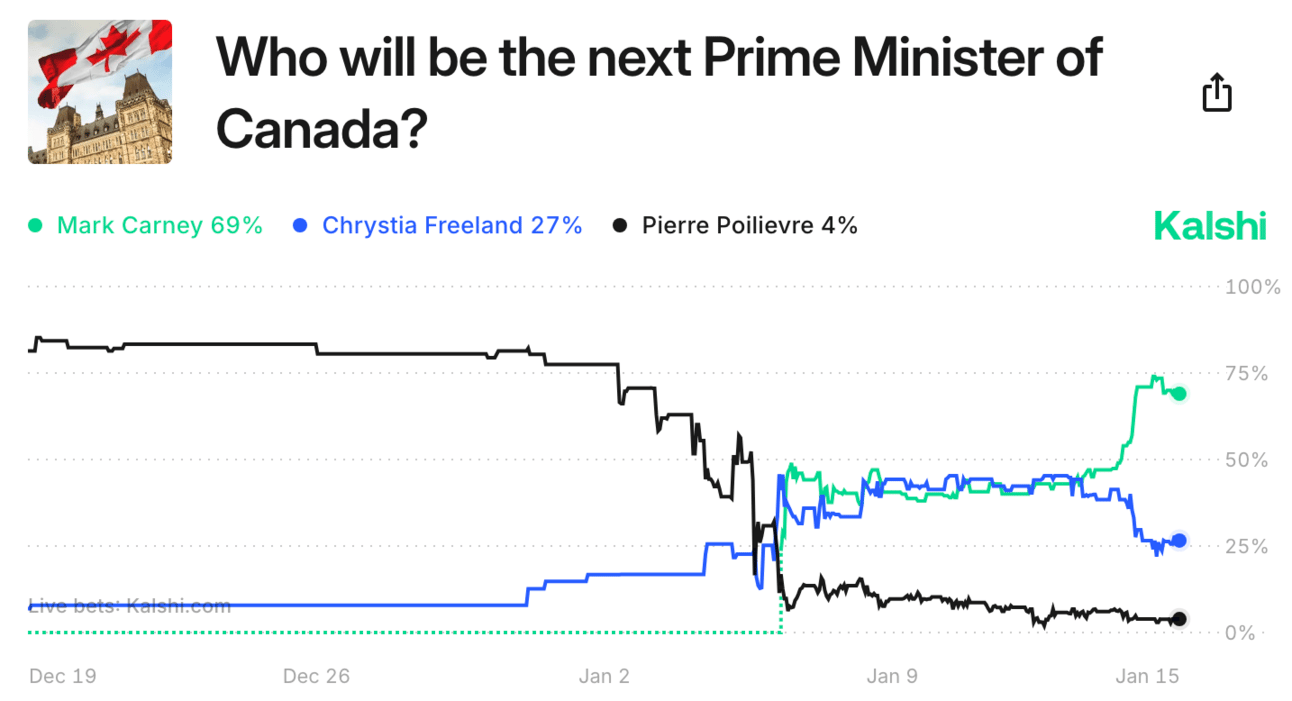

Prediction Markets

Justin Trudeau's resignation means a new race for Canada's top government job.

Headline Roundup

US CPI rose 2.9% YoY (CNBC)

UK inflation unexpectedly cooled to 2.5% (CNBC)

VCs are eying accounting firm stakes as AI potential excites (WSJ)

Bank CEOs expect Trump bump to business as profits surge (RT)

Yellen defended Covid spending with millions of jobs saved (RT)

Equal weight S&P 500 sees record inflows as concentration risks rise (FT)

Foreign funds brush aside Treasuries 'death spiral' risk (BBG)

China faces harsh dilemma as yuan comes under pressure (WSJ)

Apollo promotes two potential CEO successors after extending Marc Rowan's tenure (WSJ)

Hindenburg Research will shut down after all ideas fulfilled (WSJ)

Investcorp's top two credit execs will depart (BBG)

TikTok US plans to go dark on Sunday after ban (RT)

Trump considers suspending the TikTok ban enforcement for 90 days (WP)

Apple is in talks with Barclays to replace Goldman in credit card deal (RT)

Bill Ackman requested UMG to move its secondary listing to US (RT)

Drake sued UMG for defamation over Kendrick's 'Not Like Us' (RT)

US 30Y mortgage topped 7%, the highest since May 2024 (RT)

State Farm canceled its Super Bowl ad after LA fires (WSJ)

Israel and Hamas agreed to a ceasefire (WSJ)

Falling birth rates raise risk of sharp decline in living standards (FT)

A Message from UpSlide

Ensure your pitchbooks win every time with Stifel, Leverest, and UpSlide.

UpSlide is hosting CIB experts from Stifel and Leverest to share their strategies and tips for deal teams to gain a competitive edge in 2025.

They'll break down some of the biggest obstacles faced by pitching teams, as well as how to overcome them. Plus, they'll share insights on:

Why pitchbooks are shrinking while deal competition is rising

What boutique teams can do to stay ahead of their bulge bracket counterparts

How to automate your work in PowerPoint and Excel to impress your MD

Save the date:

📆 January 30th

⌚ 10:30 am EST

⌛ 45 minutes

Deal Flow

M&A / Investments

Beacon Roofing Supply rejected an $11B takeover offer from building-products distributor QXO

Blackstone is exploring a sale of a portfolio of music rights including Bob Dylan, Adele and Ariana Grande from portco SESAC for over $3B after fielding interest from Apollo, Warburg Pincus, and Singapore's Temasek

O&G firm Civitas Resources is exploring a sale its Denver Basin assets, which could be valued at over $4B

Brookfield is planning a sale of its $1.3B Spanish student housing business Livensa Living

French PE firm Ardian will acquire a 60% stake in three of luxury goods company Kering's Paris properties for $860M

Spanish energy giant Repsol canceled a $530M sale of its Colombian upstream assets to GeoPark due to its partner SierraCol Energy exercising preemptive rights

Thoma Bravo-backed IT management software firm Flexera agreed to acquire a portfolio of cloud software assets from NetApp in a $100M deal

UK's Octopus Energy agreed to acquire Sweden-based OX2's French solar unit

Italian insurance giant Generali and France's Natixis Investment Managers are close to a deal to form an asset management JV

VC

A group of investors is seeking to raise $5B in private capital to form a basketball league to rival the NBA

Stoke Space, a rocket company building a reusable medium-lift rocket, raised a $260M Series C from by Breakthrough Energy Ventures, Point72 Ventures, Y Combinator, and more

Colossal Biosciences, the world's first de-extinction company, raised a $200M Series C led by TWG Global

Space infrastructure company Loft Orbital raised a $175M Series C led by Tikehau Capital

Nelly, a fintech startup digitizing medical practices, raised a $51M Series B led by Cathay Innovation

Reshop, a platform redefining refunds for consumers and merchants, raised a $17M round led by Matrix Partners, Sound Ventures, Woodson Capital, and Touch Ventures

AI-based architectural planning startup qbiq raised a $16M Series A led by Insight Partners

Reeco, an AI-driven procure-to-pay platform for the hospitality industry, raised a $15M Series A led by Aleph VC

Metafuels, a Swiss aviation fuel startup, raised a $9M round led by Celsius Industries

Sarla Aviation, a startup building electric air taxis, raised a $10M Series A-1 led by Accel

Rainbow, a startup building tailored small business insurance products, raised an $8M Series A led by Zigg Capital

AI-powered cloud infrastructure platform ControlMonkey raised a $7M seed round led by lool ventures and Joule Ventures

Klearly, a Dutch fintech facilitating in-person card payments, raised a $6.6M seed round led by Global PayTech Ventures

South African clothing reselling startup FARO raised a $6M pre-seed round led by Bloomberg president JP Zammitt

Trustup, a Belgian startup connecting individuals with certified construction and renovation professionals, raised $5.3M from Rise PropTech Fund, Brick & Mortar Ventures, and more

MetAI, a startup creating AI-powered digital twins, raised a $4M seed round led by Nvidia

Rockfish, a startup using GenAI to create synthetic data for enterprise workflows, raised a $4M seed round led by Emergent Ventures

IPO / Direct Listings / Issuances / Block Trades

Berry farmer Agrovision, last valued at $1B in 2024, is considering an H1 IPO

India's Aditya Birla Fashion and Retail plans to raise $500M via a qualified institutional placement and private placement of shares

Oilfield services provider Flowco raised $427M after pricing its US IPO above its marketed range

Chemicals giant DuPont canceled plans to spinoff its water business but will proceed with a spinoff of its electronics business

Steam-turbine manufacturer Doosan Skoda Power plans to IPO in Prague in Czech Republic's first IPO in four years

Debt

Climate Investment Funds raised $500M in a debut bond sale

Jio Finance, the shadow lender spun off from Indian conglomerate Reliance, is planning a debut debt sale

Bankruptcy / Restructuring / Distressed

Defaulted Chinese developer Sino-Ocean is seeking UK court approval to restructure $5.6B of debt without full creditor approval

Crafts and fabric retailer Joann filed for it second bankruptcy in less than a year

Fundraising

MM private credit firm Colbeck Capital Management closed its third flagship fund at $700M

Intel plans to spin off its corporate VC arm Intel Capital into a standalone fund to potentially attract external capital

Crypto Sum Snapshot

Crypto hedge funds failed to beat Bitcoin in 2024

Trump's new SEC leadership is poised to kick start crypto overhaul

Thailand may approve Bitcoin ETFs to list on local exchanges

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

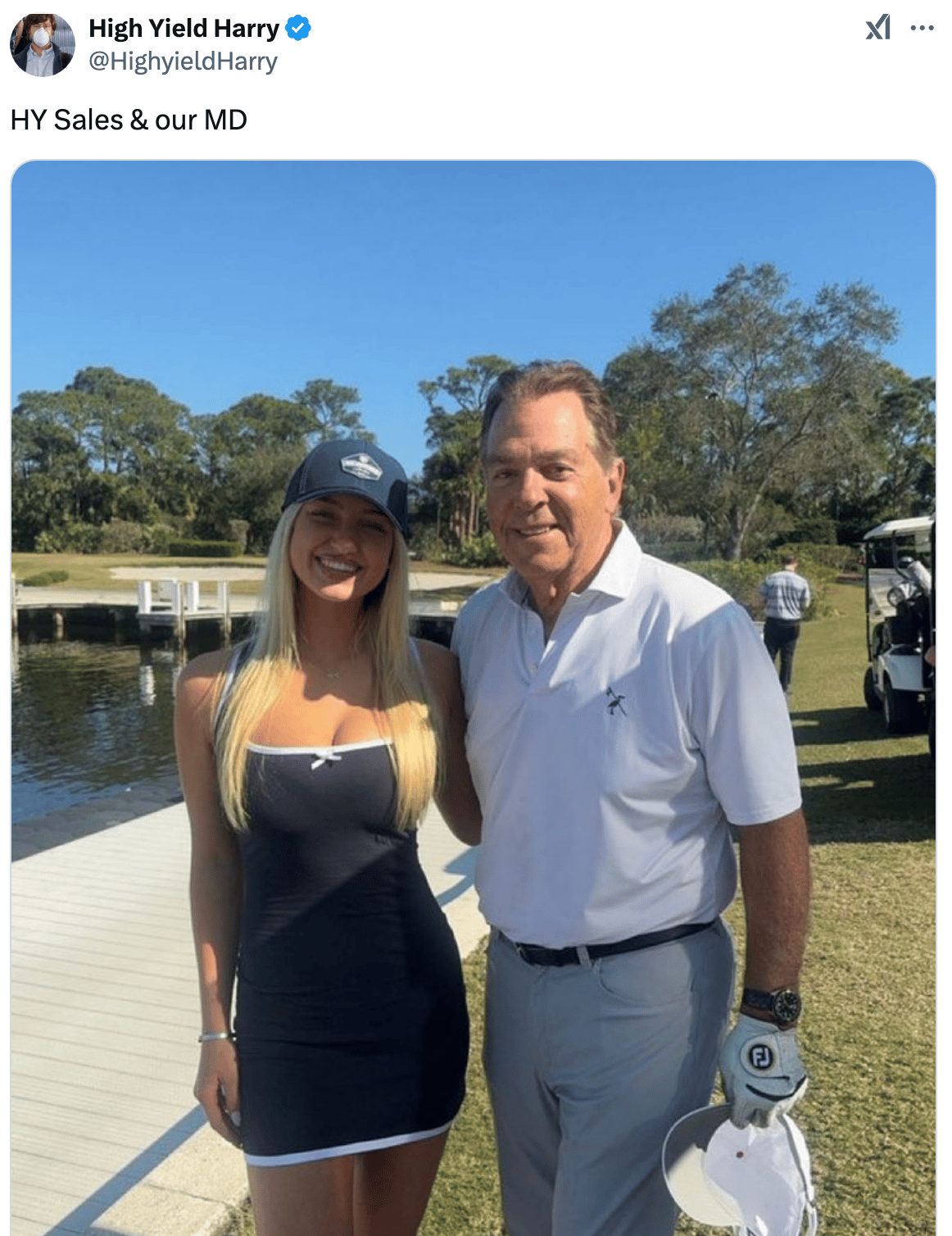

Financial Times' latest hit piece is going viral for highlighting the unapologetic attitude shift gripping Wall Street offices since Trump's victory. This may not even feel foreign to many of y'all. Is corporate America going MAGA?

Read Nate Anderson's personal note on his decision to wind down his high-profile short-seller shop Hindenburg Research.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

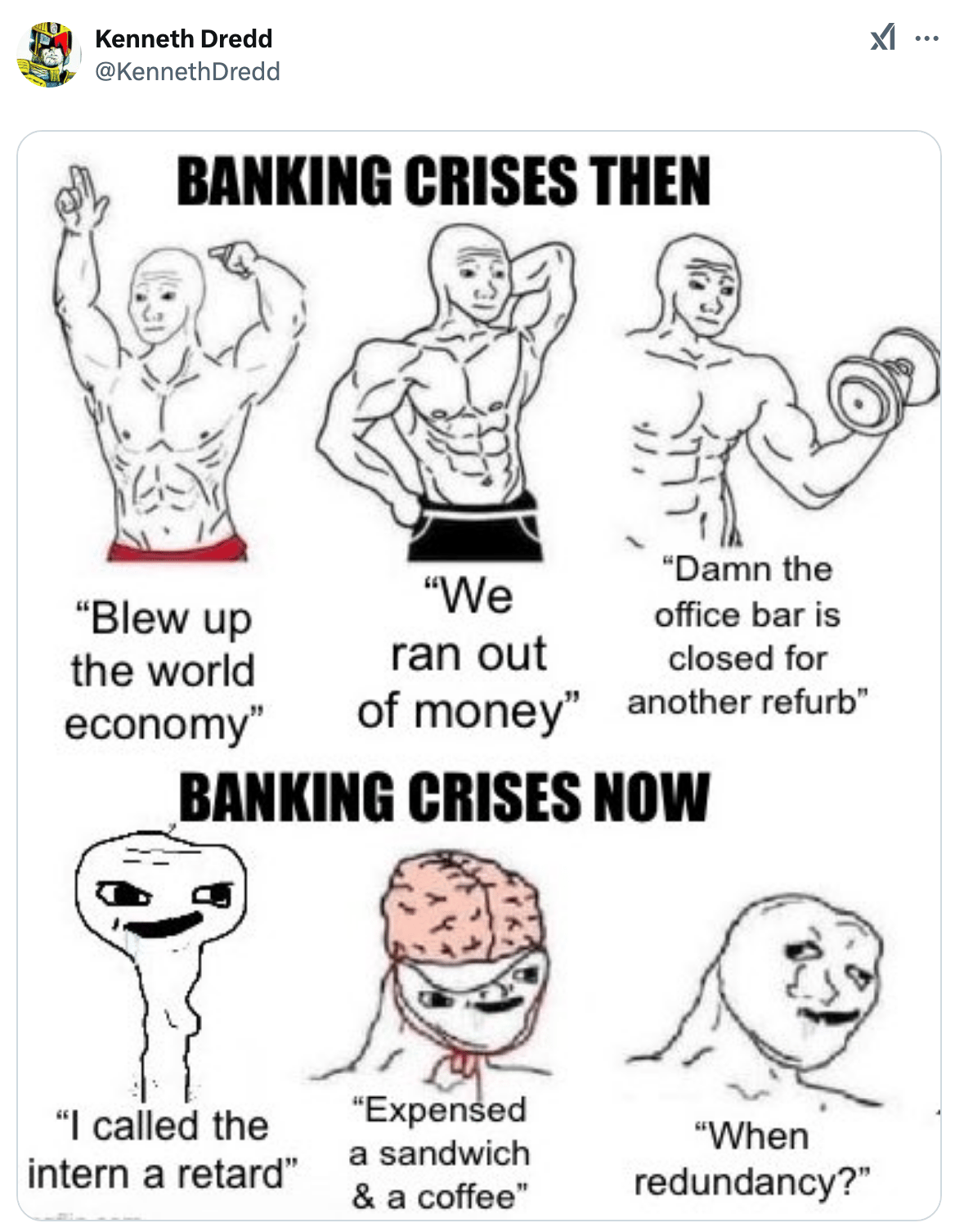

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.